Here’s a Card Strategy for Folks Who Like to Stay Off the Beaten Path!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Emily and I love to help folks get Big Travel with Small Money! So we started a new series to help readers with their credit card strategy, to help them achieve their travel goals!

If you’re interested in being featured, send us an email or a message to info -at- millionmilesecrets.com or on Facebook or Twitter.Million Mile Secrets reader Paul writes:

I am overwhelmed with all the cards and need advice. I don’t travel a lot, but really like the idea of free motel stays first and flights second.I mainly stay in smaller towns in rural America, but still like free rooms when possible. I have excellent credit and currently have 80,000 Alaska Airlines miles and 23,000 Starwood points.

I plan on going to Alaska in the next year or two. Everything I read says get Chase cards, but it looks like the Capital One® Venture® Rewards Credit Card might be a good fit for me. Do you have any advice?

Excellent question! It’s important to have a strategy when deciding which miles and points to collect for your trip.

I’ll compare cards that earn Chase Ultimate Rewards points and the Capital One Venture card to see which might be a better fit for Paul’s travel goals.

Chase Ultimate Rewards Points vs. Capital One Venture Miles for Hotel Stays

Paul already has clear travel goals which makes his decision much easier. And he’s already got Alaska Airlines miles and Starwood points which he can easily use to get to Alaska.

If Paul hasn’t opened a lot of cards recently, it makes the most sense to apply for Chase cards first. Because with the Chase “5/24 rule”, if you’ve opened 5+ cards in the past 24 months from ANY bank (excluding Chase business cards and other certain small business cards), you will NOT be approved for most Chase cards.

Then, once Paul is over 5/24, he could consider applying for cards from other banks, including the Capital One Venture Rewards Credit Card. Or Chase cards that are NOT restricted by the 5/24 rule. Including cards like the IHG® Rewards Club Select Credit Card and The Hyatt Credit Card, which could help Paul get more hotel stays in the future.

1. Chase Ultimate Rewards Points

The great thing about Chase Ultimate Rewards points is that they’re so flexible. You can transfer them to travel partners to book award flights and hotel stays. Or book paid travel (even non-chain hotels) through the Chase Ultimate Rewards travel portal using your points!

Transfer Chase Ultimate Rewards Points to Hotel Partners

You can transfer Chase Ultimate Rewards points to Hyatt, IHG, Marriott, and Ritz-Carlton directly at a 1:1 ratio with these cards:

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Chase Ink Business Preferred

- Chase Ink Bold (no longer available)

- Chase Ink Plus (no longer available)

If you have the Chase Freedom, Chase Freedom Unlimited, or Chase Ink Business Cash Credit Card, you must combine points with one of the cards listed above to transfer to airline and hotel partners.

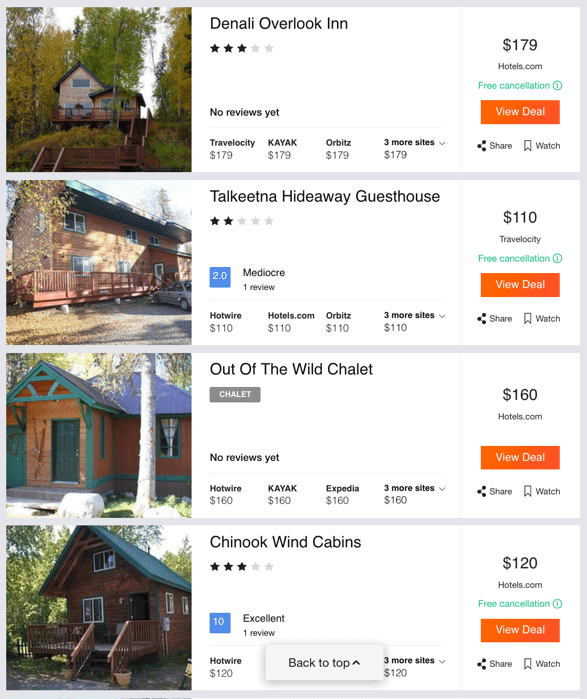

That said, Alaska doesn’t have a lot of chain hotels, especially outside of cities like Anchorage and Fairbanks. So Paul might have to consider independent hotels, motels, or Airbnb for his travels.

