When Does It Make Sense to Use Your Points for Flights?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Million Mile Secrets reader, Bansi, emailed:

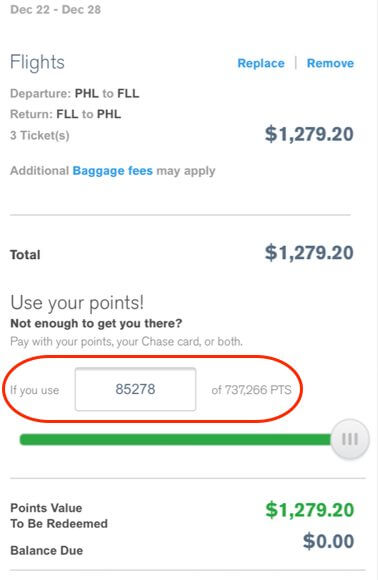

For 3 round-trip tickets from Philadelphia to Fort Lauderdale, is it better to pay $1,279 or redeem ~85,000 Chase Ultimate Rewards points linked to my Chase Sapphire Reserve through the Chase travel portal?

Excellent question!

Chase Ultimate Rewards points are my favorite flexible points. Because these points can be extremely valuable when you transfer them directly to airline and hotel partners like Hyatt or United Airlines.

But you’ll also save money using Chase Ultimate Rewards points for flights and other travel through the Chase portal. Plus, when you book this way, you can book flights on airlines beyond those on the list of transfer partners. You also don’t have to worry blackout dates!

And folks with the Sapphire Reserve like Bansi get a great deal because cardholders get a 50% bonus, or 1.5 cents per point, redeeming points for travel through the Chase portal.

I’ll share tips to help you save money or points for your next flight!

3 Tips When Deciding to Use Points or Pay Cash for Flights

Link: Chase Sapphire Reserve Increases Value of Your Ultimate Rewards Points

Link: Save Points (and Money) Using the Chase Ultimate Rewards Travel Portal

Link: What Are Your Favorite Ways to Use Miles and Points?

Saving money on flights and hotel stays is why folks get into the miles & points hobby. But after earning points with lucrative credit card sign-up bonuses, you might wonder when is a good time to use them!Remember, there’s no right or wrong way to use points. If they help you achieve your travel goals, that’s all that matters!

Here are some tips that might help you figure out if you should pay cash or use points.

1. How Many Points Do You Have?

Folks who apply for multiple credit cards or spend a lot for a small business can earn points quickly! It’s nice to have points saved up, especially flexible Chase Ultimate Rewards points like reader Bansi collects.

But I normally suggest using points instead of hoarding them. Unlike cash, the value of your points can potentially change overnight!

So if you can redeem points for 3 round-trip flights and still have a lot left over, I think this is better than paying cash.

2. Could You Use Fewer Points by Booking an Award Flight?

While you can NOT transfer Chase Ultimate Rewards points directly to American Airlines, it’s still possible to use these points for an award flight on the airline. You can do this by transferring points to British Airways, which is part of the Oneworld alliance.

But finding award seats can require flexibility with your travel dates and even airports. That said, booking this way can save you lots of points!

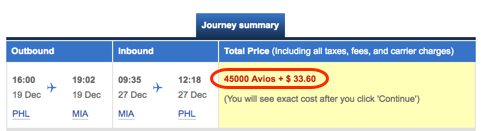

For example, Bansi wants to travel to Fort Lauderdale during the holidays in December. If she’s flexible, she could transfer Chase Ultimate Rewards points to British Airways. Then, book 3 round-trip American Airlines award flights to Miami, which is just a ~30 minute drive from the Fort Lauderdale airport.

Bansi would have to transfer 45,000 Chase Ultimate Rewards points to British Airways and pay ~$34 in taxes & fees to book these 3 award flights. That’s almost 50% fewer points than the other flight through the travel portal.

But if you’re not flexible, redeeming points for flights through the Chase travel portal can make a lot of sense because:

- You can buy a ticket even if award seats aren’t available on the flights you want (no blackout dates)

- You’ll earn airline miles for the ticket

- If you don’t have enough points to pay for a ticket (either an award ticket or paid fare), you can combine your points with cash

Don’t forget to move points to your Chase Sapphire Reserve account before booking this way. Because points linked to this card are worth 1.5 cents each toward travel through the Chase travel portal.

3. Can You Replenish Your Points?

If you don’t have lots of points, you might be thinking of paying cash for a flight and saving your points to use for a future trip. There’s nothing wrong with that!

But planning ahead and having a credit card strategy could help you save money by having little to no out-of-pocket expense for travel.

For example, team member Keith used more than 620,000 points from different flexible programs when booking his around-the-world honeymoon. But he didn’t want this travels to stop there. So he quickly boosted his points balances by applying for other travel cards with lucrative sign-up bonuses.

Be sure to check out my guide to credit card rules at major banks. This way, you can understand your sign-up bonus eligibility and maximize your points earning!

Bottom Line

Deciding when to pay cash or use points for flights can require some thought!

If you’ve been building up a stash of points, using a small percentage to book flights can save you from having an out-of-pocket expense. And if you collect flexible points, like Chase Ultimate Rewards points, you can redeem points through the Chase travel portal without having to worry about blackout dates.

Or if your travel dates are flexible, you could potentially transfer your flexible points to an airline partner and book an award flight. You might use fewer points this way!

And having a credit card strategy might make you more likely to use points instead of paying cash. Because you can replenish your points balance quickly by earning a lucrative sign-up bonus on a new card!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!