How We Earn Money From the Blog (And Why You Should Care!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

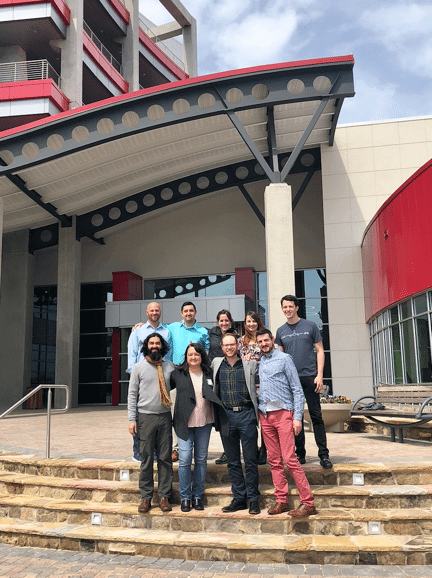

It’s been ~7 years since Emily and I started Million Mile Secrets out of a small apartment in Kansas. What was then a hobby blog has grown into a larger family with our terrific team writing posts to help y’all get Big Travel with Small Money!

Folks often ask how we make money at Million Mile Secrets. So we’re here to answer common questions and explain what we do (and will NOT do) to keep the blog running and the team working hard for you.

We earn a commission if you apply for certain credit cards using affiliate links found on the site. You don’t have to use our links, but we appreciate it greatly because it helps support the blog!

It’s how Million Mile Secrets has been able to grow over the years. And we’re super grateful for our readers who’ve helped us along the way.

We’ll spill the beans about how we make money at Million Mile Secrets!

How Million Mile Secrets Makes Money

Many miles and points blogs earn money from credit card affiliate links. And we do too. We don’t earn a dollar unless you are APPROVED for a card through our affiliate links. But you’ve probably noticed that we often write about cards for which we do NOT have an affiliate link. So we earn nothing! And that’s OK!

We believe keeping y’all (our readers!) up to date with the very best deals is a win-win for both us AND you. Because earning credit card sign-up bonuses is the best way to get Big Travel with Small Money.

We’re extremely proud that the Hot Deals page always has the best links to publicly-available credit card offers regardless of whether they pay us a commission or not. By publicly available, we mean that anyone can apply (NOT targeted offers, but a little more on that later!).

So here’s more about affiliate links and how we use them on Million Mile Secrets.

What Is an Affiliate Link?

An affiliate link is a way to identify which website generated a sale for advertisers. Using affiliate links is the primary way we earn money on the blog.

Million Mile Secrets earns a commission if you apply for certain credit cards using our affiliate links. And we’re always very grateful to readers who apply for cards using them. 🙂

Earning and keeping our readers’ trust is how we’ve been able to grow the blog and bring you more of the best travel deals. We call it as we see it – if it’s a great deal, we’ll tell you! But if it stinks, we’ll come right out and say so, too.

When folks get approved for cards through our links and we generate income, we want to re-invest in readers by hiring more writers to create more useful content you want. Or by creating video guides and trying out new posts to help y’all learn about miles and points faster.

We share the very best offers because it’s the right thing to do for you, our readers. And we won’t stop doing it!

How Do We Use Affiliate Links?

At Million Mile Secrets, we will ALWAYS tell you about the best available public offer, whether we make money from it or not. And we’re very upfront about it!

For example, if our affiliate link (that pays us a commission) is only good for 30,000 miles, but there’s a public link that is offering 50,000 miles, we’ll let you know. That way you’ll get the best deal!

You can visit the Hot Deals page for the latest and greatest credit card offers.

1. Disclosure

At the top of each post we always include the following disclosure:

Million Mile Secrets supports our readers with thousands of hours of research and writing to help you get Big Travel with Small Money. You support us (and you!) by signing-up for credit cards through partner links on our site, which earn us a commission. This keeps our small team employed and working hard for you! Here’s a longer explanation of our Advertising Policy.

