5 Reasons to Choose the AMEX Starwood Over the Chase Marriott Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Glen, commented:

Which card and sign-up bonus is better, 25,000 Starwood points with the Starwood Preferred Guest® Credit Card from American Express or 80,000 Marriott points with the Chase Marriott card?

The points you earn with the AMEX Starwood and Marriott Rewards cards can be used interchangeably between both hotel chains. Because Starwood points transfer to Marriott at a 1:3 ratio, and vice versa.

If you have to pick one, I think the AMEX Starwood card is best for everyday spending. And it’s easier to get approved for it.

Although, the Chase Marriott card comes with a slightly higher sign-up bonus. And the card has additional perks, like a free anniversary night. But you might face tougher application rules with Chase.

I’ll explain 5 things to consider when deciding between the AMEX Starwood and Marriott Rewards cards.

AMEX Starwood Vs. Chase Marriott

1. AMEX Starwood

Link: Starwood Preferred Guest® Credit Card from American Express

Link: Starwood Preferred Guest® Business Credit Card from American Express

With the AMEX Starwood card, you earn 25,000 Starwood points after spending $3,000 on purchases within the 1st 3 months. And with the AMEX Starwood small business card, you’ll earn 25,000 Starwood points after spending $5,000 in purchases within the 1st 3 months of account opening.

You’ll also get:

- 2 Starwood points per $1 you spend at Starwood, Marriott, and Ritz-Carlton hotels

- 2 stay credits or 5 night credits toward Starwood elite Status

- No foreign transaction fees

- Access to AMEX offers, which can save you money on everyday purchases

- Free in-room internet at participating Starwood hotels

The $95 annual fee is waived for the 1st year.

Note: You’re only eligible to earn AMEX sign-up bonuses once per card per lifetime.2. Chase Marriott

Link: Marriott Rewards® Premier Credit Card

When you sign-up for the Chase Marriott Rewards Premier card and spend $3,000 on purchases within the 1st 3 months of opening your account, you’ll earn 80,000 Marriott points.

Plus, you’ll earn an additional 7,500 bonus Marriott points when you add an authorized user who makes a purchase within the 1st 3 months of opening your account.

Other perks of this card include:

- 1 free night in a Marriott Category 1 to 5 location on your card anniversary

- 5 Marriott points per $1 spent at Marriott, Ritz-Carlton, and Starwood hotels

- 2 Marriott points per $1 at restaurants, on car rentals, and airline tickets purchased directly from the airline

- 1 Marriott point per $1 spent on all other purchases

- No foreign transaction fees

- 15 nights credit towards elite status (so you get Marriott Silver status)

- Visa Signature discounts

The $85 annual fee is NOT waived for the 1st year.

Note: You are NOT eligible to receive a new Chase cardmember sign-up bonus if you’ve received a bonus on the same card in the past 24 months.5 Reasons to Get the AMEX Starwood Card

The Chase Marriott Premier Rewards card sign-up bonus is 5,000 points higher than the AMEX Starwood card.

You’ll earn 80,000 Marriott points with the Chase Marriott card. This compares to the 25,000 Starwood points you’ll earn with the AMEX Starwood card, which you can convert to 75,000 Marriott points (at a 1:3 ratio).

Even with the slightly higher sign-up bonus, I still think there are 5 reasons to get the AMEX Starwood card.

1. Annual Fee Is Waived the First Year

The AMEX Starwood card has a $95 annual fee, which is waived for the first year.

Even though you’ll earn 5,000 more Marriott points with the Chase Marriott card, you’ll have to pay the $85 annual fee.

So you can use the AMEX Starwood card for ~10 months to see if you like the perks. Then, decide if it’s worth keeping.

2. Earn More Starwood or Marriott Points With Spending

You can earn more Starwood or Marriott points by using the AMEX Starwood card.

Because you’ll earn 1 Starwood point per $1 you spend on everyday purchases. Then, you can convert every 1 Starwood point you earn to 3 Marriott points.

With the Chase Marriott card, you only earn 1 Marriott point per $1 spent.

Plus, you’ll also earn more bonus points by using the AMEX Starwood card on spending at Marriott, Ritz-Carlton, and Starwood hotels.

Because of the 1:3 transfer ratio, you can essentially earn 6 Marriott or Ritz-Carlton points per $1 spent on Marriott or Ritz-Carlton stays when you use your AMEX Starwood card.

