Amex Blue Cash Preferred benefits: Save hundreds per year on U.S. streaming services and supermarkets

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Blue Cash Preferred® Card from American Express is a cash back rewards card ideal for folks who spend a lot on supermarket and gas station purchases in the U.S., transit and on select U.S. streaming services. In exchange for a $0 introductory annual fee for the first year, then $95 (see rates & fees) you’ll earn:

- 6% cash back at U.S. supermarkets (up to $6,000 in purchases per calendar year, then 1% cash back)

- 6% cash back on select U.S. streaming services

- 3% cash back at U.S. gas stations and transit purchases

- 1% cash back on other purchases

- Terms Apply

Cash back is received in the form of Reward Dollars that can be redeemed for statement credits.

The Blue Cash Preferred benefits also include perks like free two-day shipping with ShopRunner, secondary car insurance and protections on purchases you charge to your card. These are nice extras, especially if you don’t get them with other cards. And having access to Amex Offers sweetens the deal.

If you spend $500 per month at U.S. supermarkets and on select U.S. streaming services — two extremely useful bonus categories given we’re all at home right now during the coronavirus pandemic — you’ll earn $360 cash back in a year and easily cover the annual fee. And that doesn’t even include the unlimited 3% cash back earnings at U.S. gas stations and on transit.

Amex Blue Cash Preferred benefits and perks

When you open the Amex Blue Cash Preferred card, you’ll earn a $300 statement credit after you spend $3,000 in purchases on your new card within the first six months of card membership.

The card has a $95 annual fee and because of the cash back earning rates, it’s best for folks who prioritize rewards on their spending with supermarkets, streaming services and gas stations in the U.S., in addition to transit expenses. That said, the welcome bonus covers the annual fee for a couple of years – and there are many other benefits.

Here’s what you get with this card.

6% and 3% cash back in common spending categories

You’ll earn 6% cash back on up to $6,000 in spending per calendar year at U.S. supermarkets (then 1%). And you’ll earn unlimited 6% cash back on select U.S. streaming services.

To earn the maximum 6% rewards at U.S. supermarkets you’d need to spend $500 per month, which is easy to do for most families. And you’d earn $360 in cash back ($6,000 X 6%).

You’ll also earn 3% cash back at U.S. gas stations and on transit purchases, like:

- Ride sharing services like Uber and Lyft

- Parking

- Taxi cabs

- Train fares

- Tolls

- Ferries

- Buses

- Subways

And there is a long list of U.S. streaming services that qualify for unlimited 6% cash back, including:

- Amazon Music

- Apple Music

- Audible

- CBS All Access

- Direct TV Now

- ESPN+

- Fubo TV

- HBO Now

- Hulu

- iHeartRadio

- Kindle Unlimited

- MLB.TV

- NBA League Pass

- Netflix

- NHL.TV

- Pandora

- Prime Video Unlimited

- Showtime

- Sling TV

- SiriusXM Streaming and Satellite

- Spotify

- YouTube Music Premium

- YouTube Premium

- YouTube TV

To ensure that you earn the bonus cash back pay for the service directly through the provider. If you pay for these subscriptions through a third party or as part of a bundled package, you might not earn the extra rewards.

Free two-day shipping with ShopRunner

ShopRunner gets you free two-day shipping (and returns) at 100+ online shops. Membership normally costs $79 a year, but it’s a free perk when you enroll with American Express credit cards, including the Amex Blue Cash Preferred.

There are popular stores on the list, so it’s not hard to take advantage of this perk. Getting your stuff a little faster is always nice, especially when it costs nothing extra.

Secondary car rental insurance

When you decline the rental car agency’s rental coverage and charge the full amount of your reservation to your Amex Blue Cash Preferred card, you’ll get secondary coverage for damage caused by collision or theft.

That means the coverage will kick in after you file a claim with your primary insurance company. There are better credit cards for car rental insurance, but if you don’t have one of them, it’s good to have a backup.

Global Assist Hotline

When you travel 100+ miles from home, you can call a 24-hour hotline to assist with medical, legal, or financial needs like:

- Translation services

- Passport replacement

- Missing luggage

- Doctor clinics or services

You’ll be responsible for any costs incurred.

More time on a manufacturer’s warranty

When you pay for certain items with your Amex Blue Cash Preferred card, you can get up to an extra year added to an original manufacturer’s warranty of 5 years or less.

This is an excellent benefit for big ticket items, like electronics or appliances. In total, you can get up to 7 years of warranty coverage.

Return protection if the store won’t take something back

If it’s been less than 90 days since you purchased an eligible item and the merchant won’t accept your return, you can file a claim for return protection and potentially get up to $300 per item, and $1,000 per account per calendar year. This applies to purchases made in the U.S. or its territories only.

Protection against theft and accidents for your purchases

If an eligible item you bought with your card is accidentally damaged or stolen within 90 days of purchase, you can get coverage up to $1,000 per claim, and up to $50,000 per account per calendar year.

This is a valuable perk, especially for expensive items. That’s why we always recommend using a card with consumer protections. Using this benefit even one time would make it worth the annual fee for potentially several years. And if you don’t already have a card with purchase protection, American Express credit cards are among the best.

Presale and member-only events

Amex cardmembers can get access to Broadway shows, concerts, family and sporting events and more through American Express Experiences.

You can get ticket presales most often, and better seats here and there – sometimes both! Team member Harlan has bought tickets through Amex and always had a great time. Definitely check out this perk if you like to attend events.

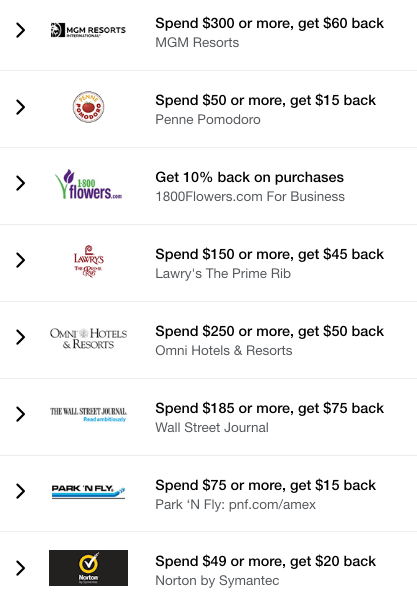

Access to Amex Offers

One of the most underrated benefits of having an Amex card is getting to add Amex Offers to your card. These are easy discounts and rebates you get for spending at a rotating list of popular merchants.

The Million Mile Secrets team uses these often. And if you do too, this perk can easily cover the annual fee on your Amex Blue Cash Preferred card on its own – and the other benefits will be cash in your pocket!

Bottom line

The Amex Blue Cash Preferred card offers a $300 statement credit after you spend $3,000 in purchases on your new card within the first six months of card membership. You’ll also get access to these benefits like return & purchase protections, access to Amex Offers and more.

For a $0 introductory annual fee for the first year, then $95 (See rates & fees) , you can do well with this card, especially with the 6% and 3% cash back bonus categories. Be sure to read our in-depth review of the Blue Cash Preferred.

You can apply for the Amex Blue Cash Preferred card here.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets email newsletter.

For the rates and fees of The Blue Cash Preferred Card from American Express, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!