Don’t Lose Out: Use the Best Hotel Credit Card Perks, Like Anniversary Free Nights and Credits, Before They Expire

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Some of the best hotel credit cards come with perks like anniversary free nights and travel credits. But if you don’t use them before they expire, you’ll miss out on incredible benefits that can make the card worth keeping year after year.

It’s like leaving money on the table. And there’s not much worse than realizing you’ve forgotten about an expiration on a weekend night or statement credit – so we’ve put together a handy list to help you keep track.

Here’s what you need to know about the best hotel credit cards with perks that expire.

The Best Hotel Credit Card Perks Are Useless If They Expire Before You Can Use Them

Applying for top hotel credit cards isn’t just about earning a big welcome bonus or earning points for ongoing spending. Many cards come with valuable extras, like automatic elite status, bonus points on your card anniversary, or other perks like airport lounge access.

But here’s where you need to keep track – some benefits, like anniversary nights (or nights awarded based on spending) and travel statement credits will expire if you don’t use them by a certain date. And these are often the ones that make keeping a card worth it each year!

It’s worth setting a calendar alarm in advance of the expiration dates so you don’t forget!

1. The World of Hyatt Credit Card

Apply Here: The World of Hyatt Credit Card

Read our review of The World of Hyatt Credit Card

The World of Hyatt Credit Card comes with up to 50,000 Hyatt points after meeting tiered minimum spending requirements:

The World of Hyatt Credit Card comes with up to 50,000 Hyatt points after meeting tiered minimum spending requirements:- 25,000 bonus Hyatt points after you spend $3,000 on purchases in the first 3 months of opening your account

- Another 25,000 bonus Hyatt points after you spend an additional $3,000 on purchases within the first 6 months of opening your account

One of the main reasons folks keep this card long term is the free night at a category 1 to 4 Hyatt each year after your account anniversary. And you can earn an additional free night at category 1 to 4 hotels if you spend $15,000 or more on purchases during your cardmember anniversary year. I’ve got the older version of this card and have used the anniversary free night at hotels like the Grand Hyatt Berlin, Hyatt Regency Paris Etoile, and Hyatt Regency Chicago.

Either of the category 1 to 4 free night awards expire 12 months from the date of issue. That is, you must have a check-out date before the expiration date of the award.

Note: Hyatt also offers free nights through their loyalty program for elite members when they reach certain milestones (you don’t need to have the credit card). The expiration rules for these nights are sometimes different.2. IHG Rewards Club Premier Credit Card

Apply Here: IHG Rewards Club Premier Credit Card

Read our review of the IHG Rewards Club Premier Credit Card

The IHG Rewards Club Premier Credit Card has an 80,000 IHG point bonus after spending $2,000 on purchases within the first 3 months of account opening. Like the Hyatt card, lots of us keep the IHG Premier card year after year because it comes with a free night at IHG hotels costing 40,000 points or less each card anniversary.

It’s easy to find IHG hotels 40,000 points or less that cost hundreds of dollars. For example, you could redeem your free night at the InterContinental Bangkok and explore one of Asia’s most exciting cities.

Your IHG anniversary free night expires 12 months from the date of issue. You must book and stay before the expiration date.

3. Marriott Rewards Premier Plus Credit Card

Apply Here: Marriott Rewards Premier Plus Credit Card

Read our review of the Marriott Rewards Premier Plus

When you open the Marriott Rewards Premier Plus Credit Card, you’ll earn 75,000 Marriott points after spending $3,000 on purchases in the first 3 months of account opening. And it comes with a free night award at hotels costing 35,000 Marriott points or less every year after your account anniversary.

