6 best ongoing credit card benefits: Each one can save you potentially $1,000 per year

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

We tout travel credit card welcome bonuses as the best way to get free travel and save a bunch of money — and that’s correct. But what happens to a credit card after you earn its bonus?

It’s true, some credit cards have seemingly little to offer beyond their intro bonuses. But other cards have such potently valuable perks that even a single benefit can provide you hundreds of dollars in savings (even $1,000+, if you know how to leverage them) every single year!

Let’s examine these benefits to see how powerful your credit cards can be long after the welcome bonus is spent.

Free night at (nearly) any Hilton hotel on earth

Several hotel credit cards offer some form of a free night certificate as a reward for renewing your card year after year. However, hotels often limit these certificates to be used only at mid to low-level hotels.

Not Hilton. They issue “Weekend Night Certificates” that can be used at just about any Hilton on the planet (except for these few). Whether your hotel costs 5,000 points per night or 120,000 points per night, you can redeem your certificate for a free stay as long as there are base rooms available.

If you play your certs right, you could save well over $1,000 from this ongoing benefit. Exotic Hilton hotels (think Maldives and Tahiti) can easily cost over $1,000 per night. Or luxury destinations like the Waldorf Astoria Park City can reach $1,300+ during ski season.

The only real restriction is that you can only use your Weekend Night Certs on the weekend. That term can vary depending on your location, but it generally means you’ll have to use it either Friday night, Saturday night, or Sunday night.

Cards that offer this benefit – You’ll need a Hilton credit card such as:

- Hilton Honors American Express Aspire Card: One annual weekend night upon opening your card, and every year after you renew your card. And an additional Weekend Night Award each calendar year in which you spend $60,000+ on eligible purchases

- Hilton Honors American Express Surpass® Card – One weekend night after you spend $15,000 on purchases in a calendar year

- The Hilton Honors American Express Business Card – One weekend night after you spend $15,000 on purchases in a calendar year

The information for the Amex Hilton Aspire, and the Hilton Surpass has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

4th night free

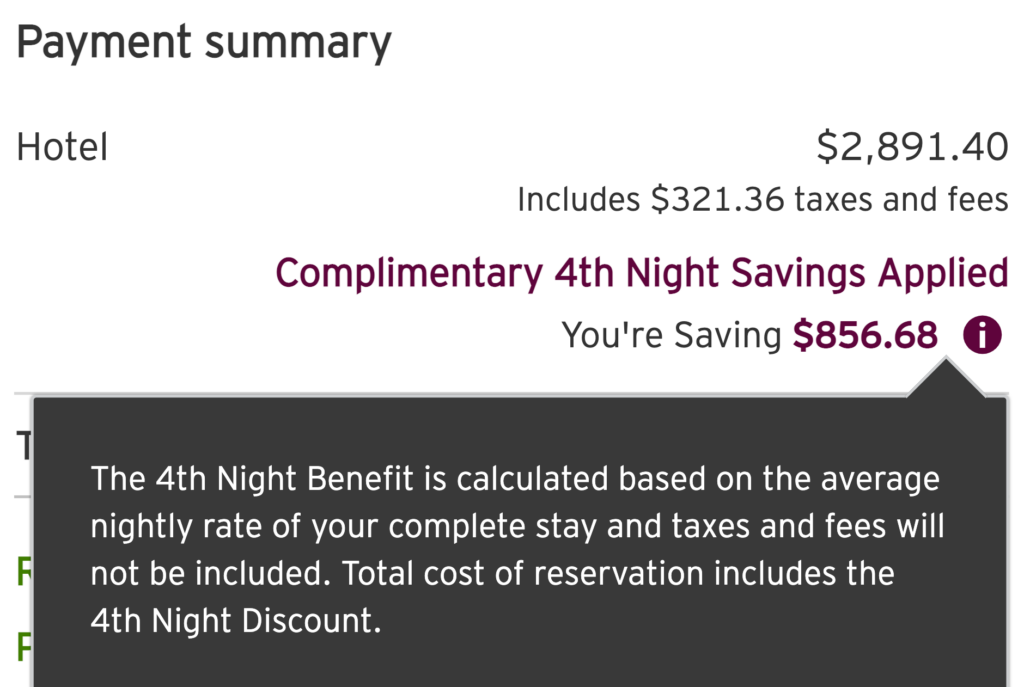

Two times every year, you can receive the fourth night free on any hotel booking you make through Thankyou.com. The savings you receive is based on the average nightly rate (before taxes and fees).

