How to Earn LOTS of Points With American Express Bluebird for Mortgages, ATM Withdrawals, Rent, Loans, & Almost ALL Transactions!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Don’t forget to follow me on Facebook or Twitter!My American Express Bluebird prepaid card showed up in the mail today and I have lots of good news to share! Note that if you already have an American Express Serve account, you have to cancel your Serve account before applying for American Express Bluebird.

I successful loaded my Bluebird prepaid card with mile earning debit cards at Wal-Mart for no extra fee.

And I also loaded my Bluebird account using a Vanilla Reload which I bought from Office Depot using my Chase Ink Bold. Note that this option is no longer available, but you may be able to find Vanilla Reloads at CVS, Walgreen’s or other locations.

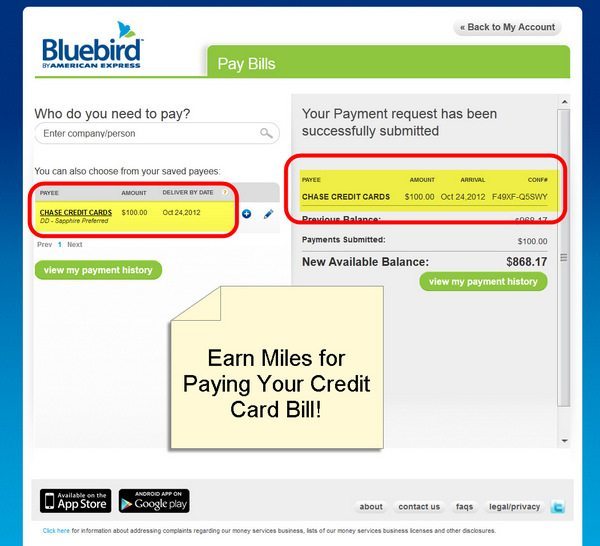

Next, I paid $100 towards my Chase credit card bill (as a test) and withdrew money from an ATM using my Bluebird card!

And I was extremely excited to earn 5X Chase Ultimate Rewards points (which can be transferred to different airlines and hotels including, United, Hyatt & Southwest) for both these transactions which otherwise would never earn miles and points!

If you earn 5X Ultimate Rewards points on only $2,000 per month (easy to do when you can pay rent, mortgages, loans, credit card bills, and regular purchases) with Bluebird, you earn 120,000 Chase Ultimate Rewards points a year. That is enough for a business class ticket to almost anywhere on United, 5 nights at a top Hyatt category 6 hotel, or ~$2,000 in travel on Southwest!

As I wrote a few days ago when I bought my Bluebird starter kit:

Bluebird has the potential (I’m still testing) to turbo charge the way we earn miles and points. You can pay rent, utilities college tuition, mortgages, and even credit card bills and potentially earn lots of miles and points!

Well, my experiments were successful, and you can earn lots of miles or points by paying your rent, mortgage & credit card bill using the Pay Bill feature on your Bluebird card. You can’t do this as easily with any other pre-paid card. And potentially earning 5X Chase Ultimate Rewards points for everyday transactions is the icing on the cake!

However, I wasn’t able to use Bluebird to buy money orders (since it appears to swipe as a credit card) or to get cash back during regular purchases. I also couldn’t buy or reload my Bluebird with a Wal-Mart gift card or with a credit card.

Load Bluebird with a Debit Card

You can load Bluebird with a miles or points earning debit card (Delta, Alaska Air, or American Airlines) online. But this option is expensive. It costs $2 per debit card load and you are limited to $100 per day and $1,000 per month, so I don’t recommend this method.

However, you CAN load your Bluebird card with a debit card for FREE when you reload at a Wal-Mart store. I used my Delta, Alaska Air, & American Airlines cards to successfully load my Bluebird card at a Wal-Mart store.

The Alaska Air and American Airlines debit cards earn only 0.5 miles per $1 spent, so the Delta debit card which earns 1 mile per $1 spent could be the better choice, but it depends which miles you’d rather earn.

The teller swiped my Bluebird card and asked me how much I wanted to load on the card. I loaded $100 from my Delta debit card, $300 from my Alaska Air debit card, and $100 from my American Airlines debit card.

