Southwest Rapid Rewards Performance Business credit card review

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

With the Southwest Rapid Rewards Performance Business Credit Card, you can earn a welcome bonus offer of 80,000 Southwest points once you spend $5,000 on purchases within the first three months of receiving the card. The airline is a favorite with flyers thanks to its great customer service, no change fees and free checked-bag policies. This intro bonus can get you ~$1,120 in Southwest flights, based on our value of Southwest points of around 1.4 cents apiece.

Although this is a business card, you don’t need to own a large corporation to qualify. Mowing lawns, reselling items on eBay, tutoring or any number of things you do outside your full-time job can qualify you as a business owner to become eligible for this card. The Southwest Performance Business even makes our list of the best airline credit cards.

Who is the Southwest Performance Business card for?

Southwest is perfect for flying domestically and to tropical destinations around the Caribbean and Mexico. It’s also excellent for anyone who finds themselves with lots of checked bags, like families or athletes with gear, as the airline allows each traveler to bring two checked bags for free. Read our Southwest Rapid Rewards review.

If you’re a small-business owner who flies Southwest, the Southwest Performance Business card is one of the best cards you can get. Note that it’s issued by Chase, so it is subject to some application rules, such as the 5/24 rule. Chase will not approve you for most of their cards if you’ve opened five or more cards from any bank (not counting Chase business cards and certain other business cards) in the past 24 months.

Yes, this is a business card — but you do not need to own a large business to qualify. And you’re eligible even if you have the other Southwest business card, the Southwest Rapid Rewards Premier Business Credit Card.

For helpful information on applying, check out our guide on how to complete a Chase business credit card application.

Current offer

The Southwest Performance Business card comes with a welcome bonus 80,000 Southwest points after you spend $5,000 within three months of account opening. Southwest points value tends to stick around 1.4 cents each toward Southwest flights. That means this 80,000-point bonus is worth $1,120. That’s more than enough to justify the card’s $199 annual fee.

Benefits and perks

Southwest Companion Pass

One of the more common ways of earning the Southwest Companion Pass is by accumulating 125,000 Southwest points in a calendar year. After attaining the Southwest Performance Business Card’s welcome bonus of 80,000 points, you’ll be well on your way to earning the Companion Pass.

Once you earn the Companion Pass, you can take a friend or family member with you every single time you fly Southwest for both the remainder of the current calendar year and the following full calendar year. There’s no limit to how many times you can use the pass, so it can literally save you thousands of dollars. For instance, I used my pass to buy tickets for my wife and me to various destinations like Mexico, Chicago and Philadelphia — we saved $1,000+ last year alone.

For more information, check out our article on how to use the Southwest Companion Pass.

TSA PreCheck or Global Entry credit

The Southwest Performance Business card offers up to $100 in TSA PreCheck or Global Entry credit every four years. With TSA PreCheck or Global Entry, you’ll skip long airport lines and save a ton of time when you travel. And if you already belong to one of these trusted-traveler programs, you can use this credit against the application fee when you renew your TSA PreCheck or Global Entry membership (they expire every five years).

Four upgraded boarding certificates per year

When available on your day of travel, you can buy upgraded boarding to positions A1 to A15 and be among the first to get on the plane. Just use your card for the upgrade (which costs $30, $40 or $50 depending on the flight) and you’ll receive a statement credit up to four times per cardmember year. That’s worth up to $200.

Inflight Wi-Fi credits

You’ll receive 365 $8 credits for purchases of Southwest inflight Wi-Fi. Fly Southwest 25 times a year and this perk alone pays for the annual fee.

9,000 anniversary points

Every year on your account anniversary, you’ll receive 9,000 Southwest points (worth ~$135 in Southwest airfare), which covers a good portion of the card’s annual fee.

Earn tier-qualifying points toward elite status

If you need more points to earn A-List or A-List Preferred elite status with Southwest, the Southwest Performance Business card gets you 1,500 tier-qualifying points (TQPs) for each $10,000 in purchases.

This could give you the boost you need if you’re just short of your qualifying-points threshold. Having Southwest elite status means you get bonus points on paid flights, priority check-in and boarding and free same-day standby. A-List Preferred members also get free inflight Wi-Fi.

Additional employee cards at no extra cost

If you have employees, a good way to quickly rack up points is to have them use the card for all business expenses. These additional employee cards are free.

How to use points from the Southwest Performance Business card

With the Southwest Performance Business card, you can earn bonus points in a number of different categories:

- 4x points on Southwest Airlines purchases

- 3x points on Southwest and Rapid Rewards hotel and car purchases

- 2x points on rideshare.

- 2x points on social media and search engine advertising, internet, cable, and phone services

- 1x on all other purchases.

- 9,000 Southwest points each cardmember anniversary

Additional information can be found in our full guide on how to earn Southwest points.

