Should you buy travel insurance?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

In these present times of uncertainty, a common question we often get from readers, friends, and family is: “Should I buy travel insurance for my trip?” The novel coronavirus continues to hold the fort, wreaking havoc on the travel aspirations of all Earthlings for still perhaps weeks and weeks into the future. Is travel insurance extra necessary?

Usually, when you book a flight or package online, you’ll get the option to add travel insurance for a fee. It can be a major additional cost in some instances, especially if you’re traveling with family or as a group. And while protecting your trip is a good idea as things can happen, many folks aren’t aware of the best travel insurance credit cards, which have a lot of the coverage you’re looking for already baked in. This includes benefits like rental car insurance, baggage and trip interruption insurance, emergency medical and dental coverage, and even emergency evacuation & transportation.

We’ll walk you through the benefits you get when you pay for insurance at time of booking and compare that to the free coverage you get with travel credit cards. In most cases, you get just as much, if not more, coverage with your card than you do paying extra money.

What is travel insurance?

Even an infrequent traveler knows that absolutely nothing is a certainty along your trip — from experiencing an unexpected sickness to dinging a rental car to staring powerlessly at a flight cancellation notification. Travel insurance is the way to protect yourself from the unknown.

You can receive help for a roadside emergency like a flat tire. You can be reimbursed for expenses when the airline loses your luggage. You can be emergency evacuated from your vacation to a hospital if you become seriously injured. Travel insurance can potentially save you millions (though, ironically, we book our trips hoping it won’t save us a cent).

Types of travel insurance

There’s a long list of travel insurances. The most popular are:

- Collision Damage Waiver – Covers you for a damaged or stolen rental car. This usurps your personal rental car insurance — you can bump your rental car and your insurance doesn’t have to know a thing.

- Baggage Delay – Reimburses for necessary expenses such as clothes, toiletries, etc. when your luggage is delayed for a certain amount of time (varies by policy).

- Trip Delay – When your trip is delayed for a certain amount of time (varies by policy) for a covered reason, you may be reimbursed for reasonable expenses, such as lodging, meals and toiletries. If your delay causes you to miss prepaid plans, like a tour or a cruise, you could even receive compensation to help you catch up to your group.

- Lost/Damaged Baggage -Reimburses for lost, stolen or damaged bags during your trip, up to the cash value of your belongings or an amount stipulated by your policy.

- Trip Cancellation – Reimburses prepaid and non-refundable expenses (for a covered reason) if you cancel your trip before it starts.

- Trip Interruption – Reimburses you for unused prepaid expenses if something goes awry during your trip. Usually includes a small reimbursement for hospital expenses, as well as transportation to get home.

- Emergency Medical Transportation – If you must be transported to a special facility due to a covered illness or injury during your travel, you can be reimbursed for the expense. This can be REALLY pricey.

Who needs travel insurance?

Technically, only a small percentage of people need travel insurance. The problem is, none of us know who those people will be! If you travel with any regularity, you should be using it. Fortunately for you, getting premium travel insurance is incredibly cheap. I’ll explain shortly.

What do you get with travel insurance?

There are numerous sites that offer travel insurance, but the most common sale is near the payment page of airline websites.

When you book travel online, you’ll often see a check box at some point during the checkout process offering you travel insurance if you pay a fee, usually from $30 to $60 per person. Oftentimes you don’t even see what the benefits are unless you expand details or click a link for more info. To find out what’s offered in terms of coverage, I did some international and domestic test bookings on Orbitz and United.com to see what exactly I would get for my money.

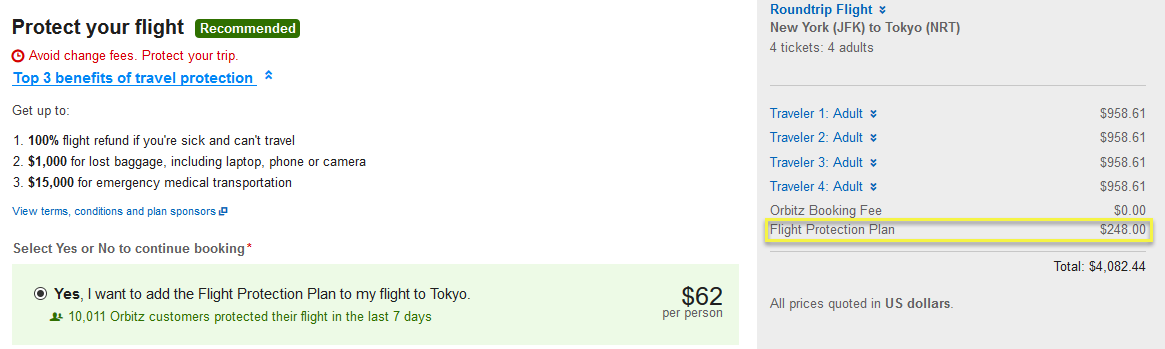

First I tried to book an international flight from New York (JFK) to Tokyo on Orbitz. For $62 per person, you get a 100% refund of the cost of a ticket, $1,000 for lost baggage, and $15,000 for emergency medical transportation.

In my booking for four people, it came out to $248 for this travel protection.

