Planning to Buy a Car? Here’s How to Earn Credit Card Rewards for Your Purchase!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Considering a car purchase and wondering if it’s possible to rack up a few thousand miles & points using a credit card to buy it?

In short, it is! And you can even use a credit card to make your monthly car payment too!

This is great news for folks looking for ways to meet a card’s minimum spending requirements, earn extra rewards, or qualify for a yearly spending bonus for a purchase you’d make anyway!

I’ll show you how to put some (or all!) of the purchase price of a car on a credit card. And mention a few pitfalls you should look out for!

Can You Buy a Car With a Credit Card?

Here’s what you need to know before you consider paying for a car with a credit card:

- If you sign-up for a new credit card before buying a car you can potentially earn a lot of money or travel by meeting the minimum spending requirement with a single purchase!

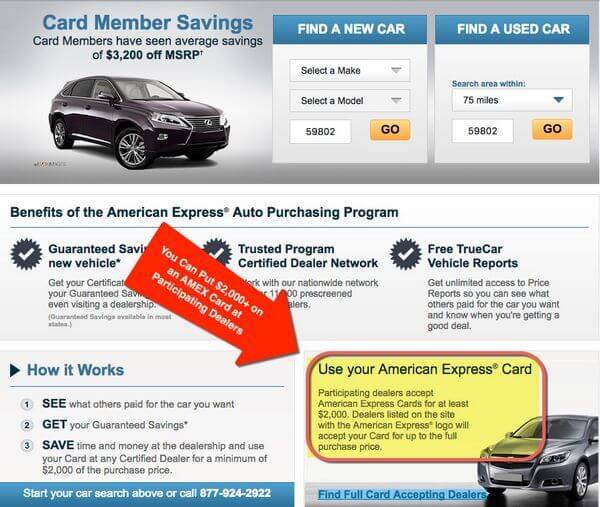

- AMEX has a program in place to allow you to pay for a car with your credit card, making them a great card issuer to use when buying a car!

- Not every dealer will let you use a credit card to pay for a car, so you might have to shop around

- You might only be able to put a down payment or pay for part of the car with a credit card

- The dealer might charge you more to pay with a credit card (but there’s a way around that!)

- Credit card interest can add up for you if you don’t pay off your balance, making it a potentially bad deal!

Buying a car can be stressful and usually requires some serious negotiating skills. Wouldn’t it be nice to earn miles, points, or cash back, for your purchase?

The good news is, in some cases, it’s possible to put at least part of the purchase price of a car on a credit card. And some dealerships even allow you to put the entire cost of a car on a card!

This could help with meeting minimum spending requirements, reaching yearly card spending bonuses for elite status or bonus rewards, or to simply earn lots of miles, points, or cash back.

That said, there’s a bit of strategy involved using a credit card to buy a car.

Tips for Buying a Car With a Credit Card

First, keep in mind the dealership will have to pay a credit card processing fee if they decide to accept a card. This fee could be ~1% to ~3% of the sales price, depending on what type of credit card you’re using. Assuming a $30,000 vehicle price and a 2% processing fee, that’s $600 ($30,000 X 2%).

Now let’s say the dealership usually makes a ~$1,500 profit off that $30,000 car. $600 in credit card fees is nearly half of their profit! So you can see why dealerships are very particular about whether they’ll accept credit cards. And if they let you pay with a card, they might be less willing to offer a discount on the vehicle price.

This video from The Credit Shifu does a great job of explaining why it might be better to negotiate a cheaper price instead of trying to buy a car with a credit card to get points.

Luckily, lots of dealerships will at least let you pay the down payment with a credit card. And folks who have done this before suggest NOT mentioning you plan on using a credit card until you’ve agreed on the price of the car. Otherwise, the sales representative might consider the credit card processing fee while negotiating the price.

Folks have reported being able to put anywhere from $1,000 to $10,000+ of the cost of a car on a credit card. And it can work for the down payment on a leased car too. So it’s certainly worth asking!

And American Express has an auto purchase program. Some dealerships participating in the program will allow you to put the entire cost of a car on an AMEX card!

This could be a great way to meet bigger minimum spending requirements, like the $20,000 tiered minimum spending requirement on the current offer for The Business Platinum® Card from American Express.

And you might even be able to make multiple payments with different cards, which can help you meet more than one minimum spending requirement!

Downsides to Consider

If you don’t have enough cash to pay in full for the car, buying the car with a credit card is a terrible idea for you! Because any miles & points you earn will be negated by the interest you’ll accrue on the purchase.

But you could use a card with a promotional rate to save on interest. Some cards offer 0% interest on purchases for 18+ months. Just be sure you can pay off the balance before the promotional interest rate expires.

