Travel Tricks: How I Saved $500+ on a Weekend Trip – A Look Inside My Personal Toolkit (American Airlines Miles, Citi ThankYou Points, and More)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

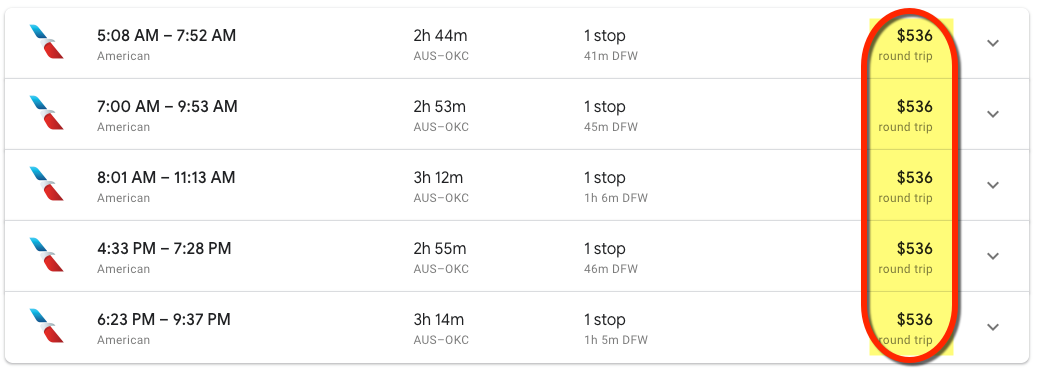

This past weekend, I flew from Austin to decidedly not-so-glamorous Oklahoma City and saved hundreds of dollars on tickets retailing for $500+! This trip wasn’t about the destination, but friends I wanted to visit. And there was no way I was going to spend that much to fly domestically.

Instead, I reached into my bag of travel tricks and brought the price of the flights down to ~$22. All I paid for was Uber rides to and from the Austin airport and boarding for my dog – and I saved on those too!

I saved money & time with benefits from these cards:

- CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

- U.S. Bank Altitude™ Reserve Visa Infinite® Card

- Citi Premier℠ Card

The information for the CitiBusiness AAdvantage Platinum card and Citi Premier card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

There are so many ways to save on travel – even on a simple domestic trip to get away for the weekend!

Here’s a look into my personal travel toolkit.

Travel Tricks to Save ~$514 a Weekend Trip to Oklahoma City

My dates were firm – no flexibility. I had to arrive on a certain day.

Austin to Oklahoma City should be $200ish, right? Or even cheaper? Nope.

I always say short flights are some of the most expensive. I’ve never paid that much to fly coach, especially domestically, and wasn’t about to start.

I racked my brain for ways to get the cost down. Could I drive to Dallas and fly from there? Or book 2 one-way flights? Both options were actually MORE expensive.

Luckily, award flights were open on dates I needed. I rubbed my hands together and cackled because getting cheap American Airlines award flights is what I’m built for.

My flights cost me ~$22.

1. American Airlines Miles to the Rescue

Apply Here: CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Our Review: This Is One of the Best American Airlines Card Sign-Up Bonuses Available!

To get to Oklahoma City, I booked a one-way award flight on American Airlines for 12,500 American Airlines miles. This one-way flight would’ve cost $303, so I got over 2 cents of value from each mile ($303 / 12,500).

That was fine because I’m flush with American Airlines miles after signing-up for the Citi American Airlines Platinum Select small business credit card. For a limited time, you’ll earn 70,000 American Airlines miles after spending $4,000 on purchases in the first 4 months of opening your account.

Here’s our full review of CitiBusiness AAdvantage Platinum Select card.

Having the Citi American Airlines Platinum Select small business credit card also got me preferred boarding, which meant I didn’t have to fight for space in the overhead bins! A small but important card benefit.

2. Avoiding Close-In Booking Fees and Regular Security With My US Bank Altitude Reserve

Apply Here: U.S. Bank Altitude™ Reserve Visa Infinite® Card

Apply Here: This Overlooked Sign-Up Bonus Worth $750 in Travel Might Be the Perfect Fit for Your (Mobile) Wallet!

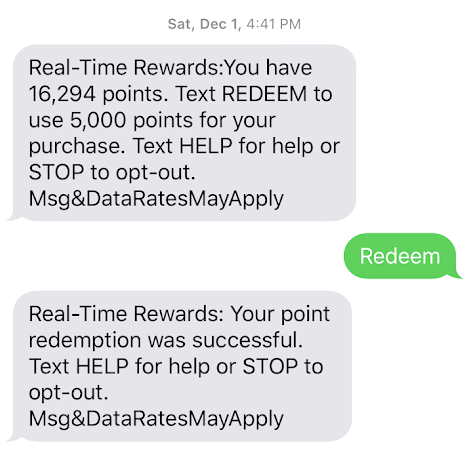

Because I booked this flight within 21 days of travel (actually 5 days), I was subject to a $75 close-in booking fee. Unfortunately, there’s no way around it unless you have top-tier elite status with the airline.

