Do You Still Get Primary Rental Car Insurance When You Use Chase Ultimate Rewards Points to Pay for Your Rental?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

I wrote about the terrific primary car rental insurance coverage you (and authorized users) get when you rent a car using the Chase Sapphire Preferred Card.

Million Mile Secrets reader Tommy commented:

If you use your Chase Ultimate Rewards points to pay for a rental car, is the insurance still covered? Or what would your best advice be there?

Excellent question, Tommy! Using Chase Ultimate Rewards points for paid car rentals through the Chase Ultimate Rewards Travel Portal can often be an excellent deal.

The good news is, you’re still covered by your Chase Sapphire Preferred card as long as you meet certain conditions!

I’ll explain how it works!

Get Primary Rental Car Insurance, Even If You Pay With Points

Link: Chase Sapphire Preferred Card

Link: Chase Sapphire Preferred Benefits Guide

Link: My Review of the Primary Rental Coverage With the Chase Sapphire Preferred

Link: Do Chase Sapphire Preferred Authorized Users Get Primary Rental Car Insurance?

Using your Chase Sapphire Preferred card to pay for rental cars can save you money! When you decline the rental company’s collision damage waiver (often referred to as CDW or LDW), you get primary rental car insurance when you pay with your card.

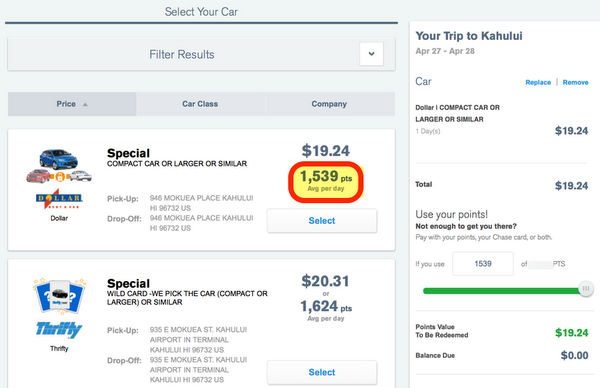

This coverage also applies if you use Chase Ultimate Rewards points through the Chase Ultimate Rewards Travel Portal to pay for your rental.Remember, Chase Ultimate Rewards points earned from the Chase Sapphire Preferred card are worth 1.25 cents each toward paid travel, including car rentals.

But here’s the catch! You must pay with points from your Chase Sapphire Preferred account. And NOT other Chase Ultimate Rewards points-earning accounts like the Chase Ink Plus, Chase Ink Bold, or Chase Freedom.

For example, if you have Chase Ultimate Rewards points in your Chase Ink Plus or Chase Ink Bold account, transfer them to your Chase Sapphire Preferred account FIRST. Then purchase your rental with points from the Sapphire Preferred account.

What About Points + Cash?

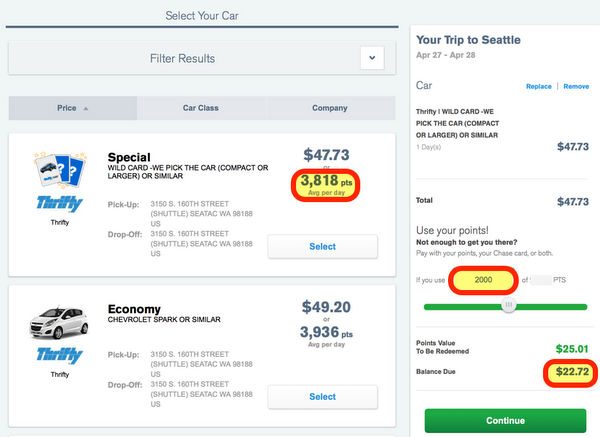

Chase Ultimate Rewards is my favorite rewards program because it’s so flexible. If you don’t have enough points to cover the full cost of your rental (or prefer not to), you can pay with a combination of points and cash.

If you’re in this situation, you’ll be covered by the Chase Sapphire Preferred primary rental insurance if:

- The points are from your Chase Sapphire Preferred account (as mentioned above), and

- You pay the balance with your Chase Sapphire Preferred card

So if you paid partly with Chase Ultimate Rewards points from your Chase Sapphire Preferred card, and the balance with a different card, you would NOT be covered.

Basically, the entire rental cost must be paid for

- With the Chase Sapphire Preferred card,

- Chase Ultimate Rewards points from your Chase Sapphire Preferred account,

- or a combination of the two

for the primary rental coverage to be in effect.

Remember, you must decline the auto rental company’s collision damage waiver to be eligible for coverage through the Chase Sapphire Preferred!

Note: The primary rental insurance from the Chase Sapphire Preferred only covers damage to your rental car in case of an accident of theft (other vehicles and injuries are NOT covered).And if you don’t have a Chase Sapphire Preferred card, here are other cards that offer primary car rental insurance coverage.

This Card Has You Covered in Other Areas, Too!

The Chase Sapphire Preferred comes with lots of other benefits that can save you money, including:

- Trip Cancellation – You could be covered for up to $10,000 ($20,000 if you’re traveling with immediate family) if your trip is cancelled for an eligible reason

- Trip Interruption – If you have to end your trip early you could be reimbursed for any prepaid transportation (not including miles & points) up to $10,000

- Trip Delays – Get up to $500 per ticket when your trip is delayed for more than 12 hours (even authorized users are eligible)

- Lost Luggage – Luggage or items inside are lost or damaged for up to $3,000 with a limit of $500 for certain items like cameras, jewelry, and electronics

- Delayed Luggage – After 6 hours, up to $100 a day for up to 5 days

That’s part of the reason why many folks, including me and Emily, keep this card in their wallet year after year!

Bottom Line

The Chase Sapphire Preferred includes primary rental car insurance when you use the card to pay for your rental.

But you’re also covered if you use Chase Ultimate Rewards points from your Chase Sapphire Preferred account to pay for your rental through the Chase Ultimate Rewards Travel Portal!

And if you use points to partially pay for your rental, you’ll still be covered! As long as the points come from your Chase Sapphire Preferred account and you pay the balance with your Chase Sapphire Preferred card.

Thanks for the question, Tommy!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!