Using Southwest points is pretty straightforward. There’s no Southwest award chart — just find a flight on the Southwest website and as long as there are seats available, you can book it with cash or points.

A few things to know about Southwest points:

- Southwest points are typically worth about 1.4 cents each and award prices are based on the cash price of a flight

- Since they’re tied to the cash price, there are no blackout dates

Here’s an example of how to find and book a Southwest award flight:

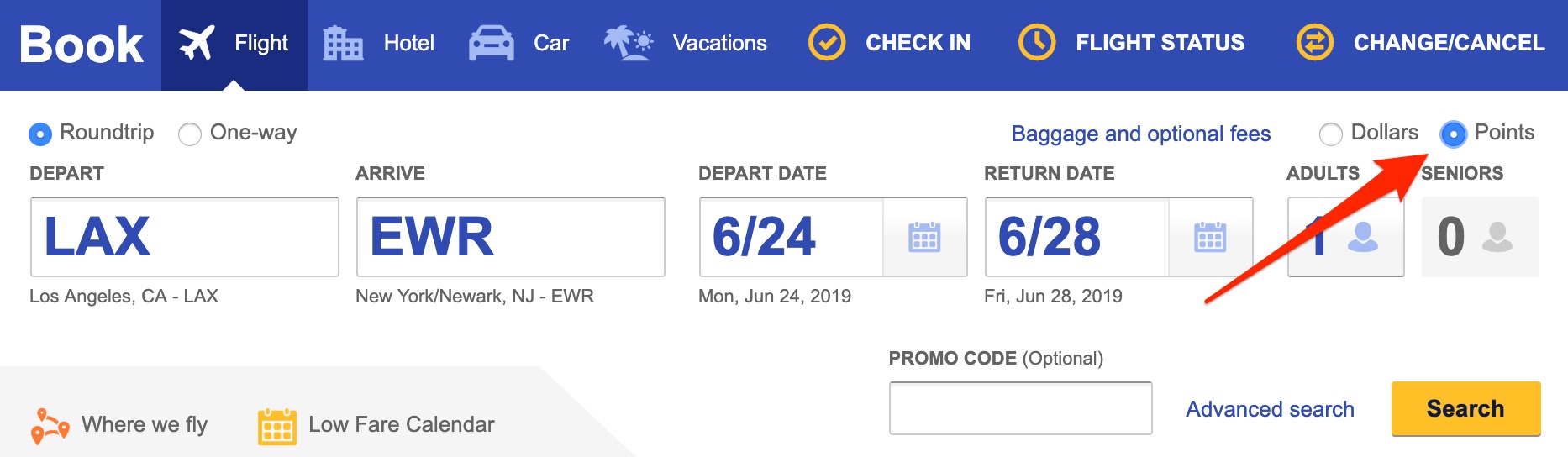

Step 1. Enter your trip details on the Southwest home page

Head to Southwest.com and put in the details of your flight, including departure and arrival airports, travel dates and number of passengers.

Make sure you check the box for “Points” in the upper right-hand corner of the search box.

