50,000 Membership Rewards Points (at Least $500 in Travel) With The Business Gold Rewards Card From American Express OPEN

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.How to Fill out an American Express Business Card Application

The Business Gold Rewards Card from American Express OPEN is now offering 50,000 Membership Rewards points after spending $5,000 within 3 months.

This is a better offer than the usual offer on this card. And it requires less spending than the occasional limited-time offers for 75,000 points which require $10,000 in spending.

I’ve written before that the 75,000 point offers are not worth the amount of minimum spending required (unless you can mange the minimum spending comfortably) because they take away from sign-up bonuses on other cards.

But spending $5,000 within 3 months is much more manageable! Here’s how to fill out a business card application.

What Can I Do With 50,000 Points?

Here’s a post on what to do with Membership Rewards points.

You can get at least $500 in air travel when you use 50,000 Membership Rewards points to book travel using the “Pay with Points” option.

The advantage of using Pay with Points is that you get lots of flexibility with booking your travel because you don’t have to search for only low availability flights. If there is a flight for sale, you can use points to book it. You will also earn miles on the flight you book.

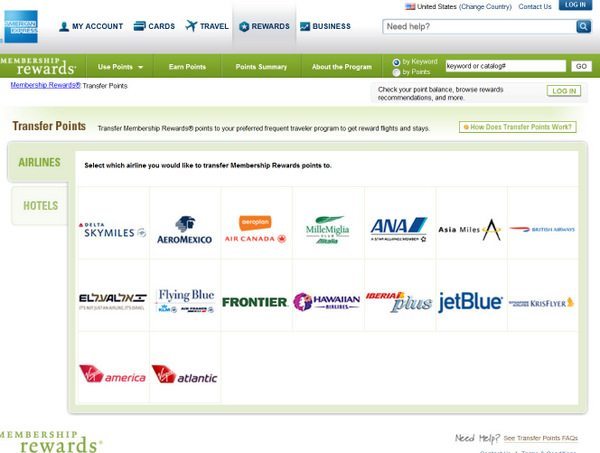

You can transfer Membership Rewards points to airline partners and then redeem for flights within the US, to Hawaii, and the rest of the world. The bad news is that most partners charge fuel surcharges on international awards which vary by the partner airline you fly on.

Membership Rewards airline and hotel transfer partners often have transfer bonuses, so you may be able to transfer your points to, say, British Airways and get 40% more points.

The $175 annual fee is waived for the 1st year and you earn:

- 3X AMEX Membership Rewards points in 1 of 5 categories (you choose): Airfare purchased directly from airlines, US advertising in select media, US gas stations, US shipping, and US hardware, software, and cloud computing purchases

- 2x points in the remaining 4 categories

- 1X points on other purchases

- NO foreign transaction fees

- Terms Apply

Who is Eligible For The Bonus?

The terms also say that the: “”

You should be able to get the 50,000 point bonus if you have have the American Express personal Premier Rewards Gold and the Platinum card since the terms preclude only business cards within the last 12 months.

But you will not get the bonus if it is less than 12 months from when you cancelled The Business Gold Rewards Card from American Express OPEN.

Bottom Line

American Express seems to be running limited time mega sign-up bonus offers, but with large minimum spending requirements.

We’ve seen similar offers before for 1 day only, so it is nice to see this offer for 50,000 Membership Rewards points run for a bit longer. And with a more manageable minimum spending requirement!

Here’s a post on how to fill out the business card application.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!