Rumor Alert: Negative Changes Coming to Sapphire Reserve and a New Chase Card Coming Soon

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Via IAD Gr8 on Twitter, there are unconfirmed benefit changes coming to the Chase Sapphire Reserve. And it’s not good news for a lot of folks – especially families.

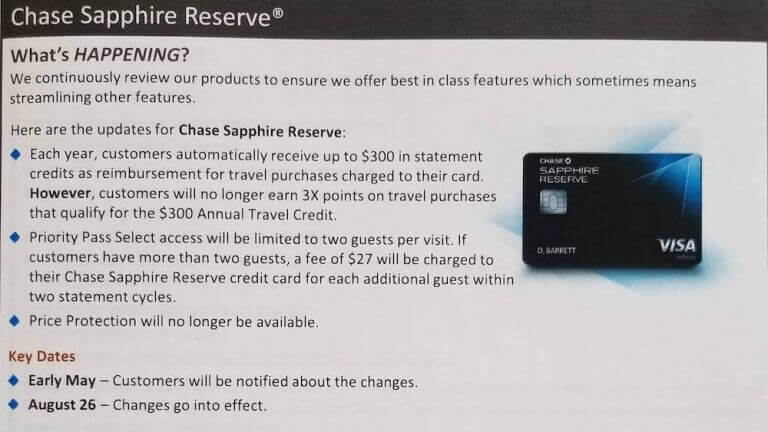

According to what appears to be a leaked internal memo, the following will take effect August 26, 2018:

- Travel purchases that are reimbursed by the up to $300 annual travel credit won’t earn 3X Chase Ultimate Rewards points per $1

- You’ll NO longer be able to bring unlimited friends and family into Priority Pass Select lounges – instead, you’ll be allowed a maximum of 2 guests

- The card will discontinue price protection

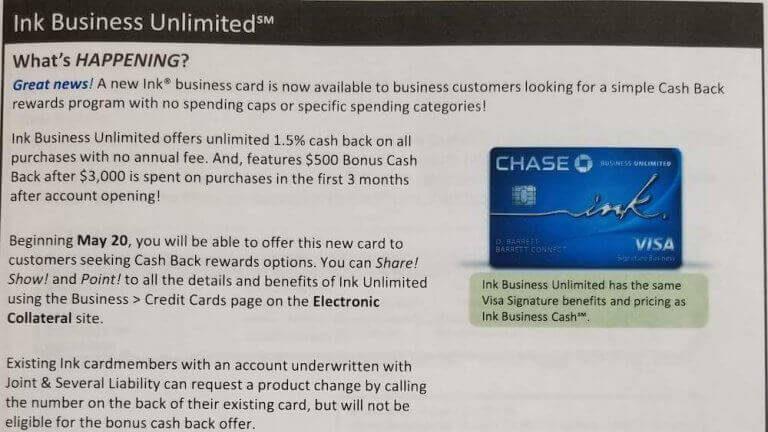

But on a happier note, another memo suggests there’s a new Chase Ink card coming on May 20, 2018. The rumored Chase Ink Business Unlimited will offer 1.5% cash back on all purchases and a sign-up bonus of $500 cash back after spending $3,000 on purchases in the first 3 months.

None of these details have been verified by Chase yet. But we’ll let you know when we hear more.

These updates won’t knock the Chase Sapphire Reserve off our list of the best Chase credit cards. But some of us will be disappointed by the changes.

Chase Sapphire Reserve Benefit Changes

According to the leaked memo, the updates to the Chase Sapphire Reserve will occur on August 26, 2018. And they say cardholders will be advised of the changes early this month.

Here’s a screenshot:

1. Not a Big Loss – No More Earning 3X Points on Reimbursed Travel Purchases

One of the reasons many of us keep the Chase Sapphire Reserve long term is the up to $300 travel statement credit per account anniversary year. This helps offset the $550 annual fee substantially!

The credit is staying, but you’ll NO longer earn 3X Chase Ultimate Rewards points per $1 for travel expenses that get reimbursed by the credit. That’s an effective loss of 900 Chase Ultimate Rewards points per anniversary year ($300 X 3 points per $1).

This isn’t a huge deal in the grand scheme of things. With the Chase Sapphire Reserve, 900 Chase Ultimate Rewards points are worth ~$14 (900 points X 1.5 cents per point) when you redeem them for travel through the Chase Ultimate Rewards travel portal. But potentially more if you transfer points to airline and hotel partners like Hyatt or United Airlines.

