Reader Question: “If I Have the Chase Sapphire Preferred, Can I Get the Sign-Up Bonus on the Ink Business Preferred?”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

When it comes to credit card applications and earning sign-up bonuses, each bank has different rules. And with the valuable sign-up bonuses currently offered by the Chase small business cards, we’ve been getting lots of questions about who is (and isn’t) eligible for those offers!

Million Mile Secrets reader Chuck, asked:

I already have the Chase Sapphire Preferred Card. If I apply for the Chase Ink Business card will I be able to receive the welcome bonus for it?

Hi Chuck. Thanks for the question!

Chase Sign-Up Bonus Eligibility

Chase offers two versions of the Ink Business card, the Ink Business Preferred Credit Card and the Ink Business Cash Credit Card. Both are considered different card products from the Chase Sapphire Preferred. So yes, you would be eligible to earn the bonus from either of those cards!

I’ll go through the benefits of these 2 cards, to help you decide which is best for your situation. And remind you about Chase’s other application rules, that could affect your ability to be approved for their cards.

Chase Ink Business Preferred vs. Chase Ink Cash

Chase Ink Business Preferred

Link: Ink Business Preferred℠ Credit Card

Link: Our Review of the Chase Ink Business Preferred

The Ink Business Preferred is a fantastic card for business owners looking to earn travel rewards or cash back. The card currently has a welcome bonus of 80,000 Chase Ultimate Rewards points after spending $5,000 in the first 3 months after account opening.

You can redeem the sign-up bonus for $800 in cash back OR $1,000 in travel by booking airfare, hotel stays, or car rentals through the Chase’s travel portal (with no blackout dates!).

The card also comes with the following perks:

- 3X Chase Ultimate Rewards points for every $1 you spend on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year)

- 1X Chase Ultimate Rewards points on all other purchases

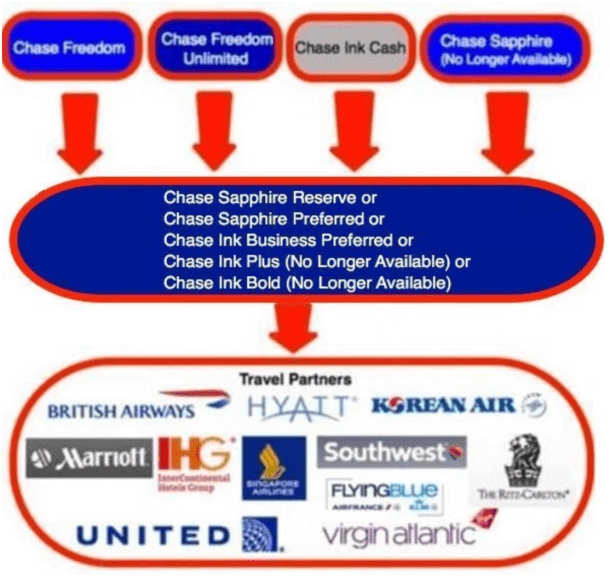

- Ability to transfer points directly to airline and hotel partners, like Hyatt, Southwest or United Airlines

- Up to $600 in cell phone insurance when you pay your cell phone bill with the card

- 25% bonus when you redeem points through the Chase Ultimate Rewards travel portal

- Primary auto rental insurance (CDW) when renting for business purposes, plus purchase and extended warranty protection

The $95 annual fee is NOT waived the first year.

Ink Business Cash $500 Cash Back (50,000-Point) Offer

Link: Ink Business Cash Credit Card

Link: Our Review of the Increased Ink Business Cash Offer

Business owners looking for a simpler, no-annual fee card may want to consider the Ink Cash.

With the Ink Business Cash, you’ll earn $500 cash back (50,000 Chase Ultimate Rewards points) after spending $3,000 in the first 3 months of account opening.

That’s the highest bonus we’ve ever seen on this card. And it also comes with:

- 5% cash back (5X Chase Ultimate Rewards points) on the first $25,000 spent in combined purchases at office supply stores and on phone, internet and cable TV services each account anniversary year

- 2% cash back (2X Chase Ultimate Rewards points) on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- 1% cash back (1X Chase Ultimate Rewards point) on all other purchases

- Primary car rental insurance (CDW) when renting for business purposes, covering damage to your rental car due to theft or collision when you pay with your Chase Ink Cash card. Secondary coverage when renting for personal reasons

- NO annual fee

By itself, points earned on this card can be redeemed for a flat 1 cent per point for cash back or travel. And you can NOT transfer points to any of Chase’s travel partners.

However, if you have cards like the Chase Sapphire Preferred, Chase Sapphire Reserve, or Ink Business Preferred, the points you earn with the Ink Cash can be worth a LOT more.

Chase Application Rules

If you’re considering any Chase cards, don’t forget about their “5/24 rule.” Where if you’ve opened 5+ cards from any bank (NOT counting Chase business cards and these other business cards) in the past 24 months, it’s unlikely you’ll be approved for most Chase cards.

If you are under 5/24, your odds of approval will go up, but will still depend on your credit score and a few other factors. Here’s how to check your 5/24 status.

Also, both the Ink Cash and Ink Preferred are small business cards, but you might qualify without realizing it! Check our step-by-step guide to completing a Chase business card application.

Bottom line

Although Million Mile Secrets reader Chuck already has the Chase Sapphire Preferred card, he is eligible for a welcome bonus on either of the Chase Ink Business cards because they’re considered different card products! But ultimately, whether or not he’s approved is up to the bank.

With the no-annual-fee Ink Business Cash, you’ll earn a $500 cash back (50,000 Chase Ultimate Rewards point) welcome bonus after meeting minimum spending requirements. That’s the highest offer we’ve ever seen on this card.

The Ink Business Preferred comes with a 80,000 Chase Ultimate Rewards point sign-up bonus after meeting minimum spending. That’s worth $800 in cash, $1,000 toward travel if used through the Chase travel portal, or potentially more if transfer points directly to Chase’s travel partners!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!