Southwest Performance Business Credit Card benefits and perks

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

When you sign up for the Southwest® Rapid Rewards® Performance Business Credit Card, you’ll earn 80,000 points after you spend $5,000 on purchases in the first three months of account opening.

The best part? Those points count toward Southwest Companion Pass.

This is an excellent offer. Southwest flies to more destinations than ever, including Hawaii, and because the airline doesn’t have blackout dates, you can use your 80,000 Southwest points to travel whenever you want. The value of Southwest points always stays around 1.5 cents each, so this welcome bonus can get you ~$1,200 in Southwest flights.

Tempting welcome bonus aside, the Southwest Performance Business Credit Card’s benefits and perks are really what set the card apart from other Southwest cards. It’s loaded with perks like four upgraded boardings per year, inflight Wi-Fi credits and a TSA PreCheck or Global Entry application fee credit.

Southwest Performance Business benefits and perks

You’ll probably be most interested in the 80,000 Southwest-point welcome bonus from the Southwest Performance Business Card (I know I am), but there are other great ongoing perks and benefits that make the Southwest Performance Business Card worth keeping long-term. They make it one of the best airline credit cards.

Four annual upgraded boarding certificates

Southwest is the only major airline in the U.S. to offer open seating. If you see an open seat when you board, you get to take it. A lot of travelers love Southwest for this reason as you avoid having to shell out cash for reserved seats.

Southwest’s open seating also means, however, that your boarding position is extremely important. The Southwest Performance Business Card comes with a benefit that’ll make scoring Group A boarding a little easier and cheaper.

You can get Group A boarding when you purchase Business Select fares, if you’re an elite frequent flyer or if you pay to upgrade your boarding position at check-in or at the gate. The price to upgrade starts at $30 but can cost as much as $50. However, with the Southwest Performance Business Card, you won’t have to worry about the cost to upgrade your boarding group; you’ll receive four upgraded boarding certificates each year.

If you make the most of this perk (four upgraded boardings x $50 per flight), you’ll get a value of $200 a year and more than offset the card’s $199 annual fee with this perk alone.

Inflight Wi-Fi credits

If you’re like me and can’t live without Wi-Fi, then the Southwest Performance Business Card is right up your alley. You’ll receive up to 365 inflight Wi-Fi credits (worth $8 each) with the card each year. Frequent Southwest flyers can do very well with this perk, and potentially save hundreds of dollars in Wi-Fi fees.

Earn points toward the Southwest Companion Pass

If there’s one thing that all Southwest flyers long for, it’s the airline’s Companion Pass. With the Southwest Companion Pass, you’ll be able to bring a companion along for just the cost of taxes and fees (usually ~$6 each way on domestic flights), when you have a paid or award ticket.

The points you earn from the Southwest Performance Business Card can help qualify you for the Southwest Companion Pass — even the 80,000-point welcome bonus counts. To earn Companion Pass, you’ll need to earn 125,000 qualifying Southwest points in a calendar year. If you earn the 80,000-point welcome bonus, you’ll need just 45,000 more points in a calendar year to earn the Companion Pass.

Earn tier-qualifying points toward elite status

The Southwest Performance Business Credit Card can give you a boost toward Southwest status (A-List and A-List Preferred). With the Southwest Performance Business Card, you’ll earn 1,500 tier-qualifying points (TQPs) for each $10,000 in purchases.

This could be a big help if you’re just short of qualifying for elite status for the year. Having Southwest elite status means you get bonus points on paid flights, priority check-in and boarding and free same-day standby (A-List Preferred members also get free inflight Wi-Fi). You’ll need to earn a certain number of points in a calendar year to qualify:

- A-List: 35,000 tier-qualifying points in a calendar year (or 25 qualifying one-way flights)

- A-List Preferred: 70,000 tier-qualifying points in a calendar year (or 50 qualifying one-way flights)