Transferring Chase Ultimate Rewards points to Hyatt is usually a very good deal, but there’s only one Hyatt location in Alaska. Transfers to other hotel partners, like Marriott and IHG, are often NOT.Book Paid Hotel Stays Using Chase Ultimate Rewards Points

If you have a card that earns Chase Ultimate Rewards points, you can use your points to book flights, hotels, car rentals, and activities through the Chase Ultimate Rewards travel portal. Including independent and boutique hotels.

But the value of your points depends on the cards you own. If you have the Chase Sapphire Reserve, your points are worth 1.5 cents each when you use them to book travel through the portal.

Folks with the Chase Sapphire Preferred, Chase Ink Business Preferred, Chase Ink Plus (no longer available), or Chase Ink Bold (no longer available) get a value of 1.25 cents per point when they book through the portal.

And if you have the Chase Ink Business Cash, Chase Freedom, or Chase Freedom Unlimited, your points are worth 1 cent each unless you combine them with points from one of the cards listed above.

If he doesn’t use the Chase travel portal to book his stays, Paul could still redeem Chase Ultimate Rewards points for a statement credit at a rate of 1 cent per point.

2. Capital One Venture Miles

Folks like Capital One Venture miles because you can redeem them for a wide variety of travel costs, including Airbnb stays, Uber rides, and flights or hotels with NO blackout dates. They’re worth a flat 1 cent each towards travel, which keeps things simple!

To redeem your Capital One Venture miles for travel, use your Capital One Venture card to pay for your travel purchase. After it’s posted to your account, you can “erase” the cost with miles. However, you must redeem the miles within 90 days of your purchase.

For example, you could use 10,000 Venture miles to erase the cost of a $100 hotel, motel, or Airbnb stay.

And there’s NO minimum redemption increment when redeeming miles, unless you’re using miles to partially pay for a travel purchase. In that case, the minimum is 2,500 Venture miles ($25).

Note: Although Capital One calls them “miles,” you can NOT use Capital One Venture miles with airline or hotel loyalty programs to book award nights or stays.Once Paul gets the Chase cards he wants, applying for the Capital One Venture card makes good sense for his trip. The sign-up bonus alone is worth $500 in travel! And by using Capital One Venture miles for his Alaska stay, he could save his Chase Ultimate Rewards points for more valuable transfers to partners later on.

Remember, when you redeem Capital One Venture miles, the stay needs to code as a travel charge with Capital One. Otherwise you won’t be able to redeem miles toward that expense. According to this Flyertalk thread, Airbnb will code as travel, however this isn’t true for all independent accommodations.

Take Sign-up Bonuses and Spending Habits Into Account

It’s important to not only compare how much each card’s points / miles are worth. Consider the sign-up bonus and your spending habits, because certain Chase cards have bonus categories that can help you earn points more quickly.

For example, with the Chase Sapphire Preferred, you’ll get:

- 50,000 Chase Ultimate Rewards point sign-up bonus after spending $4,000 on purchases in the first 3 months (worth $625 in travel booked through the Chase travel portal, $500 in statement credits, or potentially more when transferred to airline or hotel partners)

- 2 points per $1 you spend on travel and dining

- 1 point per $1 you spend on everything else

The $95 annual fee is waived for the first year.

And with the Capital One Venture, you’ll get:

- 50,000 Capital One Venture mile sign-up bonus after spending $3,000 on purchases in the first in 3 months (worth $500 in travel)

- 2 miles per $1 you spend on all purchases

The $95 annual fee is also waived for the first year.

So another good reason to get a card like the Chase Sapphire Preferred, Chase Ink Business Preferred, or Chase Sapphire Reserve is the sign-up bonus compared to the Capital One Venture.

However, if Paul spends a lot in non-bonus categories, then the Capital One Venture card’s 2x points per $1 on all purchases could make it more valuable over time.Bottom Line

You can easily redeem Chase Ultimate Rewards points and Capital One Venture miles for free nights in remote locations, like Alaska.

If Paul is under 5/24, getting Chase Ultimate Rewards cards like the Chase Sapphire Preferred, Chase Ink Business Preferred, or Chase Sapphire Reserve first makes the most sense. Plus, the sign-up bonuses are worth more than that of the Capital One Venture.

Once he’s got the Chase cards he wants, signing-up for the Capital One Venture is a good choice for his trip. Because he can use Capital One Venture miles for nearly any travel purchase, like motels, lodges, and Airbnbs in Alaska.

Which cards would you pick for a trip off the beaten path?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!