50+ Ways to Earn Miles & Points!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

You can get Big Travel with Small Money from miles and points credit cards. But do you know there are more than 50 ways you can earn miles and points?

Earning miles and points can be easy, especially if you know the secrets, which I’ll share with you below.

Before showing you 10+ ways to earn points by paying a fee, let’s look at the better way.

34 Ways to Earn Miles & Points WITHOUT Paying Extra Fees

You can use your credit card to earn miles and points on a regular basis without paying extra fees.

Note: Some of these bonus points offers change on occasion, so you should check to make sure the offer is still available.

Regular Expenses

1. Insurance

Some companies will let you pay your medical, vision, car, homeowners, or renter’s insurance with a credit card.

Folks who have a Flexible Spending Account (FSA) for medical expenses might be able to pay with a credit card and then submit a request for reimbursement.

Tip: If you get an insurance company payment for car or home repair, you may be able to use your credit card to pay those expenses and use the money from the insurance company to pay your credit card bill. (Hat Tip to Roger Haynie)

2. Cable, Hulu, Netflix, or Satellite Television

You can earn miles and points paying your cable, Hulu, Netflix, or satellite television bills. And you can earn 25,000 United Airlines miles when you sign-up for DIRECTV.

3. Cell Phone and Internet

You can pay your cell phone and internet bills with a credit card.

The Chase Ink Plus and Ink Business Cash Credit Card get you 5X Chase Ultimate Rewards points when you use them to pay your cable TV and internet bills.

4. Utilities

The permanent way to earn miles and points is to pay your utilities with a credit card. Sometimes there are bonuses when you become a new customer and for your monthly utility charges.

Some folks might consider paying their utilities with online bill paying services like Evolve Money or Bluebird.

However, Evolve Money now charges a 3% fee for paying bills with prepaid debit or gift cards, and credit cards. So it’s no longer worth it for most folks.

Note: Not all utility companies allow you to pay by credit card. And some charge a fee.

Note: These offers are subject to change and some have expiration dates.

American Airlines:

- 5,000 American Airlines miles for Energy Plus customers in Illinois, Maryland, Massachusetts, New Jersey, New York, Ohio, and Pennsylvania and 2 American Airlines miles for every $1 in charges each month

- 5,000 American Airlines miles for Everything Energy customers in Texas and 2 American Airlines miles for every $1 in charges each month

- 20,000 American Airlines miles for Gexa Energy customers in Texas

- Up to 27,000 American Airlines miles for Texas residents who sign-up for Reliant and 500 American Airlines miles per month

Delta:

- 5,000 Delta miles for Energy Plus customers in Illinois, Maryland, Massachusetts, New Jersey, New York, and Pennsylvania and 2 Delta miles for every $1 in charges each month

- 2,500 Delta miles for Ohio Natural Gas customers and 2 Delta Airlines miles for every $1 in charges each month

- 2,500 Delta miles for Georgia Natural Gas customers and 2 Delta miles for every $1 in charges each month

JetBlue:

Southwest:

- 5,000 Southwest points for Energy Plus customers in Illinois, Maryland, Massachusetts, New Jersey, New York, Ohio, and Pennsylvania and 2 Southwest points for every $1 in charges each month (Southwest cardholders get 7,500 Southwest points and 3 Southwest points for every $1 in charges each month)

- 5,000 Southwest points for Everything Energy customers in Texas and 2 Southwest points for every $1 in charges each month (Southwest cardholders get 7,500 Southwest points and 3 Southwest points for every $1 in charges each month)

- 15,000 Southwest points for Reliant customers in Texas and 500 Southwest points each month for 24 months

United Airlines:

Virgin America:

- 2,500 Virgin America points for Energy Plus customers in Connecticut, Illinois, Maryland, Massachusetts, New Jersey, New York, Ohio, and Pennsylvania and 1 Virgin America point for every $1 in charges each month

5. Dining

Dining out is another way to earn miles and points. And you can also pick up some bonuses.

