What’s the Difference Between US Bank FlexPoints and Altitude Points?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.A Million Mile Secrets reader emailed:

How do the US Bank travel credit cards work? Can I redeem points for a statement credit or only toward travel purchases?

This is a great question!

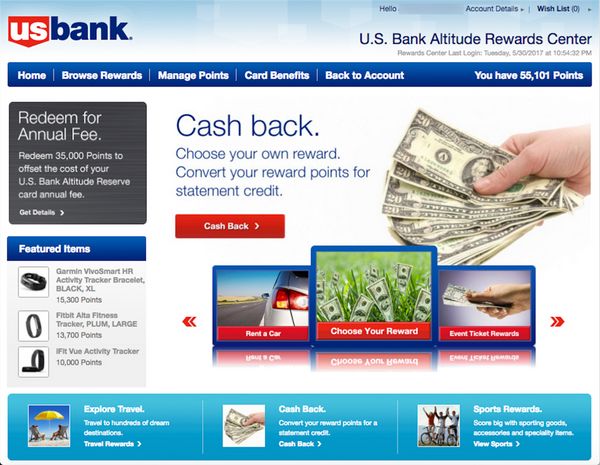

US Bank has 2 different kinds of points – FlexPoints and Altitude points. You can redeem both types of points for travel, statement credits, or gift cards. But you’ll get the most value using your points toward travel.

For example, you can earn 50,000 points with the new U.S. Bank Altitude™ Reserve Visa Infinite® Card after meeting minimum spending requirements. The sign-up bonus is worth $750 toward travel. But you would only get $500 if you redeemed the points for a statement credit.

I’ll compare US Bank FlexPoints and Altitude points. And show an example of how many points you’ll use for a flight.

Comparing US Bank FlexPoints and Altitude Points

Link: New Card Worth $750 in Travel

Link: Should You Consider the US Bank AMEX Cards?

The points you earn with US Bank travel credit cards do NOT transfer directly to frequent flyer or hotel loyalty programs. But you can still redeem your FlexPoints and Altitude points for lots of travel options, including:

- Airfare

- Car rentals

- Hotel stays

The main difference between FlexPoints and Altitude points is the value at the time of redemption.

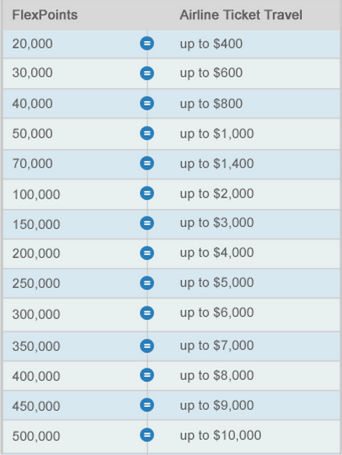

Altitude points are straightforward. Because they’re worth 1.5 cents each when you redeem them for any type of travel. And you can only earn these points with the US Bank Altitude Reserve Visa Infinite Card. You can read my full review of this new card, which has a sign-up bonus worth $750 in travel. FlexPoints are a little more complicated. Because there are different fixed redemption tables. This means the value of your points varies depending if you’re booking airfare, hotels, cruises, or car rentals.For example, you can redeem 20,000 FlexPoints for a plane ticket worth up to $400. This means FlexPoints can be worth up to 2 cents each toward airfare.

Meanwhile 20,000 FlexPoints can get you a hotel stay worth $300. So FlexPoints are worth up to 1.5 cents each toward hotel stays.

And 20,000 FlexPoints can get you a car rental worth up to $250. Redeeming FlexPoints this way makes your points worth up to 1.25 cents each toward car rentals.

And 10,000 FlexPoints are worth $100 toward a cruise. This makes your points worth 1 cent each, which means you’re getting less value than other types of travel redemptions.

