An Even Better Deal for This Hotel Card (I’ll Show You the Trick to Finding It!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Did you miss out on the improved Chase IHG 80,000 point offer this summer? Now you’ve got another chance to get in on the deal – and it’s even sweeter!

When you make a test booking on the IHG website, you’ll see an offer for 80,000 IHG points after meeting minimum spending requirements. Plus a $50 statement credit after your first purchase!

Emily and I don’t earn a commission for this offer. But we’re committed to sharing the best deals with our readers!

I’ll show you how to find the better offer for the Chase IHG card.

Better Offer for the Chase IHG Card

Link: Chase IHG Card

Link: IHG Hotels

To see the better offer for the Chase IHG card, navigate to the IHG website (do NOT log-in) and search for any hotel in the US. This trick doesn’t seem to work if you search for international locations.

Proceed to the final booking screen and scroll down to find the ad for the better offer. You’ll earn 80,000 IHG points after spending $1,000 on purchases in the first 3 months of account opening. And a $50 statement credit after your first purchase!

Normally, the Chase IHG card’s sign-up bonus is 60,000 IHG points after meeting the minimum spending. And even the previous improved offer for 80,000 IHG points did NOT include the $50 statement credit. So this is an excellent deal!

You’ll also get:

- 5 points per $1 spent at IHG hotels

- 2 points per $1 spent at gas stations, grocery stores, and restaurants

- 1 point per $1 spent on all other purchases

- 5,000 bonus IHG points adding an authorized user and making a purchase within the same 3 month period

- Free night at any IHG hotel after each cardmember anniversary

- Platinum Elite Status as long as you have the card (50% bonus points, complimentary room upgrades if available, priority check-in)

- 10% points rebate (up to 100,000 points back per year)

- No foreign transaction fees

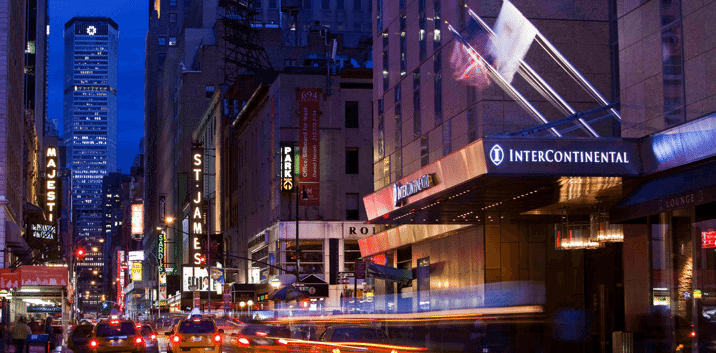

The $49 annual fee is waived the first year. But most folks (including me!) keep the Chase IHG card year after year, even with the annual fee. Because you get a free night at ANY IHG hotel each cardmember anniversary. Even at fancy resorts or luxury hotels like the InterContinental New York Times Square!

IHG hotels include Candlewood Suites, Crowne Plaza, EVEN Hotels, Holiday Inn, Holiday Inn Club Vacations, Holiday Inn Express, Holiday Inn Resorts, Hotel Indigo, InterContinental Hotels & Resorts, and Staybridge Suites brand hotels.

Chase’s tighter application rules do NOT apply to the Chase IHG card. So even if you’ve opened 5+ cards in the past 24 months (not including Chase business cards and these other business cards), you’re still eligible to sign-up!

Bottom Line

The improved offer for the Chase IHG card is back (and even better!). To find the offer, make a test booking at a US hotel on the IHG website.

You’ll earn 80,000 IHG points after spending $1,000 on purchases in the first 3 months of account opening. And a $50 statement credit after your first purchase.

I keep the Chase IHG card in my wallet year after year, even with the $49 annual fee. Because the annual free night at ANY IHG hotel can be worth many times more than that!

We don’t earn a commission for this offer, but we’ll always share the best deals with you!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!