Best Western Credit Card Review: OK for Best Western Fans, but You Can Do Much Better

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Best Western Credit Card Review

- Earn 50,000 Best Western points after meeting minimum spending requirements, plus 20,000 Best Western points when you spend at least $5,000 on purchases during each 12 billing cycle period

- 20 Best Western points per $1 on Best Western stays, 2 Best Western points per $1 on all other purchases

- Redeem Best Western points for award nights from 8,000 to 36,000 Best Western points per night

- This card is only good if you really like Best Western and would spend $5,000+ on the card each 12 billing cycles

- Other cards, like the Chase Sapphire Preferred Card, Capital One Venture, or any of our picks for best hotel credit card or best credit cards for travel are a better deal for most folks

Alex: If you like Best Western, or often travel to smaller cities and towns where there are usually Best Western hotels, you might consider the Best Western Rewards® Premium Mastercard.

This card isn’t on the radar of most miles and points enthusiasts because it’s not issued by a major bank. And for most folks, there are better hotel cards that earn more valuable points and have superior perks and flexibility.

But if you’re a Best Western fan, or already have a lot of cards from other banks, it’s worth a look.

We don’t earn a commission from the Best Western credit card, but we’ll always tell you about interesting deals!

Here’s a closer look at the card. And which cards are better for similar travel goals!

Should You Consider the Best Western Credit Card?

Link: Best Western Rewards® Premium Mastercard

Best Western is a favorite among road warriors and families because you can find their hotels pretty much everywhere. They’ve got over 4,200 hotels in 100+ countries, and are known for being in spots you might not find other mainstream hotel chains, like small towns.

Many are family friendly, with pool and spacious rooms. And most locations offer complimentary breakfast to everyone – no elite status required!

When you open the Best Western credit card, you’ll earn 50,000 Best Western points after spending $1,000 on purchases in the first 3 billing cycles. Plus another 20,000 Best Western points when you spend at least $5,000 on purchases during each 12 billing cycle period thereafter.

So in total, you could earn 70,000 Best Western points in the first 12 billing cycles if you meet the full $5,000 spending requirement.

The card also offers:

- A total of 20 Best Western points per $1 on Best Western stays (this includes 10 points per $1 you would always get as a Best Western Rewards member, and another 10 points per $1 for using this card)

- 2 Best Western points per $1 on everything else

- Automatic platinum elite status (15% bonus points per stay, room upgrades, 10% discount on award redemptions)

- 10% discount off paid Best Western stays when cardholders use their card and book through bwrcarddiscount.com

- No foreign transaction fees

- $59 annual fee (waived the first year)

This card is issued by First Bankcard, which is part of First National Bank of Omaha. So it could be an option for folks who’ve maxed out the number of cards they’ve gotten from other major banks.

How Does the 70,000-Point Sign-Up Bonus Work?

The total sign-up bonus of 70,000 Best Western points is made up of 2 parts.

First, you will earn 50,000 Best Western points after you spend $1,000 on purchases during the first 3 billing cycles. That’s not a huge spending requirement to earn a chunk of Best Western points.

But to earn an additional 20,000 Best Western points, you’ll have to spend a total of $5,000 on purchases in 12 billing cycle period. You’ll earn this bonus every year, provided you spend $5,000 in each 12 billing cycle period.

While 50,000 Best Western points sounds like an impressive sign-up bonus, remember not all hotel points are created equal.

And although the 20,000 Best Western points bonus for spending $5,000 on purchases each 12 billing cycles seems like a good incentive to use this card, there are far more valuable cards with better bonus categories to put that kind of spending on. Or you could use those expenses to unlock a sign-up bonus on one of the best credit cards for travel.

What Are Best Western Points Worth?

Again, it’s important to compare apples to apples when you’re considering sign-up bonuses and spending on rewards cards.