There are a couple of issues here, but the biggest one is this: You’ve got to spend money to save money. The more you spend, the more jaw-dropping your savings. For example, below I’ve booked a four-night stay at Ashford Castle, my all-time favorite hotel. Rooms are selling for $856 per night, which means I’ll save $856! Instead of my final bill costing $3,747, it costs $2,891. Still hard to swallow, but what a savings if you’re planning to pay for an expensive hotel stay anyway!

The other problem is that you will not receive elite night credits or hotel points for your stay — and your elite status won’t even be recognized. That’s because you’re booking through a third-party website instead of directly with the hotel.

Cards that offer this benefit:

- Citi Prestige® Card

The information for the Citi Prestige has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Airline companion certificate

Many airline credit cards offer some manner of companion certificate that will allow you to bring a travel buddy on a round-trip ticket with you for cheap. The terms vary, but occasionally it’s just the cost of taxes and fees, other times there’s a flat $99 fee (pre-tax), other times it’s only valid for award flights.

But there’s almost always a spending goal you must hit before achieving this reward. Depending on how you use it, this could save you several hundred dollars per year — maybe even $1,000+. Read our airline companion pass guide for all the details and restrictions (seriously, you need to read that), but I’ll summarize below:

Credit cards that offer this benefit:

Delta Companion Certificate – Receive a companion certificate each year you renew your card (eligibility terms). Companion fare costs only taxes and fees of no more than $75:

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

Alaska Airlines Companion Fare – Receive a companion fare code after paying the annual fee. Companion fare costs as little as $121 ($99 fare, plus taxes and fees from $22):

- Alaska Airlines Visa Signature® credit card

- Alaska Airlines Visa® Business credit card

The information for the Alaska Airlines Visa and Alaska Airlines Visa Business card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

American Airlines Companion Certificate – Spend a certain amount on your card in a cardmember year to earn the companion certificate. Your companion can fly with you for $99, plus taxes and fees (between $22 and $43, based on itinerary)

- CitiBusiness® / AAdvantage® Platinum Select® Mastercard® – Spend $30,000 on purchases in a cardmember year (account must be renewed and open for at least 45 days after account anniversary date)

- AAdvantage® Aviator® Business Mastercard® – Spend $30,000 on purchases in a cardmember year

- AAdvantage® Aviator® Red World Elite Mastercard® – (You only need to spend $20,000 on purchases in a cardmember year)

British Airways Travel Together Ticket – Bring a travel buddy for just the cost and taxes of fees when reserving a British Airways-operated award flight departing from and returning to the U.S.

- British Airways Visa Signature® Card

The information for the Barclaycard AAdvantage Aviator Red, AAdvantage Aviator Business, British Airways Visa Signature Card, CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Secret award seats

If you’ve been playing the points game for a while, you’ve been frustrated that airline award seats are not available on the dates you desire to travel.

With United Airlines, you can help your situation by holding certain credit cards. They actually hide award seats from non-cardholders so that you’ll have a better chance at booking a seat. Check out the screenshot below for an example.

United Airlines cards give you access to “XN” award availability. 95% of United flyers don’t have a United credit card, so these award seats hardly ever sell out. This will save you hundreds of dollars if you need to take a last-minute flight and publicly available award seats are snatched up. It’s saved me a number of times!

Cards that offer this benefit:

- United℠ Explorer Card

- United Club℠ Infinite Card

- United Business Card

- United Club℠ Business Card

The information for the United Club Business card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Amex Offers

Amex Offers are targeted coupon-esque statement credits that help you to save money on everyday purchases. Think Amazon, dining, travel, groceries, etc.

They’re actually better than coupons for a couple of reasons:

- They are given to you as statement credits after your purchase. In other words, you’ll earn points for the full price, and get the credits afterward. An offer will trigger automatically once you’ve satisfied its terms

- Amex handles the statement credits, which means you can add other coupon codes or promo codes at checkout and stack them both. You can even go through online shopping portals

- You’ll still earn points from Amex on the purchase as well.

