How to complete a Citi Business card application

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Citi is an MMS advertising partner.

We love small-business credit cards at Million Mile Secrets. They offer great perks that some personal cards don’t, they can help organize your business expenses and they let you tap into some great earning structures.

Some come with large welcome offers – like the CitiBusiness® / AAdvantage® Platinum Select® Mastercard®. With it you can earn 65,000 American Airlines AAdvantage bonus miles after spending $4,000 in purchases within the first 4 months of account opening. But filling out a business rewards credit card application isn’t always as simple as filling out a consumer card application. So we’ll break it down for you, step by step.

The information for the CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Qualifying for a small business credit card is easier than you think and if you’re not using business credit cards, you could be missing out on a world of miles and points.

Let’s walk through the steps of the Citi business card application.

Why consider small-business cards?

Here’s the million-dollar secret about opening small-business cards: Most do not appear on your personal credit report. This means that opening a Citi small-business card won’t hurt your chances of being approved for Chase credit cards later on. If you’ve opened five or more credit cards from any bank in the past 24 months (excluding certain small-business cards), Chase won’t approve you any cards.

Citi has some application and welcome bonus rules of their own. Read up on Citi application rules to learn more. For example, the CitiBusiness AAdvantage Platinum Select® card application states:

“American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a CitiBusiness® / AAdvantage® Platinum Select® account in the past 48 months.”

Business credit cards are an easy way to get extra miles and points if you’re self-employed or simply have a side hustle. Lots of people may qualify for small-business cards without realizing it. For example, if you’re a freelance writer, a tutor, an Uber driver or a seller on eBay or Etsy, you could be eligible for a small-business card.

Business credit cards do not come with all the consumer protections of a personal travel credit card, but a lot of business cards come with perks that many personal cards don’t. For example, you can earn more points per dollar when spending on wireless and cable bills using the Citi American Airlines Platinum Select small-business card than using the equivalent Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. You can learn more by reading our CitiBusiness AAdvantage review.

The information for the Citi AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

How to fill out a Citi business card application

Citi business applications are straightforward and easy to complete. You’ll have no problem applying for a Citi business card for your sole proprietorship using these steps:

Things to remember

Citi has some specific language in their application, here’s a quick reference for you:

- Authorized officer: This is you (the owner) for a sole proprietorship. Authorized officers are folks who can act on the business’ behalf.

- Beneficial owner: This is you for a sole proprietorship. Beneficial owners are folks who own at least 25% of the business.

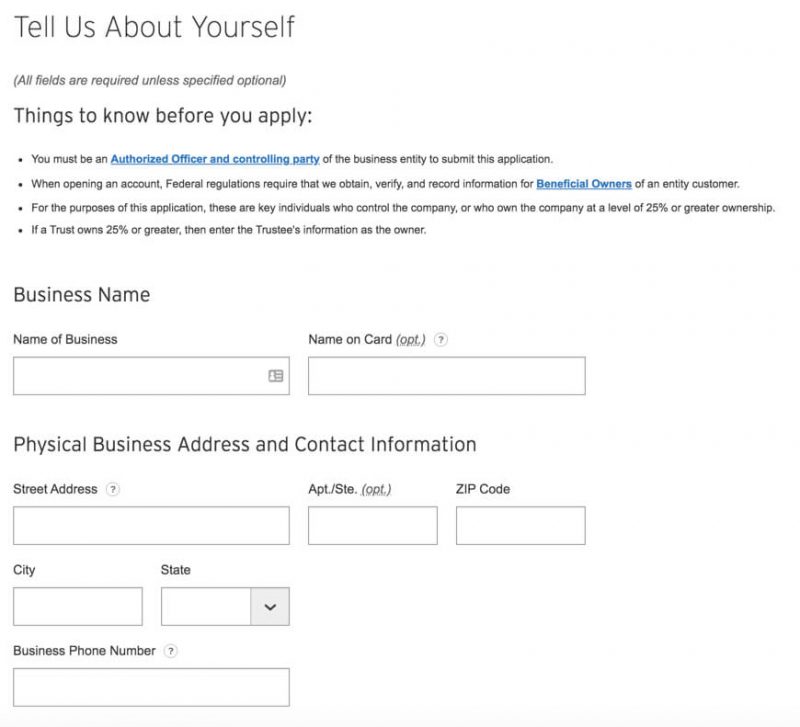

Enter your business information

Here’s how to fill out the form for a business for a sole proprietor.

Name of business: If you’re a sole proprietor, you can enter your full name as your legal business name.

Name on card (optional): This is the name of your business that you want printed on the credit card. This can also be your name, but is optional.

