The Capital One Savor Is the Best Cashback Credit Card for My Family – And Maybe for Yours, Too

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Most folks in our hobby focus almost exclusively on earning miles and points for travel, because this is typically the easiest way to earn the most rewards for spending. Sometimes you can get a return of 10 cents or more per $1 you spend, especially if you redeem for fancy hotel stays or luxury Business and First Class flights.

But the best cash back credit cards have a place in your travel arsenal, too. Earning cold hard cash gives you complete flexibility in how you redeem your rewards, and can help cover travel expenses you can’t redeem miles and points for – like meals, souvenirs, or activities.

That’s why I’m looking to add a new cash back credit card to my wallet. And I’ve decided on the Capital One Savor Cash Rewards Credit Card because it fits well with my family’s spending habits (and not to mention comes with a very substantial welcome bonus)!

The information for the Capital One Savor Cash Rewards card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

I’ll share why the Capital One Savor tops my list of the best cash back credit cards for my family.

The Capital One Savor Is the Best Cash Back Credit Card If You Have Hungry, Active Kids

Read our review of the Capital One Savor

I shared my new Chase credit card strategy now that I’m below Chase’s 5/24 rule – that is, I’ve only opened 1 credit card in the past 24 months so I’m eligible for up to 4 new Chase personal cards in the near future.

So why is the Capital One Savor on my list of cards to get this year? It’s not a Chase card and will take up a valuable personal card slot in my 5/24 count – doesn’t it make more sense to apply for a Chase card instead?

For some, maybe. But for me, the bonus and spending categories are too good to pass up!

With the Capital One Savor card, you’ll earn $300 cash back after spending $3,000 on purchases within the first 3 months of account opening.

And you’ll earn bonus points in certain categories, with NO limits:

- 4% cash back on dining

- 4% cash back on entertainment

- 4% cash back on popular streaming services

- 3% cash back at grocery stores (excluding superstores like Walmart and Target)

Earning unlimited 4% cash back on dining is huge for our family. My 2 middle-school daughters love to try new cuisines and we’re often checking out restaurants to try something different. (This card is wasted on my endlessly-picky son, Mr. Vegetarian Who Doesn’t Eat Vegetables).

Right now I’m using my Citi Prestige Card (open to new applications later this month) to earn 5X points on dining, but I’d consider switching some purchases to the Savor just to earn a nice chunk of cash back.