Another issue you might run into is not having enough credit. For example, say you want to buy a $10,000 car and only have a $7,000 credit limit. With AMEX cards, there’s a way to check online whether you can spend above your credit limit.

For other cards, you could call the credit card company to see if they’ll raise your credit limit. But be sure to ask whether this will count as a hard credit inquiry because this can potentially impact your credit score.

Finally, it’s a good idea to set the cash advance limit on the card you’re using to $0. Then you won’t have to worry about being charged cash advance fees that would cancel out the value of any rewards you’d earn! And it’s a good idea to call your credit card company ahead of time and let them know you’ll be making a large purchase so it isn’t declined.

Which Card to Use to Buy a Car?

Buying a car with a credit card for rewards can be a great way to collect extra miles & points.

But you’ll earn even more points if you use your car purchase to meet the minimum spending requirement on one of the best credit cards for rewards.

Plus, there are many fantastic rewards credit cards, which earn 2X per $1 spent. So you could use a card like the Capital One® Venture® Rewards Credit Card (2X Venture miles on all purchases) or the Capital One® Spark® Cash for Business (2% cash back on all purchases).

On a $5,000 down payment, you’d earn $100 in rewards (2% X $5,000). And that’s not including any sign-up bonus you might qualify for!

When I make large (or small) purchases, I prefer to earn transferable points whenever I can. Because while a cash back card can earn you 2% in rewards, you can potentially get much more value having the ability to transfer points to airline or hotel partners. That’s how you get Big Travel with Small Money!

You can also consider the AMEX Platinum small business or personal card if you plan on paying for a car with a credit card. Because there is already a program in place for using AMEX credit cards to buy a car. And the AMEX Platinum cards come with extremely valuable bonuses!

The Platinum Card® from American Express card comes with a 60,000 AMEX Membership Rewards point bonus after you spend $5,000 on purchases within the first 3 months of account opening.

Every once in a while some folks are targeted for a huge 100,000 AMEX Membership Rewards point bonus on this card through the CardMatch tool (offer subject to change at anytime). If you’re one of the lucky ones, then buying a car with the AMEX Platinum personal card becomes much more of a “no-brainer” deal.

If you qualify for small business cards (you might and not even know it!), it makes a lot of sense to get the AMEX Business Platinum card to use for a car purchase. Small business cards from AMEX do NOT appear on your personal credit report. So they won’t count toward your Chase “5/24” limit, which will give you a better chance of earning lucrative bonuses on other cards in the future!

And the AMEX Business Platinum card comes with a bigger welcome bonus. You’ll earn 50,000 AMEX Membership Rewards points after spending $10,000 on purchases within the first 3 months of card membership. And you can earn an additional 25,000 AMEX Membership Rewards points by spending another $10,000 on purchases within the same first 3 months of card membership.

The $20,000 minimum spending requirement on the AMEX Business Platinum card is a lot for most folks to spend in 3 months, which is one reason why buying a car with this card makes sense!

Use Plastiq to Make Car Payments

If you plan to finance your vehicle purchase, you don’t have to miss out on earning valuable rewards.

You can use a service, like Plastiq, to make you car payment. This is a great way to meet your minimum spending requirement! And Plastiq already has a lot of car financing companies listed as payment options. So the process is even more seamless.

You’ll pay a 2.5% fee to use their service. So if you make a $400 monthly payment, you’ll pay an extra $10 ($400 X 2.5%) for the convenience of putting the charge on your card. For me, this is worth it if I’m working toward earning a big sign-up bonus. But otherwise I wouldn’t pay the extra fee to earn points because the rewards I earn from $400 of normal spending usually aren’t worth $10.

Bottom Line

It IS possible to pay for some (or all!) of a car’s purchase price with a credit card. But you’ll likely have to negotiate with the sales representative. And some folks suggest mentioning you’d like to use a credit card AFTER the price of the car is agreed upon.

Also, if you don’t have enough cash to pay your credit card bill in full after you purchase the car, do NOT use a credit card to make the purchase. Because the interest you’ll pay will negate the value of any rewards you earn.

Otherwise, being able to charge a few thousand dollars to a credit card for a purchase you already plan on making could be a great way to meet minimum spending requirements, meet yearly card spending bonuses for elite status, or to earn lots of miles!

Other Popular Million Mile Secrets Articles to Read

- Get a $100 dining credit with select hotels thanks to AMEX FHR!

- The top credit card for travel can save you $1,000s on your next bucket list trip!

- Book the travel of your dreams with the best AMEX card!

- Take advantage of this Chase Marriott credit card bonus for Big Travel with Small Money!

- One of these metal credit cards is what your wallet is missing!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!