Be sure to read the rules about the dining programs. For instance, you can NOT register the same credit card in more than 1 Rewards Network program. ex. Your enrolled Sapphire Preferred will earn American Airlines miles OR United Airlines miles but not both.

Note: These offers are subject to change and some have expiration dates.

- Alaska Airlines Mileage Plan Dining gets you 500 Alaska Airlines miles and up to 5 Alaska Airlines miles for every $1 you spend

- American Airlines AAdvantage Dining Program by Rewards Network up to 5 American Airlines miles for every $1 you spend, and sometimes you can earn a 2,000 mile bonus

- American Express iDine gets you up to 15% back

- Delta SkyMiles Dining gets you 3,500 Delta Airlines miles and up to 5 Delta Airlines miles for every $1 you spend

- Hawaiian Airlines Mogl gets you up to 25% cash back redeemable only for Hawaiian Airlines miles (But Mogl has a very limited number of participating restaurants)

- Hilton Honors Dining gets you 2,000 Hilton points and up to 8 points for every $1 you spend

- IHG Rewards Club Dining gets you 1,000 IHG points and up to 8 points for every $1 you spend

- Orbitz Rewards Dining gets you up to 5% in Orbucks for every $1 you spend (Orbucks is Orbitz’s rewards program.)

- Southwest Rapid Rewards Dining gets you 3 points for every $1 spent; 10 points for a dining review; 500 bonus points after earning 1,500 points; and 300 bonus points for every 1,000 points you earn after the first 1,500 points

- Spirit Free Spirit Dining gets you 1,000 Spirit Miles and up to 5 Spirit Airlines miles for every $1 you spend

A few cards that earn bonus points at restaurants:

- Chase Sapphire Preferred (2X points, 3X on the 1st Friday of the month)

- Chase Ink Cash (2X points)

- Citi ThankYou Premier Card (2X points)

- Citi Prestige Card (2X points)

- Chase Freedom (5X points when it’s a quarterly bonus category)

6. Groceries

Pay for your groceries using a miles and points earning credit card. You can also buy grocery store gift cards and use them later.

Some cards give you extra points or cash back at US supermarkets:

- Blue Cash Preferred® Card from American Express

- Blue Cash Everyday® Card from American Express

- AMEX EveryDay® Preferred Credit Card

- AMEX EveryDay® Credit Card from American Express

- Hilton Honors™ Card from American Express

- Hilton Honors™ Surpass® Card from American Express

- Premier Rewards Gold Card from American Express

- Citi Hilton HHonors Visa Signature Card

7. Gas

Use your new credit card at the pump instead of paying cash or using your debit card. Although some gas stations may charge more for using a credit card at the pump instead of a debit card.

I’d recommend you avoid using your credit card if you have to pay more unless you have to meet minimum spending on new credit cards.

Instead consider buying gas station gift cards inside at the cashier, or at other stores that sell them. Then use those gift cards to fill your tank.

A few of the cards that earn extra points at gas stations are:

- Premier Rewards Gold Card from American Express (2X at US gas stations)

- AMEX EveryDay® Preferred Credit Card (2X at US gas stations or 3X when you use your card 30+ times in a billing cycle)

- Chase Freedom when gas stations are a quarterly 5X category

8. Shopping Online

A. Online Shopping Malls

Most airlines have an online shopping mall where you can earn additional miles and points for shopping:

- Alaska Airlines has Mileage Plan Shopping

- American Airlines has AAdvantage eShopping

- Barclays Rewards Boost

- Chase Ultimate Rewards Mall

- Delta has SkyMiles Shopping

- JetBlue has Shop True

- Southwest has Rapid Rewards Shopping

- United Airlines has MileagePlus Shopping

- Virgin America has Elevate Fly Store

You can use Evreward or CashBackMonitor to see which shopping portal has the best bonus.

B. Flowers

Most of the airlines have flower companies in their online shopping malls. When you buy flowers for special occasions like Valentine’s Day, you can use these links to find the best bonuses.

