Don’t Give Up Transfer Flexibility by Downgrading Both of These Popular Travel Cards!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Lots of folks have a couple of Chase cards with annual fees. And want to save money by closing or downgrading their accounts.

Million Mile Secrets reader, Shirley, commented:

I’ve had the Chase Sapphire Reserve and Chase Sapphire Preferred cards for ~1 year and and my annual fees are almost due. I want to avoid the $450 annual fee. Can I downgrade them both to a no annual fee card and keep my points? Do I have to keep one card open to transfer points to airline and hotel partners?

You can avoid duplicate benefits and save on annual fees by downgrading the Sapphire Reserve OR Sapphire Preferred to a no annual fee card like the Chase Freedom Unlimited. But I would NOT downgrade both!

Because you must have an annual fee Chase Ultimate Rewards card open in order to transfer points directly to airline and hotel partners.

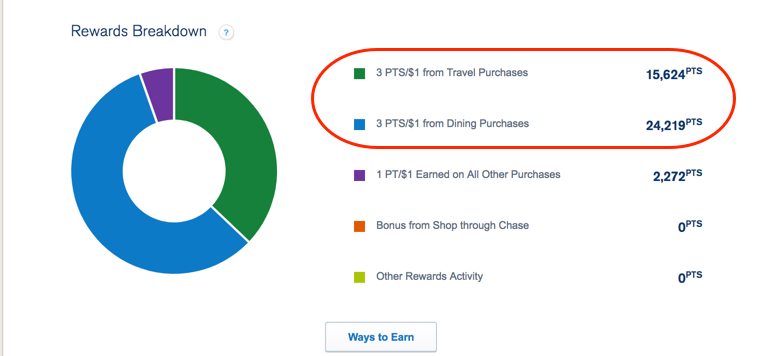

Before downgrading, you should consider if you regularly make travel or dining purchases. Because the value of the bonus points you earn with the Sapphire Reserve or Sapphire Preferred can be worth much more than the annual fee expense on the cards.

Perks With the Sapphire Reserve Can Easily Offset the $450 Annual Fee

Link: Chase Sapphire Reserve Increases Value of Your Ultimate Rewards Points

The Sapphire Preferred and Sapphire Reserve cards both earn Chase Ultimate Rewards points, which are my favorite kind of points!

With the Sapphire Reserve, you get all of the same benefits as the Sapphire Preferred, plus a few extra including:

- 3X Chase Ultimate Rewards points on travel & dining purchases

- $300 annual credit for travel purchases such as airfare and hotels

- $100 statement credit for Global Entry

- Chase Ultimate Rewards points are worth 1.5 cents each through the Chase travel portal

- Priority Pass Select membership for access to airport lounges

- Visa Infinite benefits like $25 food and beverage credit at the Luxury Hotel Collection and complimentary car rental elite status with Silvercar

To get the extra perks with the Sapphire Reserve, you’ll pay a higher annual fee. The Sapphire Reserve annual fee is $450 per year. While the Sapphire Preferred annual fee is $95 per year and is waived the first year you have the card.

But the additional perks of the Sapphire Reserve can easily offset the annual fee. For example, the $300 travel credit effectively makes the Sapphire Reserve annual fee $150 ($450 annual fee – $300 travel credit).

And depending on your spending habits, you can easily get more than $150 worth of value by making purchases in the 3X bonus category. For example, 10,000 Chase Ultimate Rewards points linked to your Sapphire Reserve are worth $150 in travel when you redeem points through the Chase travel portal.

And earning 10,000 points in a year isn’t difficult. This would require spending ~$3,300 per year (~$275 per month) on travel and dining purchases (~$3,300 in travel & dining purchases / 3 points per $1).

Plus, consider the savings from accessing a Priority Pass lounge 1 or 2 times per year. Keeping the Sapphire Reserve open can definitely make a lot of sense!

I’d Downgrade the Sapphire Preferred to Save on Annual Fees

Link: Avoid Duplicate Card Perks and 2 Annual Fees by Downgrading the Sapphire Preferred

Folks like reader Shirley who have the Sapphire Preferred and Sapphire Reserve cards can consider downgrading the Sapphire Preferred to a no annual fee card.

This way, you can save $95 a year by not having to pay the Sapphire Preferred annual fee.

For example, after getting the Sapphire Reserve, I downgraded my Sapphire Preferred to the no annual fee Chase Freedom Unlimited. Or you can also consider downgrading to the Chase Freedom. Here’s a comparison of both cards.

| Chase Freedom | Chase Freedom Unlimited | |

|---|---|---|

| Rewards Earning Rate | Earn 5% cash back (up to $1,500 in combined purchases) in bonus categories each quarter after activating offer Earn Unlimited 1% cash back on all other purchases | Earn unlimited 1.5% cash back on every purchase |

| Transferring Chase Ultimate Rewards Points to Travel Partners | Only if first transferred to a Chase Sapphire Preferred, Chase Ink Business Preferred, Chase Ink Plus (no longer available), Chase Ink Bold (no longer available), or Chase Sapphire Reserve card | Only if first transferred to a Chase Sapphire Preferred, Chase Ink Business Preferred, Chase Ink Plus (no longer available), Chase Ink Plus, Chase Ink Bold (no longer available), or Chase Sapphire Reserve card |

| Annual Fee | $0 | $0 |

| Notes | Bonus categories change each quarter, and must be manually activated. This card charges a 3% foreign transaction fee in US dollars for each international transaction. | The Chase Freedom Unlimited does NOT have bonus categories, but has a higher non-bonus earning rate than the Chase Freedom. This card charges a 3% foreign transaction fee in US dollars for each international transaction. |

| Full Review | My review of the Chase Freedom | My review of the Chase Freedom Unlimited |

When you downgrade, you will NOT be eligible to receive the new card sign-up bonus. But your:

- Account history information will transfer to the new card

- Credit card number will be the same

- New card will NOT show up as a new account on credit report

And downgrading your card is not automatic. Chase will review your account for eligibility when you call the number of the back of your card. Usually, you’ll need to have the card open for ~1 year before making a change.

The information for the Chase Freedom and Chase Freedom Unlimited has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.Bottom Line

Avoid duplicate card perks and 2 annual fees by downgrading the Sapphire Preferred OR Sapphire Reserve to a no annual fee card like the Chase Freedom Unlimited.I would NOT downgrade both cards if these are your only annual fee Chase Ultimate Rewards cards. Because you must have 1 Chase Ultimate Rewards card with an annual fee active in order to transfer points directly to airline and hotel partners.

Keeping the Sapphire Reserve open and downgrading the Sapphire Preferred can make sense for a lot of folks. Because the Sapphire Reserve gets you all of the same benefits as the Sapphire Preferred, plus a few extra like a $300 annual credit for travel purchases.

Although the Sapphire Reserve has a higher annual fee, it can easily be offset by the annual travel credit and value of the points you earn in the 3X bonus category (travel & dining purchases).

If you’re in a similar situation to reader Shirley, I’d love to hear which Chase card you’re downgrading!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!