Earn a Round-Trip Ticket Within the US With the Asiana Card Sign-Up Bonus

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Via Doctor of Credit, the Bank of America Asiana credit card is now offering an increased sign-up bonus of 30,000 Asiana Airlines miles after meeting minimum spending requirements. So here’s my Asiana credit card review!

The bonus grants you enough miles for a round-trip coach ticket within the US (excluding Hawaii) or Canada on Star Alliance partners like United Airlines!

Emily and I don’t receive a commission for this card but we’ll always tell you about the best deals!

The Asiana card could be a good option if you already have a lot of rewards earning cards. But I do NOT recommend it if you’re new to miles & points. I’ll explain.

Review of the Asiana Credit Card

Link: Bank of America Asiana Airlines Credit Card

Link: Asiana Airlines Award Chart

Link: Asiana Airlines Partners

Link: Asiana Partner Award Chart

With the Bank of America Asiana Airlines card, you can earn 30,000 Asiana Airlines miles after spending $3,000 on purchases within 90 days of account opening.

You’ll also get:

- 3X Asiana miles on Asiana Airlines purchases

- 2X Asiana miles on gas and grocery store purchases

- 1X Asiana miles on all other purchases

- 10,000 bonus Asiana miles on each anniversary of card membership

- $100 annual statement credit on Asiana Airlines ticket purchases

- 2 Asiana Airlines lounge passes (only for primary cardholder)

- No foreign transaction fees

The $99 annual fee is NOT waived the first year.

Should You Apply for the Asiana Credit Card?

Link: Chase Sapphire Preferred

Link: Chase Sapphire Reserve

This offer is more than the usual sign-up bonus of 10,000 Asiana Airlines miles. And it’s the highest I’ve seen for this card. Plus, it’s now a Visa Signature card instead of an AMEX.

But most folks can do better with other cards, especially if you’re new to miles and points. And I recommend folks new to our hobby apply for Chase cards first because of their stricter application rules.

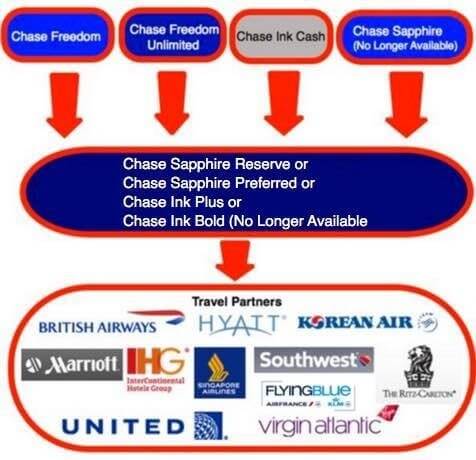

The Chase Sapphire Preferred is the first card I recommend for folks starting in our hobby. It earns Chase Ultimate Rewards points (my favorite kind!), which you can transfer to airline and hotel partners like United Airlines, Southwest, and Hyatt. You can read my review of the card here.

Or consider the new Chase Sapphire Reserve that comes with a 100,000 Chase Ultimate Rewards points sign-up bonus after meeting the minimum spending requirements. It has a large annual fee that may or may not be worth it for folks. Check out my review of the Sapphire Reserve card here.

That said, if you already have the other cards you want, you could consider the Bank of America Asiana Airlines card. Because 30,000 Asiana Airlines miles is enough for 1 round-trip coach flight within the US (excluding Hawaii) and Canada, which costs 25,000 Asiana Airlines miles.

Or you could use the sign-up bonus for a one-way coach ticket to Europe, which costs 25,000 Asiana Airlines miles.

But don’t forget, you’ll have to pay fuel surcharges on Asiana Airlines award tickets.

If you needed more Asiana Airlines miles, you could transfer Starwood points to Asiana Airlines at a 1:1 ratio. Plus, when you transfer 20,000 Starwood points to airlines, you get 5,000 bonus miles.

Bottom Line Review of the Asiana Credit Card

There’s an increased sign-up bonus on the Bank of America Asiana Airlines card. You’ll earn 30,000 Asiana Airlines miles after spending $3,000 on the card within 90 days of opening your account.

We don’t earn a commission for this offer but we’ll always post about the best deals!

With the bonus you can get 1 round-trip coach ticket within the US (excluding Hawaii) and Canada. Or a one-way coach ticket to Europe.

That’s good news, but I do NOT recommend this card if you’re new to miles & points.

You’re better off applying for Chase cards first because of their stricter application rules. And because many of the Chase cards, like the Sapphire Preferred and Sapphire Reserve, earn Chase Ultimate Rewards points that you can transfer to travel partners for Big Travel.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!