Physical business address and contact information: This is your home address if you run the business from your home. The business phone number is your personal or business number as appropriate.

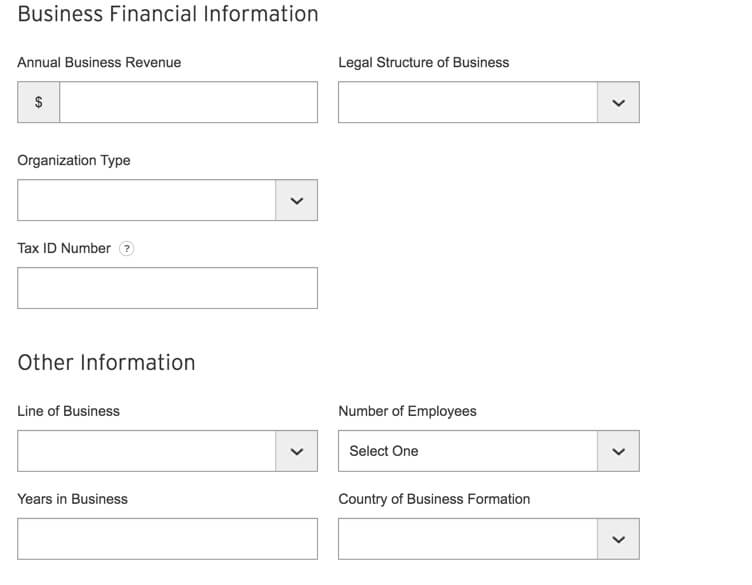

Annual business revenue: Enter the total amount you receive annually for selling your products. If you haven’t yet earned anything, don’t fib. Entering $0 is perfectly acceptable.

It is very important to fill out credit card applications truthfully. It’s much better to say that you have no annual income than to enter a fictitious amount. In the past, MMS team members have entered revenue of less than $100 and were still approved for a small-business card.

Legal structure of business: Sole proprietor (if the business is run by one person).

Organization Type: Sole proprietorship will usually be “other business type.”

Tax ID number: If you’re a sole proprietor, enter your Social Security number (SSN).

Line of business: The kind of work you perform.

Number of employees: You have at least one employee (yourself) if you are a sole proprietor. So choose “1-5” if it’s just you.

Years in business: This doesn’t mean the amount of time you’ve been making a profit. For example, if you have been planning on selling homemade cookies for the last two years and have been buying ingredients to test different recipes, you can enter “2.”

Country of business formation: Likely the USA, this is the country in which your business was created or founded.

