Why I Do NOT Agree With WalletHub’s 2017 Credit Card Report!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

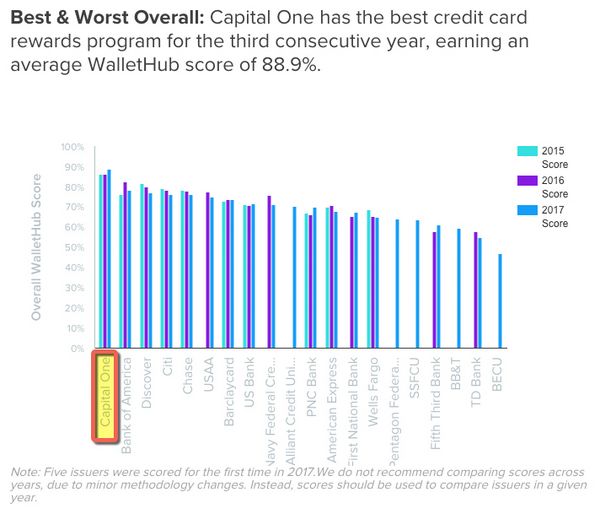

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. WalletHub recently released their annual Credit Card Rewards Report, comparing rewards cards from the largest banks. They used measures like a card’s earning potential, how easy the rewards are to redeem, whether the rewards expire, and annual fees, to rank each card.And you might be surprised at which bank came out on top!

But I wanted to share a more in-depth take on their methodology, because I don’t completely agree with their results.

Here’s more about WalletHub’s report, and my take on their findings.

WalletHub’s Credit Card Rewards Study

Link: WalletHub’s Comparison of Rewards Credit Cards

In WalletHub’s 2017 Credit Card Rewards Report, they compared rewards credit cards from the most popular issuers, like American Express, Capital One, Chase, Citibank, Bank of America, Discover, and more.

Through a fairly complex ranking system, they charted the best credit card rewards programs, the cards with the most earning potential, the best ways to redeem rewards, the banks that are most transparent, and those that offer the best earning & redemption policies.

According to WalletHub, Capital One’s Venture rewards are the best, overall. But to my surprise, Chase was 5th on the list, after Bank of America, Discover, and Citi.

That said, they recommended the Chase Sapphire Preferred Card as the top card from Chase. And I agree, that’s the best card for beginners.

What’s Missing From WalletHub’s Study

While the rewards programs from banks like Capital One, Discover, and Citi, are straightforward, Chase offers some of the most valuable travel rewards cards. Because Chase Ultimate Rewards points are incredibly flexible, easy to earn, and have great transfer partners.

Also, WalletHub’s analysis didn’t take into account each bank’s application rules, or how applying for a particular card might affect your credit report.

For example, Capital One pulls from all 3 main credit bureaus when they process your application. Other banks, like Chase and American Express, only pull from one. And they report small business cards to your personal credit reports. So applying for a card from Capital One has a bigger temporary effect on your credit score.

WalletHub’s study also didn’t consider the value of perks that come with certain cards, like lounge access, annual travel credits, etc. And benefits like these can really add up!

A day pass to an airport lounge, for example, can cost $50+. So if you’re a frequent traveler, having a card that offers free access to airport lounges, like the The Platinum Card® from American Express, can save you a lot of money.

You might also find that a co-branded card or a small business card makes the most sense for you. And those types of cards were excluded from WalletHub’s study.

But Million Mile Secrets readers are savvier than most, so y’all know it’s important to consider and compare all types of rewards cards.

In fact, there are certain business cards don’t show up on your personal credit report, making it easier to get approved for more cards in the future. And you might qualify for a small business card without realizing it!

Keep in mind, the average consumer isn’t opening lots of cards, trying to maximize rewards, and transferring points. So when you see credit card rankings by major websites, remember that you probably need to dig deeper into the results. Because the miles & points hobby takes a different approach and requires a bit of strategy. 😉

Plus, things in the world of miles & points are always changing, like when the sign-up bonus for the Chase Sapphire Reserve went from 100,000 Chase Ultimate Rewards points to 50,000 points, after meeting minimum spending requirements. So a top card one week might not be the best card the next!

Don’t Overcomplicate Things

Overall, WalletHub’s analysis is very complex, and I don’t believe figuring out the right card for you needs to be THAT complicated.

As a general rule, I recommend applying for Chase credit cards before you sign-up for cards from other banks. Because Chase has some of the most valuable credit cards for getting Big Travel with Small Money. And their strict application rules mean you won’t be approved for many of them if you apply for other cards first.

That said, there isn’t a one-size-fits-all when it comes to miles & points, either. The best kind of miles & points for you depends on your travel goals.

Are you looking to use miles & points for all out luxury, to travel domestically or internationally, or to stretch your rewards and make every point count? Once you’ve decided where you want to go and how you want to travel, it will be easier to narrow down the best rewards card for your particular situation.

Here’s my best credit card strategy for beginners. And don’t forget to check out my latest list of the top 7 credit cards to help you reach your travel goals.

Bottom Line

WalletHub’s latest annual Credit Card Rewards Report is out, and the Capital One rewards program was ranked #1 for the 3rd year in a row.While their methodology was very complex, it didn’t take into account the banks’ application rules, how applying might affect your credit score, or card perks like lounge access or travel credits.

It also excluded co-branded and small business cards, which are some of the top cards!

What do you think of WalletHub’s findings? Let me know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!