What’s the Best Card for Entertainment and Dining? Capital One Savor vs Citi Premier

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: You can transfer your Citi ThankYou points to a number of Citi transfer partners which can skyrocket the value of the 60,000-point sign-up bonus.

Despite what we may wish, our wallets and lifestyles can’t accommodate every credit card. The Capital One Savor Cash Rewards Credit Card and Citi Premier® Card are two cards that reward folks very well when they spend on dining and entertainment.

The information for the Capital One Savor Cash Rewards card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

The Capital One Savor earns 4% cash back on dining, entertainment and popular streaming services, and you’ll earn $300 cash bonus after spending $3,000 on purchases within the first three months of account opening.

And the Citi Premier Card earns 2x ThankYou points per dollar on dining and entertainment. You’ll also earn 60,000 Citi ThankYou points when you spend $4,000 on purchases within the first three months of opening your account. That’s worth $750 toward travel booked through the Citi ThankYou travel portal.

Each card has its merits which makes it hard to choose a clear winner in a head-to-head competition. Let’s look at the Capital One Savor vs Citi Premier to see which is best for your spending and travel habits.

Which Card Is Best for Entertainment and Dining? Capital One Savor vs Citi Premier

Read our review of the Capital One Savor Card

Apply Here: Citi Premier Card

Read our review of the Citi Premier Card

Best Sign-Up Bonus

Okay. Let’s do some calculations and we’ll assume all minimum spend is on entertainment and dining to be fair! 🙂

After spending $3,000 on entertainment and dining purchases, you’ll earn $420 cash bonus ($300 welcome bonus + $120 from spending) with the Capital One Savor Card. You earn 4% on the $3,000 spent, which is $120. So, you essentially earn ~14% cash back for the first $3,000 if spending on entertainment and dining only. Not bad!

After spending $4,000 on entertainment and dining purchases, you’ll earn 68,000 ThankYou points (60,000 point welcome bonus + 8,000 points from spending) with the Citi Premier Card. You earn 2x points per dollar on the $4,000 spent, which is 8,000 Citi ThankYou points. If you redeem your points using Citi’s ThankYou travel portal, you’ll get $850 worth of travel because your points are worth 1.25 cents each toward airfare, hotels, rental cars and cruises.

Here, you essentially earn ~21% back for the first $4,000 in purchases if spending on entertainment and dining only. Pretty decent!

But you can also transfer your points to a number of Citi’s travel partners which can boost the value of the sign-up bonus.

Winner: Citi Premier Card

Best Point Earning

Each card has solid earning on entertainment and dining. The Capital One Savor card earns 4% cash back here while the Citi Premier earns 2x points per dollar spent.

Entertainment for both cards looks the same and includes things like concerts, movies, and music downloads. See more about eligible entertainment and dining purchases here.

The Citi Premier Card excels over the Capital One Savor card in earning points for travel and gas at 3x points points per dollar spent. The Capital One Savor only earns 1% cash back here. 🙁

For grocery store purchases, you’ll get 3% back with the Capital One Savor card (excluding superstores like Walmart and Target) and 1x points per dollar with the Citi Premier.

Lastly, for all non-category spending, each card earns 1% cash back or 1x points per dollar.

Your spending habits should help you decide which card here is the winner. For me, I’d prefer the straight 4% cash back on dining and entertainment from the Capital One Savor card.

Winner: Tie

Best Redemption Value

However, here’s where things get interesting. If you transfer points to Citi’s travel partners, you can unlock much more value.

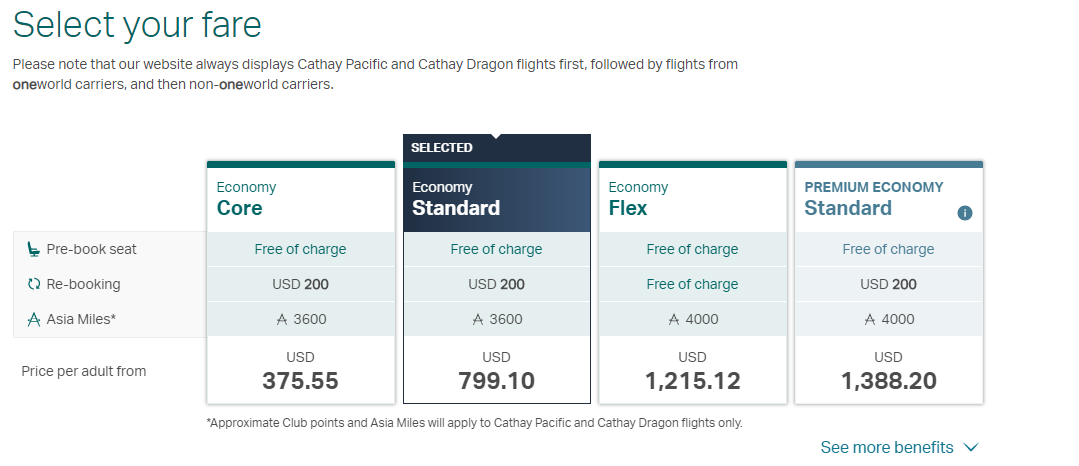

For example, you can transfer 20,000 Citi ThankYou points to Cathay Pacific to book a round-trip award seat from New York to Vancouver. The cash value of this ticket varies, but in my search I found round-trip tickets early next year for ~$800 each. Fees were ~$85 in either case.

