Virgin Atlantic credit card review: Earn up to 80,000 valuable miles

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Virgin Atlantic doesn’t get much attention, but it offers great value to people who fly its routes. And the exciting thing about its miles program isn’t actually flying on Virgin Atlantic, but instead, flying on partner airlines like Delta and ANA at surprisingly low redemption rates.

The increased offer on the Virgin Atlantic World Elite Mastercard® offers many opportunities to earn these miles. It even includes a new perk that allows you to bring a companion with you for no addition

al miles on your next reward flight and a way to earn elite status through spending alone. Those are just a few reasons why it’s on our list of the best airline credit cards.

That said, we we want to make sure you understand if this card fits your spending habits before applying. Here’s what you need to know:

Who is the Virgin Atlantic World Elite Mastercard for?

The Virgin Atlantic World Elite Mastercard is a good choice for those who value Virgin Atlantic miles, but it’s especially useful for anyone looking to fly in style on a product like Delta One Suites or ANA business class. For example, you can fly Delta business-class saver award seats for only 50,000 Virgin Atlantic miles one-way from the U.S. to Europe and 75,000 miles one-way to Australia. That’s a steal considering Delta charges 80,000+ miles for the same seats.

Current bonus

The Virgin Atlantic World Elite card offers up to 80,000 Virgin Atlantic bonus miles for a limited time. Earning the bonus is a little complicated, but the miles you earn can be incredibly valuable.

60,000 bonus miles after completing minimum introductory spend

Similar to other cards, the main chunk of your welcome bonus is earned by meeting minimum spending requirements during the first three months of getting your card. You can earn 60,000 Virgin Atlantic bonus miles after spending $2,000 within the first 90 days of account opening.

This is a generous welcome bonus with a lower-than-average spending requirement compared to other cards. Even if you don’t earn any other tiers of the welcome bonus, it is more than enough miles for two round-trip tickets to almost everywhere in the U.S.

Up to 5,000 bonus miles after adding authorized users

Another easy way to earn bonus miles with this card is to add authorized users to your account. You will receive 2,500 Virgin Atlantic bonus miles for each authorized user you add, with a maximum of two (for 5,000 bonus miles).

Up to 15,000 bonus miles after meeting annual spending requirements

The final way to complete your welcome bonus is by meeting tiered spending requirements during the first year. There are two tiers of bonus miles you can earn:

- Earn 7,500 bonus miles when you spend $15,000

- Earn an additional 7,500 bonus miles when you spend a total of $25,000

So if you spend $25,000+ on the card within 12 months of getting your Virgin Atlantic World Elite Mastercard, you can earn an additional 15,000 bonus miles on top of the miles you’d normally earn for that spending.

This is actually a bonus you can earn each anniversary year and is not limited to the first year. So we will consider it an ongoing perk of the card later on. But we listed it here because Virgin Atlantic considers it as part of the “up to 80,000 bonus miles” welcome bonus for the card.

If you are able to earn the entire welcome bonus by spending $2,000 in the first 90 days, adding two authorized users and spending $25,000 in the first calendar year, then you will be looking at that huge, limited-time welcome bonus of 80,000 Virgin Atlantic bonus miles.

Benefits and perks of the Virgin Atlantic World Elite Mastercard

The Virgin Atlantic World Elite Mastercard offers several perks that are focused on flying with Virgin Atlantic, making it a great value for those who fly this airline often.

Earn Virgin Atlantic miles on every purchase

With the Virgin Atlantic World Elite card you earn miles on any purchase you make with the card.

There are two categories for earning miles:

- Earn 3 Virgin Atlantic miles per $1 spent directly on Virgin Atlantic purchases

- Earn 1.5 Virgin Atlantic miles per $1 spent on all other purchases

Because Virgin Atlantic miles are generally worth about 1.5 cents each, that means you can earn ~4.5 cents in value (1.5 cents per mile x 3 miles = 4.5) per $1 on Virgin Atlantic purchases, or ~2.25 cents in value (1.5 cents per mile x 1.5 miles = 2.25) per $1 spent on all purchases.

Earn up to 15,000 Virgin Atlantic miles every year

Each year that you keep the card open, you have the opportunity to earn even more miles by hitting tiered spending requirements over the course of the year (discussed before in relation to the sign-up bonus).