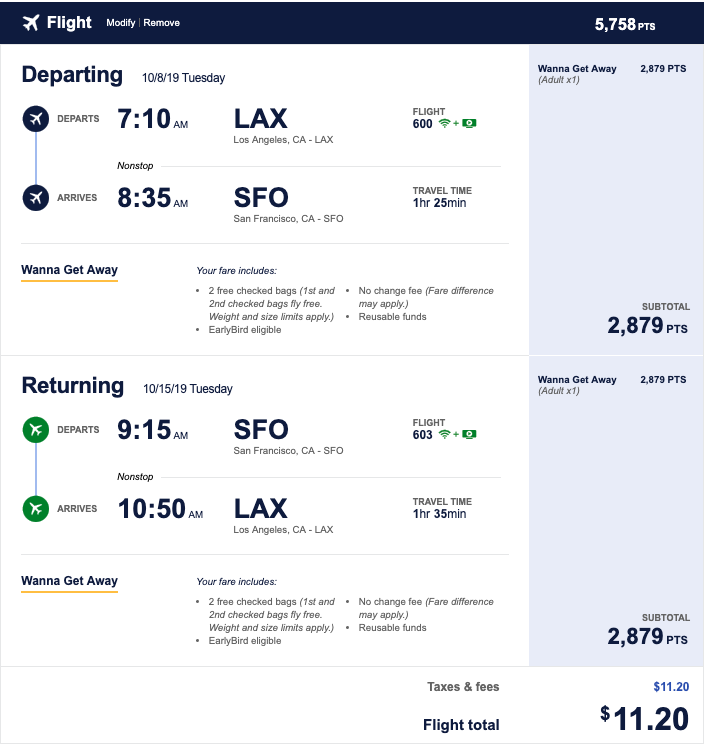

9,000 anniversary points

As if 80,000 bonus points weren’t enough, Southwest Performance Business Card holders also receive 9,000 Southwest points (worth ~$135 in Southwest flights) each account anniversary when they renew the card. Though 9,000 points might not sound like a lot, you’ll be surprised to find out just how far the annual anniversary points can get you on Southwest. Here’s just one example:

Global Entry or TSA PreCheck application credit

With the Southwest Performance Business Card, you’ll receive a statement credit of up to a $100 every four years toward the application fee for either Global Entry or TSA PreCheck.

I highly recommend (as long as you have a valid passport) that you use your $100 statement credit for Global Entry. Not only will you be able to bypass long lines at immigration but Global Entry also comes with TSA PreCheck. When you’re approved for Global Entry, you’ll receive expedited immigration and expedited airport security. Plus, if you apply for Global Entry, you’ll be maximizing the $100 statement credit.

Purchase protection

The Southwest Performance Business Card protects eligible new purchases for up to 120 days against damage or theft. Coverage is available up to $10,000 per claim and $50,000 per account.

Extended warranty coverage

When you use your Southwest Performance Business Card for the full cost of an item, you might be eligible to receive extended warranty coverage. The card can extend a manufacturer’s warranty by an additional year on eligible warranties of three years or less. This benefit provides coverage of up to $10,000 per claim and up to $50,000 per year. Extended warranty coverage is great for pricey new purchases like a new laptop or appliance.

Travel accident insurance

When you use your card for the full cost of a ticket offered by a common carrier (airline, train, bus service, cruise line), you’ll be eligible for travel accident insurance should the unthinkable happen.

The Southwest Performance Business Card offers this coverage to the cardholder, their immediate family and employees. The card’s travel accident insurance covers accidental death, dismemberment, and loss of speech, sight and hearing.

Lost luggage reimbursement

If you, an employee or a member of your immediate family loses carry-on or checked baggage or your luggage is damaged, you’ll be covered up to $3,000 per passenger as long as you use your card to pay the full fare. Coverage is available up to $500 for each insured person for items like jewelry, watches, camera equipment and other electronics.

Baggage delay insurance

When you pay for the full fare with your card, you, your immediate family and employees are eligible to receive reimbursement for the essentials like toiletries and clothing when bags are delayed for six hours or more. You’ll be covered up to $100 per day for a maximum of three days.

