Maximizing Black Friday and Cyber Monday holiday purchases

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

This page includes information about the Discover it® Cash Back that is not currently available on Million Mile Secrets and may be out of date.

War is declared in less than a week.

If you intend to participate in the rampageous bargain hunting this Black Friday and Cyber Monday, you need a strategy. There are countless angles you can add to your money-saving battle plan — many of them you can stack to save an unprecedented amount of money. In this post we’ll talk about:

- Online shopping portals

- The best cash back and points credit cards

- Targeted offers

- Earning welcome bonuses with your holiday spending

With these methods, you could very well earn a free vacation by the time the dust has settled and you’ve arrived back to your vehicle, shopping cart teeming. Be sure to also subscribe to our newsletter and follow us on Facebook and Twitter to stay up to date on ridiculous Black Friday and Cyber Monday deals.

Online shopping portals

Online shopping portals are a truly effortless way to increase your miles and points intake. Whenever you plan on making a purchase online, you should start by checking online portals. If you don’t, you’re throwing points and cashback in the trash. Practically every airline, hotel and bank has some form of shopping portal.

When you start your online shopping through a portal, you’ll be able to double-dip rewards and boost your savings or points earning. Here’s how they work:

- Choose the type of rewards you want to earn (if you want American Airlines miles, go to the AAdvantage shopping portal)

- Search for the store at which you want to make your purchases

- Click the “shop now” link within the shopping portal (if your store is available)

- The portal will take you to the actual store website, and you can shop just as you normally would

- Points generally deposit a few weeks after your purchases

Check out our full guide on everything you need to know about earning bonus miles shopping online. Even if you’re in-store and you see something you want, it’s worth a look to see if any shopping portals are offering bonus rewards for that item. You can order it online, and may even be able to pick the item up before you leave.

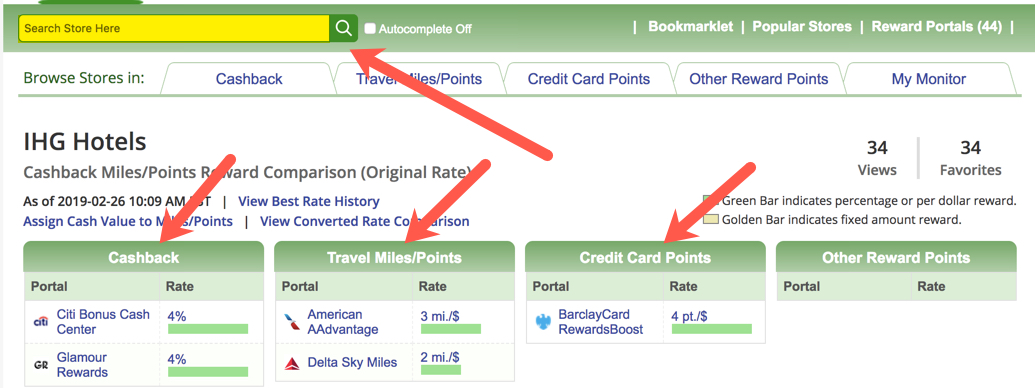

We highly recommend that you use shopping portal aggregators, which keep an eye on all the various shopping portals and let you know which is currently offering the best return for your desired store. My absolute favorite is Cashback Monitor.

Cashback Monitor

Shopping portal bonuses change constantly, and checking each individual portal takes eternity. To know the best shopping portal for your purchase, head to Cashback Monitor. You can search by store, and the results will filter in order of highest return in cashback, miles, points, and other various rewards.

Currently, I see shopping portals offering:

- 10% cashback at Amazon

- 6 Chase Ultimate Rewards points per dollar at Macy’s

- 4% back at Apple

- 20% cashback at StitchFix

- 30 United Airlines miles per dollar at 1-800-Flowers

- 30 American Airlines miles per dollar at Restaurant.com

- thousands more stores

Both return rates and participating stores can sharply increase the closer we get to Black Friday and Cyber Monday, so use Cashback Monitor to keep a close eye on your favorite stores. Without fail, airline shopping portals will begin to offer tiered bonuses for meeting different spending requirements via their online portals. Check out our review of Cashback Monitor.

United MileagePlus X

If you’re a collector of United Airlines miles, the United MileagePlus X app is one sweet deal. The app is a sort of shopping portal itself; you’ll receive bonus United Airlines miles when you shop through the app. But you’re actually able to “triple dip” your earnings if you have the right strategy:

- Use the United MileagePlus X app to purchase an eGift card from your favorite store

- Make an purchase through any online shopping portal

- At checkout, use the eGift card that you purchased through the MileagePlus X app

You’ll then earn bonus United Airlines miles for using the app, credit card rewards for your spending, and any rewards you earn via a shopping portal. Just note that both the app and shopping portals don’t always provide rewards when you buy gift cards. Be sure to read the terms and conditions before you buy.

Read our full instructions on how to triple dip with the United MileagePlus X app.

