Capital One Venture Cardholder? Don’t Make This Easy Mistake When It Comes to Using Your Travel Rewards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

One of the best things about the Venture miles you earn with the Capital One Venture Rewards Credit Card is the fact that they’re so easy to redeem. Capital One Venture miles are worth 1 cent each. You can use your miles for nearly any travel purchase, like taxi rides, hotels, room service, and free flights. And you don’t even have to worry about searching for available award seats or hotel nights!

But there’s something you should be aware of when it comes to redeeming your miles – something I just recently noticed while logged in to my account to erase a travel purchase.

It’s something that’s important to pay attention to when your current balance exceeds your most recent statement balance because you want to avoid paying interest on your purchases. That’s because any interest charged to your account with likely negate the value of the rewards you earn. I’ll explain.

Pay Attention When Redeeming Capital One Venture Miles

To redeem your Venture miles for travel, you can just buy travel like you normally would with your card. Then, you have 90 days to sign into your online account, find the travel purchase, and “erase” it with your miles.

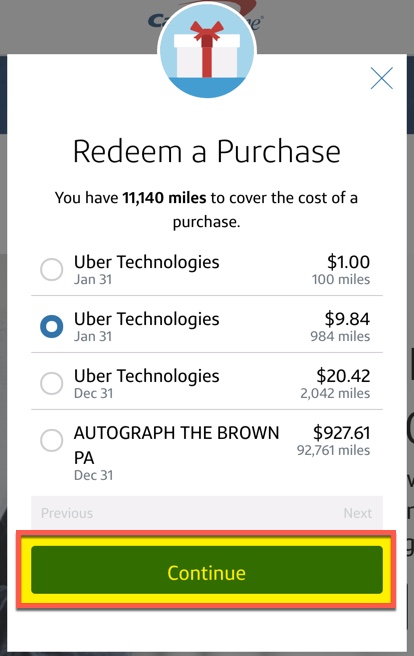

Just a few days ago I logged in to my Capital One account to erase a few travel purchases. I started by selecting an Uber ride I’d charged to the card in late January.

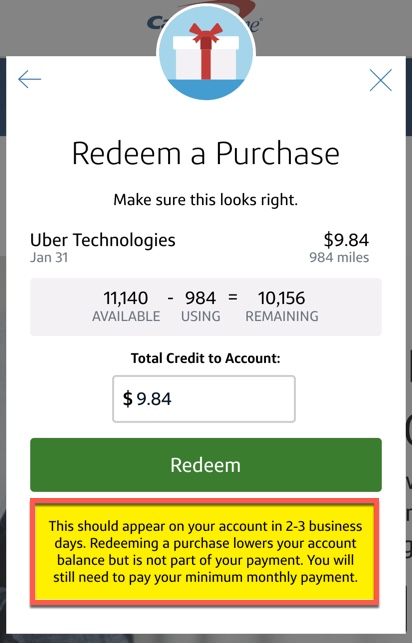

After selecting the purchase I wanted to erase, the system asked me to confirm the number of Capital One Venture miles I wanted to use. It was in that confirmation box that I noticed something I hadn’t paid attention to before – a blurb that notes that “redeeming a purchase lowers your account balance but is not part of your payment.”

The note gave me pause because I oftentimes float expenses on this card. When you charge something to a credit card, you’re given a grace period to pay it off (the number of days between statement periods). Essentially you’re making a charge one month and paying it off the next. And as long as you pay your bill in full each month, you aren’t charged interest.

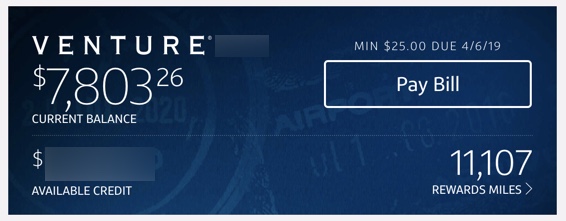

It’s nice to have a grace period like this, but for me, it means that my current balance often exceeds my most recent statement balance.

For example, the current balance on my Capital One Venture card is $7,803.26, but my last statement balance was only $4,231.51. To avoid interest charges I only need to pay off the $4,231.51 amount, but that brings me back to the point about rewards redemptions not being a part of a payment.

Erasing the $9.84 Uber ride with my Venture miles DOES NOT lower my amount due by $9.84. To avoid paying interest, I’ll still need to pay off the full $4,231.51 statement balance.

So take note! If you’re using your Venture miles to erase a travel purchase it will lower your account balance but won’t be counted as part of your payment.

Want to learn more about the Capital One Venture card? Be sure to check out these posts:

- All the Ways to Earn Capital One Miles in 2019!

- Capital One Transfer Partners and the Smartest Uses of Your Miles (The Good, the Bad, the Meh)

- Start Traveling Now With the Simplest Rewards Program Around

- Do Capital One Miles Expire? Their Policy Is Straightforward

- How to Set Up a Capital One Miles Account (It’s Easier Than You Could Ever Imagine)

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!