Citibusiness American Airlines Platinum Select benefits and perks: Free checked bags, preferred boarding and more

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Citi is an MMS advertising partner.

If you’re a small business owner and like American Airlines miles, the CitiBusiness® / AAdvantage® Platinum Select® Mastercard® comes packed with benefits that can be worth much more than its $99 annual fee (which is waived for the first 12 months). Among them are:

- 2x American Airlines miles in popular categories like telecommunications merchants, cable and satellite providers, car rental merchants, and gas stations

- First checked bag free for yourself and up to four companions on the same domestic travel reservation (worth $60 per person for round-trip flights)

- Travel extras like Reduced Mileage Awards, preferred boarding, and 25% off in-flight food and beverages

If you can make use of the CitiBusiness® / AAdvantage® Platinum Select® Mastercard® benefits and perks, it’s one of the best airline credit cards out there. This is a small business credit card, so it won’t appear on your personal credit report or add to your Chase 5/24 count (unlike the consumer version, the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®).

Here’s what you’ll get with the card.

The information for the Citi AAdvantage Platinum and CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

CitiBusiness American Airlines Platinum Select benefits and perks

The most obvious benefit of the CitiBusiness American Airlines Platinum Select is the welcome bonus. You’ll earn 65,000 American Airlines AAdvantage bonus miles after spending $4,000 in purchases within the first 4 months of account opening. That’s a large stack of miles for an airline card bonus — you can do some bucket-list erasing things with 65,000 miles.

For example, you can:

- Fly round-trip to Japan for 65,000 miles

- Fly round-trip in coach to anywhere in Europe for 60,000 miles

- Fly round-trip business class flight (lie-flat seats) to Peru for 60,000 miles

- Book two round-trip coach flights to Hawaii for 60,000 miles

Check out our in-depth post on how to use American Airlines miles. I’ll share all the card’s benefits, and show you why it ranks among the best travel credit cards.

2X American Airlines miles for eligible American Airlines purchases and small business spending

With the Citi American Airlines Platinum Select small business card, you’ll earn:

- 2x American Airlines miles on eligible American Airlines purchases

- 2x American Airlines miles at telecommunications merchants, cable and satellite providers, car rental merchants and gas stations

- One American Airlines mile on all other purchases

If your small business has significant spending in any of these categories, you can do well to earn extra American Airlines miles with the card.

First checked bag for free

When you fly domestically on American Airlines, you’ll get a free first checked bag for yourself and up to four travel companions on the same reservation.

Preferred Group 5 boarding

When you add your American Airlines loyalty number to your flight reservation, you and up to four companions will get Group 5 boarding status. This is the group that boards right after premium cabins and elite status members – and is actually one of my favorite perks.

I like getting to my seat early to snag precious overhead bin space while everyone else boards.

Access to reduced mileage awards

American Airlines releases a monthly list of routes you can book with American Airlines miles and save up to 7,500 miles on round-trip award flights, know as reduced mileage awards.

The Citi American Airlines Platinum Select small business card gives you access to these awards.

Annual $99 companion certificate

This is a niche benefit, but could be useful for some. When you spend $30,000+ in a cardmember year and renew your card membership (account must remain open at least 45 days after account anniversary), you’ll get a certificate to fly a companion with you for $99, plus taxes and fees (~$22 to ~$43, based on itinerary).

I wouldn’t go out of my way to earn this certificate, but if you earn it as part of your organic yearly spending, you could save cash on a round-trip coach fare for a buddy.

25% savings for in-flight purchases

When you fly American Airlines, you’ll save 25% on in-flight purchases of drinks, snacks, and Wi-Fi when you pay with your card.

