1 Million in 1 Year: How I Earned 1 Million Miles & Points From Credit Card Bonuses in 2011

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Don’t forget to follow me on Facebook or Twitter!

[I currently earn a referral for only 2 out of the 16 cards mentioned in this post – The American Express SPG card and the Citi Thank You Premier card which Emily and I both applied for. As always, we are very grateful to the readers who apply for those cards using the links on the blog!]When CNN Travel interviewed me in November 2011, I had earned only~900,000 miles and points for the year.

But I ended 2011 with over 1 million miles and points from credit card sign-up bonuses, and my credit score is still above 730.

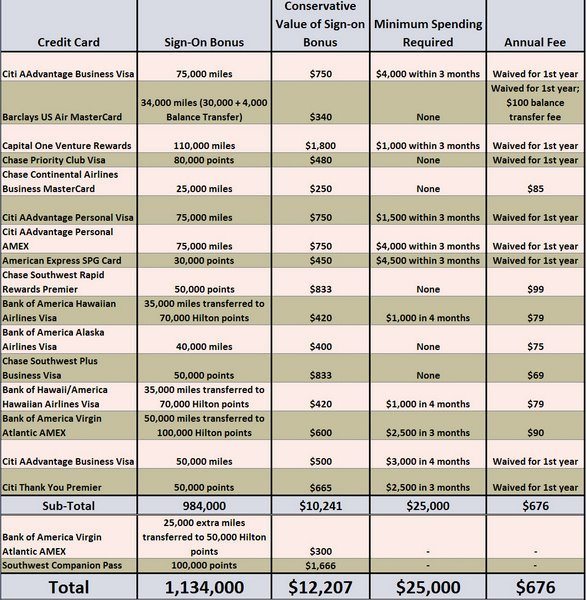

That’s worth $10,241 if you assume a very conservative value of 1.5 cents per SPG point, 1 cent per airline mile, & 0.6 cents per Hilton and Priority Club hotel point.

Much more importantly, Emily and I have had terrific memories thanks to miles and points such as traveling to India in First Class, having a weekend proposal in London, visiting Brazil during Carnival, surprise birthday getaways, flying to see our families more often, and taking our parents on trips they otherwise wouldn’t have gone on.

I valued my Capital One Venture Reward points at $1,800 because I redeemed them for $1,800 in Hyatt certificates. And I valued 110,000 Southwest Airlines points at 1.66 cents each which is the fixed rate to purchase “wanna get away” fares.

The retail value of the trips which I will take using these miles and points is much more than $10,241. But I wouldn’t pay the retail value for those trips, so I don’t value the miles and points at retail value.

I had to complete minimum spending of $25,000 to earn the full sign-on bonus for most of these cards, and paid annual fees of $676. I’m not a big spender, but managed to complete the minimum spending by using the 40+ ways to complete minimum spending requirements.

But if I had spent $25,676 ($25,000 in minimum spending + $676 in annual fees) on a 2% cash back card (my opportunity cost or my next best option), I would have earned only $514 ($25,676 X 2%).

Now you know why I spend so much time collecting miles and points!

I’m unlikely to earn that many miles & points in 2012, but I’m confident that I’ll easily earn a few hundred thousand miles and points to have Big Travel with Small Money.

The 2011 highlights for me were:

- Earning 275,000 American Airline miles (that’s 11 free tickets within the US or 2 business class tickets to almost anywhere in the world) from 4 Citi American Airline cards and earning lifetime Gold elite status on American Airlines for earning over 1 million miles

- Earning a Companion Pass on Southwest Airlines which will let Emily travel with me for free for the rest of 2012 and will let us have $3,666 worth of free travel

- Having a credit score over 730 which will let me continue to earn miles and points from credit card sign-up bonuses

Why you shouldn’t do this

I don’t recommend applying for credit cards if you’ve got a big loan coming up, in which case it is prudent to get the best interest rate on your loan before applying for credit cards. I suggest no credit card applications in the 2 years before you get a big loan.

If you’ve got a short credit history or no credit history, you’re better off building your credit history and demonstrating your credit worthiness by making small purchases and paying them off in full before applying for more credit cards.

There’s also no point applying for miles and points credit cards if you can’t pay off your credit card balances in FULL each month. The interest rates on all the cards below are very high, and will negate most of the miles and points you’ve earned.

You’ll never get ahead paying interest on credit cards, so don’t do it!

My strategy

I apply for credit cards in batches throughout the year (3 to 4 month intervals), and occasionally apply for cards outside those batches if there is a great limited time deal.

As I wrote last Monday:

In general, I apply for credit cards from different banks so that I don’t have credit inquiries (which usually happens every time you apply for credit) hitting only 1 credit bureau.