Travel and emergency assistance services

If something comes up while you’re on the road, the Southwest Performance Business Card offers travel and emergency assistance services. Simply call the benefits administrator (available 24/7) and you’ll be able to receive medical or legal referrals and relay messages back home.

This benefit also provides assistance with emergency travel arrangements, ticket replacements, locating lost luggage, prescription refills and more. Keep in mind that this is just a referral service and you’ll be responsible for any costs incurred using this benefit.

Rental car coverage

When you rent a car for business travel and pay for the entire rental using your Southwest Performance Business Card, you may be eligible for primary rental insurance coverage. Coverage will kick in when you decline the rental car company’s collision damage waiver. If you’re renting in the U.S. for personal travel, coverage is secondary. However, if you don’t have your own insurance or you’re traveling outside the U.S., you’ll receive primary coverage.

The rental car coverage offered by the Southwest Performance Business Card covers damage to the vehicle from collisions and theft. However, you will not receive liability coverage, so you’ll need to have your own coverage to cover liabilities. This benefit can potentially save you thousands of dollars if you need to file a claim. Harlan, an MMS team member, found out the value of car rental coverage after being billed almost $700 for a small dent on the passenger-side door.

Roadside assistance

For a small flat service fee per call, you’ll be able to receive assistance when you’re out on the road and experience a common mishap like:

- Towing – up to five miles included

- Tire changing – must have good, inflated spare

- Jump-starting – battery boost

- Lockout service (no key replacement)

- Fuel delivery – up to five gallons (cost of fuel not included)

- Winching (within 100 feet of paved or county maintained road only)

You’re responsible for the cost of any services used, but it’s extremely helpful if you’re unfamiliar with an area and experience car trouble.

Employee cards at no additional cost

The Southwest Performance Business Card is a small-business card. For small businesses, issuing multiple employee credit cards can often become quite expensive. However, with the Southwest Performance Business Card, employee cards are available at no additional cost. Small-business owners will also be eligible to earn points from purchases made by employees with the Southwest Performance Business Card.

Overall value

The first year you have this card, you can expect to receive a value of $1,715:

- $1,200 – 80,000 point welcome bonus(based on Southwest points value)

- $135 – 9,000 bonus anniversary points (based on Southwest points’ value)

- $200 – Four upgraded boardings each year (worth up to $50 each)

- $80 – Wi-Fi credits worth $8 each (based on the assumption that you take five round-trip Southwest flights per year)

- $100 – Global Entry credit (or TSA PreCheck worth $85)

The ongoing benefits of this card can save you conservatively $415 each year with the anniversary points, the upgraded boardings and the Wi-Fi credits. Subtract this from the $199 annual fee you’ll pay each year, and you come out $216 ahead. This figure doesn’t include the money you’ll inevitably save by using the card for your travel purchases and being reimbursed for late bags and rental car insurance.

Bottom line

If you use all of the benefits and perks that come with the Southwest Performance Business Card, you won’t have any trouble justifying the annual fee. Even if you already have a card that offers statement credits for Global Entry or TSA PreCheck, the card’s numerous other perks can more than make up for the annual fee.

The four upgraded boarding certificates you’ll receive each year can save you up to $200, plus you’ll be among the first to board which means snagging your favorite seat. The Southwest Performance Business Card also earns points toward the Companion Pass, which can save you thousands in airfare each year. And you’ll receive up to 365 inflight Wi-Fi credits (worth $8 apiece) each year.

I highly recommend the Southwest Performance Business Card, not just for the card’s welcome bonus of 80,000 Southwest points (worth ~$1,200 in airfare). For more detailed information on the card, you can read our review of the Southwest Performance Business Card.

You can apply for the Southwest Performance Business Credit Card here. And subscribe to our newsletter for more in-depth and easy-to-understand posts on credit card benefits.

Featured Image by Felipe I Santiago/Shutterstock

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!