Note: Bonuses change so keep checking for the best offers.

- Alaska Airlines partners with 1-800-Flowers and Teleflora

- American Airlines partners with FTD, Teleflora, and 1-800-Flowers.com

- Delta partners with FTD

- Hawaiian Airlines partners with 1-800-Flowers, FTD, Hana Flower Company, and Teleflora

- United Airlines partners with FTD

- Southwest partners with 1-800-Flowers

- Virgin America partners with Teleflora

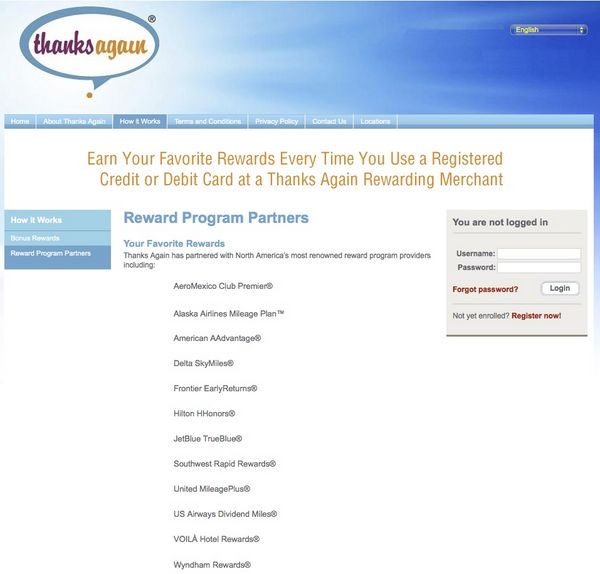

C. Thanks Again Network

You can also earn miles and points with the Thanks Again network.

Thanks Again lets you earn miles and points with your enrolled credit card when you shop at participating Thanks Again locations (usually in airports).

10. Gifts

Paying for gifts, including store gift cards, for the holidays, birthdays, graduations and other special events on your credit cards will earn you lots of miles and points.

If you’re looking to get points now, you might consider buying gifts in advance and stocking up on store gift cards to use later. You can also buy American Express, Visa or MasterCard gift cards (for a fee) to give as gifts.

11. Amazon & Store Gift Cards

You can earn miles shopping on Amazon and at local stores.

A. Amazon

I love Amazon because it has almost everything I need! You can buy things now or stock up on Amazon gift cards (no expiration date) to use later. (Hat Tip to Gary Steiger)

And you’ll get 5X Chase Ultimate Rewards points when the Chase Freedom card has Amazon as its bonus category!

B. Stores

Buying store gift cards are a great way to earn miles and points.

Some gas stations, office supply stores, and grocery stores also sell gift cards.

12. Gym Memberships

Pay for your gym membership with a credit card.

You can earn 2,000 United Airlines miles when you joint select gyms.

13. Spa

Emily and I love the spa and being able to earn miles and points for spa treatments makes it more enjoyable!

- American Airlines offers 3 American Airlines miles per $1 spent via Spa Finder

- JetBlue offers 3 points per $1 spent via Spa Finder

14. Car Repairs

Save your checks and debit cards to pay for other things. Use your credit card for that oil change or car repair.

Consider buying an AAA membership with your credit card. Not only do you get flat tires and batteries replaced, but you get hotel discounts.

15. Contractor Supplies

Some contractors may let you buy the supplies needed for your construction project directly from places like Home Depot and Lowe’s.

And during some quarters, Home Depot and Lowe’s is a 5X bonus category on the Chase Freedom card.

16. Toll Transponders

You can load your automated toll transponder account (I-Pass, K-Tag, FastTrak, etc.) with a credit card. (Hat Tip to Gary Steiger)

Use your Chase Sapphire Preferred card and earn 2X Chase Ultimate Rewards points.