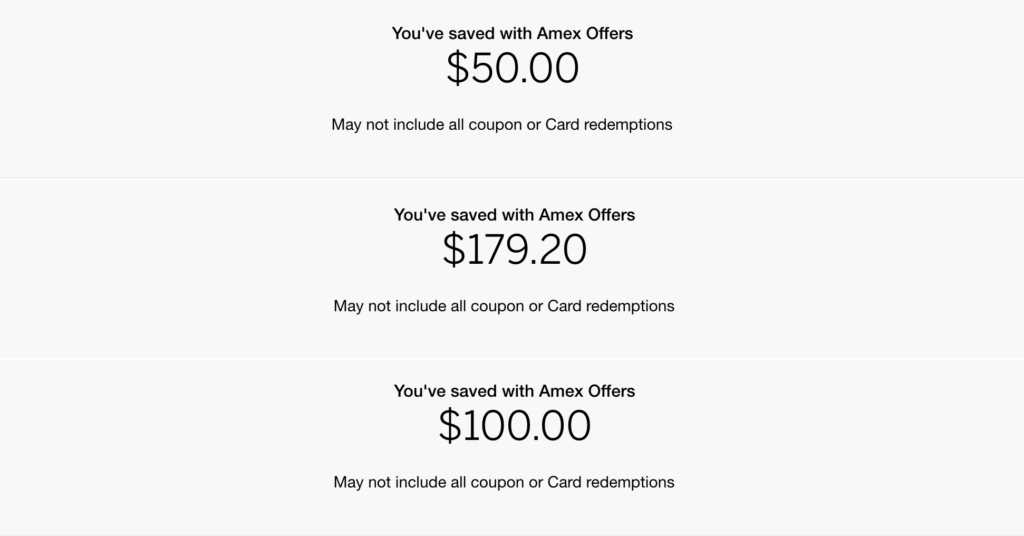

My wife and I have saved well over $1,000 from the beginning of 2020 to now with Amex Offers. I’m a casual Amex Offer user (I only use them if it’s super duper easy), and here are my accounts this year with three of my Amex cards:

Cards that offer this benefit: All Amex cards come with Amex Offers. The offers you’re targeted for may vary depending on the card you have, though. Here are some examples of the cards I have:

- The Platinum Card® from American Express

- Marriott Bonvoy Brilliant™ American Express® Card

- Marriott Bonvoy Business® American Express® Card

- Delta SkyMiles® Gold American Express Card

Eligibility for Amex Offers is limited. Enrollment is required in the Amex Offers section of your account before redeeming.

Amex Platinum cards airport lounge access

A fistful of cards come with airport lounge access. They’re all super valuable, as they give you membership to Priority Pass (the largest lounge network in the world by far), but no other travel card can compare with the comprehensive access that comes with Amex Platinum cards. Enrollment required.

Amex Platinum cards give you access to You’ll get unlimited airport lounge access to 1,300+ lounges worldwide with networks such as:

- Priority Pass (you’ll find them almost everywhere)

- Centurion Lounges (hand-down the best domestic lounges available)

- Delta Sky Club (when flying Delta)

- Airspace Lounges

- Escape Lounges

Centurion Lounges alone (while there are only 14) can save you hundreds of dollars with just a few visits per year. They’ve got complimentary sit-down hot meals and free premium spirits. One lounge even offers wine tastings! I just experienced my first Centurion Lounge last month — check out the honest review here.

Generally, you’ll be allowed two free guests per visit. That’s a big savings, as a lounge day pass can cost up to $60 per person!

Cards that offer this benefit:

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Amex Centurion cards

- Other Amex Platinum variants

Bonus: $300 travel credit

This perk can’t save you $1,000 per year, but it’s one of our favorites and we like to talk about it.

Every cardmember year, you’ll receive a $300 travel credit to be used for just about anything travel-related. It’s an automatic reimbursement — in other words, the first $300 in travel you spend will be free. Here are some things that will trigger the credit:

- Hotels

- Airfare

- Rental cars

- Cruises

- Tolls

- Parking

- Uber

- Timeshares

- Campgrounds

- Trains

- Buses

- Ferries

There are some quirky purchases that won’t qualify for the travel credit, even though they clearly should (such as vacation rentals, HomeAway, and VRBO).

Cards that earn offer benefit:

- Chase Sapphire Reserve®

Bottom line

Credit card benefits are the blood running through your credit card’s plastic veins. Welcome bonuses are great (and you should earn as many of them as you can), but you should also assess a card’s benefits before decided with which you want to engage in a long-term relationship.

Let me know your all-time favorite credit card benefit! And subscribe to our newsletter for more posts like this delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!