To recap, the tiers are:

- 7,500 Virgin Atlantic bonus miles after you spend $15,000 or more each anniversary year

- 7,500 additional Virgin Atlantic bonus miles after you spend a total of $25,000 or more each anniversary year

So after spending $25,000 on this card during the year, you will have a total of 15,000 more miles awarded to you, on top of any of the miles you earn from normal spending on the card.

Consider for a moment that if you spent exactly $25,000 on this card throughout the year, you would be earning at least 52,500 miles at the lower 1.5 miles per $1 rate. That comes out to 2.1 miles per $1 spent total — which would be significantly higher if you use your card frequently for Virgin Atlantic purchases.

These totals are all based on the “anniversary year,” which means the rolling 12 months from when you signed up for your card. So if you apply for and open the account in October 2019, you have until October 2020 to meet the first year’s spending requirements. It resets after that and you have another 12 months to earn it again. (As we mentioned before, the first year’s points are considered part of the up to 80,000 mile welcome bonus.)

This anniversary bonus is a very good deal if you can realistically meet the spending requirements.

Bring a companion for no extra miles or get a seat upgrade once per year

The Virgin Atlantic World Elite Mastercard recently added a new benefit, allowing you to bring a free companion with you on a Virgin Atlantic award flight after spending $25,000 on the card in the previous anniversary year.

The companion ticket will be the same seat class as the ticket you purchase with miles and you’ll still need to pay any taxes or fees for the companion. However, Virgin Atlantic has some strange stipulations on which class you can book, depending on your elite status with the airline.

- Red Tier members can only use the companion voucher for a ticket in economy class

- Silver Tier members can use the companion voucher for a ticket in economy or premium economy

- Gold Tier members can use the companion voucher for a ticket in economy, premium economy or business class

There is good news for solo travelers or anyone who thinks they would not use the companion pass. Virgin Atlantic lets you choose instead to use the voucher for a seat upgrade from economy to premium economy. Just like the companion voucher, you can only use this upgrade on an award flight and it cannot be used to upgrade from premium economy to business class.

You can choose either a companion fare or a free seat upgrade, but not both. Generally, the companion fare will be more valuable, but for those who are unlikely to need a companion ticket, it is great that Virgin Atlantic offers an alternative.

This perk is only earned after spending $25,000 or more during the previous year, but you have a full two years to redeem it.

Earn elite tier qualifying points on all purchases

Flying on any airline can be drastically improved by having elite status. Virgin Atlantic offers a great opportunity to gain elite status without even needing to fly.

You can earn 25 elite tier points for every $2,500 in purchases you make with this card each month. There is a maximum of 50 elite tier points to be earned each month (600 elite tier points per year).

Elite status with Virgin Atlantic starts at 400 elite tier points for Silver Status. Gold Status requires 1,000 elite tier points. This means that you can earn Silver Status through spending alone.

How to redeem Virgin Atlantic miles

Virgin Atlantic miles offer surprising value compared to other airlines, but unfortunately, also come with extremely high fuel surcharges and fees when flying on Virgin Atlantic metal. Flights from New York-JFK to London Heathrow (LHR) run just 20,000 award miles round-trip, which seems incredible until you see the $300+ in taxes and fees.

