Better Deal! Earn 30,000 Miles and $100 Statement Credit With Bank of America Alaska Airlines Card!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Yesterday, I wrote the Bank of America Alaska Airlines card increased its sign-up bonus to 30,000 Alaska Airlines miles after completing minimum spending requirements. But the offer did NOT include a $100 statement credit like the previous 25,000 mile offer.

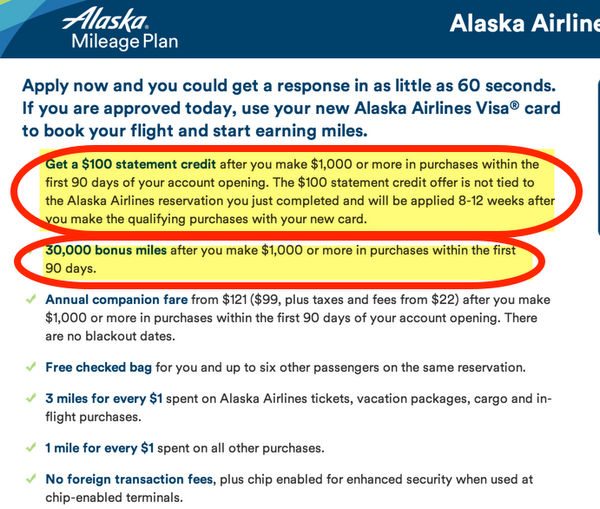

Now, via Frequent Miler, there’s a way to get the 30,000 mile offer WITH a $100 statement credit after spending $1,000 on purchases in the first 90 days of opening your account.

To see the better offer, you’ll have to make a test booking on the Alaska Airlines website.

I’ll show you how to find the deal!

Alaska Airlines 30,000 Miles + $100 Statement Credit

Link: Alaska Airlines

To see the better offer, search for a flight on the Alaska Airlines website.

Select a random flight and add it to your cart. You’ll have to enter your name, date of birth, phone number, and email, but skip the seat selection and other add-ons like insurance.

Once you get to the payment screen, you’ll see an ad for the better offer. Click “Apply Now For an Instant Decision“. Don’t worry, you won’t book the flight!

With this offer, you’ll earn 30,000 Alaska Airlines miles and a $100 statement credit after you spend $1,000 on purchases in the first 90 days of opening your account.

That’s an excellent deal, because the $100 statement credit more than makes up for the $75 annual fee (NOT waived the first year).

You’ll also get:

- 3 Alaska Airlines miles per $1 you spend on Alaska Airlines

- 1 Alaska Airlines mile per $1 you spend on everything else

- A coach Companion Fare certificate each year (your companion travels with you on a paid ticket for $99 plus tax)

- First checked bag free for yourself and up to 6 companions traveling on the same reservation

- Access to Visa Signature benefits

- No foreign transaction fees (new!)

Check out my full review of the card. And how to use Alaska Airlines miles!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!