What’s the Income Requirement for AMEX Business Cards?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.I’ve written about how to fill out an American Express small business credit card application. But you might be wondering, is there a minimum business income requirement to be approved for AMEX small business cards?

In short, no. And that’s good news for lots of folks, because AMEX small business cards will NOT hurt your chances of being approved for Chase cards.

I’ll show you how you might qualify for an American Express small business card.

American Express Small Business

Link: How to Fill Out an American Express Business Card Application

American Express has a number of great small business cards, like The Business Platinum® Card from American Express OPEN, The Business Gold Rewards Card from American Express OPEN, Gold Delta SkyMiles® Business Credit Card from American Express, and Platinum Delta SkyMiles® Business Credit Card from American Express.

And because of Chase’s stricter approval rules, many readers are even more interested in AMEX business cards because they do NOT show up on your personal credit report. And therefore do NOT count against Chase’s 5/24 rule.

Also, qualifying for a small business card might be easier than you think. Because if you earn income for performing a service, or selling goods, you could have a small business.

To qualify as a small business, you must be for-profit. And often times AMEX will approve folks who haven’t yet earned anything with their business.

Just remember, American Express only allows folks to get the welcome bonus ONCE per person, per lifetime on ALL their cards.

Income Requirements for AMEX Business Cards

An AMEX representative told me there are no strict income requirements to be approved for American Express small business cards. And that AMEX is oftentimes more concerned with your personal income, because even though it’s a business card, you’ll be personally responsible for any debt you accrue.

This makes sense, because on any AMEX small business card application you’ll be asked to enter your business income AND your personal income. And folks with sole proprietorships can use their social security number instead of an EIN (Employer Identification Number).

Your small business card application will be evaluated based not only on how much (or little!) money your business makes, but on your personal credit score and income too.

What If It’s a New Business or Didn’t Make Any Money Last Year?

You should always be honest when you apply for a credit card.

So, if your business is new or hasn’t made any income, put that on the application.

And you should use your actual business income, not your projected income. Even if it’s $0. Because AMEX can do a financial review and check your application information against your tax returns.

Plus, not having any business income might not hurt your chances of being approved anyway! Because your personal credit score and income are taken into account when AMEX decides whether to approve your application.

A commenter on FlyerTalk reported being approved for several American Express small business cards with no current business income. And they did NOT lie on their applications. They used their own name for the business’ name, reported $0 in business income and 0 years in business, and used their social security number instead of an EIN.

So if your business is brand new and you haven’t earned any income yet, it’s still possible to be approved. And it’s better to tell the truth and be denied than to lie and go through a financial review with a bank.

Filling Out an AMEX Small Business Card Application

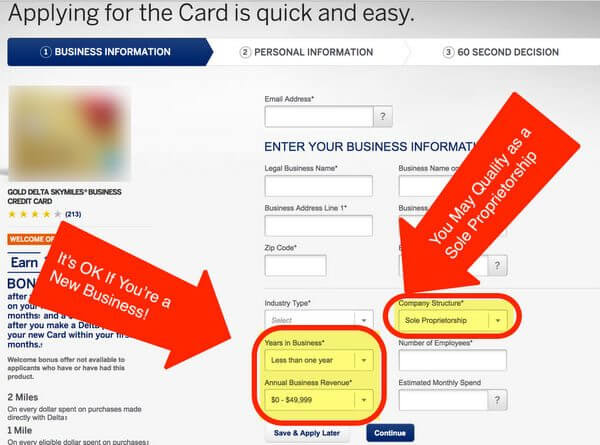

Here’s what an AMEX small business card application looks like:

On the first page of the application, you’ll be asked to enter your business information, including the number of years in business and your annual business revenue.

If you’re applying as a sole proprietor, you won’t be asked for an EIN (Employer Identification Number).

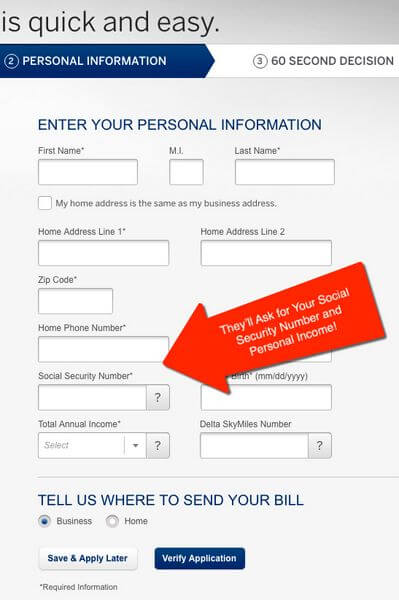

You’ll then be asked to add your personal information, like name, address, and social security number.

If you’re considering applying for an AMEX small business card, here are the best AMEX business cards from our Hot Deals page:

- The Business Platinum® Card from American Express OPEN

- SimplyCash® Plus Business Credit Card from American Express

- The Business Gold Rewards Card from American Express OPEN

- Gold Delta SkyMiles® Business Credit Card from American Express

- Platinum Delta SkyMiles® Business Credit Card from American Express

Bottom Line

American Express small business cards are often relatively easy to get. As long as you’re operating a for-profit business, you have a good chance at qualifying for a small business card.Plus, there are no strict income requirements to be approved. So if you decide to apply for any AMEX small business card, you should be completely honest on your application. Even if your business hasn’t made any money yet!

That’s because American Express will also use your personal credit score and income when making their decision about your business card application.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!