Is It Worth Keeping Your American Express Card After the 1st Year?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Readers often ask when to cancel or close a credit card. In general, I evaluate whether to keep or cancel a card after 9 to 10 months. That’s because most cards waive the annual fee for the 1st year, so there’s no point canceling the card immediately. And banks don’t like when you close a card right after getting the welcome bonus! So they might hesitate to approve you for more of their cards in the future.

Many cards provide a benefit for keeping the card after the 1st year and for paying the 2nd year annual fee. But what’s a good benefit for me, may not be good for you. So let’s review the benefits for keeping certain American Express cards.

That way you can decide whether to keep or cancel your American Express card when the annual fee is due!

Here’s how I evaluate the different credit cards and charge cards from American Express.

Note: American Express only allows folks to get the welcome bonus ONCE per person, per lifetime on their personal cards. But you CAN get the bonus again (typically after at least 12 months) on business cards.1. American Express Premier Rewards Gold

Link: Premier Rewards Gold Card from American Express

I like the American Express Premier Rewards Gold card because it earns American Express Membership Rewards points.

You can use American Express Membership Rewards points to pay for travel, buy gift cards, use on Amazon, and transfer to certain airlines & hotels.

Check out my post on what to do with American Express Membership Rewards points.

Reason for Getting Card: Welcome bonus and earning 3X points on flights purchased directly from airlines, 2X points on restaurants, gas, and groceries (in the US). $100 per calendar year airline incidental fee credit.

Annual Fee: $195 (waived for the 1st year)

Benefits for Keeping Card: Category bonuses – if you spend a lot on airfare purchased from airlines and at US gas stations, restaurants, and supermarkets. Airline fee credit makes up for part of annual fee.

Drawbacks of Keeping Card: High annual fee.

Worth It or Not: This card is NOT worth keeping unless you spend a lot in bonus spending categories. This used to be a good card for Big Spenders, because you’d get 15,000 bonus points after spending $30,000 or more in a calendar year. But American Express has discontinued that perk.

2. Starwood Preferred Guest

Link: Starwood Preferred Guest® Credit Card from American Express

Link: Starwood Preferred Guest® Business Credit Card from American Express

The Starwood Preferred Guest card (personal or business) is a good card to put everyday spending on because Starwood points can be used for hotel stays, transferred to airlines, used for special events, or used for gift cards.

Check out my series on how to use Starwood points.

Reason for Getting Card: Welcome bonus. There aren’t many other ways to earn Starwood points, which are valuable because you’ll get a 5,000 mile bonus when transferring to airline miles (20,000 points becomes 25,000 miles).

Annual Fee: $65, increasing to $95 beginning August 11, 2015 (waived for the 1st year)

Benefits for Keeping Card:

- Earn Starwood points for everyday spending

- 2 stay credits and 5 elite qualifying night credits every calendar year (doubled if you have both the personal and business card)

- Use Cash + Points to pay for hotels (and you earn hotel stays)

- Over 1,100 hotels in ~100 countries

- Use Starwood points with SPG Flights on ~150 airlines with no blackout dates

Drawback of Keeping Card: 2.7% foreign transaction fee so you don’t want to use it outside the US (this will change effective August 11, 2015).

Worth It or Not: Yes. There aren’t many ways to earn Starwood points!

And 2 stay credits & 5 elite qualifying night credits each calendar year can get you closer to Starwood elite status.

If you transfer Starwood points to airlines, the 5,000 mile bonus pays for the $65 annual fee because you’re only paying 1.3 cents per point. If you bought 5,000 Starwood points outright, you would pay $175 or 3.5 cents per point. And there’s no limit on how many Starwood points you can transfer to airlines, although you can only transfer 79,999 points in a 24-hour period.

If you don’t fly, it might be worth paying the annual fee to earn points toward inexpensive hotel stays using the Cash + Points benefit.

Note: You do NOT have to be a cardholder to get the 5,000 mile bonus when transferring 20,000 points to airlines or to use Cash + Points. But it’s much harder to earn Starwood points if you don’t have the card!3. American Express Hilton Honors Surpass

Link: Hilton Honors Surpass Card from American Express

Emily and I like the American Express Hilton Honors Surpass card because you can get free Gold elite status as long as you have the card (free breakfast)!

Reason for Getting Card: Welcome bonus and…

- 12X points at Hilton hotels (including Waldorf Astoria, Conrad, Doubletree, etc.)

- 6X points at US restaurants, US supermarkets, and US gas stations

- 3X points on everything else

Annual Fee: $75 annual fee (NOT waived the 1st year)

Benefits for Keeping Card: Hilton Gold elite status; Diamond elite status if you spend $40,000 in a calendar year

Drawbacks of Keeping Card: 2.7% foreign transaction fee when you pay in currency other than US dollars

Worth It or Not: It depends. Yes, if you spend a lot at US gas stations, restaurants, and supermarkets or don’t have another card like the Citi Hilton HHonors Reserve Card which offers Gold Elite status.

The American Express Hilton Honors Surpass card earns Hilton points that you can use at any Hilton hotel such as Conrad, Doubletree, and Embassy Suites. You do NOT earn American Express Membership Rewards points.

