You Can Save a Friend or Family Member $100 With This Card Perk!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Bob, commented:

I have several credit cards that will reimburse me for the Global Entry application fee. Can I pay for a friend’s application fee using my card and still get the credit?

Excellent question, Bob! You certainly can!

When you pay the $100 Global Entry fee with cards like the AMEX Platinum or Chase Sapphire Reserve, you’ll automatically get a credit for the charge once every 4 or 5 years (depending on the card).

This terrific perk is NOT linked to the cardholder. So you can pay the fee for ANYONE and still get the credit. This is great for folks who already have Global Entry.

If you have a Global Entry fee credit to spare, I’m sure your friends will appreciate you saving them time and money! 🙂

I’ll remind y’all which cards come with the $100 Global Entry fee credit! And how you can use it to pay the fee for a friend or family member.

Global Entry Fee Credit

Link: Apply for Global Entry

Link: How to Fill Out the Global Entry Application

Global Entry is fantastic because it can save you lots of time by getting you quickly through US Customs and Immigration when you return to the US from abroad.

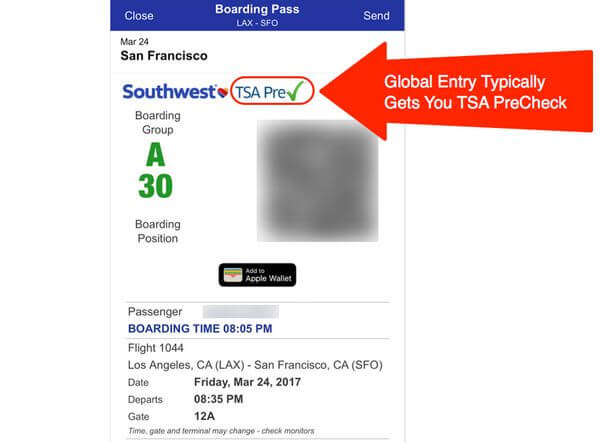

And once you’re approved for Global Entry, you’ll usually get access to the TSA PreCheck security line when traveling domestically.

I’ve written about how to fill out the Global Entry application. And how you can add your known traveler number to airline reservations.

Global Entry costs $100 and is valid for 5 years. But the fee is refunded if you pay with one of these cards:

- The Platinum Card® from American Express

- The Business Platinum® Card from American Express

- The Platinum Card® from American Express Exclusively for Mercedes-Benz

- Chase Sapphire Reserve

- Ritz-Carlton Rewards® Credit Card

- Citi® / AAdvantage® Executive World Elite™ Mastercard®

- Citi Prestige® Card

- U.S. Bank Altitude™ Reserve Visa Infinite® Card

If you have more than one of these cards and already have Global Entry, you can use the benefit to pay someone else’s application fee.

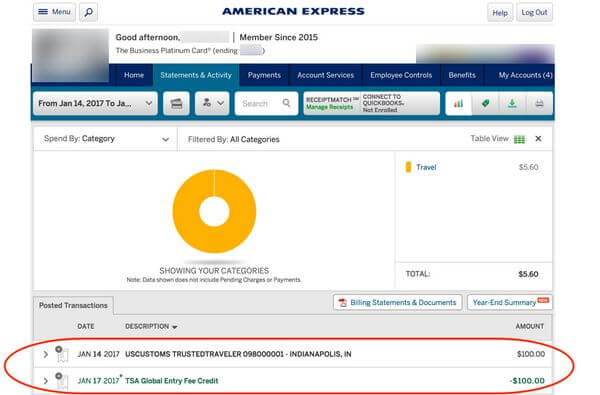

For example, team member Keith already has Global Entry. Instead of letting the credit on his AMEX Business Platinum card go to waste, he paid for a friend’s application fee.

After paying the $100 fee, he received a refund within 3 days.

Taking advantage of this benefit can be especially useful for families or groups of friends who travel together frequently. Because it’s no fun speeding through immigration or security just to wait for everyone else you’re traveling with!

And not having to pay $100 should be an easy way to convince your friends or family to apply for Global Entry.

Remember, you have to complete an in-person interview after your Global Entry application is conditionally approved. Here’s a list of all the enrollment centers and whether or not they will accept walk-in appointments.

And keep in mind, you can renew your Global Entry membership online up to 1 year before it expires.

Bottom Line

Global Entry saves you time going through immigration when you return to the US from overseas. And it typically gets you access to the TSA PreCheck security line when traveling domestically.

If you already have Global Entry, you can pay for a friend or family member to apply and get a $100 credit with one of these cards:

- The Platinum Card® from American Express

- The Business Platinum® Card from American Express

- The Platinum Card® from American Express Exclusively for Mercedes-Benz

- Chase Sapphire Reserve

- Ritz-Carlton Rewards® Credit Card

- Citi® / AAdvantage® Executive World Elite™ Mastercard®

- Citi Prestige® Card

- US Bank Altitude Reserve Visa Infinite® Card

These cards automatically get you a Global Entry fee credit once every 4 or 5 years (depending on the card).

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!