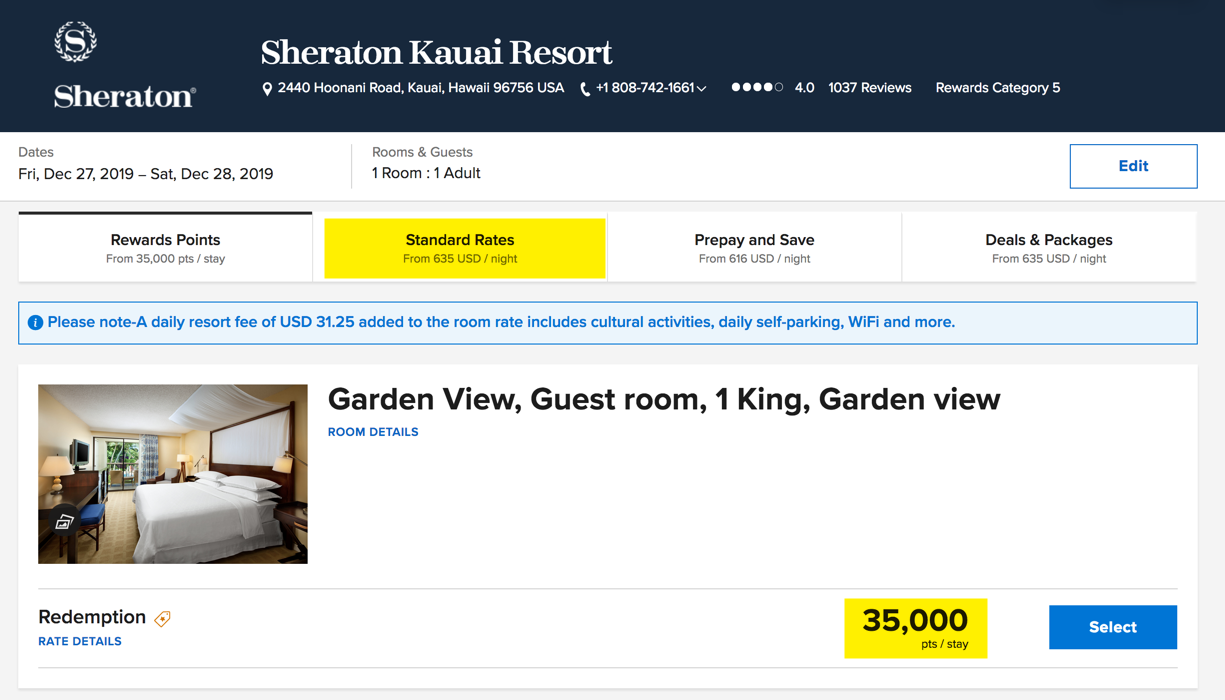

There are plenty of luxurious Marriott hotels where you can redeem your anniversary free night, and you can sometimes get huge value. Check out the Sheraton Kauai Resort, where paid rates can exceed $700 per night after taxes during peak season!

Similar to Hyatt and IHG, your anniversary free night expires 12 months from the date of issue.

Note: The Marriott Rewards Premier Business Credit Card also comes an anniversary free night at hotels costing 35,000 Marriott points or less, with the same expiration terms. The information for the Marriott Rewards Premier Business Credit Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.4. AMEX Starwood Cards

Apply Here: Starwood Preferred Guest® Credit Card from American Express

Read our review of the Starwood Preferred Guest Credit Card from American Express

Apply Here: Starwood Preferred Guest® Business Credit Card from American Express

Read our review of the Starwood Preferred Guest Credit Card from American Express

Similar to the Marriott Rewards Premier Plus Credit Card, the Starwood Preferred Guest® Credit Card from American Express and Starwood Preferred Guest® Business Credit Card from American Express both come with a free night at Marriott hotels costing 35,000 points or less after each card anniversary.

And both cards come with a welcome bonus of 75,000 Marriott points after spending $3,000 on purchases within the first 3 months of account opening.

The terms for the free night certificate are the same, also. You must use it within 12 months of it being issued.