4. American Express Mercedes-Benz Platinum

Link: The Platinum Card® from American Express Exclusively for Mercedes-Benz

The American Express Mercedes-Benz Platinum card earns American Express Membership Rewards points which can be used to pay for travel, buy gift cards, use on Amazon, and transfer to certain airlines & hotels.

Here’s my detailed review of the American Express Mercedes-Benz credit card.

Reason for Getting Card: Welcome bonus and no foreign transaction fees

Annual Fee: $475 (NOT waived for the 1st year)

Benefits for Keeping Card:

- $200 annual airline credit

- Delta lounge access (worth $300 to $500

- Centurion lounge access

Drawbacks of Keeping Card: $475 annual fee

Worth It or Not: It depends. Yes, if you can redeem the $200 annual airline credit twice and fly enough to use the lounges

If you can only get the $200 airline credit once and don’t fly often enough to use lounge access, it may not be worth paying the $475 annual fee.

5. Platinum Card from American ExpressLink: The Platinum Card® from American Express

Link: The Business Platinum® Card from American Express OPEN

Like the American Express Mercedes-Benz Platinum card, the Platinum Card from American Express (personal) and (business) earns American Express Membership Rewards points which can be transferred to airline partners and redeemed for flights.

Note: Most American Express Membership Rewards points airline partners charge fuel surcharges on international awards.

Reason for Getting Card: Welcome bonus and no foreign transaction fees

Annual Fee: $450 (NOT waived for the 1st year)

Benefits for Keeping Card:

- $200 annual airline credit

- $100 credit towards Global Entry fee

- Free Starwood Gold status

- Delta lounge access (worth $300 to $500)

- Centurion lounge access

Drawbacks of Keeping Card: $450 annual fee

Worth It or Not: It depends. Yes, if you can redeem the $200 annual airline credit twice and fly enough to use the lounges.

If you can only get $200 airline credit once and don’t fly enough to benefit from lounge access, the $450 annual fee may not be worth it.

6. Gold Delta SkyMilesLink: Gold Delta SkyMiles® Credit Card from American Express

Link: Gold Delta SkyMiles® Business Credit Card from American Express

The Gold Delta SkyMiles (personal) and (business) card isn’t a fancy card with a lot of bells and whistles. But it could be good for someone like me who doesn’t earn elite status from flying because I mostly use miles.

Reason for Getting Card: Welcome bonus and $50 statement credit

Annual Fee: $95 (waived for the 1st year)

Benefits for Keeping Card: First checked bag for free and Priority Boarding

Drawbacks of Keeping Card: The annual fee.

Worth It or Not: It depends. If you fly frequently and check bags, the free checked bag could cover the cost of the $95 annual fee.

If you don’t fly on Delta often, but want to earn Delta miles, the Starwood Preferred Guest card would be a better card to get because of the 5,000 bonus miles when you transfer 20,000 Starwood points to airlines.

If you fly a lot on Delta, the American Express Delta Platinum or American Express Delta Reserve card could be a better choice.

7. American Express Delta PlatinumLink: American Express Delta Platinum

If elite status on Delta is important to you, and you are a Big Spender, the American Express Delta Platinum card could be worth the $195 annual fee.

Reason for Getting Card: Welcome bonus and earn elite qualifying miles

Annual Fee: $195 (NOT waived for the 1st year)

Benefits for Keeping Card: First checked bag for free, Companion Certificate, and 10,000 elite qualifying miles after spending $25,000 plus an additional 10,000 miles after spending $50,000 in a calendar year

Drawbacks of Keeping Card: Annual fee of $195

Worth It or Not: It depends. Yes, if you are a Big Spender. If you spend $25,000 within 1 calendar year you get 10,000 elite qualifying miles plus another 10,000 miles if you spend $50,000.

10,000 to 20,000 elite qualifying miles won’t get you Delta elite status, but it could help you reach elite status if you’ve already earned elite qualifying miles. Delta elite status gets you perks such as free upgrades for you and a companion, seats with more leg room, and a free checked bag.

If you don’t spend a lot of money on the card, it may not be worth paying the $195 annual fee.8. American Express Delta Reserve

Link: American Express Delta Reserve

If you’re a Big Spender who wants it all – elite Delta miles and lounge access – the American Express Delta Reserve card might be the card for you.

Reason for Getting Card: Welcome bonus and earn elite qualifying miles

Annual Fee: $450 (NOT waived for the 1st year)

Benefits for Keeping Card: Earn 15,000 redeemable miles and 15,000 elite qualifying miles after spending $30,000 in a calendar year. Earn 30,000 redeemable miles plus 30,000 elite qualifying miles after spending $60,000 in a calendar year; up to 30,000 elite qualifying miles can be can be transferred to anyone’s Skymiles account

Drawbacks of Keeping Card: $450 annual fee

Worth It or Not: It depends. Yes, if you are a Big Spender and want lounge access and elite status. 30,000 elite qualifying miles gets you Delta Silver status and is just 20,000 miles short of Delta Gold status.