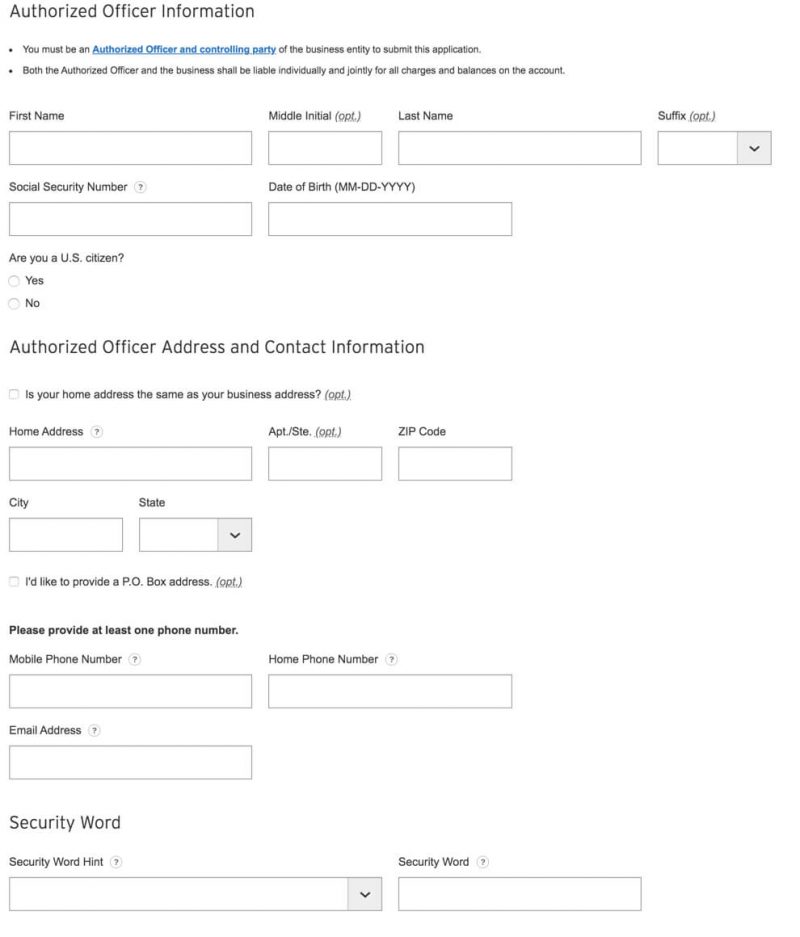

Authorized officer information

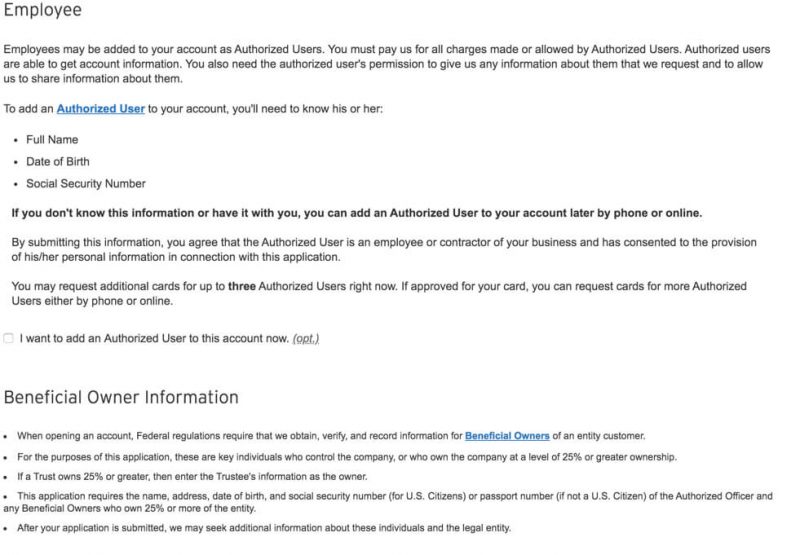

If this is a sole proprietorship, you are the authorized officer and beneficial owner. Input everything you’d need to enter on a personal credit card application.

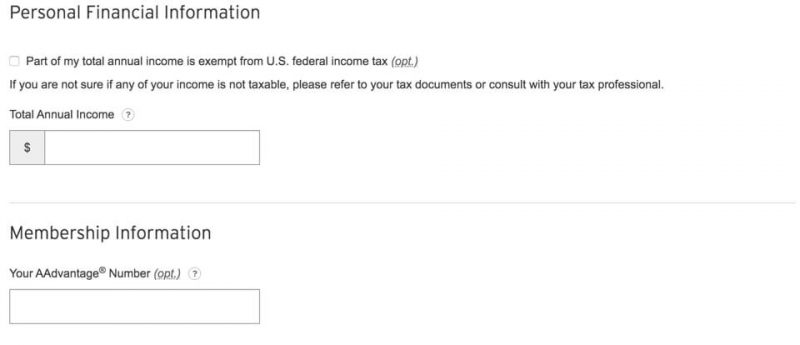

Financial information and AAdvantage membership

Another easy piece of the application: Enter a security word and hint for account access then input your annual income. Your “Total Annual Income” includes any money you earn outside of the business as well, so if your business is only a part-time gig, this number will be higher than your “Annual Business Revenue.”

Then enter your AAdvantage membership number so they can tie your Citi business account to your American Airlines account. If you don’t include an AAdvantage number, an AAdvantage account will be created for you. Finally, enter your percentage of ownership, which is 100% if you’re a sole proprietorship and add any authorized user (optional). Click the “Agree & Submit” button, after checking the terms and conditions box to submit your application.

Wait for approval

You may or may not be automatically approved when you submit your application. If you’re not denied but also not automatically approved, it’s usually good to wait for an official decision or more information from Citi before reaching out to customer service. If you’re denied, you can call Citi business customer service and discuss reconsideration. Sometimes, clarifying your situation with a representative can help get you approved.

Some Citi representatives are more willing to help than others. So, if the representative is unwilling to help or appears to be a stickler, politely hang up (dinner is ready!) and call back later.

Bottom line

The Citi business card application process is quick and easy, so when you’re looking to apply for the Citi American Airlines Platinum Select small-business card, it doesn’t have to be a chore.

Most folks qualify for a small-business credit card. It’s easier than you think and let’s you tap into a whole new world of miles and points. I’ve been approved for many business cards by being honest about the revenue I’ve earned in my freelancing and reselling business.

Let us know if you have any Citi business card application tips below.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Featured image by jannoon028/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!