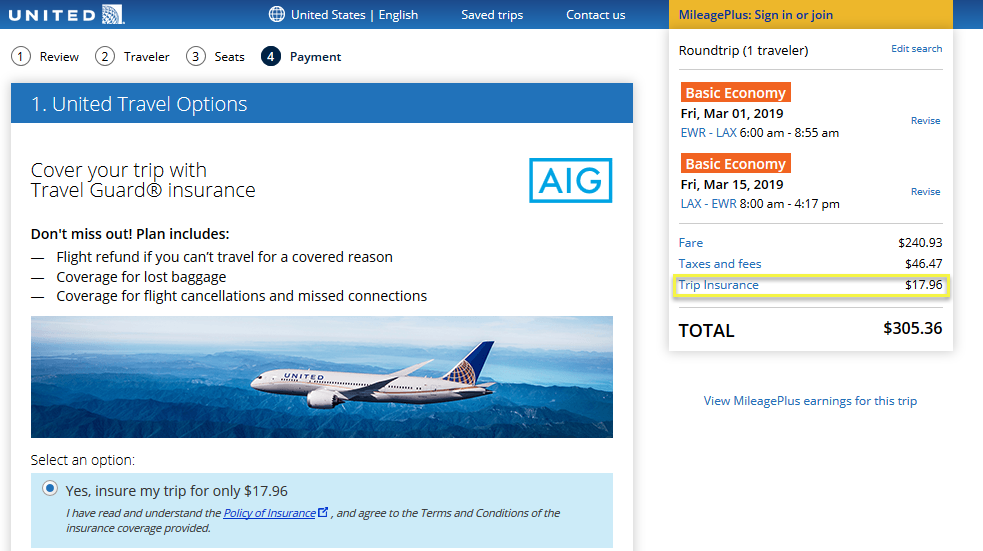

Next, I went to United.com to book a domestic flight from New York (JFK) to Los Angeles. For ~$18 per person, I would get insurance through AIG, where I would receive a refund for my ticket if I can’t travel for a covered reason, lost baggage coverage of $300 total ($100 per day), and trip interruption insurance up to 125% of the cost of booking (in this case $300).

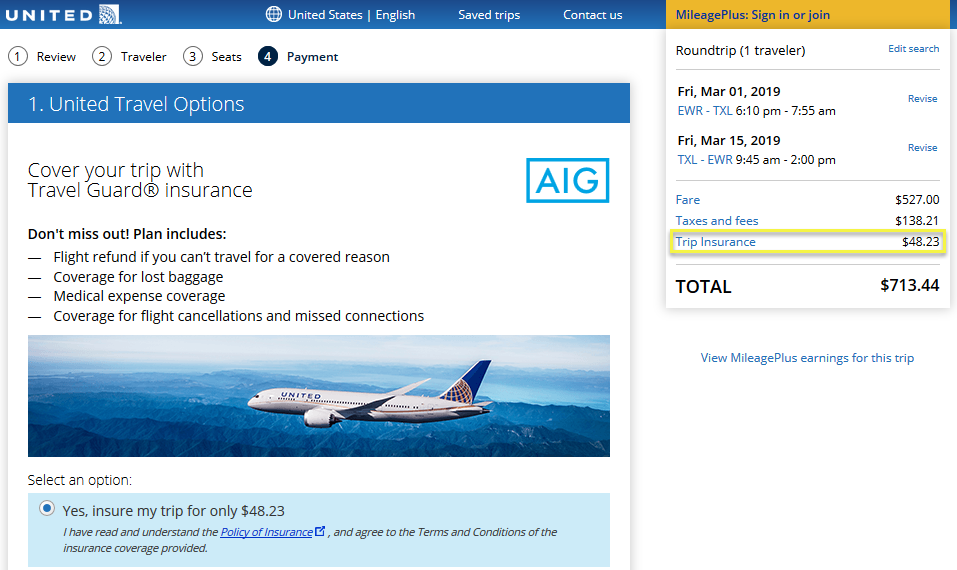

Finally, I tried to compare United Airlines’ international insurance to that of Orbitz, so I looked up a flight from New York (JFK) to Tokyo. For ~$48 per person, I would get a flight refund, baggage insurance of $1,000, $10,000 worth of accident/sickness medical expense coverage, and emergency evacuation insurance of $20,000. For a group of four, you are looking at ~$200 in fees for insurance.

It absolutely makes sense to cover your trip in case the unexpected happens — but you might already have coverage when you book with the right card.

How to get travel insurance

In some cases, you can get all of the above coverage, and more, using certain travel credit cards. Here’s an rundown of the best travel insurance credit cards:

Let’s quickly look at a couple real world examples of how these cards can be better than the insurance coverage offered by booking sites. You can save a ton of money while enjoying more protection during your trips!