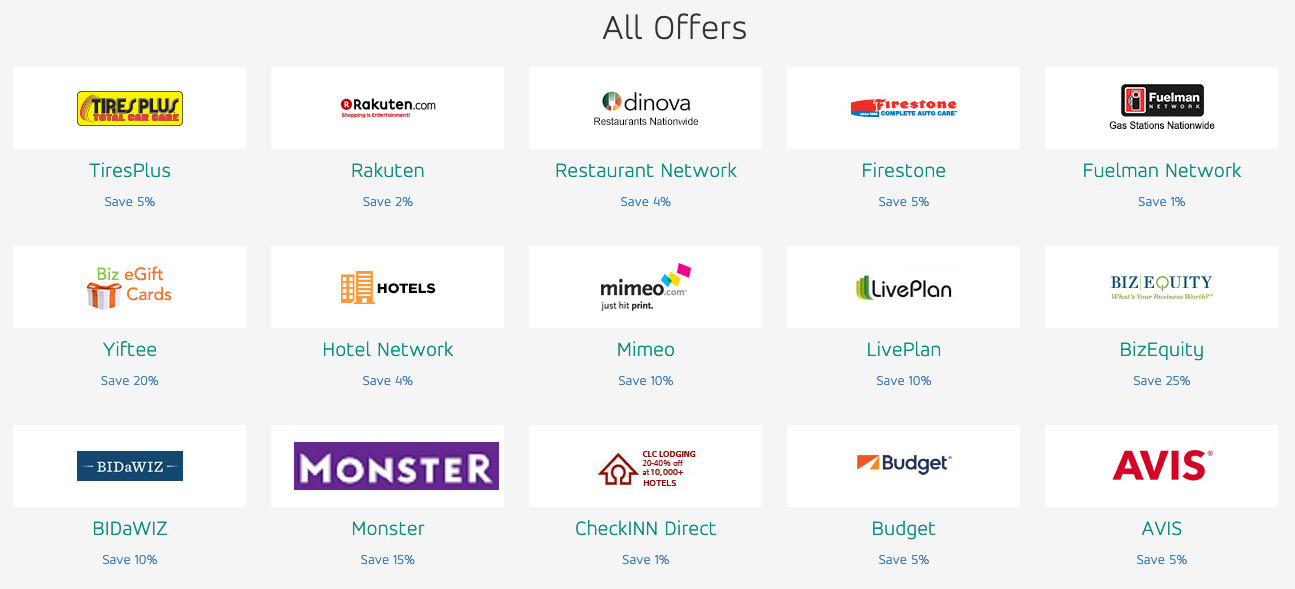

Automatic Mastercard easy savings rebates

With the Citi American Airlines Platinum Select small business card, you’ll get automatic enrollment in Mastercard Easy Savings, which is a rebate program when you spend at certain merchants.

They’re not huge, but it all adds up.

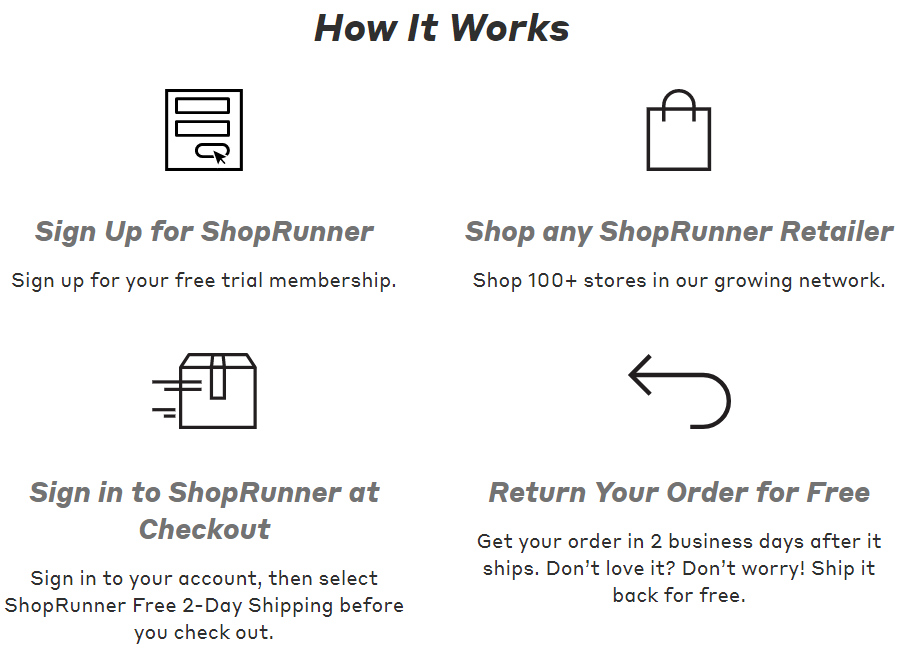

Free ShopRunner membership for 2-day shipping

With the Citi American Airlines Platinum Select small business card, you can sign-up to get free 2-day shipping and returns at 140+ popular online stores.

I use my ShopRunner membership more than expected, so getting it for free is a nice benefit.

Free employee cards

If you want to track purchases and set spending limits per employee, you can add authorized users for free. Many small businesses value this level of granularity for expense reports and accounting, so you’ll be pleased to know you get it with no added charge.

Citi Private Pass for event access

Citi Private Pass gives Citi customers early access to concerts, sports events, theater performances and more. Other times, you’ll get better seats or invitations to special events.

There are lots of events listed on the website, and they’re always changing. This is a fun perk you could use for a team outing or for spending time with a client.

Personal business assistant for help with day-to-day planning

You can call the Personal Business Assistant line to help with:

- Travel plans

- Vendor sourcing

- Dining arrangements

- Entertainment tickets

If you don’t have an administrative assistant, they can handle basic tasks to help you manage.

No strike against 5/24

Many folks want to watch their 5/24 status so they can open the best Chase credit cards. Certain cards don’t appear on your personal credit report, and therefore don’t affect your 5/24 status, including Citi small business credit cards.

So you can earn American Airlines miles and score a nice sign-up bonus with the Citi American Airlines Platinum Select small business card if you’re trying to keep your card count low.

Bottom line

The Citi American Airlines Platinum Select small business card comes with benefits built for small business owners and American Airlines flyers, like:

- 2x American Airlines miles at telecommunications merchants, cable and satellite providers, car rental merchants and gas stations

- 2x American Airlines miles on eligible American Airlines purchases

- 25% discount on in-flight purchases of drinks, snacks and Wi-Fi on American Airlines flights

- Preferred boarding and first checked bag free on domestic AA flights

- Access to Reduced Mileage Awards, Personal Business Assistant, and Citi Private Pass

Plus, you can unlock 65,000 American Airlines miles after meeting spending requirements – and it won’t affect your Chase 5/24 count. Overall, this is a rewarding card if you like the perks line-up.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!