How to Use Chase Ultimate Rewards Points to Avoid Close-In Booking Fees (And Save $100s)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

My aunt recently flew in from Dallas to Missoula, Montana (my hometown) to help my mom take care of my 3-year-old daughter while I was on a work trip. My aunt had to sort out her schedule so we didn’t end up booking her flights until about a week she was due to fly.

She let me know that she had a stash of American Airlines miles, which was great, but she wasn’t familiar with the close-in booking fee that American Airlines charges.

I explained to her that because we were less than 20 days from departure, there would be a $75 fee tacked on to the ticket in addition to the 20,000 miles each way for a ticket. I never want anyone to get a bad deal, so I offered to search for other options and use my flexible rewards points if possible.

I started by checking cash prices to get a feel of what a good deal might look like. A round-trip coach ticket was going to cost $569 in basic economy (ouch!). I knew I could do better than that, especially with my stash of Chase Ultimate Rewards points.

I decided to check the price of an award ticket through British Airways because booking an American Airlines flight using British Airways Avios points is one trick to avoiding American’s close-in booking fee. And I was also aware of the 30% transfer bonus (good through June 15, 2019) for transferring Chase Ultimate Rewards points to British Airways Avios.

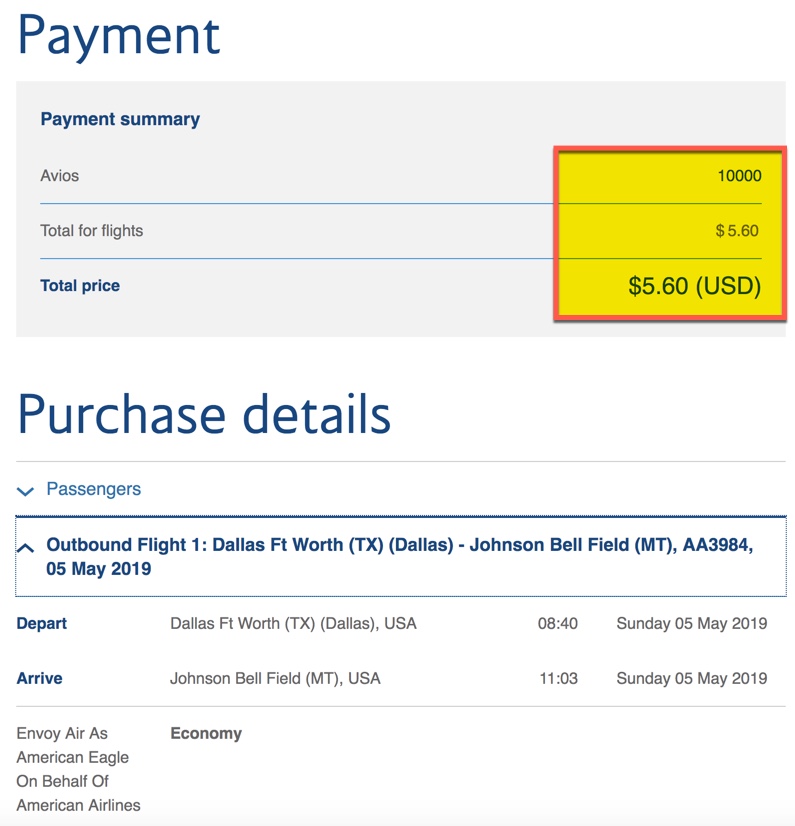

To my delight, I found a one-way award ticket from Dallas to Missoula for just 10,000 British Airways Avios points and $5.60 in taxes and fees. With the transfer bonus, I only had to transfer 8,000 Chase Ultimate Rewards points to cover the cost of the award seat (you can only transfer in 1,000-point increments).

There weren’t any awards available for the return flight, but that didn’t faze me. I knew I’d be able to use my Chase Ultimate Rewards points through the Chase travel portal and still come out ahead.

