2 AMEX Delta Cards Can Get You $1,350 or $1,500 Off Flights WITHOUT Searching for Award Tickets

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.If you like Delta, it’s a fantastic time to consider the huge limited-time AMEX Delta offers. The best-ever AMEX Delta welcome bonuses are only available until April 3, 2019:

- Gold Delta SkyMiles® Credit Card from American Express – 60,000 Delta miles after spending $2,000 on purchases in the first 3 months of account opening

- Platinum Delta SkyMiles® Credit Card from American Express – 75,000 Delta miles after spending $3,000 on purchases in the first 3 months of account opening

- Delta Reserve® Credit Card from American Express – 75,000 Delta miles after spending $5,000 on purchases in the first 3 months of account opening

AMEX restricts welcome bonuses to one bonus, per person, per card, per lifetime. But because each AMEX Delta card is considered a different card product, even if you’ve had one version of these cards, you’re still eligible for the others. For example, if you’ve had the AMEX Delta Gold card, you’re still eligible for the AMEX Delta Platinum or AMEX Delta Reserve.

And it’s actually possible to qualify for 2 of these cards before the limited-time offers expire. With this strategy, you could easily earn enough Delta miles for at least $1,350 or $1,500 worth of Delta flights – without searching for award tickets.

Here’s how applying for 2 AMEX Delta cards makes sense if you don’t want to fuss with award charts or blackout dates.

Earn the Bonus With 2 AMEX Delta Cards, Pay With Miles for $1,350 or $1,500 in Delta Flights

Until April 3, 2019, you can earn increased welcome bonuses on these 3 AMEX Delta personal cards:

Update: The offers in the table below are no longer available.| Card Name | Welcome Bonus |

|---|---|

| Gold Delta SkyMiles® Credit Card from American Express | 60,000 Delta miles after spending $2,000 on purchases in the first 3 months of account opening, plus a $50 Statement Credit after your first Delta purchase with your card in the same time frame. Terms Apply. |

| Gold Delta SkyMiles® Business Credit Card from American Express | 70,000 Delta miles after spending $4,000 in the first 3 months of account opening, plus a $50 statement credit after your first Delta purchase with your card in the same time frame. Terms Apply. |

| Platinum Delta SkyMiles® Credit Card from American Express | 75,000 Delta miles and 5,000 Medallion® Qualification Miles after spending $3,000 on purchases in the first 3 months of account opening, plus a $100 Statement Credit after your first Delta purchase with your card in the same time frame. Terms Apply. |

| Platinum Delta SkyMiles® Business Credit Card from American Express | 80,000 Delta miles and 5,000 Medallion® Qualification Miles after spending $6,000 on purchases in the first 3 months of account opening, plus a $100 statement credit after your first Delta purchase with your card in the same time frame. Terms Apply. |

| Delta Reserve® Credit Card from American Express | 75,000 Delta miles and 5,000 Medallion® Qualification Miles after spending $5,000 on purchases in the first 3 months of account opening. Terms Apply. |

| Delta Reserve for Business Credit Card | 80,000 Delta miles and 5,000 Medallion® Qualification Miles after spending $6,000 on purchases in the first 3 months of account opening. Terms Apply. |

One of the best perks of having any of these cards is the ability to quickly redeem the welcome bonuses to save hundreds of dollars off Delta flights using Pay With Miles.

So how do you save $1,350 or $1,500? You can apply for 2 of the card offers! These 3 cards are considered different products, which means you’re not restricted to applying for just one card. Keep in mind, you’re not eligible to earn the bonus on an exact card you’ve had before because of AMEX’s one bonus per card per lifetime rule.

With the current welcome bonuses, you could apply for:

- AMEX Delta Gold and AMEX Delta Platinum or AMEX Delta Reserve to earn a total of 135,000 Delta miles after meeting minimum spending requirements (60,000 miles from the AMEX Delta Gold and 75,000 miles from the AMEX Delta Platinum or AMEX Delta Reserve)

- AMEX Delta Platinum and AMEX Delta Reserve to earn a total of 150,000 Delta miles after meeting minimum spending requirements (75,000 miles from each card)

Then, you could redeem 135,000 Delta miles for $1,350 worth of Delta flights, or 150,000 Delta miles for $1,500 in Delta flights using Pay With Miles. And you can get potentially much more value by using these miles to book award flights on Delta or their partners to destinations all over the world.

Tips for Applying for 2 AMEX Delta Credit Cards

Anecdotally, the general rule with AMEX is you can get 2 cards in a rolling 90-day period (NOT 2 of the same card). And folks report it’s not possible to get approved for more than 1 personal card in 5 days.

So you should wait at least 5 days between application submissions. You’ll also want to be sure you haven’t opened any other AMEX cards recently to stay under their 90-day rule.

It bears repeating, American Express restricts welcome bonuses to once per card, per person, per lifetime. For instance, if you’ve had the AMEX Delta Gold in the past, you will not be eligible for the bonus again.

The good thing is AMEX will now let you know if you’re not eligible for the bonus during the application process, before they pull your credit (either because of the once per lifetime rule or because you’ve opened / closed a lot of AMEX cards recently).

If you’re new to rewards credit cards, this rule should NOT impact you.

Are you wondering how applying for multiple cards impacts your credit score? Have a look at our post about 11 credit card myths that could be holding you back from free travel. Many Million Mile Secrets team members have 10+ credit cards each and have excellent credit scores.

But What About Having 2 Annual-Fee Cards?

The value of the huge welcome bonuses and card perks (like free checked baggage) are terrific reasons to apply for the AMEX Delta card limited-time offers.