Chase Sapphire Reserve

The Chase Sapphire Reserve® is packed with ton of great benefits, including many types of travel insurance. This card has a $550 annual fee (though you’ll only need to pay $450 if renewing your card in 2020 — check out this post for the details). It offers these protections when you book with your card:

- Baggage Insurance – You’ll receive up to $3,000 per person, per trip for lost checked bags. You, your spouse or domestic partner, and your immediate family members can receive up to $100 per per day (for up to 5 days) that your bags are delayed 6+ hours

- Trip Delay Protection – If your trip is delayed for more than 6 hours, you and immediate family could be reimbursed for up to $500 per ticket for reasonable expenses (meals, lodging, toiletries, medication, and other personal use items)

- Primary Car Insurance – You are covered when you rent a car with your card and decline the car rental agency’s collision damage waiver

- Trip Cancellation & Interruption Insurance – Up to $10,000 per person per covered trip (maximum $20,000 per occurrence)

- Emergency Medical and Dental Coverage – Up to $2,500 for medical expenses if you or your immediate family member becomes sick or injured 100 miles or more from home on a trip

- Emergency Evacuation & Transportation – Up to $100,000 in coverage

- Travel Accident Insurance – Up to $1,000,000 per person ($2,000,000 maximum)

If you compare the protection you get from booking with your Chase Sapphire Reserve to the protection I would have paid for four family members ($248) on my flight booked with Orbitz, I would get more $2,000 more per person in baggage insurance and up to $85,000 more coverage for emergency medical transportation by booking with the card.

That doesn’t even include other benefits like emergency medical coverage or travel accident insurance. The best part — these benefits are free with the card. That means I can put that $248 towards a nice dinner in Tokyo where I can earn 3 Chase Ultimate Rewards points per dollar and pay no foreign transaction fees. 😉

Amex Platinum

You’ll also get slew of benefits with The Platinum Card® from American Express. While the travel benefits aren’t quite as extensive as the Chase Sapphire Reserve, it’s a very competent card, and it better be, with a $695 annual fee (see rates and fees for the Amex Platinum):

- Trip cancellation and interruption – Bookings are eligible for up to $10,000 per trip, with a maximum payout of $2,000 per 12-month period) for flight cancellations occurring due to a covered reason (such as inclement weather, jury duty, injury, illness, etc.). You must pay the full ticket with your card (award flight taxes and fees and Pay With Points tickets also eligible)

- Trip delay – Bookings may receive up to $500 in reasonable expenses (such as lodging, meals and toiletries) when you trip is delayed more than six hours for an eligible reason (award flight taxes and fees and Pay With Points tickets also eligible)

With the Amex Platinum card, you get Emergency Evacuation & Transportation Insurance with no limits on the amount of coverage. If you are booking travel where you know medical facilities are few and far between or your destination is very remote, this card is perfect in case anything happens. You won’t have to worry about paying for transportation if you need to be rushed to a medical facility.

You’ll also receive lost luggage insurance of up to $2,000 per person, per trip for checked bags, and up to $3,000 per person for carry-on baggage.

What if you’re looking for medical coverage while traveling abroad?

If you are looking for medical insurance while you are traveling outside the U.S., most coverage you get either through your card or pay for through booking sites will not be sufficient. As mentioned, the Chase Sapphire Reserve offers up to $2,500 for emergency medical expenses and up to $100,000 in Emergency Evacuation & Transportation coverage, however, that might not be enough to cover any major issues while traveling.

If you anticipate that you may need medical attention while traveling or just want to cover all of your bases, you should consider paying for travel medical insurance. Make sure you check with your insurance company first to see if you’re covered for emergency medical outside the country. In many cases, you aren’t. Read our post on getting medical coverage while traveling outside the U.S. for more details.

Should I buy travel insurance due to COVID-19?

The answer may surprise you. The travel industry has never quite seen something like the current COVID-19 travel restrictions. Airlines, hotels, cruises and trains wring their hands as they stare at the clock awaiting permission to begin serving the world again.

Until then, these businesses have been overwhelmingly and unexpectedly generous with their change and cancellation policies. Many airlines and hotels allow you to scrap your upcoming travel for free, depending on your travel dates and locations. You can read our post on what to do if your travel plans are impacted by the coronavirus to learn more — we’ve got a list of airline and hotel policies that we update as often as we have time.

Additionally, credit card issuers have stated that, while their trip interruption insurance policies don’t specifically cover the novel coronavirus, they will work with each customer on a case-by-case basis to help them through their difficult situations.

Bank and travel juggernauts are doing everything they can to help you keep from contracting and spreading this contagion. Purchasing travel insurance can never do any harm, but I certainly wouldn’t say it’s critical at this time.

Bottom line

When it comes to travel insurance, you shouldn’t pay extra for limited benefits when the best travel insurance credit cards often offer more protection than the booking sites themselves.

With cards like the Chase Sapphire Reserve and Amex Platinum, you get plenty of trip delay, trip cancellation, and even emergency medical coverage all covered for free when you book with your card. You’ll still want to consider purchasing travel health insurance if you’re traveling overseas. Always check with your personal insurance provider to find out if you’re covered first.

If you’ve had any issues while traveling and used your card benefits to cover your expenses, we’d love to hear your stories below so you can help folks deal with similar issues should they arise! And subscribe to our newsletter for more travel tips and info like this delivered right to your inbox.

For rates and fees of the Amex Platinum card, click here.

For rates and fees of the Amex Business Platinum card, click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!