17. Buy, Refinance, or Sell

If you’re buying, refinancing or selling a home, you can earn American Airlines miles:

- 1,250 American Airlines miles for every $10,000 of purchase or refinance

- 2,000 American Airlines miles for every $10,000 of purchase or sale price from a SIRVA-referred real estate agent

- 2,000 American Airlines miles for every $10,000 or purchase or sale price; 5,000 American Airlines miles when you move

Note: Some offers are limited in certain states.

18. Banking and Investments

A. Opening Bank Accounts

You can earn bonus miles and points for opening bank accounts. Although, different banks have different offers depending on your deposits, so it pays to shop around.

Note: Promotions constantly change and some have expiration dates.

- Bank of America – Up to 25,000 Alaska Airlines miles for new checking accounts

- BankDirect – thousands of American Airlines miles monthly

- Citi – up to 30,000 American Airlines miles for new accounts offered periodically throughout the year, check for promo codes

- UFB Direct – up to 120,000 American Airlines miles per year

Note: Citi sends a 1099 for the value of American Airlines miles you receive.

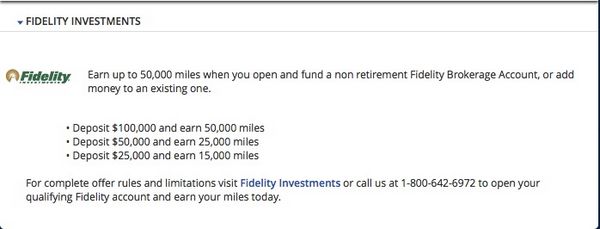

B. Investments

You can earn up to 50,000 American Airlines, Delta Airlines, or United Airlines miles when you open and transfer money into a non-retirement brokerage account with Fidelity. You can even get the miles when you add money to an existing Fidelity account.

19. Charitable Contributions

Instead of writing a check or using cash to make donations and regular religious contributions to your church, temple, etc., many charities let you use a credit card. (Hat Tip to Megan)

Some charities accept gifts from PayPal making it easy for you to use your credit card. And you can use your US Bank FlexPerk Travel Rewards card to earn 3X FlexPerks points.

You can earn airline miles donating to the National Foundation for Cancer Research:

- Up to 10 American Airlines miles per $1 for donations of $25 or more

- Up to 10 Delta Airlines miles per $1 for donations of $25 or more

- Up to 10 United Airlines mile per $1 for donations of $25 or more

20. Surveys

Folks with spare time can pick up extra miles completing surveys. I don’t think this is worth the time involved but you might!

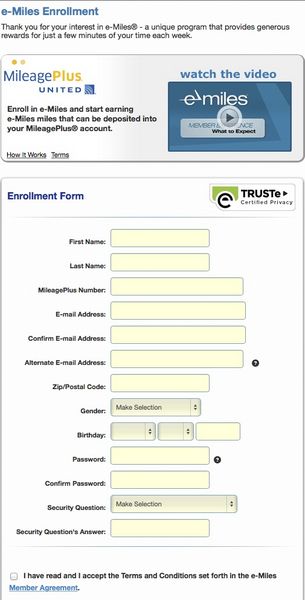

A. e-Miles

You earn e-Miles miles when you complete surveys which you can convert to airline miles and hotel points:

- Alaska Airlines

- Frontier

- Hilton

- IHG

- United Airlines

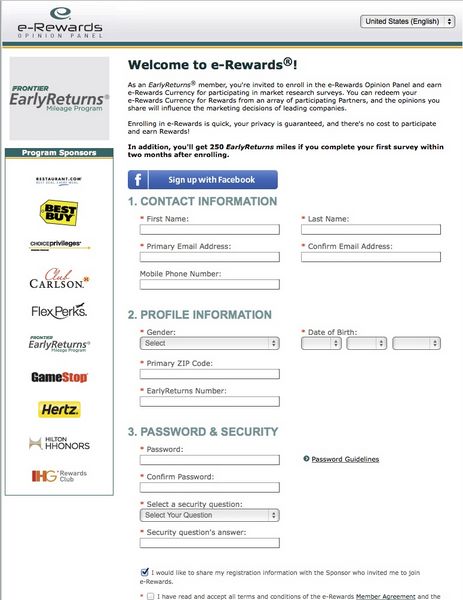

B. e-Rewards

You can earn airlines miles, hotel points, and gift cards for completing surveys. However, most programs are by invitation only.