You can earn FlexPoints with these cards:

- U.S. Bank FlexPerks® Travel Rewards Visa Signature® card

- U.S. Bank FlexPerks® Select+ American Express® Card

- U.S. Bank FlexPerks® Gold American Express® Card

- U.S. Bank FlexPerks® Business Edge™ Travel Rewards Card

Redeeming FlexPoints or Altitude points toward travel is better than gift cards, statement credits, and merchandise where your points are only worth 1 cent each!

And both types of US Bank points have an advantage over redeeming airline and hotel miles or points. You do NOT have to search for award seats or nights, which means you can avoid blackout dates.

That said, I still prefer earning other types of flexible points with programs like:

Because you can often get more than 2 cents per point when you transfer these points to travel partners.

And if you’re new to miles & points, I’d suggest applying for Chase travel cards first. That way you aren’t restricted by Chase’s approval rules.

Which Type of US Bank Points Is Better?

There are a couple of factors that will determine which US Bank points are best for you.

1. An Example Flight

First, let’s look at a sample flight using FlexPoints and Altitude points.

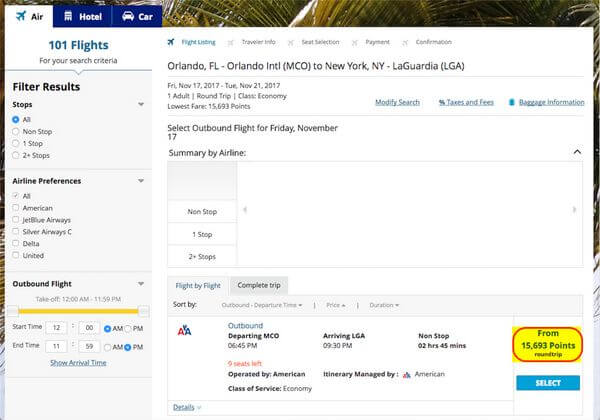

I searched a sample round-trip American Airlines coach flight from Orlando to New York (LGA) in November 2017. The flight costs ~$236 if you pay cash.

Or you can redeem 15,693 points linked to your US Bank Altitude Reserve card. Because points are worth 1.5 cents each toward travel (~$236 cash cost of flight / 1.5 cents).

Using FlexPoints for this same flight would cost you slightly more. Because 20,000 FlexPoints is the minimum redemption amount for airfare, which gets you a flight worth up to $400.

Keep in mind, if you’re booking a flight that costs just under $400, you’ll do better with FlexPoints. Because you’ll use 20,000 FlexPoints based on the fixed redemption table vs. ~27,000 Altitude points (~$400 flight cost / 1.5 cents).

So run the numbers to make sure you’re getting the best deal!

2. Earning Potential

Another thing to consider is which type of US Bank points are easier to earn. This will depend on the US Bank travel card you get and spending habits. Because the cards have different bonus spending categories.

For example, with the US Bank Altitude Reserve card, you’ll earn:

- 3X points per $1 spent on travel purchases

- 3X points per $1 spent on mobile wallet purchases (like Apple Pay or Samsung Pay)

But folks who eat out might prefer the US Bank FlexPerks Gold AMEX card. Because you’ll earn 3X FlexPoints at restaurants.

Bottom Line

US Bank has 2 different types of points depending on which travel credit card you have. You’ll earn Altitude points with the US Bank Altitude Reserve Visa Infinite® Card. And you’ll earn FlexPoints with other cards, such as the US Bank FlexPerks Gold AMEX.

The key difference between both points is the value you get when you book travel, including airfare, hotels, and car rentals.

US Bank Altitude points are worth a fixed amount of 1.5 cents each. But there are fixed redemption tables when you redeem US Bank FlexPoints, which means your points are worth varying amounts depending the type of travel you book. For example, 20,000 FlexPoints are worth up to $400 in airfare or up to $300 for a hotel stay.

The best type of US Bank points to earn depends on your travel goals and spending habits. Because the travel cards have different bonus spending categories.

Which type of US Bank points would you rather earn?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!