Credit cards

Let me just run down what I consider to be (by far) best credit cards for Black Friday and Cyber Monday. In the below list are some of the best cashback credit cards, most of which don’t even have an annual fee:

- Discover it® Cash Back: Best credit card for Amazon purchases

- Chase Freedom®: Best credit card for department stores

- Capital One® Venture® Rewards Credit Card: Best credit card for booking Black Friday and Cyber Monday travel deals

- Ink Business Cash® Credit Card: Best credit card for office supply stores

- The Business Platinum® Card from American Express: Best credit card for price protection

Remember, you’ll earn cash back with these cards even when going through a shopping portal — so you’re effectively double dipping.

Earn cashback

Discover it® Cash Back

This card is a game-changer for racking up cashback during Black Friday and Cyber Monday. You’ll earn 5% cash back in rotating categories (on up to $1,500 in purchases) each quarter — and through December 31, 2019, the bonus categories happen to be Amazon, Walmart.com and at Target.

But listen to this: During your first cardmembership year, Discover will match all the cashback you’ve earned during your first 12 billing cycles. So whether you open the Discover it Cash Back now or you’re still in your first cardmember year, this translates to 10% back when spending in bonus categories. In other words, if you manage to spend $1,500 between Amazon, Walmart.com and Target this holiday season, you’ll receive a total of $150 cashback after Discover matches your earnings.

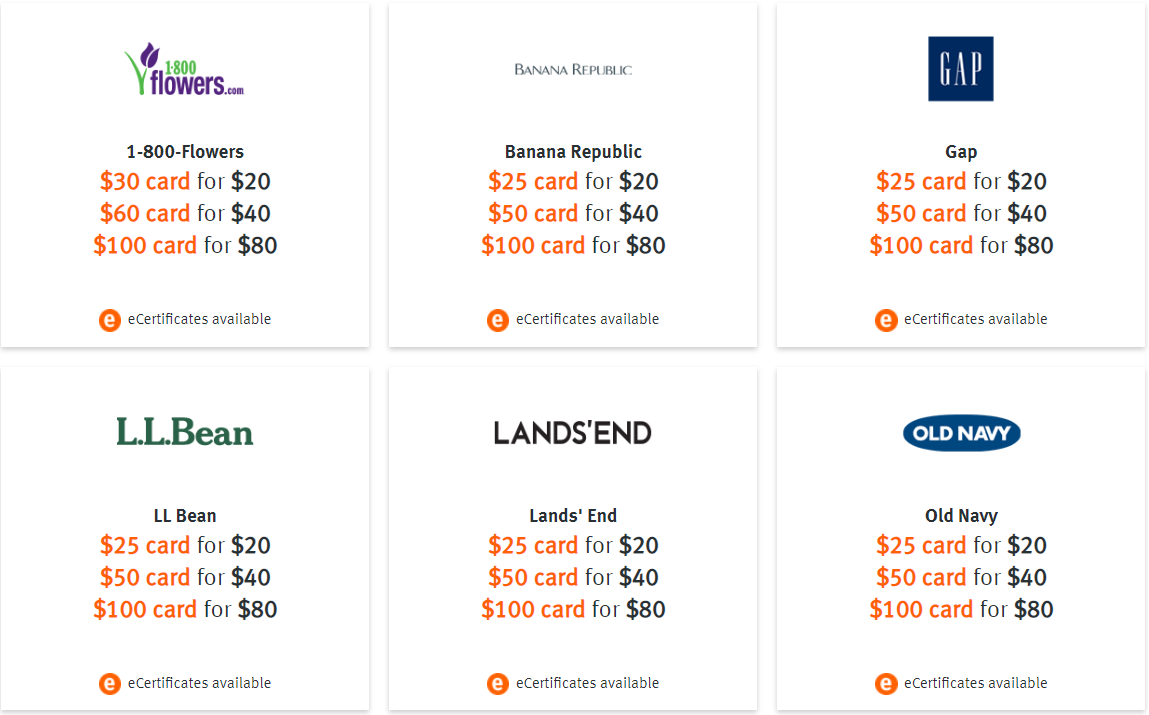

You can request a check from Discover with the cashback you’ve earned, or you can redeem it through the Discover website for discounted gift cards. Gift cards include Hotels.com, Apple, Spotify, American Eagle, Fandango and tons more.

As you can see above, you could use the $150 in cashback you’ve earned for $200+ at 1-800-Flowers, or $175+ at GAP.

Chase Freedom®

The Chase Freedom is similar to the Discover it Cash Back in that it also offers rotating 5% (5 Chase Ultimate Rewards points) bonus categories each quarter, on a maximum of $1,500 in spending.

Through December 31, 2019 the bonus categories are department stores and purchases made through PayPal or Chase Pay. You can bet that department stores are a huge boon for Black Friday shoppers.