This is better than the 5 Marriott or Ritz-Carlton points you’ll earn on the same stays using the Chase Marriott card!

And AMEX sometimes offers promotions to earn bonus Starwood points after meeting spending requirements.

3. Save Money With AMEX Offers

You can use the AMEX Starwood card to take advantage of AMEX Offers. This is a terrific way to save money on purchases you may already be planning.

Recent AMEX offers have included:- $25 back on a $100+ Verizon purchase

- $20 back on a $100+ Staples.com purchase

- $10 back on a $30+ Ruby Tuesday purchase

AMEX is constantly adding new offers. Just remember to register your card before the purchase, so you can get the savings!

4. Tougher Chase Application Rules

Chase has stricter application rules, which makes it difficult for some folks to get approved for cards like the Chase Marriott card.The rule affects folks who have opened ~5 or more credit cards (from any bank) in the past 24 months (excluding certain business cards). If you have lots of new cards, it’s unlikely you’ll be approved for most Chase cards.

Remember, there’s an easy way to check your 5/24 status. If Glen is NOT impacted by the Chase rule, then he can apply for either card.

Keep in mind both of these cards count toward Chase’s 5-card limit. So if Glen is thinking about getting other Chase cards in the future, he should factor this in before he applies.

5. The AMEX Card Might Not Be Around Forever

Following the Starwood and Marriott merger announcement, I said the AMEX Starwood cards could possibly be discontinued in the future.

I don’t have any official information this will happen anytime soon. But once the hotel chains officially merge loyalty programs in 2018, it’s possible they only keep 1 card And Marriott already has a relationship with Chase.

So given there’s potential for the cards to go away, I think it’s just another reason to get the AMEX Starwood card.

How to Use Starwood and Marriott Points

Link: How to Earn and Use Starwood Points

Between the Marriott and Starwood rewards programs, Starwood points are more flexible.

Besides booking free hotel nights at Marriott, Ritz-Carlton, and Starwood hotels, you can:

- Transfer Starwood points to airline partners (and get 5,000 bonus miles when you transfer 20,000 Starwood points)

- Book Nights & Flights packages

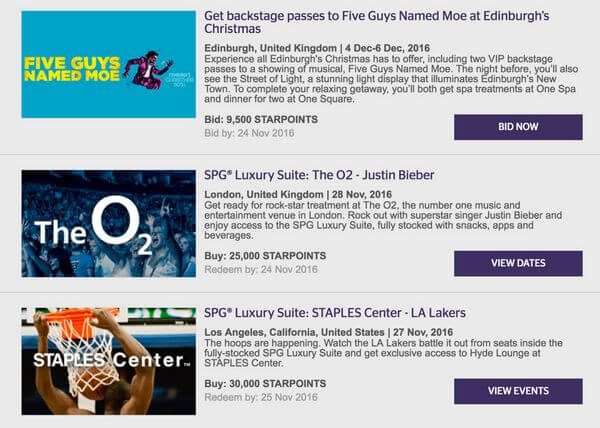

- Redeem Starwood points for special SPG moments like sporting events and concerts

Marriott points can also get you free nights at Marriott, Ritz-Carlton, and Starwood hotels. Or you can transfer Marriott points to airlines. But I wouldn’t recommend this because the transfer ratio is usually unfavorable.

To convert your Marriott points to airline miles, you can book Marriott Hotel + Air Packages. This can get you a 7-night hotel stay and airline miles!

Bottom Line

I think the AMEX Starwood card is a better choice compared to the Chase Marriott Rewards card. The sign-up bonuses on both cards are similar and can get you a free night at a Starwood Category 6 hotel or 2 free nights at a Marriott Category 7 hotel.

But with the AMEX Starwood card, the annual fee is waived the 1st year and you’ll be eligible to save money with AMEX Offers. And the AMEX Starwood card will also earn you more points on everyday purchases and when you pay for Marriott, Ritz-Carlton, and Starwood hotel stays.

The AMEX Starwood card is also easier to get because the Chase Marriott card is impacted by the bank’s tougher application rules.

Regardless of the card you choose, the points you earn can move back and forth instantly between your Starwood and Marriott accounts. This gives you great flexibility to transfer Starwood points to airline partners or book Marriott Hotel + Air Packages.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!