Now Is the BEST Time to Start Earning the Southwest Companion Pass!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

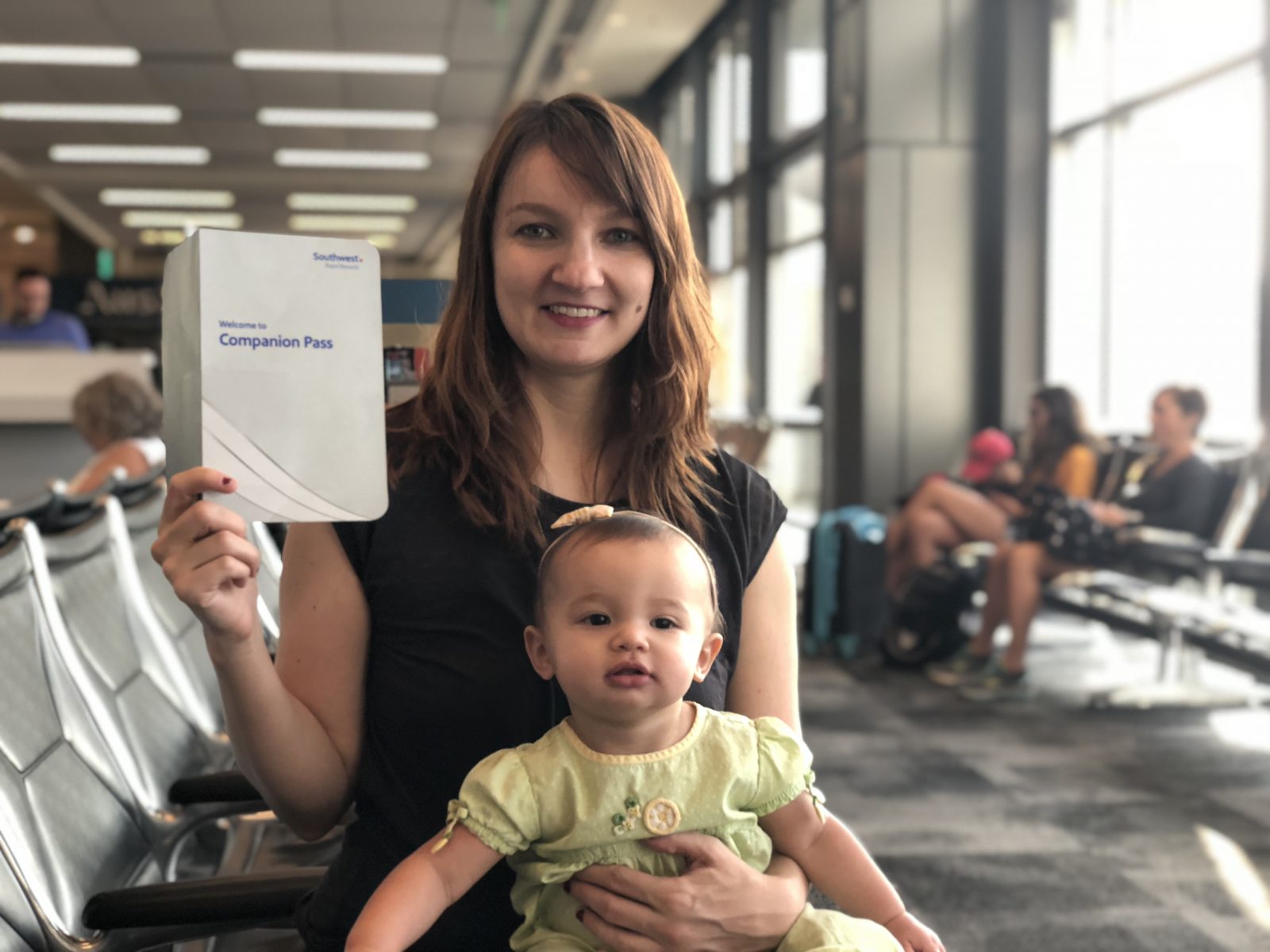

It’s the time of year when many miles and points enthusiasts set their sights on earning the coveted Southwest Companion Pass. It’s one of the best deals in travel because with the Companion Pass, a friend or family member can travel with you for just the cost of taxes and fees on both paid and award tickets!

The end of the year is ideal for firming up your Companion Pass strategy because the pass is valid for the remainder of the calendar year in which you earn it and for the entire following year! So by qualifying for the Companion Pass in early 2019, it’ll be valid until December 31, 2020 – almost 2 full years!

Here’s a quick review of the Southwest Companion Pass rules. And why you should consider applying for Southwest credit cards now to qualify for the pass in early 2019!