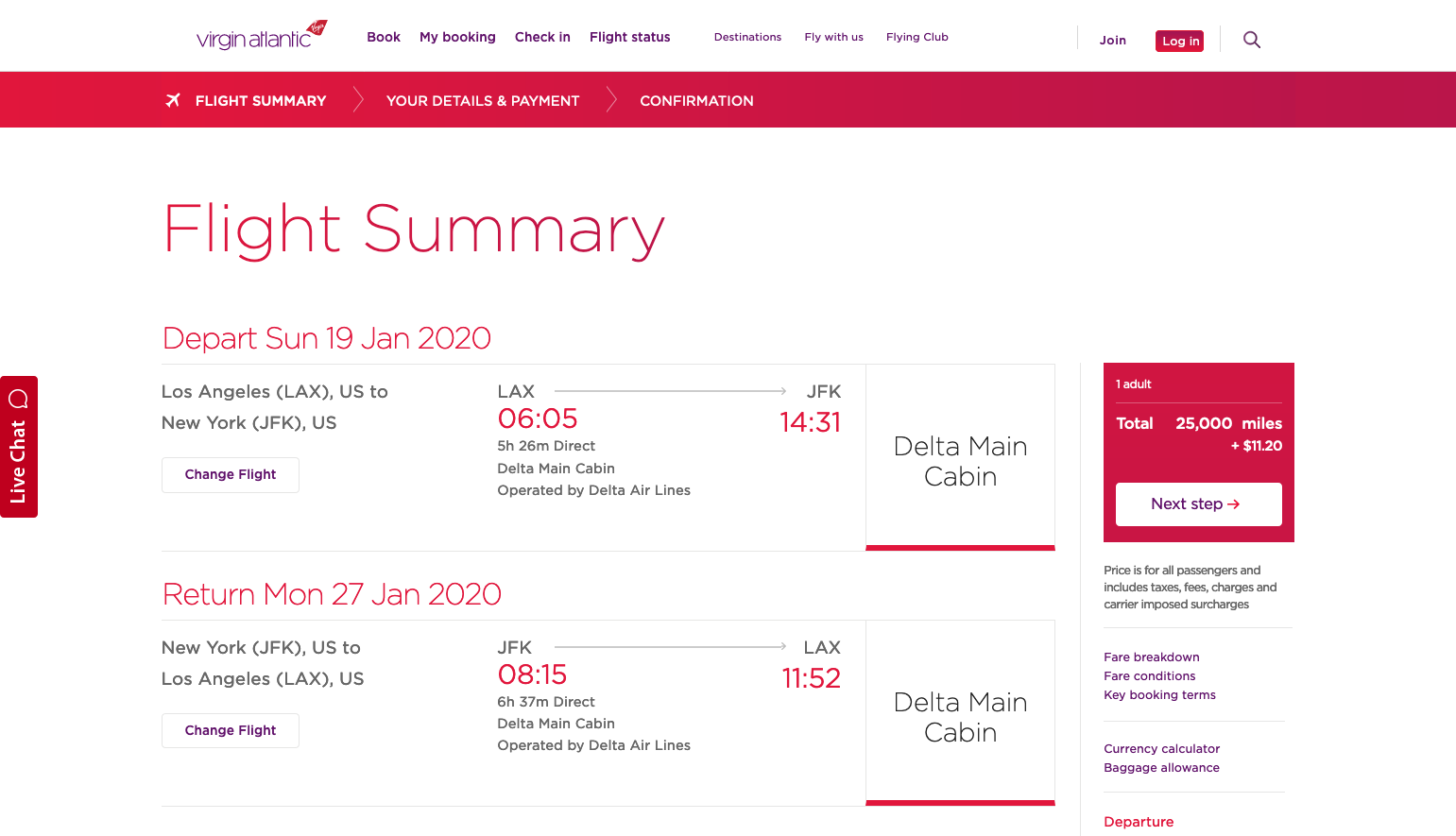

Where the Virgin Atlantic bonus miles can be more valuable is when flying on partners like ANA or Delta Air Lines. For example, I was able to find flights between Los Angeles (LAX) and New York (JFK) on Delta for just 25,000 Virgin Atlantic miles round-trip (plus ~$11 in fees). This means earning the full welcome bonus would be more than enough for three round-trip flights across the country on Delta in economy. Now that’s a deal to get excited about.

Another sweet spot within Virgin Atlantic’s award chart is for flights on ANA between the U.S. and Japan.

A first-class round trip flight from the U.S. will only cost you 110,000 miles from the eastern and central U.S., or 120,000 miles from the western U.S. and Canada. Business class flights follow the same zones and cost 90,000 and 95,000 miles, respectively. Given that business class seats can easily go for $7,000+ and first class seats for nearly $15,000, these are incredible deals.

In addition to a variety of great ways to use Virgin Atlantic miles, redeeming miles through the website is simple. You can even preview award flight costs without logging into an account, which makes it great for seeing what points are worth. Virgin Atlantic also lets you search for reward flights for Delta through its website, but booking a flight on many of their other partner airlines requires a call to customer service.

The biggest downside to Virgin Atlantic’s reward program is that many of the flights they operate will have very high surcharges. I have even seen reward flights where the surcharge was within a few dollars of the cash price of the ticket. Keep an eye out for these before you book an award.

Is the annual fee worth it?

