I Saved Hundreds on Dining in Hawaii Using Cash Back: How to Redeem Rewards From the Capital One Savor

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

INSIDER SECRET: You’ll earn one of the best cash back returns around for dining and entertainment with this card — it’s like getting a 4% discount on these purchases, anywhere you go.It’s said there’s no such thing as a completely free vacation, and that’s mostly true. However, you can get pretty darn close between redeeming points and miles from the best travel credit cards for flights, hotels and other travel purchases, and offsetting expenses like dining and entertainment with rewards from the best cash back credit cards.

I’d had my eye on the Capital One Savor Cash Rewards Credit Card as a way to help defray the cost of restaurant meals and groceries on a recent trip to Hawaii. Between the welcome bonus and cash back I’d earned from spending, my family saved hundreds of dollars and splurged on a couple meals we’d otherwise have balked at. When it came time to redeem cash back rewards, it couldn’t have been more straightforward.

If you’re new to the Capital One Savor, I’ll show you how easy it is to redeem your cash back online.

The information for the Capital One Savor Cash Rewards card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.How to Use Cash Back Rewards From the Capital One Savor

Read our review of the Capital One Savor

With the Capital One Savor, you’ll currently earn a welcome bonus of $300 after spending $3,000 on purchases in the first three months of account opening. That’s a nice chunk of change, although in the past (as when I applied) the bonus has been as high as $500 after meeting minimum spending requirements. There’s a $95 annual fee, but it’s waived the first year.

The Savor also gives an excellent return on everyday purchases like dining, entertainment and groceries. You’ll earn:

- 4% cash back on dining

- 4% cash back on entertainment

- 2% cash back at grocery stores

- 1% cash back on everything else

There aren’t any limits to how much cash back you can earn, and you’ll never get penalized for using your card overseas because there are no foreign transaction fees.

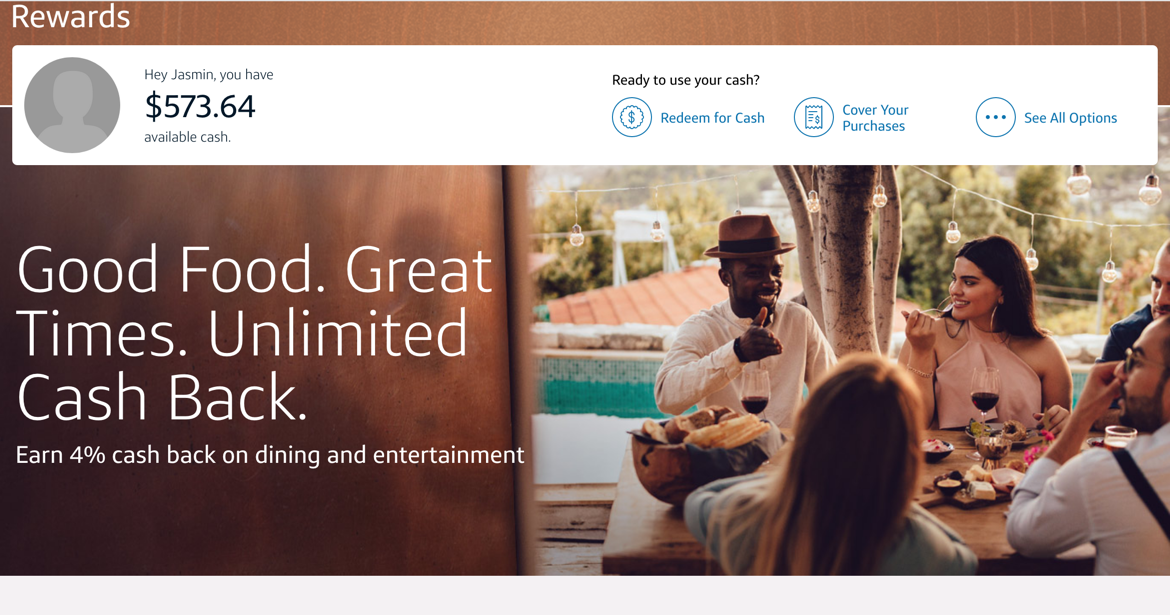

When you’re ready to use your cash back, it’s a simple process. Start by signing into your Capital One account and navigating to the “Rewards” section from the main page.

There are a few different options for getting your cash back:

- Redeem for cash (either via statement credit or check)

- Redeem for a recent purchase (similar to the statement credit above, but for a specific transaction)

- Get gift cards (I don’t recommend this — more on that in a second)

- Share your rewards with another Capital One account

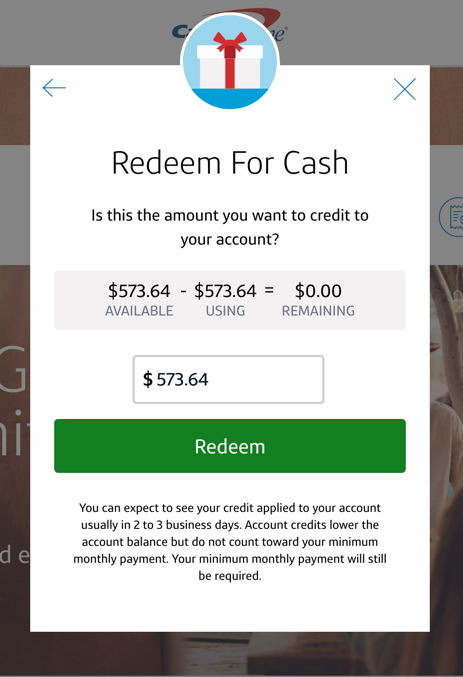

Redeem for Cash

If you have charges on your account, your best (and simplest) bet is to redeem your cash back to reduce or eliminate your account balance, plus there’s no minimum redemption amount.

