You may be able to cash out your Amex points for double the normal value

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Banks continue to get creative in their ways to provide value for customers who hold travel credit cards but are stuck at home during the pandemic.

One of our favorite flexible points currencies, American Express Membership Rewards, is out with a deal where you can cash out your points for double the normal rate, reports Doctor of Credit.

While we normally suggest that you should reserve your Amex points to transfer to travel partners like Delta, Air Canada Aeroplan and ANA, this could be a worthwhile deal if you don’t plan on traveling anytime soon or are looking for straight cash.

[ Subscribe to our newsletter for more deals and tricks delivered straight to your inbox ]

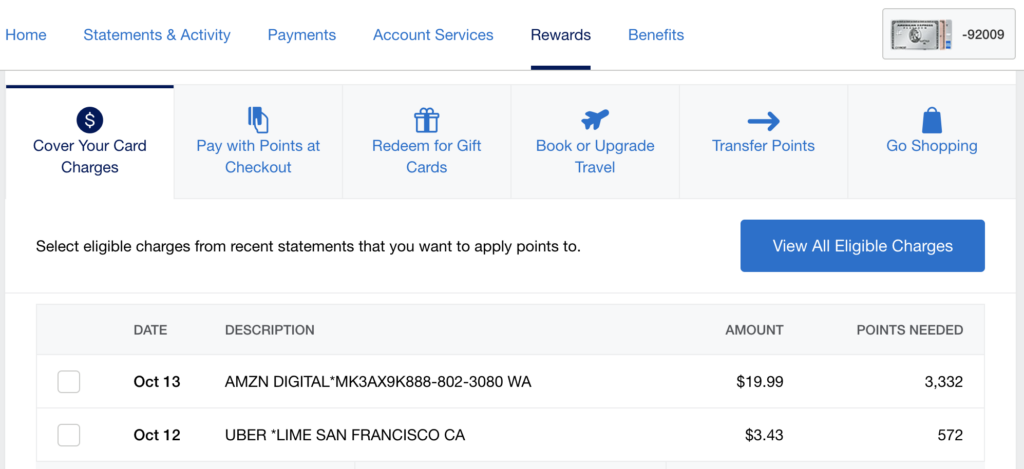

Normally, you can use Amex points to cover charges made directly to your card at a rate of 0.6 cents per point. That’s a pretty paltry rate, especially given that we value Amex points at 1.8 cents each. However, with this new deal, Amex is offering select cardholders the option to cash out their points at a rate of 1.2 cents each.

For example, 10,000 points would normally cover a $60 charge to your card, but under the new redemption rate, you’ll be able to erase a $120 purchase with the same amount of points.

This deal does appear to be targeted and valid through Dec. 31, so make sure to log in to your Amex account and see if you’re eligible. Log-in and navigate to the “Rewards” tab and then click “Cover Your Card Charges”. Unfortunately, neither of my Membership-Rewards-earning cards were showing the deal. It’s possible Amex is just starting to roll out this promo and a wider swath of cardholders will soon see it.

Most points programs allow you to cash out your points at a maximum rate of 1 cent per point, so you’re getting 20% more value than normal with this deal. If you do have the American Express Schwab Platinum card, you can redeem your points for a rate of 1.25 cents towards a cash deposit in a brokerage account, which is a slightly better deal.

Note that Chase has also launched its own program where you can “Pay Yourself Back” for purchases made at grocery stores, restaurants (including delivery) and home improvement stores at a rate of 1.25 to 1.5 cents, depending on what type of Ultimate-Reward-earning card you have.

Cards that earn Amex Points

There are several cards that earn Amex Membership Rewards points, including personal and small-business cards. It appears that only Membership-Rewards-earning cards are eligible for the deal.

Bottom line

Amex doubling its normally cash-out rate is great and provides real value for cardholders who aren’t traveling right now. Hopefully, we see this deal rolled out more widely. Let us know in the comments if you’ve been targeted and don’t forget to bookmark our travel deals hub and subscribe to our newsletter for more deals and tricks.

Featured image by jd8/Shutterstock.com

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!