I spoke with a Best Western representative to talk about the value of the points in their rewards program. They told me that point values are determined based on each hotel, and can vary from location and date around the world. However, they did tell me that:

Best Western free night stays range from 8,000 to 36,000 Best Western points per night

Theoretically, 70,000 Best Western points could be get you up to 8 free nights (70,000 point bonus / 8,000 points per night). That’s only if you can find the elusive 8,000 points per night deals.

These must be pretty rare because the Best Western representative could not find an award night for me at this price. She admitted to me that their literature states an average free night stay worldwide is 16,000 Best Western points, and that’s what they estimate the value of the sign-up bonus from.

The 16,000 point “average” will give you 4 FREE NIGHTS with your 70,000 bonus Best Western points (70,000 point bonus / 16,000 points per night) during the first year.

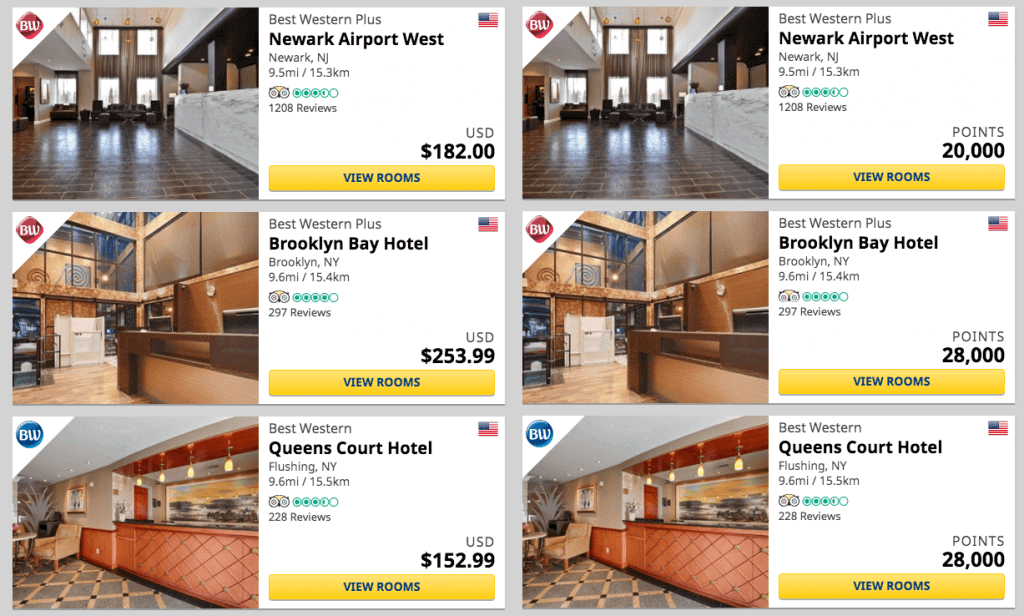

Based on comparing the paid prices of hotel nights, and the number of Best Western points you would need to redeem to get that same room for free, I found that on average that Best Western points were worth ~0.6 cents each. The best earning rate I found was ~0.9 cents (see the Newark airport example in the image above, the best deal I found), while a few hotels gave a value per point as low as ~0.35 cents.

Using an average of ~0.6 cents per point, you could consider the 50,000 Best Western point bonus worth $300 in hotel stays (50,000 points X 0.6 cents per point). Or, if you unlock the full 70,000 point bonus after 12 billing cycles, you’d get a value of $420 (70,000 points X 0.6 cents per point).

These values are considerably lower than points from other programs. For example, Capital One Venture Rewards Credit Card miles are worth 1 cent each towards paid travel, including hotels like Best Western. And Chase Ultimate Rewards points are worth 1.25 cents each if you have a Chase Sapphire Preferred card and redeem points for travel (also including hotels) through the Chase Ultimate Rewards travel portal.

Other Cards Get You Better Value and Flexibility

Before deciding if the Best Western Rewards card is right for you, consider these other cards. You’ll get potentially much more value from your miles and points. And you won’t be locked into spending your rewards with a single hotel chain!