I want to limit the number of inquiries on each of the credit bureaus, because banks don’t like seeing too many inquiries (especially in the last 6 to 12 months) on your credit report.

Equifax, Experian, and TransUnion are the 3 main credit bureaus in the US. Banks will usually request a copy of your credit report from at least 1 (sometimes more) of these credit bureaus. The exact credit bureau used depends on where you live and which bank you’ve applied for credit from.

Here’s a post which explains how to find out which credit bureau a bank may use.

Many credit cards require you to complete a certain minimum amount of spending before receiving the sign-up bonus. I am careful to see that I can complete the minimum spending and use the 40+ ways to complete minimum spending requirements.

My Credit Score

[I get a referral if you sign up for a free Credit Sesame score. Emily and I have used Credit Sesame for years and are very grateful to readers who sign-up using our link!]Both my free credit scores from Credit Sesame (Experian) and Credit Karma (TransUnion) are still above 700.

Credit Sesame and Credit Karma are not the official FICO scores which lenders use, but are proxies of your real credit score.

Credit SesameMy credit score of 735 is roughly the same where it was 6 months ago. I can’t see more than 6 months historic data on Credit Sesame.

My score dropped 32 points from 766 points in Jan 2011 to 734 points in Jan 2012. But since my score is above 700, I still get approved for credit cards.

January 2011 – 75,000 miles

1. Citi AAdvantage Business card. I applied for 2 Citi personal American Airline cards (Visa and American Express), but was denied because it wasn’t 18+ months since my last successful Citi American Airlines card approval.However, I was approved for the Citi American Airlines business card for 75,000 miles! Business cards are a great way to double up on the miles you earn, and I’ve written previously how you may qualify for a business credit card and how to fill out the application.

Business credit cards don’t have the same consumer protections as personal cards, so do your own research before applying for them.

February 2011 – 34,000 miles

2. Barclays US Air card. I applied for the Barclay’s US Air card because Barclay’s pulled my credit report from TransUnion. MyTransUnion credit report doesn’t see much activity (i.e. most banks don’t pull my TransUnion credit report when evaluating my credit) so this was a great way to get more miles and points. The current offer for the US Air card is 40,000 miles and is better than the version which I applied for. I got 25,000 miles as the sign-up bonus and 9,000 miles for making a 0% interest balance transfer for a $100 fee. March 2011 App-0-Rama – 215,000 miles and points 3. Capital One Venture Rewards. I applied for both the business and personal Capital One Venture card which had a promotion where they would match your existing miles with other airlines with Capital One’s Venture Rewards miles. So if you had, say, 100,000 miles in your Delta account, you would get 100,000 Venture Reward miles. You also got a 10,000 sign-up bonus for a total of 110,000 Venture Reward miles.I remember applying and getting approved for the personal version late at night while in Brazil and then excitedly explaining to Emily what I had done. But she just went back to sleep.

I redeemed slightly over 100,000 Capital One Venture miles for $1,800 in Hyatt gift certificates which I just used to pay for 2 rooms for 3 nights each at the Grand Hyatt in Bangkok.

But I wasn’t approved for the business version of the card and I couldn’t convince the reconsideration department to approve my application.

4. Chase Priority Club Visa. I signed up via a targeted offer for 80,000 (versus the regular 60,000) Priority Club points. If you’re wondering how to get the targeted offer, sign-up for Priority Club email and you should soon get an invitation for the 80,000 point offer.I also got credit towards Priority Club’s “Crack the Case” promotion which was an extremely lucrative promotion.

This is one of the few cards for which I gladly pay the $49 annual fee. That’s because I get a free night certificate every year (starting 1 year after you receive the card) which can be used at ANY Priority Club hotel including the expensive InterContinentals and Crowne Plazas.

5. Chase Continental Business MasterCard. Continental and United are merging so I could get the bonus on the Continental business card for only a limited time. I earned only 25,000 miles for this application, and I wonder if I should have waited for a more lucrative offer.I had to call the Chase reconsideration line to get approved for the business card (800-453-9719), but I was able to get it approved without much trouble.

July 2011 App-0-Rama – 340,000 miles and points

I wrote a more detailed report in my earlier post on my July App-O-Rama.

6 & 7. Citi AAdvantage Visa & AMEX. I applied for the Citi Visa and American Express using the 2-browser trick and was approved for both & earned another 150,000 miles.In my opinion, this was the best credit card deal available of all time and was the number one deal on the “Hot Deals” tab. I know that the Chase Sapphire Preferred is mesmerizing to some, but I’ll take 150,000 American Airline miles over 50,000 Ultimate Rewards points any day!