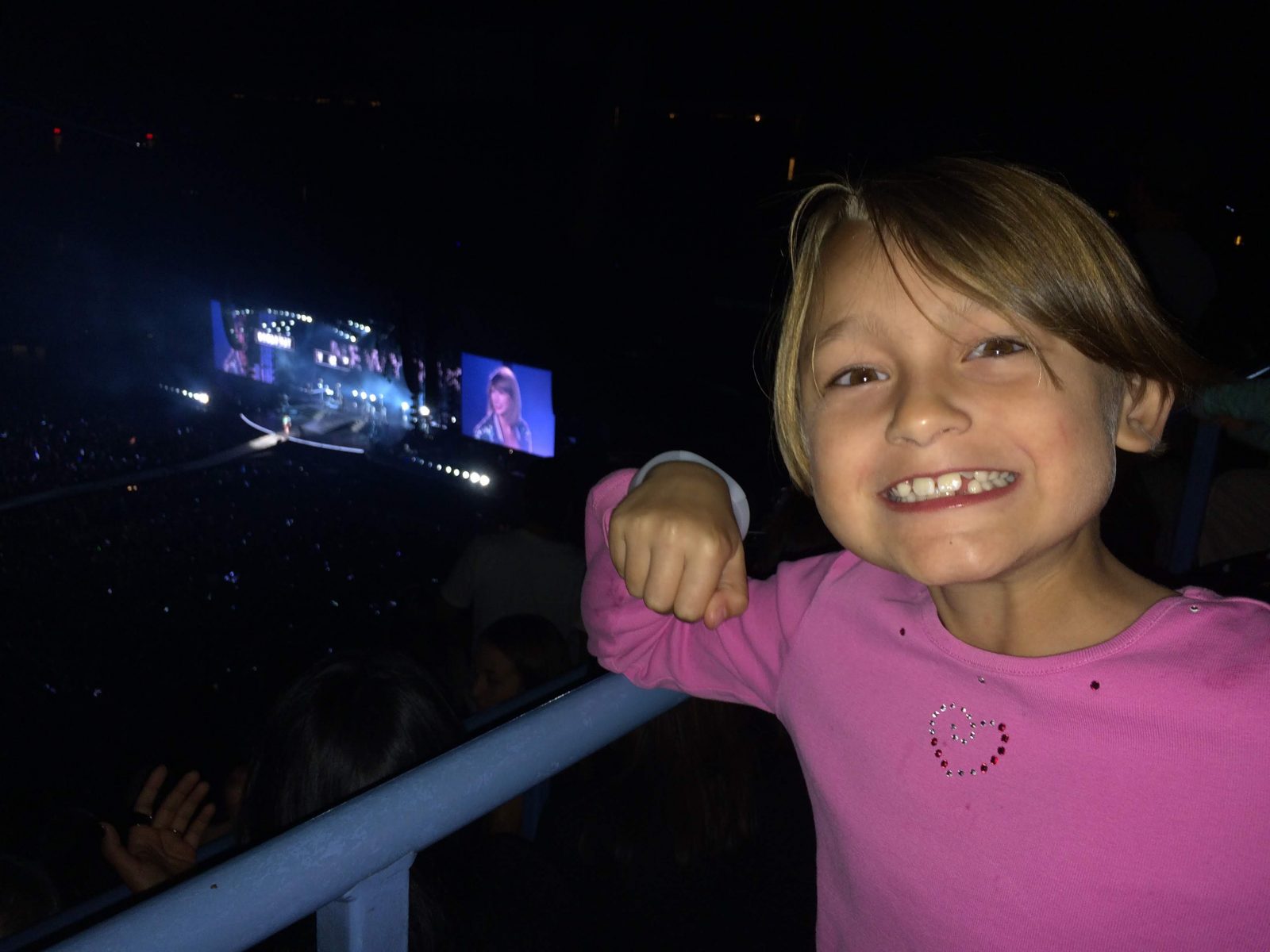

And the kids are now of the age where they like to hang out with their friends and go to concerts, movies, and theme parks. With 4% cash back on entertainment (which also includes plays, sporting events, tourist attractions, aquariums, zoos, dance clubs, pool halls, bowling alleys, record stores, and video rental locations) is a nice boost when we’re going to spend money anyway. Check out Harlan’s post on what exactly counts as entertainment with the Capital One Savor.

And the Capital One Savor bonus ain’t too shabby, either. Earning $300 cash back after spending only $3,000 on purchases in the first 3 months is easily attainable for our family. Between groceries and dining out, it’ll be a cinch to knock out the spending requirement.

Note: I probably won’t use the Savor for groceries, because I have other cards that earn more (or offer rotating quarterly bonus categories that earn more). Here’s our post on the best credit cards for grocery stores.

Bottom Line

The Capital One Savor is on my short list of cards to get this year. For our family, the bonus categories and welcome offer make it the best cash back credit card for our spending habits.

With the Capital One Savor, you’ll earn $300 cash back after spending $3,000 on purchases in the first 3 months. The card has a $95 annual fee. But it’s the 4% cash back on dining, entertainment, and popular streaming services that really appeals about this card. (You’ll also earn 3% cash back at grocery stores, and 1% back on everything else).

If you like dining out and attending things like concerts, plays, movies, or sporting events (like my kids do!), the Capital One Savor is a top card to consider. But if those aren’t categories you spend in often, check out our list of the best cash back credit cards to find a card that better suits your needs.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!