1. Chase Sapphire Preferred

Link: Chase Sapphire Preferred

Link: Our Review of Chase Sapphire Preferred

If you are new to miles and points, the Chase Sapphire Preferred is a great card to consider starting with. You’ll earn 60,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months of opening the card.

- 2X Chase Ultimate Rewards points per $1 on travel and dining worldwide

- 1x Chase Ultimate Rewards points per $1 on everything else

- Primary car rental insurance – Covers damage due to theft or collision to your rental car, when you pay for the rental with your card

- Trip delay reimbursement – Get up to $500 back per ticket when your trip is delayed more than 12 hours

- NO foreign transaction fees

There is $95 annual fee.

The Chase Sapphire Preferred is a much better deal than the Best Western credit card. 60,000 Chase Ultimate Rewards points from the Chase Sapphire Preferred are worth $750 when you redeem them for travel through the Chase Ultimate Rewards portal. And potentially much more when you transfer them to airline and hotel partners like Hyatt or United Airlines!

You’re NOT committed to a single hotel or airline program when you collect Chase Ultimate Rewards points. In fact, you can book Best Western hotel stays (in addition to nearly any other hotel) through the Chase Ultimate Rewards travel portal.

And you’ll have the flexibility to transfer your points to airline and hotel partners for award flights or hotel stays!

Many Best Western hotels tend to be in more rural locations, so folks might find themselves frequently renting a car while staying with Best Western. If this is the case, I highly recommend the Chase Sapphire Preferred card because it offers primary rental car insurance, as opposed to the secondary car insurance offered on the Best Western credit card.

2. Capital One Venture Rewards Card

Link: Capital One Venture Rewards

Link: Our Review of the Capital One Venture Rewards

The Capital One Venture card is popular with folks who prefer a straightforward rewards program without having to worry about bonus spending categories or complicated award charts.

It’s easy to save on travel with the Capital One Venture, because you can purchase hotels the way you normally would. Then, sign into your account within 90 days of the purchase and redeem your Venture miles to “erase” the transaction from your card. This makes it super simple to use miles for Best Western (or any hotel) stays!

Plus, you can redeem miles for a wide variety of travel purchases beyond hotels, including airfare, Airbnbs, Uber, cruises, travel agents, and much more.

The sign-up bonus for the Capital One Venture is 50,000 Venture miles (worth $500 in travel) after spending $3,000 on purchases within the first 3 months of opening your account.

- 2 Venture miles per $1 spent on all purchases

- 10 Venture miles per $1 spent on hotel stays (including Best Western) when booked and paid through this Hotels.com link (through January 31, 2020)

- NO foreign transaction fees

Capital One Venture miles are worth 1 cent each towards travel. That’s almost double the average value of Best Western points (~0.6 cents each). And because this card allows you to “erase” almost any travel purchase, you’re not just limited to redeeming miles at Best Western hotels!

Having trouble deciding between the Chase Sapphire Preferred and Capital One Venture? Here’s a comparison between the 2 cards.

Bottom Line

For folks who stay at Best Western hotels often, the Best Western credit card is worth a look. With the Best Western credit card, you’ll earn 50,000 Best Western points after spending $1,000 on purchases in the first 3 billing cycles. Plus another 20,000 Best Western points when you spend at least $5,000 on purchases during each 12 billing cycle period.

But Best Western points are only worth, on average, ~0.6 cents each. So 50,000 Best Western points are worth ~$300, and 70,000 Best Western points worth ~$420.

You’ll do much better (and get a TON more flexibility) with other top travel rewards credit cards, like the Chase Sapphire Preferred or Capital One Venture.

Those cards have sign-up bonuses that are worth much more. And you won’t be locked into a single hotel rewards program, but instead have the ability to redeem rewards for a wide variety of travel purchases, like hotels (including Best Western) or airline tickets.

Would you consider the Best Western credit card? Or if you already have it, I’d love to hear how you like it in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!