If you don’t spend a lot of money on the card, and don’t want Delta lounge access or elite qualifying miles, it’s not worth paying the $450 annual fee.

9. American Express Simply Cash

Link: American Express Simply Cash

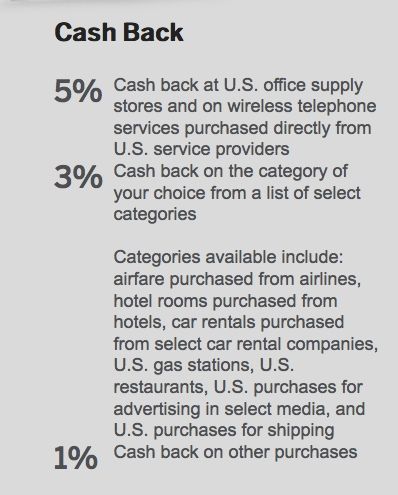

Because miles and points can’t pay for everything, like sightseeing and tours, the American Express Simply Cash card offers cash back on all purchases.

Reason for Getting Card: Welcome bonus and you can get bonus cash back on select purchases:

- 5% Cash back at US office supply stores and US wireless services

- 3% Cash back on your choice of airfare, hotel, car rental, US gas stations, US restaurants, US advertising, or US shipping

- 1% Cash back on everything else

Annual Fee: NO annual fee

Benefits for Keeping Card: Cash back on all purchases with up to 5% on select bonus categories

Drawbacks of Keeping Card: 2.7% foreign transaction fee so not a card to use outside the US

Worth It or Not: Yes, if you’re looking for a fee-free card to keep for a long time. But there are other cash back cards without an annual fee, like the Chase Freedom or Citi Double Cash Card.

Some folks who don’t have or want a Chase Ink Plus or Chase Ink Bold (no longer available) card might like the American Express Simply Cash because you get 5% cash back on US wireless services and 3% cash back in 1 of 7 categories you choose.

And another American Express card means more money on Small Business Saturday and AMEX Offers.

10. American Express Blue for Business

Link: The Blue for Business® Credit Card from American Express

You earn American Express Membership Rewards points with the American Express Blue for Business card.

Reason for Getting Card: Welcome bonus

Annual Fee: NO annual fee

Benefits for Keeping Card: 30% year end American Express Membership Rewards point bonus based on your spending

Drawbacks of Keeping Card: 2.7% foreign transaction fee makes it not worth it for charges not in US dollars.

Worth It or Not: It depends. Yes, if you plan to cancel an American Express premium card. Because you’ll lose your American Express Membership Rewards points if you cancel an American Express card, and having another card that earns American Express Membership Rewards points lets you keep your points.

If that’s the case, the American Express Everyday card is a better choice, because it also has no annual fee and the points you earn can be transferred to airline and hotel partners.

However, American Express Membership Rewards points earned with the American Express Blue for Business can NOT be transferred to airline or hotel partners.

11. American Express Everyday Preferred

Link: American Express Everyday Preferred

The American Express Membership Rewards points you earn with the American Express Everyday Preferred card CAN be transferred to partner airlines and hotels.

Reason for Getting Card: Welcome bonus and you get a bonus on select purchases:

- 3X American Express Membership Rewards points at US supermarkets up to $6,000 a year

- 2X American Express Membership Rewards points at US gas stations

- 1X American Express Membership Rewards points on other purchases

Annual Fee: $95

Benefits for Keeping Card: 50% American Express Membership Rewards points bonus if you make 30 purchases or more in a billing cycle

Drawbacks of Keeping Card: 2.7% foreign transaction fee so you shouldn’t use it when you travel outside the US

Worth it or Not: Yes, because you can earn a lot of American Express Membership Rewards points for regular spending (groceries and gas) each month

12. American Express Everyday

Link: American Express Everyday

You can earn American Express Membership Rewards points with the American Express Everyday card.

Reason for Getting Card: Welcome bonus and bonus on spending:

- 2X Membership Rewards points per $1 at US supermarkets up to $6,000 a year and

- 1X Membership Rewards points per $1 on other purchases

Annual Fee: NO annual fee.

Benefits for Keeping Card: 20% American Express Membership Rewards points bonus if you make 20 purchases or more in a billing cycle.

Drawbacks of Keeping Card: 2.7% foreign transaction fee makes it not worth it for charges not in US dollars.

Worth It or Not: Yes, because you can earn a lot American Express Membership Rewards points for regular spending (groceries) each month

Or if you need to move your American Express Membership Rewards points when you cancel an American Express premium card. You’ll lose your American Express Membership Rewards points if you cancel an American Express card, unless you 1st transfer them to another card that earns American Express Membership Rewards points.

Bottom Line

Some American Express cards are worth keeping open for the long-term because the benefits outweigh the cost.

The Starwood Preferred Guest cards are worth paying the annual fee because of the 5,000 mile bonus when transferring points to its many airline partners.

Some cards like the American Express Delta Platinum, and the American Express Delta Reserve could be worth paying the annual fee if you’re a Big Spender.

Other cards like the American Express Premier Rewards Gold might not be worth it.

Think about your travel goals, then decide which cards are best for you!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!