The current version where you could get up to 100,000 American Airlines miles, 4 lounge passes, and $300 in statement credits (after 2 purchases from American Airlines) by using the 2-browser trick is again, in my opinion, the BEST current credit card offer and is listed as #1 on the Hot Deals tab even though it doesn’t pay me a referral.

8. American Express Starwood Preferred Guest (SPG). I applied for this card with a 30,000 point sign-up bonus after spending $4,500 within 3 months via a referral on MilePoint (which was later open to everyone).The current offer is for 25,000 points after spending $5,000 within 6 months which is still a very good deal. The 30,000 point offer has surfaced in June/July in 2010 and 2011, so you may want to hold off until then for an extra 5,000 points.

9. Chase Southwest Rapid Rewards Premier. I paid the $99 fee and earned 50,000 points or $833 worth of US travel after the 1st purchase. Even better, the points counted towards the 110,000 points needed to earn a Companion Pass (where you can designate a Companion to fly with you for free). But I don’t know how much longer the points from the sign-up bonus will count towards the Companion Pass. 10. Bank of America Hawaiian Airlines. I paid the $79 fee and earned 35,000 Hawaiian Airline miles after spending $1,000 within 4 months. I immediately transferred these miles to Hilton hotel points at a 1:2 ratio and ended up earning 70,000 Hilton points.Hilton points are not worth as much as an air mile, but I’m always short on hotel points.

Warning: Bank of America may issue you a lower platinum card if you don’t qualify for the Signature card, which offers only 10,000 miles! You can’t select which version you’ll get, so be careful.

11. Bank of America Alaska Airlines card. I paid the $75 fee and earned 40,000 Alaska Airline miles. Alaska Airline miles are quite valuable because they can be redeemed on lots of different airlines. November 2011 App-0-Rama – 320,000 miles and pointsI wrote a more detailed report in my earlier post on my November App-O-Rama.

12. Chase Southwest Airlines Plus Business Card. I paid the $69 fee and earned 50,000 Rapid Rewards points which also counted towards the Southwest Companion Pass. I earned a Companion Pass and Emily and I will have up to $3,666 worth of Big Travel with Small Money! 13. Bank of America Virgin Atlantic AMEX. I paid the $90 fee and earned 50,000 Virgin Atlantic miles after spending $2,500 within 3 months and for adding 2 authorized users.I transferred Virgin Atlantic miles to Hilton hotel points in a 1:2 ratio and ended up with 100,000 Hilton points.

14. Bank of Hawaiian Airlines Visa. I paid the $79 fee and earned 35,000 Hawaiian Airline miles after spending $1,000 within 4 months.I transferred Hawaiian Airline miles to Hilton hotel points in a 1:2 ratio and ended up with 70,000 Hilton points.

Warning: Bank of America may issue you a lower platinum card, if you don’t qualify for the Signature card, and that card offers only 10,000 miles! You can’t select which version you’ll get, so be careful.

15. Citi AAdvantage Business card. I was also eventually approved (more on that later) for the Citi business AAdvantage Visa with a 50,000 point sign up bonus, 2 lounge passes, and a $150 statement credit for any American Airlines purchase after spending $3,000 within 4 months.This is a great deal and is much better than other versions of the card which offer 30,000 to 40,000 miles, but for a lower minimum spending of $750.

16. Citi Thank You Premier card. I was eventually approved for the Citi Thank You Premier card and will redeem the 50,000 point bonus for $665 in airfare within the US.This is a great card to use for coach trips within the US since there are no restrictions or capacity controls on the ticket you can buy.

But this only adds up to 984,000 miles & points!Yes, that’s right. But I got an extra 😉 25,000 Virgin Atlantic miles from Bank of America after completing the minimum spending requirement for the AMEX Virgin Atlantic card which I will convert into 50,000 Hilton points. I wouldn’t count on this happening to everyone though, but I’m not complaining!

And the 100,000 Southwest points ($1,666 worth of flights) which I earned from the Chase credit cards are actually worth 200,000 Southwest points ($3,332 worth of flights) because Emily will fly for free with me in 2012 (assuming I redeem 100,000 Southwest points during the validity of my Companion Pass).

Bottom Line: Emily and I (& our family and friends) will have lots of Big Travel with Small Money for years to come with the miles and points I earned from my 2011 App-o-Ramas!However, it is important to take care of your credit score and to not apply for too many credit cards at once. And don’t apply for credit cards if you have a big loan or can’t pay off your credit card balance.

If used correctly, your credit worthiness (credit score) could unlock lots of Big Travel with Small Money!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!