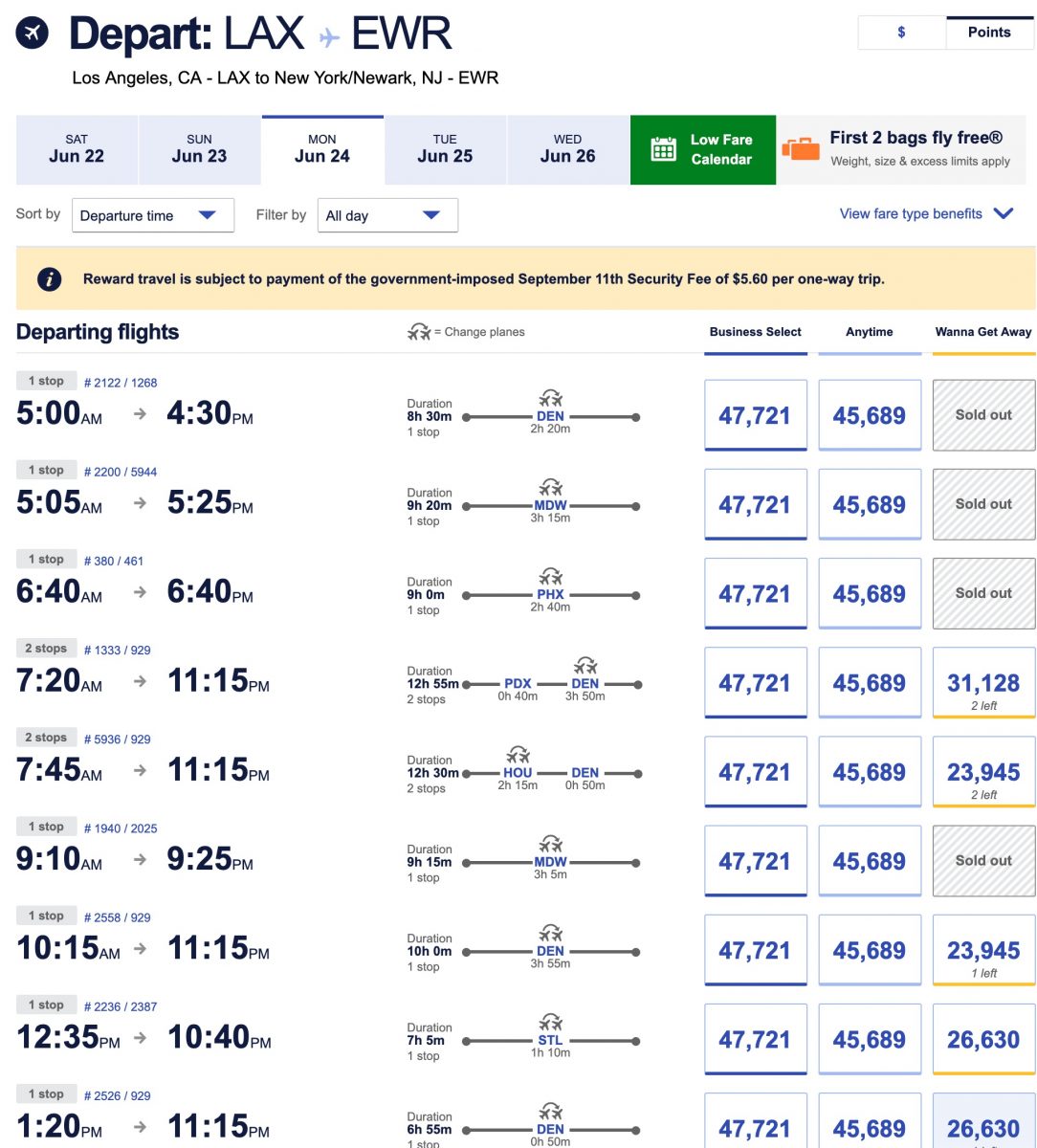

Step 2. Select the flight you want

Once you’ve entered the details of your trip, you’ll be given a page with available flights, along with their corresponding point costs.

One great thing about Southwest is they do not charge change fees. If you ever need to cancel a reservation altogether, the points you originally redeemed for the flight will simply be deposited back to your Southwest account.

Check out our post with ideas on the best ways to use Southwest points.

Is the annual fee worth it?

Absolutely yes. At $199, the Southwest Performance Business card has the highest annual fee of all of Chase Southwest cards but it has a ton of perks. Here’s a summary:

- The intro bonus alone is worth $1,120 based on our valuations.

- The intro bonus can be used toward earning the Companion Pass.

- Speed through the airport with a statement credit of up to $100 for TSA PreCheck or Global Entry application fee.

- Receive four upgraded boarding certificates per year, worth up to $200.

- Get inflight Wi-Fi credits worth $8 per flight, up to 365 times per year (and save hundreds of dollars).

- Boost your progress toward Southwest elite status by earning tier-qualifying points.

- You’ll earn 9,000 bonus points each anniversary year, worth ~$135.

Insider secret

Chase small-business cards have superpowers.

Remember, Chase won’t approve you for most of their cards if you’ve opened five or more cards from any bank in the last 24 months — not counting Chase business cards and certain other business cards. That’s right, as long as you’re under 5/24, you can still apply for this card and it won’t hurt your chances of being approved for any other Chase cards you want. Essentially, most business cards don’t count against Chase’s 5/24 rule.

Additionally, Chase will not approve you for multiple cards under the same brand (for example, you can’t hold two personal Southwest cards at once). However, this rule doesn’t apply to Chase small-business cards. Even if you have a Southwest personal credit card (and another Southwest small-business card), you can be approved for this card.

Bottom line

New cardmembers with the Southwest Performance Business card can earn a welcome bonus of 80,000 Southwest points after meeting tiered minimum spending requirements.

The welcome bonus alone is worth around $1,120 in Southwest airfare (and much more if you utilize the Companion Pass regularly), which is more than enough to cover the card’s $199 annual fee. You’ll also get additional perks like 9,000 bonus points each account anniversary (worth ~$135), Global Entry/TSA PreCheck credit, inflight Wi-Fi credits and four upgraded boarding certificates per year.

The points earned from the welcome bonus also count toward the Southwest Companion Pass, for which you’ll qualify if you earn 125,000 Southwest points in a calendar year. It’s the best deal in travel because a friend or family member flies with you for nearly free (just pay taxes and fees) on paid and award tickets.

For the latest news, tips, and tricks to traveling cheap, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!