But I paid with my US Bank Altitude Reserve card, which comes with $325 in travel credits per year. Or you can instantly redeem your points via text for statement credits.

Right after I paid for the ticket, I got a text.

I sent back one word – “Redeem” – and used points to erase the charge. I love using my Altitude Reserve points for nagging charges like this! For me, it takes the stress out of paying fees because I literally never see them in my account balance.

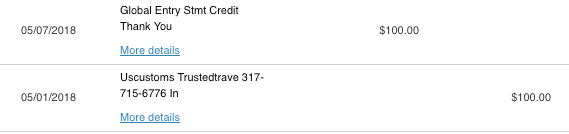

This card comes with a $100 credit toward Global Entry, which I happily redeemed earlier this year. Because of it, I got TSA PreCheck and was able to speed past security in under 5 minutes on my flights there and back.

With the US Bank Altitude Reserve card, you can earn 50,000 points (worth $750 in travel) after spending $4,500 on qualifying purchases within 90 days of account opening. And you’ll earn 3X Altitude Reserve points per $1 spent on travel and mobile payments, like Apple Pay and Google Pay.

I love this card and use it more than I expected I would. Please check out our full review of the US Bank Altitude Reserve to learn more about it.

3. Travel Insurance With the US Bank Altitude Reserve

I always pay for airfare with a card that includes built-in travel insurance. Some of our favorites include:

The US Bank Altitude Reserve card has coverage similar to the Chase Sapphire Reserve card. I mention this because when I checked the weather, I saw a potential snowstorm or ice storm blowing right across Oklahoma. And I didn’t want to get stuck without options if my flights were cancelled or significantly delayed.

This travel trick is an easy win. Several MMS team members have used their card’s benefits to pay for toiletries, hotel rooms, meals, and more when they’ve had delayed flights. Using it just once can easily make a card’s annual fee worth it many times over.

4. Creative Use of Partners With Citi ThankYou Points

Apply Here: Citi Premier℠ Card

Our Review: This 50,000-Point Offer Can Get You an Easy $625 in Travel (or Much More When You Transfer to Airlines!)

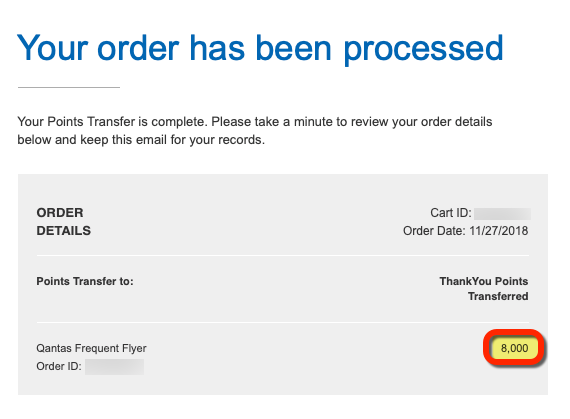

Of course, I checked American Airlines partners British Airways and Qantas for award flights in both directions. I didn’t find what I wanted for the inbound flight with either partner, but typically, you can book:

- Coach tickets under 1,151 miles for 7,500 British Airways Avios points each way, and you’ll pay per segment

- Coach tickets under 600 miles for 8,000 Qantas miles each way, and you’ll pay for the total mileage including connections

That’s cheaper than the 12,500 American Airlines miles you’ll normally pay!

Fortunately, I found perfect flights back on the Qantas site. And both segments, Austin to Dallas and Dallas to Oklahoma City, only added up to 364 flight miles! Score – I happily booked flights for 8,000 Qantas miles transferred from Citi ThankYou points. I only paid ~$11 for these flights, too.

This is one of my favorite ways to use Citi ThankYou points. But keep in mind, transfers can take a couple of business days.

With the Citi Premier℠ Card, you can earn 50,000 Citi ThankYou Points (worth $625 in travel) after you spend $4,000 in purchases within the first 3 months of account opening. Here’s our full review of the Citi Premier.

Don’t underestimate the power of partners because they’re not domestic. In this case, I paid 8,000 points for flights costing $303. So each point was worth ~4 cents each ($303 / 8,000). That’s an excellent deal!

5. Making the Most of a Travel Alert Through Twitter

I mentioned nasty winter weather (from Winter Storm Diego) passed through Oklahoma. It ended up being overblown (there, at least), but I still got travel alerts for my flights home.

The weather in Dallas and Austin wasn’t as fair. Rain in Dallas, and heavy winds, downpours, and lightning in Austin. Ugh, I didn’t want to deal with it. My gracious friends let me stay another night.

Typically, you’ll pay $75 to change your flight same-day, or up to $200 to cancel or rebook for later. So I took advantage of the travel alert to change my flights for free!

