How to build your credit score with the right habits

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Collecting miles & points with travel credit cards is a fantastic hobby that can save you thousands of dollars on your travel expenses. But you can’t get in the game if you don’t have a good credit score and most of the best cards require excellent credit.

So let’s take a look some ways you can increase your credit score. You’re better off paying your balances in full and increasing your credit score before you apply for new rewards cards.

How is your score calculated?

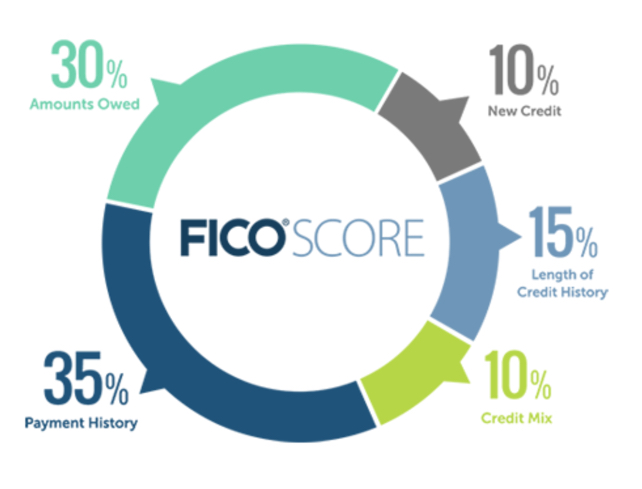

FICO is the main score we refer to when we’re talking about your credit score, although there are other scores like UltraFICO. According to FICO, your credit score is based on five categories:

- Payment history – 35%

- Amount owed or credit utilization – 30%

- Length of credit history – 15%

- New credit – 10%

- Types of credit used (revolving credit vs. installment loans) – 10%

You can check your credit with free services like myBankrate. It’s important to maintain a good credit score so you can get good rates on major loans (i.e. home, car and student). So what can you do to increase your score? Well, it depends on your situation, but you always have options, even if you’re just starting to build your credit.

Do you have a low credit score?

The most important aspect of your credit score is your payment history, because it accounts for 35% of your credit score. So the best thing you can do for your credit is pay your bills on time.

Assuming everything on your credit report is accurate, here are some tips & tools that can help get your credit back on track:

Use auto-pay

Auto-pay is an excellent way to ensure your bills are paid on-time. This not only helps your credit, but also helps you avoid paying late fees. However, start out slowly and make sure you have sufficient funds in your bank account, so you don’t wind up paying overdraft fees instead.

Change your due dates

You can request to change your due dates to a more convenient time. For example, some people like to have all their bills due the same week they get paid.

Use services that help track your accounts or budget

There are also fantastic services that can help you keep track of your account balances and payments dates including:

- Mint – Puts your loans, bank and credit card accounts all in one place and helps you budget

- Mobills – Budgeting app with a great visual layout that allows you to see your budgeting progress

- Prism – Allows you to see all your bills and financial accounts in one place

Pay off debt

Unpaid bills can really weigh down your credit. So take steps to pay down these debts. If you have credit card debt, one option may be to transfer the balance to a card that offers no interest for a set period, usually 12 to 18 months. The Chase Slate card is an excellent option because it also does not charge a balance transfer fee during the first 60 days, which can cost 3%-5% of the amount you transfer with other cards.

However, this is only worth it if you can pay off the balance during the no interest period. Because after that you will be charged regular interest rates depending on your credit score.

Information for the Chase Slate card has been collected independently by Million Mile Secrets and has not been reviewed by the card issuer.

Do you have a short credit history?

It’s possible to have a low credit score because you have little to no credit history. For example, maybe you’re a college student and you’ve never had a credit card. If that’s you, here are some ways you can start demonstrating to banks that you know how to handle credit responsibly.

Sign-up for a no-annual-fee card

The length of your credit history accounts for 15% of your score. You can increase the length of your credit history by applying for credit cards with no annual fee and keeping your oldest cards. In addition to increasing your credit score, no-annual-fee cards are the a great way to establish a good relationship with the banks.

Check out this article for a list of our top no-annual-fee cards.

Become an authorized user

Having a relative or close friend with excellent credit add you as an authorized user on one of their credit card accounts can also increase your score. Many credit cards allow the cardholder to add an authorized user for free. This is an easy way to begin developing a credit history and you will still be eligible for the intro bonus if you decide get the same card on your own once you have better credit.

But there are some drawbacks to this strategy. First, make sure you trust that the primary cardholder handles their credit responsibly. If they don’t pay their bills on time or max out the card this will negatively impact your credit score.

The primary cardholder should be aware that there are certain risks that go along with adding you as an authorized user:

- They are ultimately responsible for your charges

- Their credit score could decrease if you use a large percentage of the available credit or if you don’t pay your bill on time

The primary account holder does have the option to remove you as authorized user. Usually this can be done with a call to the bank and you will be removed within 24 hours. However, each bank is different.

Note that if you’re removed as an authorized user, the credit history will also be removed from your credit report, so this will impact your score.

Apply for cards that don’t require a high credit score

Another way to establish a credit history is by applying for a credit cards that are easier to get approved for such as:

- Secured cards – To get a secured card, like the Capital One Platinum Secured Credit Card, you have to make a cash deposit and that amount becomes your credit limit. It’s like getting a secured loan from the bank.

- Entry-level credit & store cards – Cards like the Capital One Platinum Credit Card and some retail store cards are specifically targeted for those with a low credit score or a limited credit history.

- Certain rewards cards – Many reward credit cards require that you have excellent credit. But cards like the Chase Freedom® don’t require a long credit history.

If you’re just starting out or don’t have much credit history, check out our list of best credit cards for beginners.

Bottom line

If you can’t pay your bills in full and on time each month, earning miles and points from credit cards may not be a good choice for you. That’s because most rewards credit cards charge high interest rates which can negate any benefit you get from the miles and points.

Additionally, you need a good credit score before you can get approved for the cards with the best deals. So the first step to earning miles and points is to make sure you take steps to pay your bills on time and establish a credit history.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Featured photo by REDPIXEL.PL/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!