Can You Earn a 2nd AMEX Sign-Up Bonus When You Apply for a New Business?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Danielle, commented:

I opened the Starwood Preferred Guest® Business Credit Card from American Express in the past using my Social Security number. I recently started a new business and have an EIN number. Can I open another AMEX Starwood small business card using my EIN to earn another sign-up bonus?

Great question, Danielle!

With the AMEX once per card, per lifetime rule, it’s very unlikely you’ll earn the sign-up bonus again by applying with a new Employer Identification Number (EIN).

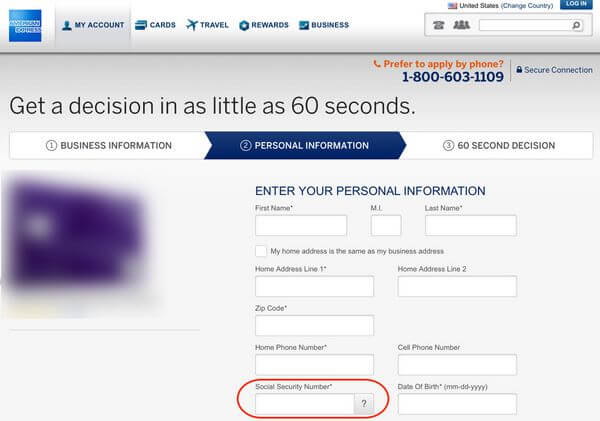

Because you must also include your Social Security number on a small business credit card application. So AMEX can see if you’ve earned the sign-up bonus before.

Instead of applying for the same card, I’ll share other ways to boost your miles & points balances!

Why a New Business Will NOT Help Earn You an AMEX Bonus on the Same Card

Link: Can You Earn More Than One Sign-Up Bonus With the Same AMEX Business Card?

Link: How to Qualify for a Small Business Credit Card (And Why You Should Get One!)

I’ve written how you can apply for a small business card using just your Social Security number. Some folks may have previously applied for cards like the AMEX Starwood small business card this way.

But if you apply for a second card with an EIN (Employer Identification Number), you still have to enter your Social Security number on the application. Because as the company owner, you’re agreeing to personally guarantee the credit line for the card.

And with your Social Security number, AMEX can see if you’ve had the same card before.

While it’s possible your second application will get approved, the sign-up bonus points will usually NOT post to your account.

Apply for Different Cards to Earn Valuable Sign-Up Bonuses

Link: Marriott Rewards® Premier Credit Card

Link: Marriott Rewards Premier Business Credit Card

Link: The Business Gold Rewards Card from American Express OPEN

Instead of applying for an AMEX card that won’t get you a sign-up bonus, you might consider applying for different cards.

Depending on your travel goals, you can boost your miles & points balances by applying for a different AMEX card. Or by applying for a card with a different bank.

For example, if your goal is to earn Starwood points, applying for the Chase Marriott personal or small business card can help. Because you can instantly convert Marriott points to Starwood points at a 3:1 ratio.

Both cards have an 80,000 point sign-up bonus after meeting spending requirements. That’s worth ~27,000 Starwood points (80,000 Marriott points / 3)!

Just remember, Chase has stricter application rules, which makes it difficult for some folks to get approved for cards like the Chase Marriott card.

If you’ve opened ~5 or more credit cards (from any bank) in the past 24 months (excluding certain business cards), it’s unlikely you’ll be approved for most Chase cards.

Or consider a different AMEX small business card, which won’t show up on your personal credit report.

For example, The Business Gold Rewards Card from American Express OPEN earns flexible AMEX Membership Rewards points, which you can transfer directly to airline and hotel partners. Here’s my full review.

Bottom Line

American Express restricts sign-up bonuses to once per card, per lifetime. Even applying for a second small business card for a new company doesn’t help get around the rule.Instead of applying for the same card, I’d recommend signing-up for a different card that can help boost your miles & points balances.

For example, if you’re looking to get more Starwood points and already have the AMEX Starwood small business card, you might consider applying for the Chase Marriott personal or small business card.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!