My bank statements haven’t yet closed, so I don’t know if I will earn miles, but I’m pretty sure that I will since the purchase will be coded as a Wal-Mart purchase. I’ve earned miles for buying money orders and paying bills at Wal-Mart, so I’m not sure why this will be any different.

There is a $1,000 daily limit & $5,000 monthly limit for loading your Bluebird card with a debit card at Wal-Mart stores. This $1,000 limit is shared with the $1,000 daily limit for Vanilla Network reloads below.

I loaded $500 with debit cards in Wal-Mart, but was only able to add an additional $500 with a Vanilla Reload.

Load Bluebird (Indirectly) with a Credit Card

Bluebird can be reloaded with a Vanilla reload.

You load your Bluebird card (which you can order online) with a points earning debit card at Wal-Mart. You can also reload Bluebird with Vanilla Reload cards which you can buy at CVS, Walgreen’s or other locations. Alternate with other credit cards so that you’re not spending too much at buying Vanilla Reloads with any one credit card.

Here’s a post on other credit cards to use with Bluebird, so that you’re not maxing out on just 1 card.

For example, let’s say you use a regular credit or your AMEX Hilton (which earns 6x points at CVS) to buy a $500 Vanilla reload card from CVS. You will earn 500 points with the Chase Sapphire Preferred or 3,000 Hilton points with the AMEX Hilton and pay $3.95 for the Vanilla reload fee.

You then load your Bluebird card with the $500 Vanilla reload card and use it for transactions for which you don’t usually earn miles or points – such as paying mortgages (using the Bluebird Bill Pay), withdrawing from ATMs, paying other persons, etc.

You come out slightly ahead when you use a credit card or any other credit card including a cash back credit card.

You can load your Bluebird up to $1,000 per day and up to $5,000 per month using a Vanilla reload. This $1,000 limit is shared with the $1,000 daily limit for Vanilla Network reloads below.

I tried exceeding the daily limit, but wasn’t able to. Note that you can buy as many Vanilla Reloads from CVS or other location, but can only load $1,000 per day on your Bluebird card.

However, you can store up to $10,000 on your Bluebird card so you can always load $5,000 in one month and $5,000 another month if you have to make a payment of more than $5,000.

I was initially skeptical that this would be allowed because, as a marketing brand manager, I don’t understand why American Express would spend a lot of money to develop the “Bluebird” brand & develop “Bluebird feeder packs” but then dilute that expensively created Bluebird brand equity by allowing you to reload the card with a “Vanilla” reload.

But this isn’t a marketing blog, and I’m glad to be wrong because loading Bluebird with Vanilla reload packs opens up a lot of lucrative points earning opportunities!

How To Load Bluebird with a Vanilla ReloadCheck out this post to see the different type of Vanilla cards available.

You load your Bluebird account with a Vanilla Reload by going to VanillaReload.com.

Enter your Bluebird card number in the “Card Number” field

Enter the PIN number from the Vanilla Reload Pack in the “PIN Number” field and click “Submit.“

What Can Bluebird Do For You?

Here’s a recap on how to earn miles and points using Bluebird.

1. Pay Rent, Mortgage, Credit Card Bills, Utilities, or College Tuition. The best use of Bluebird to me is the ability to pay for transactions which can’t usually be made with a miles or points earning credit card.Bluebird has a Pay Bills option which includes most mortgage companies, utilities, and other payees.

I tried to pay Emily’s Sallie Mae student loan, but the system didn’t recognize her account number. I’m assuming this is a glitch and will try again later.

But I was able to pay $100 towards my Chase credit card bill using the Bluebird Bill Pay! I love being able to earn miles and points for paying my credit card bill!

You can use the Pay Bill feature to pay your mortgage, car loan, student loan, and many other payees!

There is a limit of $10,000 in payments per month for payments to businesses already listed in the Bluebird Pay Bills system.

2. Pay ANYONE. This is actually part of #1 above, but I wanted to emphasize just how important this can be.For example, let’s say that the person or business you want to pay, say, your apartment complex or your contractor or your college is NOT listed in the Bluebird Pay Bills option.