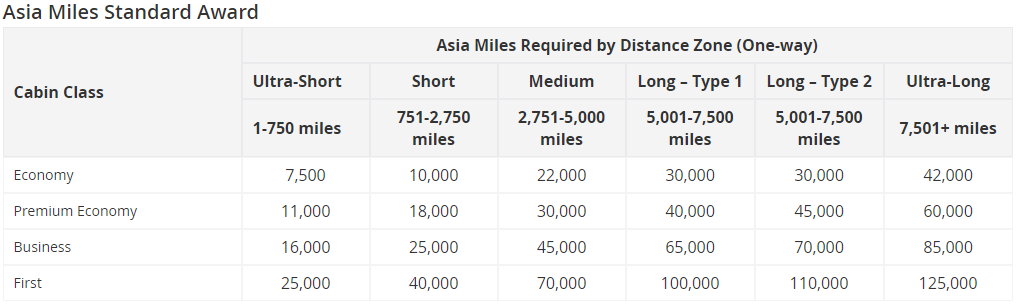

Asia Miles (Cathay Pacific’s award program) operates on a distance-based award chart, so this route only costs 20,000 miles. That’s an incredible value and much better than redeeming through the Citi ThankYou travel portal.

Here’s our rundown on Citi ThankYou points value.

Meanwhile, the Capital One Savor has one very simple redemption option: Cash back.

Winner: Citi Premier

Best Annual Fee

Both cards carry the same annual fee of $95, but let’s look at how you can earn your annual fee back once it sets in.

To earn $95 in value from the Capital One Savor card, you’d need to spend at least $2,375 in dining or entertainment. We calculate this by dividing $95 by 4% for dining and entertainment and then you can take the cash back redemption of $95.

And to earn $95 in value from the Citi Premier card, you’d need to spend at least $2,533 in travel or gas. We calculate this by dividing $95 by 3% for travel and gas, then dividing by 1.25 because of the power of redeeming through the Citi ThankYou travel portal.

Team member Jasmin has kept her Citi Premier for over four years, it’s that valuable!

Winner: Capital One Savor

Best Additional Benefits

Both cards currently offer the full suite of the World Elite Mastercard perks. Some of the top benefits include: Extended Warranty, Price Protection, and Auto Rental Insurance.

However, effective September 22, 2019, the Citi Premier is losing the vast majority of its perks, including Worldwide Car Rental Insurance, Trip Cancellation and Interruption Protection, Worldwide Travel Accident Insurance, Trip Delay Protection, Baggage Delay Protection, Lost Baggage Protection, Citi Price Rewind and 90 Day Return Protection.

For this reason, the Capital One Savor comes out on top.

Winner: Capital One Savor

Best Worldwide Acceptance

Both cards have no foreign transaction fees.

Winner: Tie

Bottom Line

The Citi Premier Card and Capital One Savor Card both offer a bonus for spending on dining and entertainment. But, there is much more to each card than just that.

- Best Sign-Up Bonus: Citi Premier Card – The Capital One Savor Card has a solid $300 cash back welcome bonus after meeting minimum spending requirements, but that can’t beat the minimum value of $750 in travel from the welcome bonus on the Citi Premier Card.

- Best Point Earning: Capital One Savor Card – Earning 4% cash back on dining and entertainment beats 2x points that the Citi Premier Card earns.

- Best Redemption Value: Citi Premier Card – Redemption for travel gets you 1.25 cents per point! Transferring points to partner airlines unlocks even better value!

- Best Annual Fee: Capital One Savor – Both have a $95 annual fee

- Best Additional Benefits: Capital One Savor – They are both part of the World Elite Mastercard program but the Citi Premier is losing a ton of benefits effective September 22, 2019

- Best Worldwide Acceptance: Tie – Both are accepted worldwide and have no foreign transaction fees.

Sometimes we don’t see a clear winner in these types of analyses. That said, each card lends itself towards certain spending and travel habits.

The Citi Premier is the clear choice for anyone looking to use their hard earned rewards on travel. You’ll get $750 in travel from the welcome bonus by using Citi’s ThankYou travel portal and even more if you transfer points to Citi’s travel partners.

For folks who want simplicity, the Capital One Savor offers an easy way to earn 4% cash back on dining and entertainment.

In each case, there’s an annual fee of $95 and need to meet the minimum spend requirement within three months of account opening.

Which card you think fits your style best? Let us know in the comments!

For more about the Citi Premier and Capital One Savor, check out these guides:

- Citi Premier Review

- Is the Citi Premier Worth It?

- Citi Premier Benefits and Perks

- Capital One Savor Review

- Is Capital One Savor Cash Rewards Credit Card Worth It?

- Capital One Savor Cash Rewards Credit Card Benefits and Perks

For more in depth guides, subscribe to our newsletter for more expert miles and points info like this delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!