How to apply for a Chase business card (A step by step guide)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Don’t miss out on the miles and points that you can earn with a small-business credit card – qualifying for a business card is easier than you think.

Knowing how to fill out a Chase business-card application for lucrative business credit cards like the Ink Business Preferred® Credit Card (and it’s 100,000-point bonus) can be intimidating or confusing if you’ve never done it. If you’re one of those people, you’re not alone.

Here are some guidelines to help you through the process.

Are you eligible for a small-business card?

You might qualify as a business if you sell on eBay, Amazon or on local sites for a profit. Any for-profit venture is a business — babysitting, lawn mowing, tutoring, etc. Small-business cards make it simple to separate personal and business expenses, and if you’re just starting out, it can be an easy way to invest in the business and earn miles and points at the same time.

In addition, you don’t need an Employer Identification Number (EIN) or six-figure revenue. I applied for an Ink Business Cash® Credit Card using my Social Security Number (SSN) as my tax ID because I am a sole proprietor.

Chase business cards and the “5/24 rule”

If you’ve opened five or more personal credit cards (from any bank) in the past 24 months, you won’t be approved for a new Chase business credit card.

Most of the time, the business credit cards you’ve opened in the previous 24 months don’t count toward the five-card limit. For example, business cards from American Express, Bank of America, Citi, Wells Fargo and even Chase don’t count against you because they don’t appear on your personal credit report. You’ll find more information about how to find out if you’re over the Chase “5/24 rule” here.

How to complete a Chase small-business credit card application

All Chase business-card applications ask virtually the same questions, but if you’re applying for an airline credit card (United Airlines credit card, Southwest credit card, etc) have your loyalty account number on hand to put on the application. If you don’t have a loyalty account before applying, you will be assigned one.

These screenshots are from an application for the Chase Ink Business Preferred.

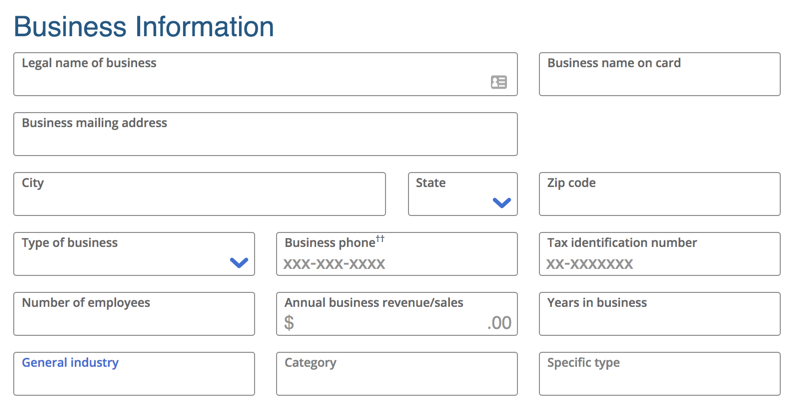

Tell Chase about your business

Here’s how to fill out this form.

Legal name of business: If you are a sole proprietor, your legal business name can be your own name or the name of your business.

Business name on card: This is the business name you want to appear on your credit card. It can be your name or a variation of your name with your profession – Jane Doe Photography.

Business mailing address: Use your home address if you run the business from your home.

Business phone: Use can use your personal phone number if that’s all that you have.

Type of business: Choose sole proprietor (a business owned by one person), partnership (a business owned by two or more people) or select the appropriate legal structure of your business (LLC, corporation, etc.).

Taxpayer identification number: If you don’t have an Employer Identification Number (EIN), use your Social Security Number (SSN). The box is formatted differently than your Social Security Number, but both numbers are nine digits long, so it works.

Number of employees: This is the total number of employees you have. Select “1” if you’re a sole proprietor.

Annual business revenue or sales: Enter the total amount you receive annually for selling your products or services. If you are just starting out and haven’t sold anything yet, enter zero.

Years in business: Enter the number of years since you started the business. This includes the time it took to get up and running before you earned any money or made a profit.

Select an industry, category and type: Select the options that best describe your business.

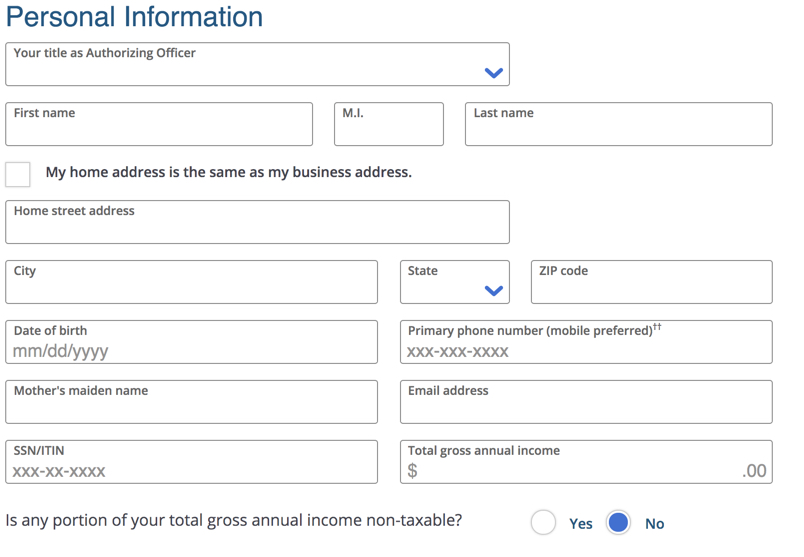

Tell Chase about yourself

As a business owner, you are personally responsible for paying the Chase credit card bill. Chase wants to know what your income is to verify that you will be able to pay.