And we want to make it easy for anyone to know – up front – while reading a post, if a link in the post pays us a commission.

2. Better Non-Affiliate Offers

There’s a very clear conflict of interest if one link (with a lower sign-up bonus) pays the website owner more than another publicly available link.

So we always try to list the best offers for cards even if these don’t pay us a commission.

Sometimes the links with the higher sign-up bonus require you to make a test hotel reservation, for example. And we will let you know if that’s the case!

We’ve also written about how to use the CardMatch tool to find increased credit card offers.

In addition, we’ll update links on the Hot Deals page within a few hours of a reader commenting or emailing with links to a better credit card offer. Yes, we won’t earn a penny when you click on a non-affiliate link instead of our affiliate link. But folks who use those links will also earn more miles, points, or statement credit!

And that’s why we’re here. To help you get Big Travel with Small Money!

So please continue to email or comment if you find links to better offers. 😉

How Can You Tell If It’s an Affiliate Link or Not?

We’ll let you know if a certain offer doesn’t earn us a commission. Because we want to be as transparent as possible! But the easiest way to tell if a card currently earns us a commission it to go to the Hot Deals page and look at the card image.

If you see a generic card image with the Million Mile Secrets logo, that’s a non-affiliate link.

If you see an actual picture of the card, it’s an affiliate deal from one of our partners. So we’ll earn a commission when you apply through that link.

Credit card deals and affiliate links change from time to time, so the best way to get the most up-to-date deals is by checking the Hot Deals page.

Other Ways We Make (or Don’t Make!) Money

1. Advertisements

Sometimes we’re approached to sell the space on the blog sidebars and below the blog header. Occasionally, an alternative non-affiliate offer becomes available which is much better than the affiliate offer.

We try to always advertise the best offer everywhere on the site. But this can get tricky, because we could sell an ad slot with a 3-month term, for example. And there could be a better non-affiliate link available before the 3-month contract is up.

In those cases, we’ll write a post telling you of the better link and, as always, it will be on the Hot Deals page.

You’ll always find the best public links (that we’re aware of!) on the Hot Deals page, regardless of the ads on the main page.

2. Paid Promotions, Endorsements, or Links

We’re often asked if we accept money to write a product review, mention a product, or include links in posts.

We’ve never accepted money or products in exchange for a review. However, if the product is really travel related (and helpful to you, our readers!) we may consider testing the product, writing a candid review, and giving away the product in a reader giveaway on the blog.

For example, we wrote a review about Get Me Global Entry. It’s a paid service that saves you the hassle of checking for open Global Entry appointment times. Instead of taking a 20% cut for each person who signed up through our link, we passed the 20% discount onto our readers!

We’ve also turned down writing about travel when a discount in exchange for a review was offered, or it was arranged and paid for by the travel provider. We do NOT want a discount or kickback to influence our sincere feelings about a product.

Again, we always want you to get the best deal, whether we make money from it or not.

Bottom Line

The small team at Million Mile Secrets is committed to sharing the best deals, top offers, and in-depth research with YOU, our readers. That’s why we’ll always tell it like it is and recommend the best offers, regardless of whether or not they earn us an affiliate commission.

We make money (which helps maintain and grow the blog) when you apply for cards through our affiliate links. But you’ll always find the highest public offers for cards on our Hot Deals page – even if we could advertise an offer for fewer miles and points which would make us money.

We do this because we want you to make better decisions when it comes time to apply for the BEST travel credit cards. Because Big Travel with Small Money is our passion, and we love seeing y’all traveling for next to nothing, too!

So don’t be shy to email or comment when you find links to better public offers than what’s on the blog. Drop us a note, leave a comment on the Contact Me page, or reach out on Facebook or Twitter.

We’re deeply grateful for all of your support through the years. And we’ll continue to write and share our best tips and tricks for Big Travel!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!