Here’s why you should collect bank points instead of airlines miles

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Do you know the difference between a “mile” and a “point”? It seems like every day the line between these two terms becomes more blurred — and more important.

With the coronavirus having its way with the global economy, we don’t know what exactly will happen to airline loyalty programs. Bankruptcy looms, though, if travel remains stagnant for an extended period of time. Bank points are safer, because you can transfer them to many different airlines — or simply redeem them for paid travel.

The biggest difference in my mind between airline miles and regular bank points is an airline award chart. See, airline miles used to operate like this:

- You go to the airline website

- You enter your origin and destination

- The airline shows you a fixed price for your seat based on that origin and destination

For example, I used to know that a ticket from anywhere in the U.S. to anywhere in Europe would cost 30,000 miles one-way in coach as long as I’m flying with American Airlines, United Airlines, or Delta.

But airlines are migrating away from this system. Delta, United and American have all tossed their award charts, and other European airlines have done the same. I submit that instead of earning airline miles, it’s better to just earn bank points, such as:

I’ll explain what I mean.

Airline award charts are becoming a thing of the past

First let me say: Never stop earning airline credit card welcome bonuses. If you can scoop up a whole bushel of miles by opening a credit card and meeting a minimum spending requirement, do it.

Yes, it’s becoming harder to attribute value to airline miles as airlines get rid of their award charts — but earning 50,000 miles in one fell swoop can still amount to $1,000+ in value. Credit card welcome bonuses are what make free travel so ridiculously easy. Plus, many airline credit cards are worth keeping year after year because of valuable ongoing benefits, like free checked bags, priority boarding and airport lounge access.

However, under no circumstances (in my opinion) should anyone be swiping an airline card because of the rewards it earns. Airline miles are just not practical enough.

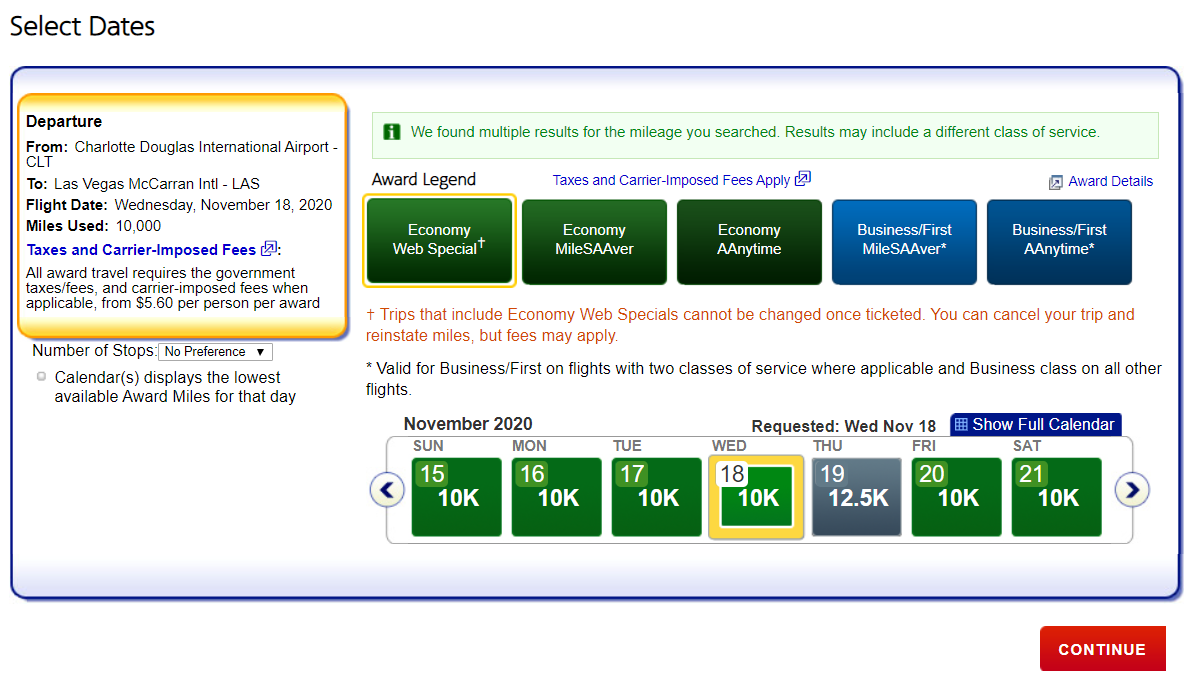

All three legacy airlines (American Airlines, Delta and United Airlines) have given themselves license to charge whatever they want for award seats. They began by giving themselves an absurd number of exceptions to their award chart, making them nearly useless. For example, even when an AA award chart existed, they still had seven or more different rates:

- MileSAAver award prices (the lowest price)

- AAnytime award prices (much more expensive, but lots more available seats)

- Economy Web Special award prices (sale prices on certain flights, though they’re sometimes higher than MileSAAver)

- Peak and off-peak award prices (varies by location and date)

- Special lower prices for flights totaling 500 miles or less

- “Reduced mileage awards,” which give certain American Airlines card holders discounts from rotating origins and destinations

None of these bullets are necessarily “bad” (in fact many of them are a good thing!). My point is that American Airlines has an abundance of price points that vary by origin, destination and date. It makes earning bonuses with cards like the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® a bit riskier, as you’re not sure if it’ll cover your bucket list trip. By the same token, the bonus could be more than enough if you find an Economy Web Special to your destination. The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Add to this the fact that American Airlines is infamous for releasing very few “MileSAAver” seats and you can conclude that American Airlines is essentially charging whatever it wants whenever it wants.

At least with points you can know the value you’re receiving

Because U.S. airlines are ignoring their award charts and essentially charging whatever they want, you’re better off collecting bank points like Chase Ultimate Rewards, American Express points and Capital One rewards.

Here’s why you should collect these points instead of airline miles:

- With these points, you can know what value to expect from them all the time (for example, if you have the Chase Sapphire Reserve your points will always be worth 1.5 cents when you book travel through the Chase Travel Portal)

- You can use the points to purchase a ticket (instead of booking an award flight), so your travel goals don’t have to be married to a certain airline

- You also have the option to transfer these points to a large number of airlines (you can compare the cash price of a flight against the price of an award flight to see which is a better deal)

Bank points have always had this upside of simplicity over airline miles. But we collect airline miles anyway because there have always been amazing sweet spots in airline award charts. So as airlines move away from award charts, I focus more on bank points.

Here are some of the best cards to rack up bank points that are worth keeping for everyday spending:

- Ink Business Preferred® Credit Card – Most MMS writers have this card. You’ll earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first three months from account opening

- Chase Sapphire Preferred® Card – I’ve had this card for more than six years. You’ll earn 80,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Chase Sapphire Reserve – This is arguably the best travel credit card in the game because of all its ongoing benefits. Earn 50,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- The Platinum Card® from American Express – Earn 100,000 Amex Membership Rewards points after spending $6,000 on purchases in the first six months from account opening. Terms Apply

- Citi Premier® Card – Earn 60,000 bonus points after you spend $4,000 in purchases within the first 3 months of account opening.

Let me know if your miles and points strategy is changing as airlines change their award charts. You can learn how to use American Airlines miles here, and subscribe to our newsletter for more info like this delivered to your inbox.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!