First, select your authorizing officer title. For a sole proprietor, you will be the owner. Then, enter your personal contact information. For your gross annual income, you can include money you receive from a job, your businesses and your spouse’s income.

Even though Chase business cards don’t appear on your personal credit report, Chase still needs to check your credit score. Enter your personal phone number, email, date of birth, Social Security Number (even if you entered it before) and your mother’s maiden name.

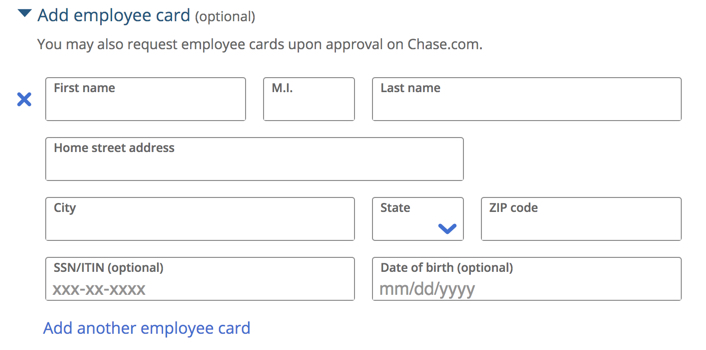

Add employee cards (optional)

Adding employee cards can be a great way to keep track of expenses, so if you have any employees who need a card, add them here.

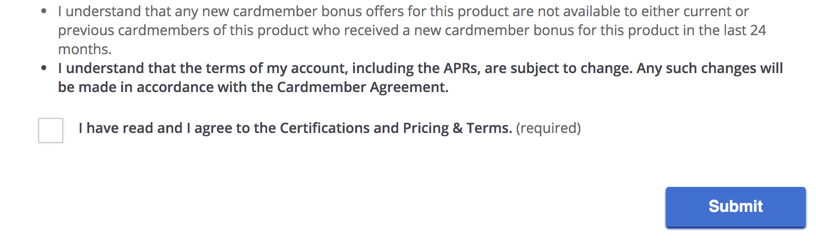

Submit your application

This is your last chance to review the details of your application. After making sure you entered everything correctly, check the box to agree to the terms and click “Submit.”

If your application is denied, I recommend calling the Chase business reconsideration line at 800-453-9719.

Occasionally, Chase will ask for a few more details about your business or ask you to verify certain information. You can sometimes move credit from one card to another or offer to close an existing card to get Chase to change its decision. I did so when I applied for the Ink Business Cash Credit Card and was initially denied. But a Chase agent was able to move credit from an existing card to the new card in order to push the approval through.

Even if you’re unsuccessful, calling Chase will give you a better idea of what you’ll need to change to be approved next time.

Our favorite Chase business credit cards

- Ink Business Preferred® Credit Card – 100,000 Ultimate Rewards points (worth up to $1,250 in travel through the Chase travel portal) after you spend $15,000 on purchases in the first three months from account opening

- Ink Business Cash® Credit Card – $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening.

- Ink Business Unlimited® Credit Card – $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening.

- Southwest® Rapid Rewards® Performance Business Credit Card – 80,000 Southwest points after spending $5,000 on purchases in the first three months of account opening.

Also, note that the three Chase Ink small business cards are considered different card products. This means you’re eligible to earn the sign-up bonus on each card. The only application restriction is the Chase 5/24 rule.

I wouldn’t recommend applying for all three Chase Ink business cards at the same time. Spreading out the applications will make it easier to meet the minimum spending requirements on each card.

FAQs about applying for a Chase business card

Can anyone get a Chase business card?

As mentioned above, you need a for-profit venture to qualify for a business card. That can be anything from selling baked goods at your local farmers market to running a small business that has multiple employees.

Just remember, even if you’re eligible for a small business card, it’s ultimately up to the bank to decide whether or not they will approve you.

How long does it take to get approved for a Chase business card?

Sometimes an approval is immediate. You’ll submit your application and within seconds, your approval will be confirmed.

But other times, the bank may need more time to review your application, after which they may request additional information or documentation. Because of this, it can take anywhere from 7-10 days, or even up to 30 days, for the bank to make a decision.

Our best advice is to be patient, offer any supporting documentation that you can, and if you’re initially declined, call in and ask for your application to be reconsidered.

Is it hard to get approved for a Chase business card?

If you run a small business and have good credit, getting approved for a Chase business card shouldn’t be too difficult. That said, you’ll likely be asked to provide proof that you’re running a for-profit venture. Chase may ask for things like an old invoice or a copy of your business license as proof. So be prepared. Otherwise, the process is very similar to applying for a personal credit card.

Bottom line

Small-business credit cards aren’t merely a great way to earn lucrative welcome bonuses; they’re helpful in keeping track of expenses and useful for investing in your business. Qualifying for a Chase business card might be easier than you think. Chase business cards won’t show up on your personal credit report, so they don’t count against your “5/24” limit.

You don’t need to make six-figure sales or have an Employer Identification Number to get approved for a Chase business card. You can use your Social Security Number on your application. And if you’re just starting the business, it’s OK to have little or no profit.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!