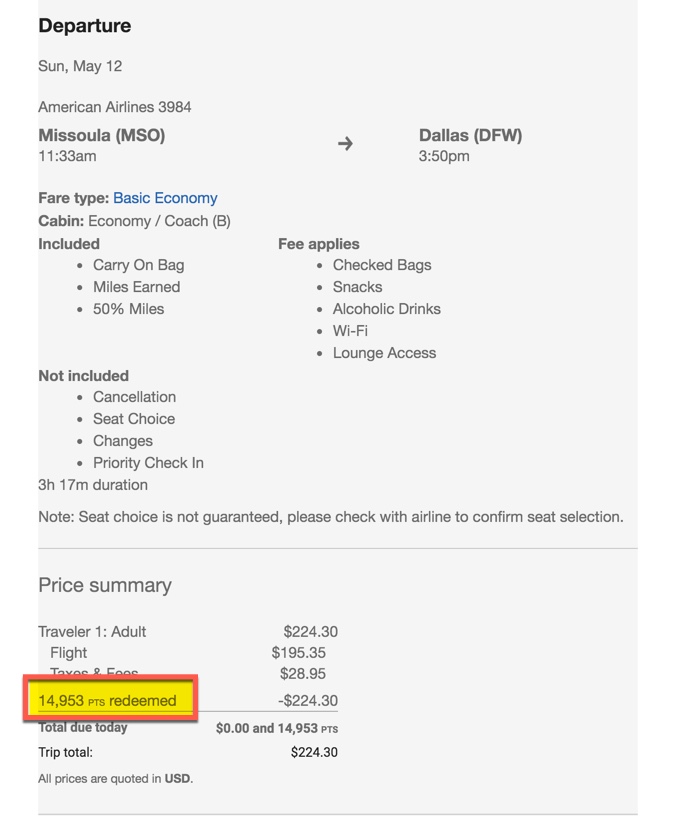

I found a nonstop return flight for $224 (or 22,400 Ultimate Rewards points) but was able to save even more because I’m a Chase Sapphire Reserve card holder. With the Sapphire Reserve, your points are worth 1.5 cents a piece when you book travel through the portal, meaning I only had to use 14,953 Ultimate Rewards points for the one-way ticket.

Again, not only was that less than the cost of an award ticket on American Airlines (20,000 American Airlines miles one-way) but I avoided close-in booking fees, too.

Had I booked directly with American Airlines I would have spent 40,000 American Airlines miles, a $75 close-in booking fee, and $5.60 in taxes and fees. That’s a lot to spend just to avoid buying a $569 ticket.

By booking two separate one-ways, one through British Airways and the other through the Chase travel portal, I spent just 22,953 Chase Ultimate Rewards points and $5.60 in taxes and fees. That’s a savings of $75 in cash and 17,047 miles!

Earning and Using Chase Ultimate Rewards Points (My Favorite Travel Rewards Currency)

I collect Chase Ultimate Rewards points with these three cards:

- Chase Sapphire Preferred Card (top rewards card for beginners)

- Ink Business Preferred Credit Card (top small business rewards card)

- Chase Sapphire Reserve (top premium rewards card)

But these cards also earn Ultimate Rewards points:

- Chase Freedom

- Chase Freedom Unlimited

- Ink Business Cash Credit Card

- Ink Business Unlimited Credit Card

In both everyday spending and small business expenses, I’m always earning Ultimate Rewards points. I like keeping a stash of them because they’re incredibly flexible. And just as I’ve shown with my aunt’s flights, their flexibility often makes them more valuable than miles from any specific airline.

To learn the ins and outs of earning and using Chase Ultimate Rewards points, check out these guides:

- Chase Ultimate Rewards Review

- Chase Points Value

- Best Way to Use Chase Points

- Chase Transfer Partners

- How to Earn Chase Ultimate Rewards Points

- How to Setup a Chase Ultimate Rewards Account

- How to Use Chase Ultimate Rewards Points

- Do Chase Ultimate Rewards Points Expire?

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Featured image by fizkes/Shutterstock

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!