2. Big Change for Families and Groups – New 2-Guest Limit at Priority Pass Select Lounges

Most cards that come with Priority Pass Select membership already impose limits on the number of free guests you can bring with you into the lounge. But the Chase Sapphire Reserve (and Ritz-Carlton Rewards® Credit Card) are unique in that they currently have NO cap on the number of pals that can tag along with you (capacity permitting).

With the Chase Sapphire Reserve changes, you’ll be restricted to a maximum of 2 guests. Any additional guests will cost $27, and will be billed to your card.

This is a major bummer for folks who travel with their family (a family of 4, like mine, will have to pay an additional $27 to access lounges). Or if you often travel with a bunch of friends or work colleagues.

I’m not terribly surprised at the new rules, to be honest. Overcrowding in lounges is becoming a big issue, and the revised policy is likely targeted at those who overdid it by bringing in massive numbers of people (like their tour group, or sports team).

If you frequently travel with a partner, it could be worth adding them as an authorized user to your Chase Sapphire Reserve card for $75 per year. That way, you’ll each get 2 guests. And they’ll be able to enter airport lounges on their own.

It’ll be interesting to see if the Ritz-Carlton Rewards® Credit Card will still offer unlimited guests in the future. In the meantime, I’ll continue using the Priority Pass Select membership that comes with my Citi Prestige. It allows 2 guests or immediate family (spouse / domestic partner and children under 18).

3. Savvy Shoppers Won’t Get Price Protection

Recently, Chase announced changes to the United MileagePlus® Explorer Card, which included removing the price protection perk.

Now, the Chase Sapphire Reserve is also removing price protection. Currently, you’ll get reimbursed for the price difference if an item you purchased with your card is advertised at a lower price within 90 days of purchase.

There’s a maximum of up to $500 per item and $2,500 per year. And there are other restrictions (read about them here).

Again, unless you were a heavy user of this benefit, these changes probably won’t matter much. And there are alternative, similar programs, like Citi Price Rewind.

The Good News – A Brand New Chase Ink Card!

New cards are always exciting! And at first glance, the rumored new Chase Ink Business Unlimited looks like a good one!

Here’s the memo:

With the new Chase Ink Business Unlimited card, you’ll earn $500 bonus cash back after spending $3,000 on purchases in the first 3 months of account opening.

And instead of having bonus categories, you’ll earn an unlimited 1.5% cash back on all purchases. This could be an excellent card if your small business does a lot of non-bonused spending!

According to the memo, the rest of the benefits and pricing will be the same as the Chase Ink Business Cash Credit Card, which currently has an increased $500 (50,000 Chase Ultimate Rewards points) sign-up bonus after meeting the same minimum spending requirement.

So we can expect this card will have no annual fee. And, if you have certain other Chase cards (Chase Sapphire Preferred Card, Chase Sapphire Reserve, or Ink Business Preferred Credit Card), it’s likely you’ll be able to combine points to those cards and transfer them to travel partners, much like you can with the Ink Business Cash, Chase Freedom, or Chase Freedom Unlimited.

Stay tuned! We’ll share more as soon as we know.

Bottom Line

There are unconfirmed changes coming to the Chase Sapphire Reserve card. According to a leaked memo, starting August 26, 2018:

- You won’t earn 3X Chase Ultimate Rewards points per $1 on travel purchases that are reimbursed by the up to $300 annual travel credit

- You’ll only be allowed a maximum of 2 guests at Priority Pass Select lounges – previously, this was unlimited (subject to capacity)

- Price protection is being discontinued

These changes hit hardest on folks who enjoyed bringing their larger family or group of friends into Priority Pass Select lounges. I wish they’d at least make an exception for families, like the Citi Prestige Card does. It allows 2 guests or immediate family (spouse / domestic partner and children under 18).

But it’s not all bad news. There’s also a rumored new small business card coming our way this month. The Chase Ink Business Unlimited card will offer $500 bonus cash back after spending $3,000 on purchases in the first 3 months of account opening. And you’ll earn an unlimited 1.5% cash back on all purchases.

Thanks, IAD Gr8, as always, for the heads up on Twitter. 🙂

Will these updates change your credit card strategy going forward? I’d love to hear your comments.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!