The Virgin Atlantic World Elite Mastercard has an annual fee of $90 which is not waived the first year.

Taking into account the annual fee and all of the perks, this is a great card if you fly on Virgin Atlantic frequently and you are willing to spend at least $25,000 per year on the card.

Most of the benefits of the card are tied to this $25,000 spending requirement. If you spend at least that much, you will earn 15,000 bonus miles. This means you could earn as much as 2.1 miles per $1 spent on the card, which represents a value of around 3.15 cents per $1 if you value each mile at 1.5 cents each. This is more than a 3% return on everyday spending with no limits, which is high for a credit card.

By spending $25,000 in a year, you also qualify for the companion pass or seat upgrade voucher, which offers value worth at least double the annual fee in most cases, sometimes more.

Depending upon your monthly spending, you will also likely qualify for bonus elite tier points. If we assume you spend $2,500 a month for 10 months, that earns you 250 elite tier points (25 tier points per month x 10 months) with the card.

The $25,000 limit also ensures that you get the majority of the up to 80,000-mile welcome bonus offered by the card. Even without any authorized users to add, you can earn 75,000 miles through the 60,000-mile introductory spending bonus and the 15,000-mile annual spending bonus.

All of this makes the Virgin Atlantic World Elite Mastercard a good deal if you can hit that $25,000 spending amount each year. For perspective, that means spending ~$2,084 per month on the card.

If you don’t think that you can spend $25,000 per year, we doubt this card would be worth keeping long term. There are other ways to earn Virgin Atlantic miles through most of the flexible travel rewards programs like Chase Ultimate Rewards, Citi ThankYou Rewards, and American Express Membership Rewards. Other cards earn points that would probably offer you more value and flexibility than this card can and present a better overall value.

Cards similar to the Virgin Atlantic World Elite Mastercard

Because Virgin Atlantic miles are available through three of the major flexible point travel rewards programs, there are actually several alternative cards to consider.

American Express Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou all allow you to transfer points at a 1:1 ratio to Virgin Atlantic miles. This means that any card from these programs may actually be better suited for you if you only fly on Virgin Atlantic occasionally.

Here are a few cards from these programs that might be worth considering.

- Chase Sapphire Preferred® Card – This card has a similar welcome bonus (60,000 Ultimate Rewards points after you spend $4,000 in the first three months of account opening) and a similar annual fee ($95). But it offers far more flexibility if you don’t want to be locked into a single airline’s program. It also includes a favorite perk of mine, primary auto rental insurance.

- Citi Premier® Card – This card has a similar welcome bonus (60,000 ThankYou points after you spend $4,000 in the first three months of account opening) and a similar annual fee ($95). It offers some really great bonus categories like 3x on travel and gas, 2x on restaurants and entertainment, and 1x on everything else. Because these points transfer to Virgin Atlantic at a 1:1 ratio, it might actually be faster to earn Virgin Atlantic miles on the Citi Premier than through the Virgin Atlantic World Elite card.

- American Express® Gold Card – This card has a slightly higher annual fee of $250 (see rates and fees). It also earns 4x Membership Rewards points on restaurants and 4x at U.S. supermarkets (on up to $25,000 in purchases each calendar year, then 1x) plus 3x Membership Rewards points on flights booked directly with the airline or on the Amex travel site. These might add up more quickly if you eat out often and spend a lot at supermarkets.

It is worth checking out the bonus categories for these other cards, because it is possible to actually earn more Virgin Atlantic miles from these cards if you find a card that matches your spending patterns well.

Bottom line

The Virgin Atlantic World Elite Mastercard is a great credit card for anyone who values Virgin Atlantic miles. The card currently has an increased welcome bonus offer of up to 80,000 miles, and if you spend enough on the card to earn the companion pass, the bonus miles each year or the elite tier points it earns can make it worth keeping year after year.

On the other hand, for many people, opening a card from a flexible rewards program may be a better fit. These cards have better spending bonus categories and more flexibility when you redeem your points since you aren’t locked into a specific airline — and many of these programs have points that transfer directly to Virgin Atlantic.

If you’re deciding between different cards, be sure to check out our guide to the best airline credit cards. You’re sure to find one that fits your spending habits and travel goals.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets email newsletter.

For rates and fees of the Amex Gold card, click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!