Southwest Companion Pass Rules

To qualify the Southwest Companion Pass, you’ll need to earn 110,000 Southwest points in a calendar year. But not all Southwest points qualify! Southwest says:

Companion Pass Qualifying Points are earned from your revenue flights booked through Southwest Airlines, your points earned by making purchases with a Southwest Airlines Rapid Rewards Credit Card, and your base points earned from Rapid Rewards partners.

Here’s more about all the ways to earn Southwest Companion Pass qualifying points.

All paid Southwest flights will count toward earning the Companion Pass, as will points earned with co-branded Southwest credit cards (more on that below). You can also earn points with Southwest’s Rapid Rewards partners, which include shopping and dining partners (but only base points, not bonus points, qualify).

One important thing that does NOT count toward earning the Companion Pass is transferring Chase Ultimate Rewards points. So moving points earned with the Chase Sapphire Preferred Card, Ink Business Preferred Credit Card, or Chase Sapphire Reserve won’t do the trick. Southwest also does not count points transferred from hotel programs or purchased points.

While there are other ways to earn 110,000 qualifying Southwest points, the quickest way is to earn sign-up bonuses on Chase Southwest cards. For example, you can quickly earn most of the points you’ll need by opening 2 Southwest credit cards (1 personal and 1 business card). Chase has tightened their cardholder rules so that you can NOT have more than 1 personal Southwest credit card at once.

Apply for a Business and Personal Southwest Card to Get Most of the Way to the Companion Pass!

Apply Here: Southwest Rapid Rewards® Premier Business Credit Card

Read our review of the Southwest Business Credit Card

Apply Here: Southwest Rapid Rewards® Plus Credit Card

Read our review of the Southwest Plus Card

Apply Here: Southwest Rapid Rewards® Premier Credit Card

Apply Here: Southwest Rapid Rewards® Priority Credit Card

Read our review of the Southwest Priority Card

You can earn most of the points required for the Southwest Companion Pass by opening the Southwest Rapid Rewards® Premier Business Credit Card and one of the Southwest personal cards (Southwest Rapid Rewards® Plus Credit Card, Southwest Rapid Rewards® Premier Credit Card, or Southwest Rapid Rewards® Priority Credit Card).

The Southwest Premier Business card comes with a 60,000 Southwest point bonus after spending $3,000 on purchases in the first 3 months of account opening. And each of the Southwest personal cards currently offer up to 60,000 Southwest points: 40,000 points after spending $1,000 in the first three months. Plus, 20,000 points after spending $12,000 on purchases in the first 12 months your account is open.

By opening 2 cards, you’ll earn 120,000 Southwest points plus points from minimum spending. That’s enough to unlock the Companion Pass!

Be VERY Careful With Timing Your Spending

For the Companion Pass, timing is everything. According to the official rules on Southwest’s website, the pass is valid for the remainder of the calendar year in which you earn it and for the entire following year. By meeting the requirements early in the year, you could get nearly 2 years of Companion Pass status.

This means that you’ll want to earn the bonus so your account hits 110,000 total points as early in 2019 as possible. Meeting the 110,000 point threshold in December 2018, for example, means that 2018 is the first year of your pass and 2019 is your second year. BUT if you hit the threshold in January 2019, you get to keep the pass through December 2020.

If you want to take advantage of this benefit for the full 2 years, apply for 2 Chase Southwest cards in the last ~2 months of the year and complete the minimum spending after your December or January statement closes. That way, the welcome bonus will credit to your Southwest account in January or February of 2019.

Remember, qualifying points don’t roll over from year to year. Any Southwest points you have in your account now will not count in 2019. So you’ll want to earn the full 110,000 Southwest points early in 2019 to make best use of your Companion Pass!

A Common Pitfall

We’ve already mentioned a few things to keep in mind as you pursue the Companion Pass but it’s worth clarifying a common mistake: You get the Companion Pass when you earn the necessary points, NOT when you spend the money!

For example, let’s say you earn 100,000 points by December 2018 and then you spend $11,000 after your December statement closes on the 8th of the month. The points you earn on the $11,000 spending will post to your account in January 2019 and will not count toward the 110,000 points you need for 2018. That’s because you’ll earn the Companion Pass as soon as your account has earned 110,000 points for the calendar year (January through December). Points you earned in previous years do NOT count!

Bottom Line

Now is the best time to apply for any of the Southwest credit cards because all 4 versions offer a generous sign-up bonus that will count towards the Companion Pass. After you earn the companion pass in 2019, it’s valid until the end of 2020. But you’ll want to make sure you complete the minimum spending after your December or January statement closes so the welcome bonus points post to your Southwest account in early 2019.

Before you start applying for Southwest cards, be sure to consult our complete guide to earning the Southwest Companion pass, where you’ll find step-by-step instructions and answers to frequently asked questions.

Once you earn 110,000 Southwest points in a single calendar year, all you need to do is activate your Companion Pass online, select your companion, and start traveling!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!