Quick Tips to Give Your Kids a Head Start on Their Miles & Points Journey!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Family travel is a huge part of the miles & points world. Lots of folks get into this hobby because they want to visit family, or they want to vacation with their family.

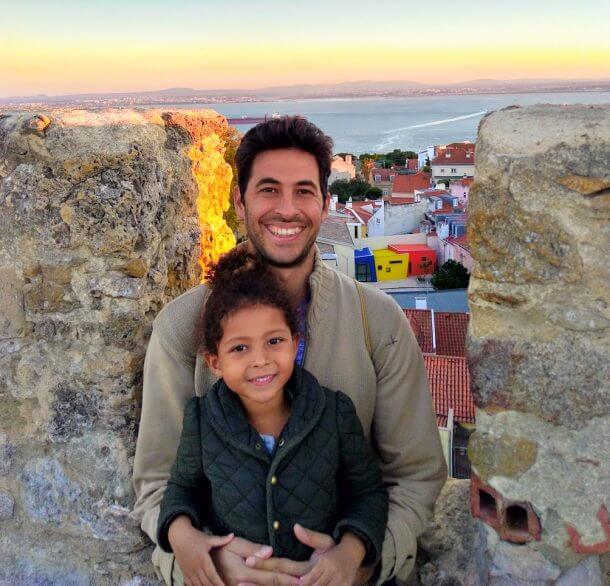

David, author of Wise Flys, is a family travel expert. So I asked him to share with you his top tips for family travel each week!

David: As a parent and miles & points enthusiast, I’ve already started helping my 4-year-old daughter establish credit history by adding her as an authorized user to certain credit card accounts. And she has her own frequent flyer accounts, so she can earn miles for eligible flights, which can really add up over time!

Giving a child a credit card is also an excellent opportunity to teach them about healthy credit and responsible financial habits, including paying balances off in full each month.

Having your kids sign up for frequent flyer programs is a great way to show the value of miles, points, or cash back. This can help them get excited about their future trip planning.

Tips for Parents to Introduce Children to the Miles & Points Hobby

Teaching children about credit cards and miles & points can encourage their passion for Big Travel with Small Money! Here are a couple of tips to get your kids started in the miles & points hobby.

1. Add Your Child As An Authorized User

Authorized user credit cards are great for kids because they can help them start building a credit history and increase their credit score.

It’s never too early to start establishing credit history. My 4-year-old daughter is an authorized user on my Bank of America and Chase credit card accounts. If your child is old enough to make responsible credit card purchases, you can benefit by earning miles and points when they shop.

Plus, certain credit cards offer bonus miles or points just for adding an authorized user. Being an authorized user can be a learning experience for your children. You can teach them about:

- Paying card balances in full each month

- How to budget

- Avoid fees

- Staying organized and managing bill payments

Some card issuers require an authorized user to be a certain age. Here’s a look at the requirements for some major banks:

| Credit Card issuer | Minimum Authorized User Age |

|---|---|

| American Express | 15 |

| Bank of America | None |

| Barclaycard | 13 |

| Capital One | None |

| Chase | None |

| Citi | None |

| Discover | 15 |

| US Bank | 16 |

| Wells Fargo | None |

Keep in mind that as the primary cardholder, you’re responsible for ALL charges to your account. So don’t add a child if you’re concerned about them buying a lifetime supply of toys the first chance they get.

Once you’ve given your child the responsibility of using credit, you can expect they will make some mistakes along the way. As adults, we sometimes make financial mistakes, too. But as long as you learn from the mistakes, it can be a worthwhile educational experience!

A $50 mistake for a teenage child is much easier to recover from than a $5,000 mistake later in life. Learning good financial habits at a young age can set you up on a path toward responsible spending the rest of your life!

Banks do NOT pull a credit report for authorized user accounts, because the primary account holder is responsible for the charges. And that’s good news because hard pulls can temporarily lower your credit score by ~3 to ~5 points.

After establishing credit history as an authorized user, your child can apply for their own travel credit card when they turn 18. The great part is that authorized users can earn a sign-up bonus on the same card if they decide to apply in the future.

Because your son or daughter will have a head start with credit cards, it’s possible they might qualify for an excellent miles & points card.

2. Create Frequent Flyer Accounts for Your Children

There’s no minimum age to get a frequent flyer account. Even if your children only fly occasionally on family trips, the miles they earn can add up over time!

Teaching your kids the value of airline miles and points can help them get excited about their future in the hobby. And accumulating frequent flyer miles over time could get them enough for an award flight to exciting destinations when they’re ready to travel on their own!

Just keep in mind, miles in most US based airline programs expire after 18 months of no earning or redemption activity.

Bottom Line

You can help your kids establish credit history by adding them as an authorized user to your credit card account. My 4-year-old daughter is already an authorized user on my Bank of America and Chase credit card accounts.

Having a credit history will help your kids once they turn 18 and can apply for their own top travel credit cards. Plus, teaching your kids about earning valuable miles & points can spark their interest in travel and encourage healthy credit habits. And you’ll earn miles, points, or cash back for purchases they make as an authorized user!

Don’t forget to create frequent flyer accounts for your children. Accumulating miles for paid flights every so often can really add up over time and might even be enough for an award flight!

Do you have any credit card or frequent flyer tips to share with fellow parents? I’d love to hear in the comments below!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!