- Aeromexico (by invitation only)

- Alaska Airlines

- Avios (can use on British Airways and Iberia)

- Choice (by invitation only)

- Club Carlson (by invitation only)

- Etihad (by invitation only)

- Flex Perks (by invitation only)

- Flying Blue

- Frontier

- Hertz (by invitation only)

- Hilton (by invitation only)

- Iberia (by invitation only)

- LaQuinta (by invitation only)

- IHG (by invitation only)

- LeClub Accor

- Southwest

- United Airlines

- Virgin America

- Virgin Atlantic

- Wyndham

C. Other Survey Sites

Here are a few other survey sites where you can earn airline miles and points:

- JetBlue points with Points For Surveys

- Southwest points with Valued Opinions

- Spirit miles with Miles for Thoughts

- United Airlines miles with Opinion Miles Club and My Points

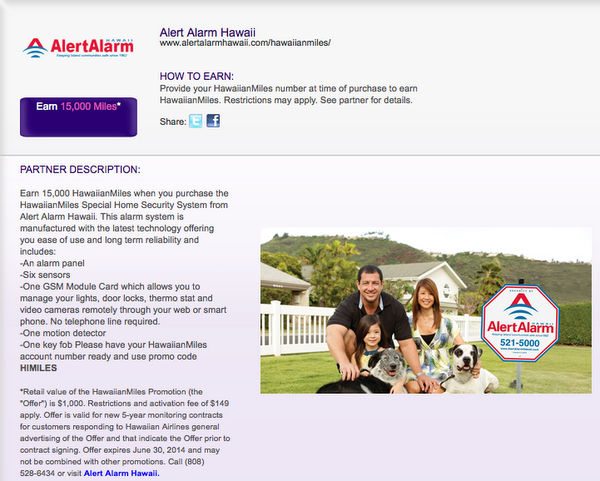

21. Home Security

In the market for a home security system?

22. Golf

Book your tee time with Golfmiles and earn miles and points in your choice of 10 frequent flyer programs:

- American Airlines

- Etihad

- Frontier Airlines

- Hawaiian Airlines

- IcelandAir

- JetBlue

- Southwest

- United Airlines

- Virgin America

- Virgin Atlantic

23. eBooks

I love reading, especially eBooks. When you subscribe to Entitle eBook, you can get 750 JetBlue points.

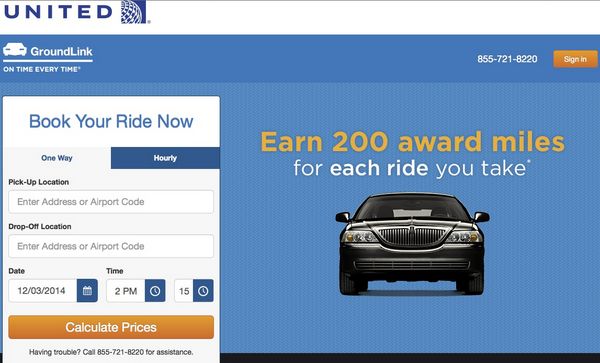

24. Car Services

You can get airline miles using a car service.

And you can get 2X Chase Ultimate Rewards points for using your Chase Sapphire Preferred card.

A. GroundLink

When you use Groundlink’s car service you can earn:

B. Zipcar

Sign-up and use for Zipcar and earn:

C. Uber

You can pick up miles and points using Uber:

- 2 American Express Membership Rewards points for every $1 spent

- 2X Chase Ultimate Rewards points when you use your Sapphire Preferred card (because it’s a travel expense)

- Up to 4 Starwood points for every $1 spent, including bonus points for Uber rides during Starwood hotel stays

25. Business Reimbursements

If you travel for business, you may be able to charge your expenses to your credit cards and submit for reimbursement from your employer.