The $95 annual fee (See Rates & Fees) on the AMEX Gold Delta card is waived the first year. So it’s free to test the card out for ~12 months. Then, you can decide if the perks of the card make it worth keeping.

With the AMEX Delta Platinum, you’ll pay a $195 annual fee (See Rates & Fees). It’s not waived the first year. But this version of the card comes with extra perks like:

- Domestic coach round-trip companion certificate each year on your card anniversary

- 5,000 Medallion® Qualification Miles after meeting the minimum spending requirements

- $100 statement credit after making a Delta purchase in the first 3 months

Folks who fly Delta often can get a huge value from the AMEX Delta Reserve card, because it comes with Delta Sky Club lounge access whenever you’re flying a Delta operated or marketed flight that day. The card has a $450 annual fee (See Rates & Fees), but if you visit Delta Sky Club airport lounges frequently, it can be worth it. If you paid for a Delta Sky Club membership directly, it would cost $545.

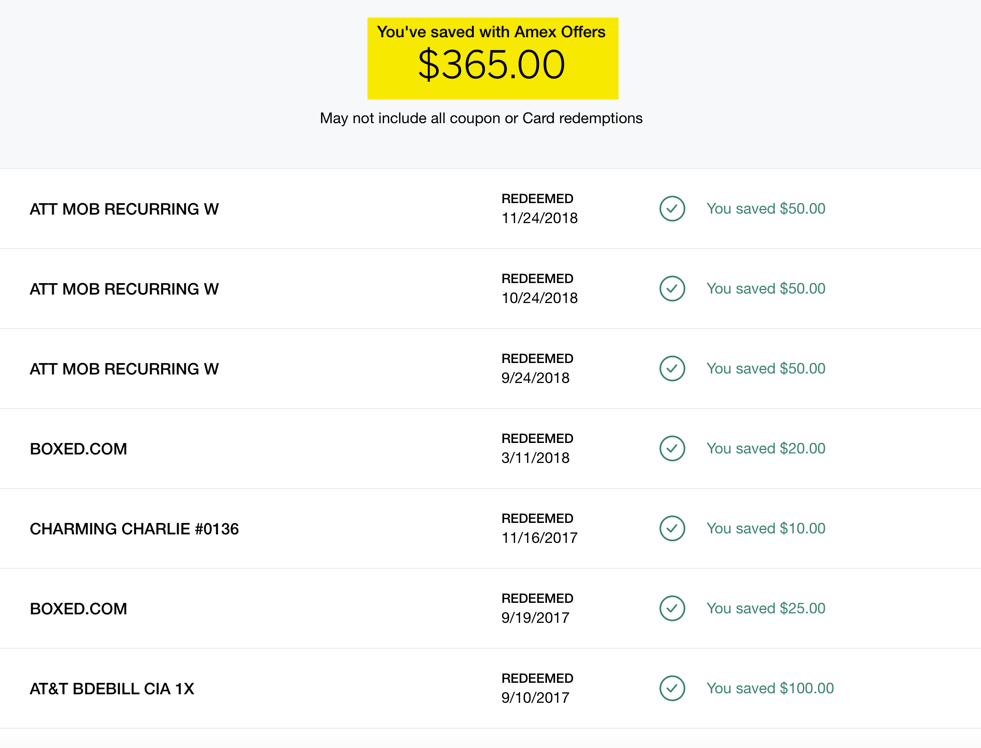

And don’t forget, each American Express card gets you access to AMEX Offers. These deals are a great way to save money on purchases you might already be planning. The savings can really add up and easily help offset the annual fee on your card.

Many of us on the Million Mile Secrets team keep annual-fee cards in our wallets year after year, because the benefits and perks far outweigh the yearly cost.

Bottom Line

If you’re looking for an easy way to save money on Delta flights, you can apply for 2 of the limited-time AMEX Delta card offers (ending April 3, 2019). These welcome bonuses are the highest they’ve ever been:

- Gold Delta SkyMiles® Credit Card from American Express – 60,000 Delta miles after spending $2,000 on purchases in the first 3 months of account opening

- Platinum Delta SkyMiles® Credit Card from American Express – 75,000 Delta miles after spending $3,000 on purchases in the first 3 months of account opening

- Delta Reserve® Credit Card – 75,000 Delta miles after spending $5,000 on purchases in the first 3 months of account opening

You could earn a total of 135,000 Delta miles (worth $1,350 in Delta flights when you Pay With Miles) by applying for the AMEX Delta Gold and AMEX Delta Platinum or AMEX Delta Reserve. Or a total of 150,000 Delta miles (worth $1,500 in Delta flights when you Pay With Miles) with the AMEX Delta Platinum and AMEX Delta Reserve.

And you’ll likely squeeze even more value from the bonuses if you book award flights on Delta and their partners.

Keep in mind, you can’t earn the bonus on a specific Delta card if you’ve had the card in the past, because of AMEX’s one bonus, per card, per lifetime rule. But that doesn’t disqualify you from the others.

If you’re applying for 2 cards, anecdotal evidence suggests you won’t be approved for more than 2 AMEX credit cards in a rolling 90-day period, and no more than 1 every 5 days, so you’ll want to space out your applications. AMEX will now tell you if you’re not eligible for a bonus during the application process before they do a credit pull.

Be sure to have a look at our post with 9 reasons to consider the AMEX Delta limited-time welcome offers, which end in less than a month on April 3, 2019.

For . For rates and fees of the Platinum Delta SkyMiles® Credit Card from American Express, please click here. For .Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!