Will closing a new credit card hurt my credit score?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

One of the most important aspects of the miles and points hobby is credit card welcome bonuses from the best credit cards for travel. They’re the fastest way to saving thousands of dollars on your vacations.

But you’ll occasionally find that a credit card you’ve opened in mouth-foaming passion doesn’t actually fit your long-term travel goals aside from its robust intro bonus. So what’s the next move? Can you cancel a card soon after you open it? Are there negative implications to your credit score?

The short answer is that your credit score will be affected, but it’s not such a big deal. However, negative impact on your credit score is the least of your worries. I’ll explain.

Can I cancel a credit card I just applied for?

Your credit cards are your employees. With every purchase, they’re working for you. 5% cash back, 3 Chase points per dollar, etc. — if you find your credit card isn’t working hard enough for you, fire it and start interviewing its replacement.

Any credit card that comes with an annual fee should be examined with a skeptical eye. Before you pay the fee, you need to look at the card’s benefits and assess the value you’ll receive during the upcoming year (benefits and perks change all the time, after all). In many cases, you’ll receive far MORE value than the annual fee costs. If not, you should cancel it.

But what’s the affect on your credit score?

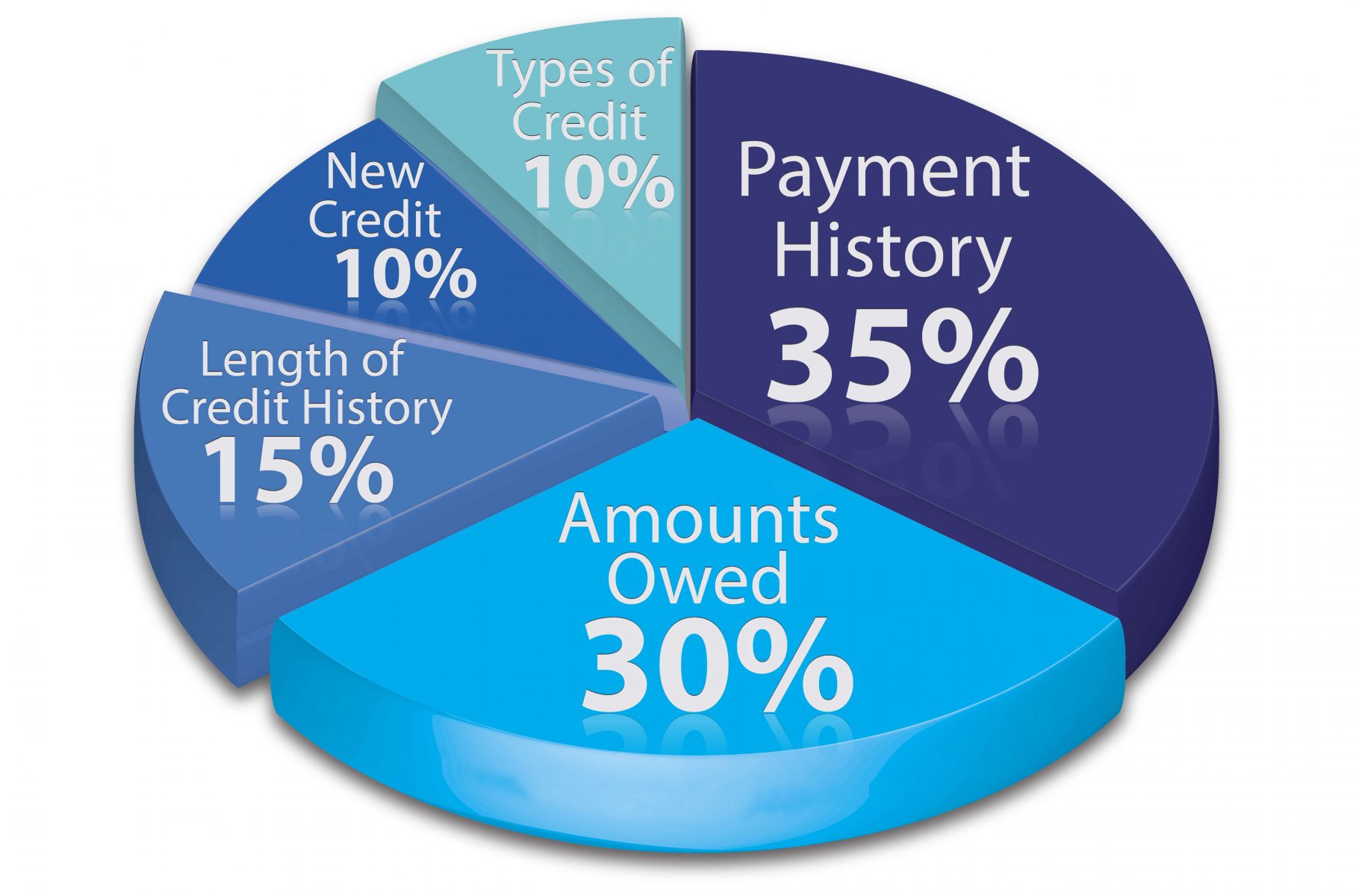

Marginal. When you close a credit card, it affects your “length of credit history.”

For example, if you’ve had only one credit card for ten years, your average length of credit history is ten years. If you open a card and cancel it within the first year, your average length of credit history is now closer to five years! Even so, this factor accounts for just 15% of your total credit score. Most people will see a small drop in their score, which is only temporary. You can read our post on how to improve your credit score for more details.

Instead of canceling, you should seriously consider “downgrading.” You can often downgrade a card with an annual fee to a no-annual-fee version. When you do this, all your card info transfers over to the new card:

- Credit card number (in most cases)

- Credit line

- Credit history

Things you should know before downgrading

Not all cards can be downgraded