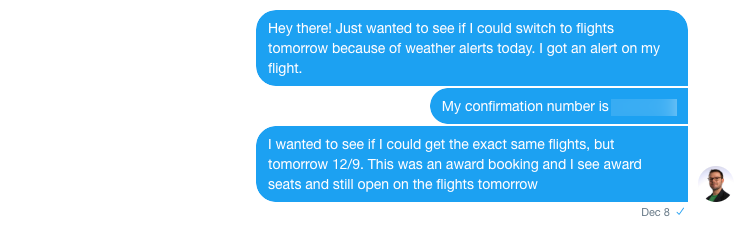

I guess lots of folks did too, because the hold time was nearly 2 hours when I called! So I hung up and pulled up… Twitter? Yup!

These social media agents have the power to change your bookings just like phone agents.

Within minutes, I was rebooked on new flights the following day. But I saw they’d lengthened my connection in Dallas.

Another message got it sorted. Again, within minutes. The updates showed up in my account right away.

Instead of dealing with long hold times, see if you can connect through social media or get assistance at the airline lounge instead. This way, I wasn’t on hold forever, and got my issue resolved with zero stress!

I Even Dipped Into My Bag of Tricks for Airport Rides and Pet Boarding

All I paid for was 2 timeshare rides (to and from the Austin airport) and $30 per night for dog boarding.

1. Extra Points for Uber and Lyft Rides

Where there’s a will, there’s a way. This month, you get an extra Chase Ultimate Rewards point when you use certain cards with Apple Pay and Google Pay.

Both Uber and Lyft let you use Apple Pay. So I used my Chase Sapphire Reserve to earn 4X Chase Ultimate Rewards points on my rides to the airport (3X points for travel and 1X bonus point)!

It just goes to show – taking advantage of promotions can get you bonus points, savings, or other benefits.

2. Discounted Pet Care and Surprise Bonus Savings

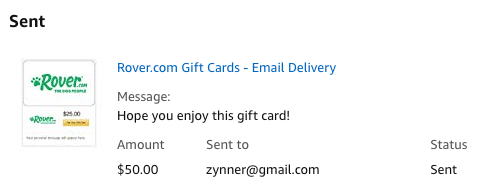

I book sitters for my dog through Rover. Right now, you can save on gift cards through Amazon when using 1 bank point:

- It Doesn’t Get Much Easier Than This: $15 Off at Amazon With a Single Citi ThankYou Point! (Targeted)

- Save Up to $100 At Amazon (20% Off) With 1 American Express Membership Rewards Point (Targeted)

- Act Fast! Save $15 at Amazon With a Single Chase Ultimate Rewards Point! (Targeted)

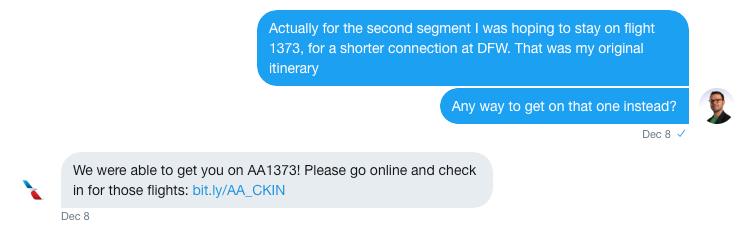

So I bought some Rover gift cards and sent them to myself for easy, automatic savings.

But that’s not all!

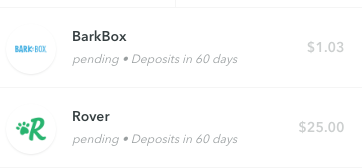

When I checked my Acorns account this weekend, I saw I’d earned $25 to invest because of my Rover booking. This is supposed to be for new customers, and I’ve used the service dozens of times. So I don’t know how I earned this extra cash, but I’ll happily take it!

You can link your cards within Acorns to earn extra cash automatically when you spend at certain merchants. And I guess when I paid with a linked card, it triggered the promotion. I also see I got automatic money back from my BarkBox subscription. Can you tell I spoil my dog rotten?

Bottom Line

I got $500+ domestic coach flights for ~$22! To get this price, I reached into my bag of travel tricks:

- Using 12,500 American Airlines miles earned with the Citi American Airlines Platinum Select small business credit card

- Real-Time Rewards to avoid $75 close-in booking fees and free TSA PreCheck thanks to my US Bank Altitude Reserve card

- Travel insurance in case of inclement weather with the US Bank Altitude Reserve card (which is similar to the Chase Sapphire Reserve card)

- Using 8,000 Qantas miles transferred from Citi ThankYou points to book flights home (you can earn Citi ThankYou points with the Citi Premier℠ Card)

- Taking advantage of travel alerts to rebook for free

- Reaching out via social media instead of waiting on hold

With these tricks, I got to speed through airport security, boarded before other coach passengers, avoided $100s in fees to rebook, and saved valuable time that I instead spent with my friends this weekend.

I even earned bonus points on my airport rides, and saved on dog boarding with gift cards through Amazon, which were my only other expenses. As an added perk, my discounted Rover booking earned me a $25 bonus which will be automatically invested in my Acorns account.

You can see these tricks aren’t always about saving money, but also saving time or getting more from planned purchases. It’s also about avoiding stressful situations.

I ended up having a fantastic trip with friends, so it was worth everything!

Do you have a favorite trick in your own travel toolkit?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!