This was the method I used, and it took a couple of days for the cash back credit to appear in my account.

If you don’t have any charges to erase, you can choose to have Capital One send you a check with your cash back. I haven’t done this personally, but they say they’ll mail it in three business days and it can take two to three weeks to arrive. Its faster and simpler to redeem as a statement credit to offset your total balance.

Keep in mind, when you redeem your cash back, you’re still responsible for the minimum payment due on your account.

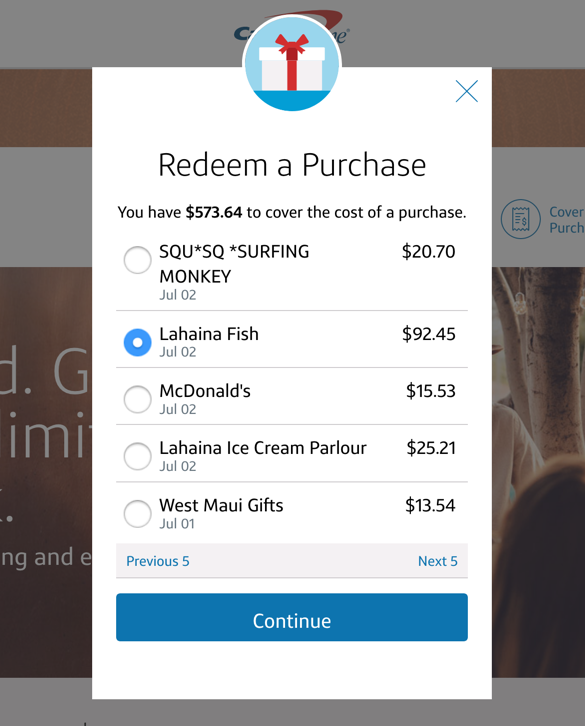

Another way to redeem cash back is to apply rewards for an individual expense, for example, if you wanted to erase the cost of a specific meal or purchase.

This seems a little redundant seeing as you can just apply the same amount as a statement credit, but it might be helpful from a record-keeping perspective.

This method of redemption also takes a couple of business days to appear in your account, and you’re still responsible for the minimum payment due even if you lower your balance this way.

Redeem for Gift Cards

Another way to redeem cash back from the Capital One Savor is to cash in your rewards for gift cards to popular retailers like Amazon, Target and Starbucks. Your rewards are worth the same as if you used them for straight cash back — for instance, a $50 Starbucks gift card would cost you $50 in rewards.

Here’s why you shouldn’t do this: When you redeem cash back for gift cards, you will not earn additional cash back on your purchase. You’re far better off using your card to buy a gift card directly from the retailer (where you’ll earn cash back for the purchase) then redeeming cash back to offset the purchase.

For example, if you used your Capital One Savor to buy that $50 Starbucks gift card at Starbucks, you’d earn 4% cash back on dining (in this case, $2). Redeeming for the same gift card through the Capital One Savor website would net you nothing in rewards (and gift cards come via snail mail, which can take two to three weeks).

Or, consider using a different credit card that earns a higher return in certain categories to buy a gift card. Then, ask Capital One to send you a check in that amount from your cash back balance, and use it to cover the cost.

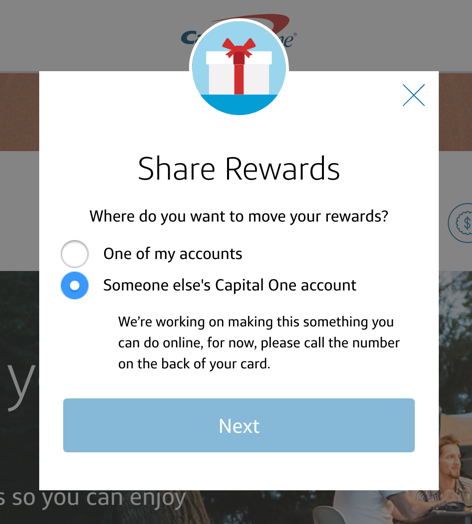

Share Your Rewards With Another Capital One Account

If you have other Capital One accounts that earn cash back, like the Capital One Quicksilver Cash Rewards Credit Card, you can combine your rewards with that account online.

You’re also able to share your rewards with someone else’s Capital One account, but it’s not currently possible to do so online — you’ll have to call the number on the back of your card.

Bottom Line

Redeeming cash back rewards from the Capital One Savor card is easy to do online. The most convenient way is to redeem for a statement credit or to offset an individual purchase you’ve made on the card, but keep in mind this will not reduce your minimum payment due.

Another method (if you don’t have a balance) is to request Capital One mail you a check, but this can take two to three weeks to deliver.

There’s also an option to redeem your cash back for gift cards, but this doesn’t make sense because you won’t earn rewards for the purchase. Instead, use your Savor card to buy a gift card directly from the merchant (you’ll earn cash back), then redeem rewards to erase the charge from your card.

Finally, you’re able to combine rewards with other cash-back-earning Capital One accounts, either your own or someone else’s account. To share rewards with a friend, you’ll have to call the number on your card — all other redemption options are possible online.

To learn more about the Capital One Savor, check out these guides:

- Capital One Savor Cash Rewards Credit Card Review

- Is Capital One Savor Cash Rewards Credit Card Worth It?

- Capital One Savor Cash Rewards Credit Card Benefits and Perks

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!