Before you downgrade a card, make sure there is a no-annual-fee equivalent. In other words, there must be a card in the same “family” that comes with no annual fee.

For example, if you open the Chase Sapphire Reserve and decide you don’t want to pay its $550 annual fee any longer, you can downgrade it to a no-annual-fee Chase Freedom Unlimited or Chase Freedom. You can even downgrade the card to a Chase Sapphire Preferred Card, with a more manageable $95 annual fee. You can’t, however, downgrade the Chase Sapphire Reserve to a no-annual-fee Marriott Bonvoy Bold Credit Card, because it’s not in the same “family.”

You’ll also find that some airline and hotel credit cards can’t be downgraded. They don’t have a no-annual-fee equivalent.

You may be forfeiting a welcome bonus

If you downgrade your Chase Sapphire Reserve to a Chase Freedom, you won’t be eligible to earn the Chase Freedom’s welcome bonus as long as you currently possess the card.

Downgrading isn’t automatic

When you request a downgrade, the bank reviews your account and decides if you’re eligible. Banks typically require your account to have been active for at least one year before you downgrade.

Issues rarely arise, but if you’re not approved, take a scan of your credit report and see if there’s something that might be holding you back. If you find anything fishy, read our post on how to dispute your credit report and win.

The bigger issue — upsetting the banks

Banks offer big welcome bonuses to draw you in. But they want you to keep the card and swipe it often. If you open a card, earn its intro offer, and promptly cancel the card a few months later, they will not like that. Do it too many times and you may find your account shut down.

Banks are reasonable. They don’t expect a customer to stick with a card they don’t like. That’s why they offer waived annual fees for the first year on many cards. They want you to give them a test run to see if they work for your lifestyle. So if you open a card, at least give it an 11 month tryout before you give up on it. This will show the credit card issuer that you were after more than just the bonus.

Bonuses are fantastic, but the meat and potatoes of a card is in its benefits (I’ve saved literally thousands from the Chase Sapphire Preferred benefits and perks). Don’t apply for a card you plan on canceling in a few months.

If you want to learn how to boost your credit score and open credit cards at the same time, subscribe to our newsletter!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!