Note: There’s also the Starwood Preferred Guest® Luxury Card, which comes with a free night at Marriott hotels costing 50,000 points or less after each card anniversary. The expiration rules are the same, but you’ll be able to redeem your night at more hotels. Additionally, the card comes with up to $300 in credit per card anniversary year for eligible purchases at Marriott hotels. If you don’t use it by your card anniversary date, you’ll lose it. The information for the Starwood Preferred Guest Luxury Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.5. AMEX Hilton Cards

Hilton Honors American Express Ascend

Apply Here: Hilton Honors American Express Ascend Card

Read our review of the Hilton Honors American Express Ascend Card

With the Hilton Honors American Express Ascend Card, you’ll earn 125,000 Hilton points after spending $2,000 on purchases within the first 3 months of account opening.

While this card doesn’t come with an automatic anniversary night, you can earn a weekend night reward valid at most Hilton hotels after spending $15,000 on purchases in a calendar year.

You’ll earn the reward 8 to 12 weeks after you meet the purchase requirement, and you’ll have to book and stay within one year of the date of issue.

The Hilton Honors American Express Business Card

Apply Here: The Hilton Honors American Express Business Card

Read our review of the Hilton Honors American Express Business Card

The Hilton Honors American Express Business Card comes with 125,000 bonus Hilton points after spending $3,000 on purchases in the first 3 months of account opening.

The Hilton Honors American Express Business Card comes with 125,000 bonus Hilton points after spending $3,000 on purchases in the first 3 months of account opening.It doesn’t include an automatic anniversary night, either. But when you spend $15,000 in purchases on your card in a calendar year, you’ll earn a weekend night reward valid at most Hilton hotels. And a 2nd weekend night after spending an additional $45,000 in purchases on your card in the same calendar year.

Like the Hilton Honors American Express Ascend Card, these weekend nights expire 12 months after the date of issue.

The Hilton Honors Aspire Card From American Express

Apply Here: Hilton Honors Aspire Card from American ExpressFolks with the Hilton Honors Aspire Card from American Express earn 150,000 Hilton points after spending $4,000 on purchases within the first 3 months of account opening. Plus a weekend night reward when they apply and every year upon card renewal.

And you can earn an additional weekend night reward after spending $60,000 on purchases in a calendar year. The expiration terms are the same as the other Hilton cards.

The Hilton Honors Aspire card also comes with the following credits:

- Up to $250 in airline incidental credits per calendar year on your selected airline

- Up to $250 in Hilton resort credit per cardmember year for eligible purchases at participating Hilton resorts

These credits don’t roll over to the following year, so again, use them or lose them!

6. Radisson Rewards Visa Cards

There are a few different versions of the Radisson Rewards cards, each with a different welcome bonus. None come with an automatic anniversary night. But you can earn up to 3 free anniversary nights at Radisson Blu, Radisson, Radisson RED, Park Plaza, Park Inn by Radisson, or Country Inn & Suites by Radisson hotels located in the US after meeting a spending threshold.

With the Radisson Rewards™ Premier Visa Signature® Card, Radisson Rewards™ Visa Signature® Card, Radisson Rewards™ Visa® Card, and Radisson Rewards™ Business Visa® Card, you’ll earn 1 free night certificate for each $10,000 in spending (up to $30,000 or 3 free nights) in an anniversary year, when you renew your card and pay the annual fee.

These certificates will post to your account 6 to 8 weeks after paying your annual fee, and are valid for 12 months from the date of issue.

Bottom Line

Don’t forget about the annual perks that come with some of the best hotel credit cards, like anniversary free nights and travel statement credits. For example, the IHG Rewards Club Premier Credit Card and The World of Hyatt Credit Card both come with a free night after each account anniversary, valid at hotels below a certain category.

These have expiration dates which vary by card and benefit. And if you don’t use them, you’re out of luck.

It’s a good idea to set a calendar alarm for each of these benefits well before they expire. That way, you’ll have plenty of time to squeeze the most value from your card!

Do you have a favorite among these annual card benefits? Let me know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!