And if you’ve also got an Ink Business Preferred Credit Card, Chase Sapphire Preferred Card, or Chase Sapphire Reserve, you can transfer points to airline and hotel partners, or book paid travel at an improved rate through the Chase Ultimate Rewards travel portal. Read our full Chase Ultimate Rewards review for more details.

The Chase Freedom comes with a $150 bonus (15,000 Chase Ultimate Rewards points) after you spend $500 on purchases in the first three months of account opening. It has no annual fee.

Meet Minimum Spending Requirements

Let me be clear. While using cashback credit cards to save money is a fantastic play, you should be using the credit cards of which you’re trying to achieve minimum spending. The worst thing you can do in the miles and points hobby is miss out on a credit card welcome bonus.

If you’re not currently trying to earn a welcome bonus, now’s perhaps the best time of year to open a card, as you probably intend to spend a considerable amount of money anyway. You should check out our Hot Deals page for the best offers. Here are my recommendations.

Capital One® Venture® Rewards Credit Card

I recommend this card because of all the crazy travel deals we see each Black Friday and Cyber Monday. They’re entirely unpredictable, but the Capital One® Venture® Rewards Credit Card absolutely guarantees an extra $500 discount on top of the sales you’ll find.

It comes with 50,000 Capital One miles (worth $500 in travel) after you spend $3,000 on purchases within the first three months of account opening. I love this card because its rewards are retroactive; that is, you can effectively use the welcome bonus before you’ve even earned it. I’ll explain.

With the Capital One Venture, you can use your Capital One miles to “erase” travel purchases up to 90 days after you make them. Simply find them on your statement, and click “redeem miles” to erase them from your balance. For example, you can book airfare, and the money you spend will go toward meeting the card’s minimum spending requirement. Then, after you complete the spending later, you can go back and erase $500 of your already discounted travel.

Great card if you want to travel soon but don’t have a stash of miles and points built up.

This card earns 2 miles per dollar for every purchase. Once you meet the minimum spending requirement, you’ll have 56,000 miles, worth $560 for travel. It’s got a $95 annual fee.

Earn the Southwest Companion Pass

The Southwest Companion Pass lets a friend or family member travel with you for (nearly) free whenever you travel on Southwest. Whether you book your flight with points or with cash, your companion flies for just the cost of taxes and fees (usually ~$6 one-way on domestic flights).

To receive the Companion Pass, you must earn 125,000 qualifying Southwest points in a calendar year. That’s quite a number of points, but the good news is that welcome bonuses from the Chase Southwest credit cards qualify toward the Companion Pass.

You can’t have two personal Southwest cards open at the same time. But you can open a Southwest personal credit card and a Southwest small business credit card and practically qualify for the Companion Pass straightaway. For example:

- The Southwest Rapid Rewards® Performance Business Credit Card currently comes with 70,000 bonus points after spending $5,000 on purchases in the first three months of account opening

- The Southwest Rapid Rewards® Plus Credit Card currently comes with 65,000 bonus points after you spend $2,000 on purchases in the first three months of account opening

After meeting minimum spending requirements, you’ll have at least 116,000 Southwest points. You can read our guide on how to earn Southwest points for details on how to knock out the last bit of points you’ll need to qualify. Plus, you get to keep those points you earn — it’s not a trade for the Companion Pass.

Also, the earlier in the year you earn your Companion Pass, the better. If you put a lot of spending on these cards, but don’t complete your minimum spending until late December, your bonus points won’t post until January 2020, and you’ll get to use the Companion Pass for nearly two years. Read our Southwest Companion Pass FAQ for everything you need to know.

Note that if you’ve opened five or more credit cards from any issuer in the past 24 months (not counting certain business cards), you won’t be eligible for any of these Southwest cards. This is referred to as the Chase 5/24 rule.

Amex Offers

Amex cards have a special power you won’t find on other credit cards. They receive (useful) discounts for purchases you’re likely to make anyway.

Amex Offers are targeted statement credits or bonus points offers for purchases like shopping, travel, and dining. They are triggered when you add them to your card and use that card at each participating merchant — it’s not a shopping portal or a promo code. Because of this, you can combine them with other discounts and coupons for more savings, which only makes the best American Express cards even more appealing. This means you can:

- Make your purchase through an online shopping portal and receive bonus points or cashback

- Earn points or cashback as you normally would from your card

- Take advantage of an Amex Offer that gives you bonus points or cashback

We’ll let you know when a super juicy offer comes out if you subscribe to our newsletter. And read our guide on everything you need to know about Amex Offers for the full details.

Bottom line

Even if you’re not a big spender, you can potentially earn hundreds of dollars in miles, points and cashback this Black Friday and Cyber Monday if you know what you’re doing. By utilizing shopping portals, targeted offers, credit card bonus categories, and meeting minimum spending requirements on a new card, you could very well earn a free vacation from purchases you planned to make anyway.

If you’ve got a Black Friday or Cyber Monday money-saving secret, let your fellow readers know in the comments. You can Subscribe to our newsletter and our Facebook and Twitter pages to stay up-to-date on upcoming flash deals.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!