You can enter that person’s or business information manually and send up to $5,000 per month, per account, with Bluebird. Bluebird will send a check to the person or business, for free!

So you can earn miles and points when you fund your Bluebird account with a credit or debit card and then use Bluebird to send a check to anyone else!

3. ATM Withdrawals. You can load your Bluebird card with a miles and points earning debit card (Delta, Alaska Air, or American Airlines) or with Vanilla reload packets (bought with a credit card)and earn miles or points for the load.You can then withdraw up to $500 per day (in up to 3 daily withdrawals) and up to $2,000 per month with your Bluebird card.

You can use this feature to help complete a minimum spending requirement on a card.

For example, say you have to spend $3,000 within 3 months on a credit card. You can buy Vanilla Reloads from an Office Depot with your credit card and load them on your Bluebird card.

Buying the Vanilla Reloads at Office Depot with your credit card will count towards the spending requirement on your credit card and earn miles and points. You then use your Bluebird for regular purchases including withdrawing money from ATMs.

There is a $2 fee per ATM withdrawal (waived until November 4, 2012), unless you set up Direct Deposit to your Bluebird card and use a MoneyPass ATM. Many employers will let you split your paycheck to different bank accounts.

If you use an ATM outside the MoneyPass ATM network, you will be charged an ATM fee which varies depending on the ATM machine.

You can also use this for meeting a bonus spending requirement on a credit card such as, say, spending on the Delta credit cards to earn extra MQMs and miles.

However, I’d make sure to not abuse this method and to also use Birdbird for regular spending as well!

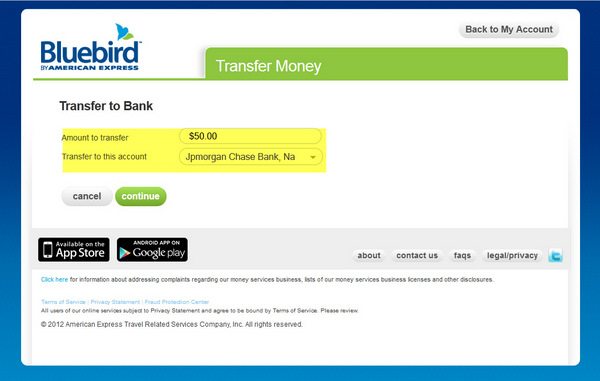

4. Transfer Money to Your Bank Account. You can also transfer money to your linked bank account from your Bluebird account.This is very similar to Amazon payments, but I’d be very careful to NOT just fund your Bluebird account (to earn miles and points or to meet a minimum spending requirement) and then withdraw money to your bank account.

Here’s a post on other credit cards to use with Bluebird, so that you’re not maxing out one one card.

Much thanks goes to Frequent Miler for showing us how to earn 5X points with American Express Prepaid cards!

CAUTION

– Do NOT only fund Bluebird with a credit card and then withdraw money from an ATM or transfer money to your checking account. That is very easy to detect. Withdraw only as much money as an average person would – that is in the hundreds of dollars and NOT thousands of dollars per week. – Use Bluebird for lots of routine transactions as well. If all you do with Bluebird is withdraw money from the ATM or to your bank account, you are likely to be shut down because you are unprofitable for American Express. – I would NOT abuse the category bonus for using the AMEX Hilton card to buy Vanilla Reload cards at CVS. AMEX financial reviews are not fun.You WILL get shut down if you try to spend tens of thousands of dollars per month at CVS with any one card.

I can’t give you an exact amount (you’ve got to decide for yourself), but $1,500 to $2,000 per month in CVS *could* be pushing the envelope.

Alternate with other credit cards so that you’re not spending too much at one location with Ink credit cards.

Here’s a post on other credit cards to use with Bluebird, so that you’re not maxing out on just one card.

Go slow and easy and enjoy the many benefits of the Bluebird card.

Bottom Line

You can order a Bluebird card online at Bluebird.com.

Bluebird opens up a whole new world of point earning opportunities, but you have to go easy. Otherwise you risk having not only your Bluebird account shut down, but also your credit cards.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!