Dinged! $692 for a Tiny Rental Car Dent…How I Escaped This Outrageous Charge Thanks to Chase Sapphire Reserve Car Rental Insurance

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

See that little ding in the rental car photo below? I was torn whether I should file an incident report. But in the end, I did.

The following week, I got a call from the rental car agency’s claims department saying I had to pay for the repairs. Luckily, I paid for the rental with my Chase Sapphire Reserve card, which comes with primary rental car insurance.

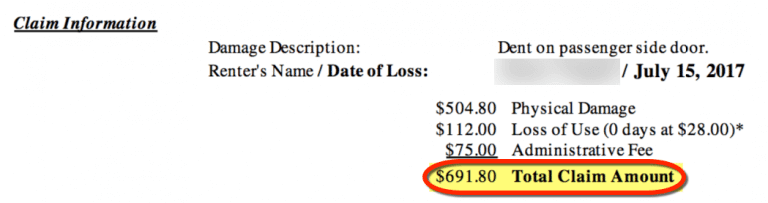

The Chase Sapphire Reserve car rental insurance saved me from paying ~$692 out-of-pocket for this tiny mark!

I’ll share what happened. And remind you which cards come with primary rental car coverage.

How I Filed My Chase Sapphire Reserve Car Rental Insurance Claim

Link: Chase Sapphire Reserve Rental Car Insurance Review

Link: Chase Sapphire Reserve Auto Rental Collision Damage Waiver Benefit

Link: Start a New Claim

To say I was shocked when I got the final bill for ~$692 is putting it mildly. The rental car agency explained I was responsible for ANY damage to the vehicle no matter who caused it.

Chase made it easy to start my claim online. And it only took a few minutes to upload the required documents, including:

- A copy of the Accident Report or police report and the rental agency’s statement of claim document, which should indicate the costs you are responsible for and any amounts that have been paid toward the claim

- A copy of the initial and final car rental agreement(s)

- A copy of the repair estimate or itemized repair bill

- Two photographs of the damaged vehicle, if available

I already had these documents in various emails. So it was just a matter of saving the files and uploading them. And I looked through my phone for photos I took of the ding. All told, it only took a few minutes to upload the files.

Rental car coverage with the Chase Sapphire Reserve is primary. That means I didn’t have to involve my personal car insurance company. Instead, Chase would cover up to $75,000 in damage because I paid for the entire rental charge with my card. That’s an incredible benefit!

It was also one I was hoping to never use. I put the Chase claims department in touch with the car rental agency’s claims department. It was as easy as giving representatives from each company the claim numbers and each other’s contact information.

Three months later, I got another call that everything was taken care of. I never paid a single buck toward the vehicle’s repair, loss of use, or any other fees.

This incident – and how easy it was resolved – has convinced me why it’s extremely important to always pay for car rentals with a card that includes primary rental car coverage! And to take lots of photos should anything happen. Also, keep every piece of paper – including rental agreements, reservation details, and incident reports – in case anything like this ever happens to you!

Which Cards Include Primary Car Rental Insurance?

Here are some cards to consider if you rent cars with any frequency.

Always remember to check the benefits guide so you know what’s covered (and what’s NOT!), how much your coverage is worth, and any other important information. To use the coverage, it’s important you waive or decline the insurance from the car rental agency, usually called a collision damage waiver (CDW) or loss damage waiver (LDW).

1. Chase

- Chase Sapphire Reserve

- Chase Sapphire Preferred® Card

- Ink Business Preferred℠ Credit Card when you rent a car for business purposes

- Southwest Rapid Rewards Premier Business Credit Card when you rent a car for business purposes

- United℠ Explorer Card

2. Citi

- CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® when you rent for business purposes

The information for the CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

3. Other Cards

Keep in mind, you can enroll for free in the American Express Premium Car Rental Protection program. But you’ll pay ~$25 (~$18 for California residents) per rental for up to 42 consecutive rental days (30 consecutive rental days for Washington State cardholders).

Primary rental car coverage also comes with the U.S. Bank Altitude Reserve Visa Infinite® Card (except in Israel, Jamaica, Ireland, and Northern Ireland).

Here’s our guide to the best credit cards for car rentals.

Bottom Line

I used the primary rental car coverage included with my Chase Sapphire Reserve card when I spotted a ding on my rental car. This benefit ended up saving me ~$692 in repairs and fees!

I spent a few minutes uploading documents to submit my claim. And Chase worked directly with the car rental agency to take care of it! This experience convinced me how important it is to use a card with primary rental car insurance every time I rent a car.

A few cards with this perk include:

- Chase Sapphire Reserve

- Chase Sapphire Preferred® Card

- Ink Business Preferred℠ Credit Card when renting for business purposes

If you ever rent cars, this perk lets you file a claim without having to involve your personal insurance company. And it can save you a lot of money if you ever have an incident!

If you’ve used your card’s rental car insurance, how did your experience compare?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!