More Details Confirmed! Can the New Bank of America Card Compete at the Top?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Last week I gave you an update on the new premium travel rewards card from Bank of America.

And now, via Doctor of Credit, we have more confirmed details about the card! It will be a Visa credit card with nice perks like a sign-up bonus worth $500 after meeting minimum spending requirements, and an annual $100 airline incidental fee credit.

I’ll tell you everything we now know about this upcoming card!

More Details of Bank of Upcoming Premium Bank of America Card

Link: Rumor: A New Premium Credit Card Arriving This Fall!

Link: Update: New Premium Travel Rewards Card from Bank of America Arriving this Fall

Bank of America plans to release a new top-notch travel card in September 2017, to compete with credit cards like the Citi Prestige, Chase Sapphire Reserve, and The Platinum Card® from American Express. The card will be a Visa, and come with:

- 50,000 bonus points after meeting a $3,000 minimum spending requirement (we don’t know the time frame yet)

- 2 points per $1 on travel and dining (Preferred Rewards customers will get up to 3.5 points per $1)

- 1.5 points per $1 on everything else (Preferred Rewards customers will get up to 2.6 points per $1)

- $100 airline incidental fee credit for things like including baggage fees and in-flight purchases

- $95 annual fee

These points do NOT transfer to airline or hotel partners. Points are worth a flat 1 cent each. So you don’t have to worry about blackout dates and available award seats.

Is This a Good Deal?

There is still plenty we don’t know about this card’s travel insurance, airline credit, and annual fee!

For example, we do NOT yet know if the card’s $95 annual fee will be waived the first year. And it’s not yet clear how easy the $100 airline incidental credit will be to use. Both of those details could be the deciding factor as to whether lots of folks will give this card a try!

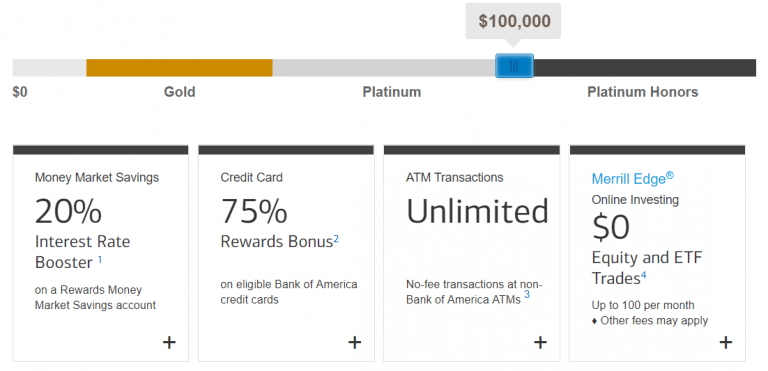

That said, this card is a good deal if you are a Bank of America Preferred Rewards member, because you’ll get a bonus percentage with every purchase! But you’ll need at least $100,000 in your Bank of America checking account to get the highest bonus.

As far as this card being competitive with other high-level credit cards, I don’t think it has enough features to steal customers away from folks who use cards like the Chase Sapphire Reserve and Citi Prestige. These cards have much better benefits, like airport lounge access, super easy to use travel credits, and Global Entry reimbursement.

And its bonus categories are similar to other travel credit cards. Even if you’re a Preferred Rewards member that earns 3.5 points per $1 on dining, you’re still only getting a return of 3.5 cents per $1. The Chase Sapphire Reserve earns 3 Chase Ultimate Rewards points per $1, which is worth 4.5 cents when you redeem points for travel through the Chase Ultimate Rewards Travel Portal. Or potentially even more when transferred to valuable Chase travel partners like Hyatt or Southwest.

The one thing this card DOES have going for it is the comparatively low $95 annual fee. Most other high-level travel cards have annual fees of $450 or more. So if you would use the $100 airline travel credit anyway, you might consider opening this card to see if it serves your travel plans, because the credit more than covers the annual fee!

Bottom Line

We have more details about the upcoming premium travel credit card from Bank of America!

Bank of America plans to launch the card in September 2017. It will come with:

- 50,000 bonus points after meeting minimum spending requirements (worth $500)

- Up to 3.5 points per $1 for Preferred Rewards members

- $100 airline incidental credit for things like checked bags and in-flight purchases (NOT airfare)

- $95 annual fee

We don’t know all the details of this card yet, but we’ll let you know as soon as we hear more!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!