26. Web Services

Starting an online business, blog, or just want a personal email address? You can earn 1,000 American Airlines miles when you purchase web services through Network Solutions.

27. Wedding Expenses

Get ready for your big day by paying for your flowers, photographer, and other wedding expenses with your credit card!

28. Broadway Shows, Concerts, and Sports

You can earn miles when you buy tickets to different events.

A. Audience Rewards

You can earn bonus miles & points when you buy Broadway show tickets:

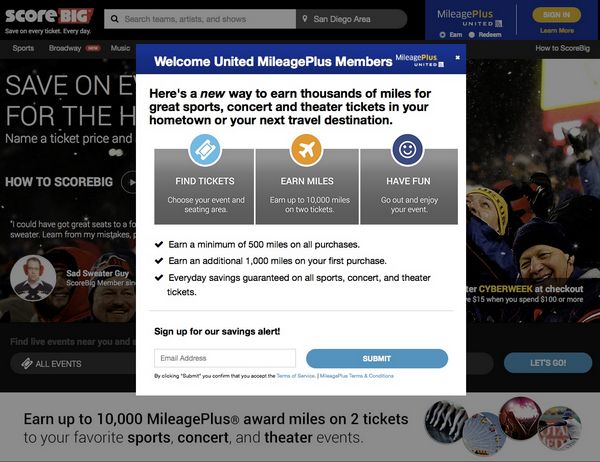

B. Score Big

Buying sports tickets can earn you United Airlines miles.

29. Online Searches

Turn your computer time into miles, points, and gift cards.

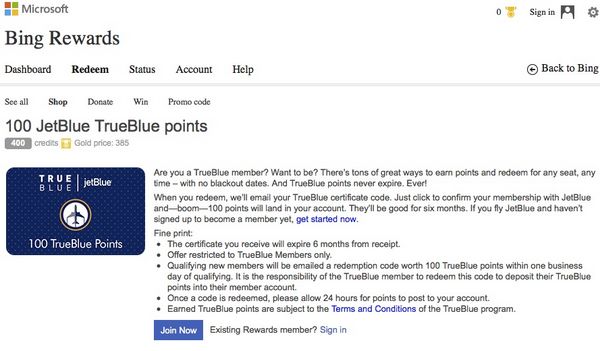

A. Bing Bar

You can earn JetBlue points when you install and use the Bing Bar when surfing the internet.

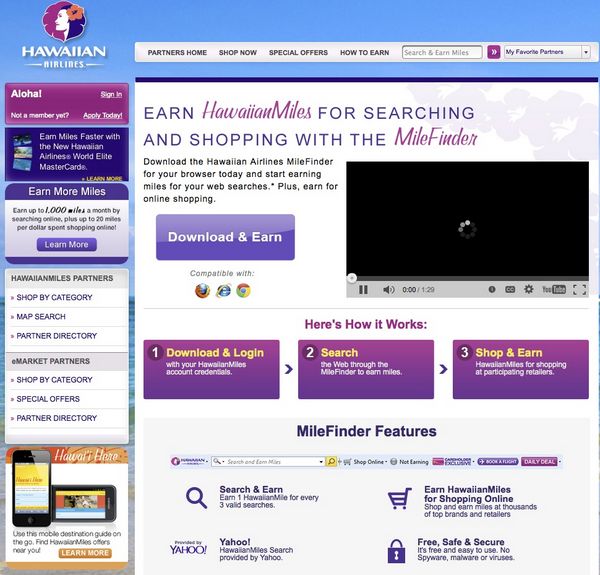

B. Hawaiian Airlines MileFinder

Install and use the Hawaiian Airlines MileFinder search bar and earn 1 Hawaiian Airlines mile for every 3 valid searches (up to 1,000 Hawaiian Airlines miles per month).

