United Airlines Just Ditched Its Award Chart, but I’m Stocking Up on United Miles With the Explorer Card Anyway – Here’s Why

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.INSIDER SECRET: If you want to get Global Entry or TSA PreCheck for free, the United℠ Explorer Card is a perfect card to consider. Its annual fee is waived the first year and you can get your Global Entry or TSA PreCheck fee reimbursed once every four years when you pay for it with the card.

Right now (through May 16, 2019) the United℠ Explorer Card has an increased sign-up bonus of up to 60,000 United miles after meeting tiered minimum spending requirements.

I had been waiting for a while to see an increased offer for this card, but when the news broke that United Airlines was killing their award chart in favor of dynamic award pricing (like Delta), I initially wanted to avoid stockpiling United miles. Even though the United Airlines news is bad, it actually won’t have a serious impact on the trip to Europe I am planning on booking using United miles.

So I went ahead and signed up for the card — OK, I signed my wife up for it, but that’s just the way we do things in our house.

3 Reasons I Am Happy to Earn 60,000 United Miles With the United Airlines Explorer Card

Apply for the Chase United Explorer Card

Read our review: Chase United Explorer

Through May 16, 2019, when you open the Chase United Explorer card, you’ll earn up to 60,000 United miles after qualifying purchases:

- 40,000 bonus miles after spending $2,000 on purchases within the first three months of account opening

- Additional 20,000 bonus miles after spending a total of $8,000 on purchases within the first six months of account opening

There’s a $95 annual fee with this card, but it’s waived the first year.

The United Explorer card is affected by the Chase 5/24 rule. So if you’ve opened five or more cards from any bank in the past 24 months you won’t be eligible for this card. However, small business cards from some banks (including Chase small business cards) won’t add to your 5/24 count.

1. Partner Business & First Class Awards Are the Same Price as Before

As of now, United Airlines hasn’t changed the cost of premium partner awards. This is good news because United Airlines is part of the Star Alliance so it has access to awards on a bunch of great airlines, like Lufthansa, Austrian, SWISS, Turkish Airlines, and ANA.

One of the biggest strengths of using United miles is that you don’t have to pay extra fuel surcharges on award tickets, which can save you hundreds of dollars on some award flights, especially if you’re flying to Europe.

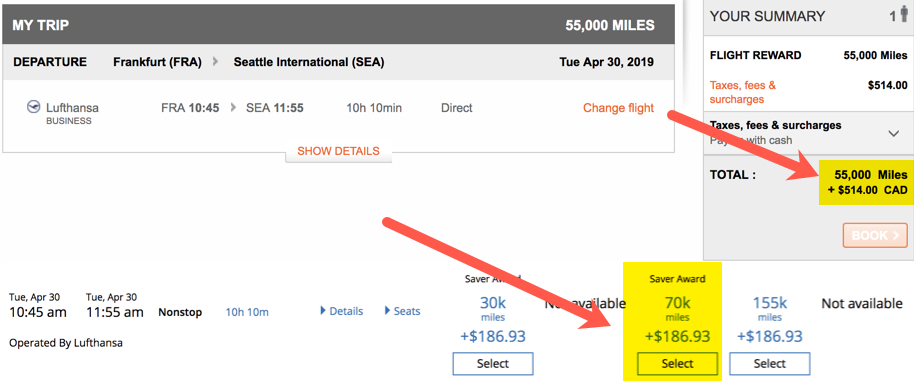

The fact that you can save so much on fees make United miles ideal for flights with certain Star Alliance partners. Just take a look at the $327 you could save by booking the exact same Lufthansa flight with United miles instead of Air Canada Aeroplan miles.

I’m OK with spending 15,000 extra miles to save $300+ in fees.

Since I’m getting ready to book a couple of partner business class award seats to Europe, it made sense for my wife to apply for the United Explorer card because after meeting the minimum spending requirement, she’ll have earned at least 68,000 United Miles (60,000 miles from the sign-up bonus + 8,000+ miles earned from meeting the minimum spending requirement).

That means we’ll only have to transfer 2,000 Chase Ultimate Rewards points to United Airlines to book the flights we want. This brings me to the second reason to consider the United Explorer card.

2. Save Chase Ultimate Rewards Points

Normally when I want to book a United Airlines award flight I transfer Chase Ultimate Rewards points. Not only do they transfer to United Airlines at a 1:1 ratio, but they also transfer instantly. So it’s easy to quickly scoop up an award flight before someone else books it out from under my nose.

By getting the United Explorer card and earning its 60,000-mile bonus, I’ll be able to keep 60,000 Chase Ultimate Rewards points in my account instead of transferring them to United Airlines. I could use the Chase Ultimate Rewards points I save to book two nights at a Category 7 Hyatt, like the Park Hyatt Sydney, when I’m visiting Australia next year.

Or I could transfer 50,000 Chase points to Virgin Atlantic and book a one-way Business Class flight to Europe on Delta.

Being able to save my Chase points is even more valuable now that Chase has begun offering transfer bonuses. Now through June 16, 2019, you’ll get a 30% bonus when you transfer Chase Ultimate Rewards points to British Airways. I plan on taking advantage of this offer to book a few American Airlines flights cheaply with British Airways Avios points.

3. Global Entry Fee Credit With Annual Fee Waived

The Chase United Explorer card is one of the few cards with a waived annual fee the first year that also comes with a Global Entry or TSA PreCheck fee credit (the Capital One® Venture® Rewards Credit Card is another). My wife will be using this credit to apply for Global Entry since it comes with TSA PreCheck.

The Global Entry fee is $100 but you’ll get it reimbursed when you pay with your United Explorer card. You can get a fee credit for Global Entry or TSA PreCheck once every four years.

You can see a list of other cards that come with a Global Entry or TSA PreCheck credit here.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!