30. Reimbursement for Purchases

You can earn miles and points paying for family members’ (or friends who are trustworthy) expenses with your credit card, and they can pay you back.

For example, use your credit card to buy your mom’s new microwave, and then ask her to write you a check for the purchase amount.

31. Split Payments

Many stores will let you use multiple credit cards for 1 purchase transaction.

For example, you can ask the clerk to charge $200 on your Visa card, $1,000 on your American Express, and $1,000 on your MasterCard to pay for your $2,200 DSLR camera and lenses. That way you can complete your minimum spending on more than 1 card. (Hat Tip to Roger Haynie)

32. Additional Cards for Your Partner or Children

Earn more miles and points by getting authorized user cards for your trusted loved ones. They can charge all their expenses while you earn the miles and points. Be careful because this can get expensive quickly!

33. Quarterly Bonuses With Freedom

34. Office Supply Stores

When you use your Ink Plus, Ink Bold, or Ink Cash card at office supply stores, you’ll earn 5X Chase Ultimate Rewards points. (The limit is $50,000 in purchases per card year for the Ink Plus and Ink Bold and $25,000 for the Ink Cash.)

You can transfer your Ink Cash points to partner airlines and hotels if you have the Ink Plus, Ink Bold, or Sapphire Preferred.

18 Ways to Earn Miles & Points With Your Card but You’ll Pay a Fee

Usually paying a convenience fee (2% or higher) to pay with a credit card on a regular basis is not worth the miles and points you earn.

However, it could be worth it to meet the minimum spending on a credit card for a large sign-up bonus or to reach a spending threshold, such as spending $30,000 in a year to earn a Travel Together companion ticket on the British Airways card.

But you should only do what’s comfortable for you.

1. American Express, MasterCard, and Visa Gift Cards

You can pay for American Express, MasterCard, and Visa gift cards with credit cards at (some) gas stations, grocery stores, malls, etc. But you’ll pay a fee on each gift card which varies depending on the amount of the gift card purchased.

You can buy American Express gift cards from places like Big Crumbs and TopCashBack and get cash back (the amount varies). You’ll pay a fee, but sometimes American Express has promo codes that waive the gift card fees.

Do NOT use Citi cards to buy American Express gift cards from American Express. That’s because Citi will count it as a cash advance.

American Express gift cards never expire so you can use them now or later.

2. AMEX Serve

Earn miles and points each month by loading your Serve account with PIN-enabled gift cards bought with a credit card. Then pay the bill using your Serve account!

3. Plastiq

Plastiq is a payment service which allows folks to pay loans, rent, mortgages, utilities, tuition, and other bills you can’t pay with a credit card.

They charge a flat 2.5% fee. But sometimes they have promotions for lower rates!

4. Babysitter, Maids, Pet Sitters, Handymen, Yard Work Providers

Some service providers such as baby sitters, maids, and pet sitters may accept PayPal for payment. They might even take American Express, MasterCard, or Visa gift cards.

You could also use your Bluebird card to pay your baby sitter. That’s because you can load Bluebird with a Visa gift card and write a check or send these workers checks.

You can load Serve with a PIN-enabled gift card, then use Serve to send money to folks who work for you. Or you can withdraw money from your Serve account for free at MoneyPass ATMs.

5. Contractors

Most contractors prefer to be paid with check, but you might find some contractors who are willing to take PayPal or American Express, MasterCard, or Visa gift cards.

If your contract won’t accept a gift card, you can load your Bluebird with a Visa gift card and pay with a check.

Load your Serve account with a PIN-enabled gift card (bought with a credit card) to pay your contractor. Or withdraw cash for free at MoneyPass ATMs from your Serve account.

6. Student Loans

You can send a payment on student loans with your Serve account.

7. Evolve Money

You can use your Visa and MasterCard to pay bills through your Evolve account. Or buy gift cards with a credit card and use those instead!

But you’ll pay a 3% fee to use a credit card and some debit or gift cards, so I wouldn’t use Evolve unless I had to meet minimum spending requirements!

8. Mortgage

Pay your mortgage with a credit card on ChargeSmart. But you’ll pay a fee which will be either a percentage of the transaction cost or a flat fee depending on the biller.

9. Rent

You can pay your rent with a number of services, each of which charge fees:

- RadPad – 2.99%

- RentMoola – 2.75%

- RentPayment ~$25

- RentShare – 2.9%

10. Car

Make your monthly car payments and annual registration fee with a mile and point earning credit card.

A. Payments

You can make your car payments with a credit card via ChargeSmart.

Again, I’d suggest you ONLY do this when meeting minimum spending requirements to get a big sign-up bonus. Because the fee for ChargeSmart will likely negate the value of the miles & points you earn!

B. Registration

Some states will let you pay your car registration with a credit card for a small convenience fee (although some states don’t charge a fee).

11. Utilities

For a small fee you can pay for utilities like electricity and water and electricity with a credit card to your utility company or via ChargeSmart.

12. College Tuition

Take the sting out of paying college tuition by earning miles and points by paying with a credit card. Fees vary depending on your college. For more information, check with your school or Official Payments.

13. Student Loans

Some private student loans will accept credit cards as payment on student loans. However, most do NOT accept credit cards for payments. For those that won’t accept credit cards directly, you can use Bluebird, Evolve Money, or ChargeSmart.

14. Property Taxes

Some counties let you pay your property taxes with a credit card for a fee. You can pay directly to your county or via a 3rd party service provider such as Official Payments.

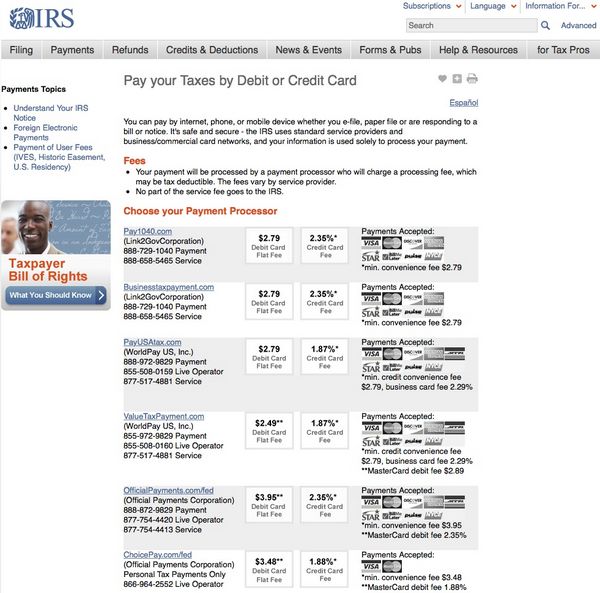

15. Federal Taxes

You can pay your Federal Income taxes with a credit card for a fee. The fee varies depending on which service provider you use to make your payment.

16. State & Local Taxes

Some states let you pay your state and local taxes directly with a credit card or through Official Payments for a fee.

17. Venmo

You can use Venmo to earn miles and points by transferring money to friends and family using your smartphone. But you’ll pay a 3% fee when you use a credit card. You should only do this to complete minimum spending. Otherwise, the fees aren’t worth it.

Note: Venmo closes accounts that frequently transfer money back and forth between 2 people.

18. PayPal

PayPal is another way folks can transfer funds to family and friends while earning miles and points. But you’ll pay a fee of 2.9% + $0.30 per transaction, so you shouldn’t do this on a regular basis.

Note: PayPal is quick to suspend or close accounts.

Bottom Line

You can earn miles and points when you make payments with your credit cards.

Some places charge a fee, but for folks who have to meet minimum spending requirements to get large sign-up bonuses, it could be worth it. Although, I don’t recommend paying fees to use credit cards on a regular basis.

What are your favorite ways to earn miles and points?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!